GOP Tax Cuts Not Leading To Increased Wages

Despite Republican hopes, the tax cuts passed by Congress in December are not manifesting themselves in increased wages.

Seven months ago, the U.S. Congress passed, and President Trump signed into law, the Tax Cut And Jobs Act, the tax cut (not reform) package that significantly lowered corporate tax rates along with some reductions in individual rates for wealthy and middle-class taxpayers. At the time, Republicans in Congress asserted that the corporate tax cuts would almost immediately enure to the benefit of American workers because the money saved would be used for business expansion, wage increases, and hiring increases that would far outpace the jobs growth that we saw during the Obama Administration. Reality is turning out to be quite different from the promises though:

Seven months after they went into effect, the Trump tax cuts are sharply boosting corporate earnings.

Ordinary Americans are still waiting.

A quarterly wage index administered by Payscale, the compensation-analytics firm, found that income actually fell by 0.9% from the first quarter to the second quarter of this year. The Trump tax cuts went into effect on Jan. 1 of this year, and on their own should have increased take-home pay for about 65% of households, according to the Tax Policy Center.

But that’s not what workers are reporting in the Payscale survey, which solicits information from 300,000 workers each month. “I’d like to say it’s an anomaly, but I’m concerned it’s not,” Payscale chief economist Katie Bardaro tells Yahoo Finance. “So far, there hasn’t been any bolstering of paychecks for the typical worker.”

Other measures of income tell a slightly different story. On a year-over-year basis, incomes in the Payscale survey rose 1.1%. The Labor Department’s latest numbers show average hourly earnings rising 2.7% during the last 12 months. Another measure, the employment-cost index, also shows a 2.7% annual increase. None of those numbers account for inflation.

Bardaro isn’t sure why the Payscale numbers are lower than other income measures, but part of it may involve methodology. The Paycale index only covers full-time workers in the private sector, so it leaves out government workers, part-timers and others. It’s not clear why pay would be falling in the private-sector, though, if it’s going up elsewhere.

The Payscale survey measures all cash compensation, including bonuses. So it captures bonuses some companies issued earlier this year, to share the tax-cut bounty with their employees. It’s also possible, however, that more private-sector companies are giving one-time bonuses instead of permanent raises, which could erode pay over time, since bonuses eliminate the benefit of rising base pay, which pushes earnings higher and higher.

Rising health care costs could also be part of the explanation. An employer spending more to cover health care benefits for workers will have less available for pay and raises. Health insurance costs have moderated in recent years, but with employers hiring more, their overall health care costs are rising considerably, which might contribute to lower pay.

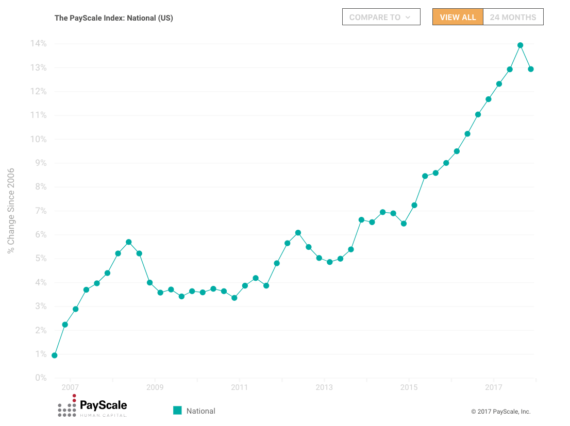

As this chart from Payscale shows, this drop in wages is the first quarterly drop since 2015, and one of the most significant since the company began tracking these numbers in 2006:

Reporting on the same Payscale report, CBS News notes that corporations are using the money saved on tax cuts on matters that will not benefit workers at all:

Six months after the Tax Cut and Jobs Act became law, there’s still little evidence that the average job holder is feeling the benefit.

Worker pay in the second quarter dropped nearly one percent below its first-quarter level, according to the PayScale Index, one measure of worker pay. When accounting for inflation, the drop is even steeper. Year-over-year, rising prices have eaten up still-modest pay gains for many workers, with the result that real wages fell 1.4 percent from the prior year, according to PayScale. The drop was broad, with 80 percent of industries and two-thirds of metro areas affected.

“Now, economic confidence has been good, we’re in a strong economy, GDP is growing, but the question has been, where’s the paycheck?” said Katie Bardaro, vice president of data analytics at PayScale.

The answer is, largely, in the companies’ coffers. Businesses are spending nearly $700 billion on repurchasing their own stock so far this year, according to research from TrimTabs. Corporations set a record in Q2, announcing $433 billion worth of buybacks — nearly doubling the previous record, which was set in Q1.

When a company buys back some of its outstanding shares, the effect is usually to boost the value of the rest of its stock, sometimes making the company appear more valuable on paper. Because many senior executives are paid in company shares, buybacks temporarily boost their pay (as well as other shareholders’ portfolios), sometimes at the expense of investments in infrastructure or workers.

In the initial month of so after the new tax law went into effect, there were almost daily announcements touted by the White House and President purporting to show that corporations were responding exactly as they said they would when the bill was being considered. Specifically, Republicans contended that the tax cuts would put more money in the hands of taxpayers and corporations, leading to higher economic growth and increased wages across the board. On the other side of the aisle, Democrats contended that the tax cuts would largely benefit high-income earners and that corporations would be more likely to use the savings created by reductions in the corporate tax rates for things such as buying back stock rather than renewed business investment requiring expansion, new hiring, or wage increases as Republicans contended. At least initially, it seemed like Republicans were being proven right as several corporations announced wage increases or, more commonly, one-time bonuses for existing workers. That being said, the forecasts being offered by Republicans regarding the impact of the tax cuts were overly optimistic to say the very least. For example, forecasts of economic growth between 4% and 5%, for example, were unlikely to come to pass based quite simply on the fact that this is a level of economic growth we haven’t seen except for isolated quarters in more than twenty years now. That, combined with the fact that we’re in the eighth year of the economic recovery suggests that we’ll be lucky to see economic growth in the 3% to 3.5% range right now. Additionally, it’s worth noting that one survey of corporate CEOs at the time seemed to indicate that most large businesses would be inclined to use the tax cut savings for stock buybacks that reward shareholders rather than for increased wages or new hiring. So far at least, that seems to be exactly what’s happening.

All of this presents Republicans running for re-election with something of a problem. After the tax bill was passed in December, the GOP made no secret of the fact that they were pinning most of their hopes in the upcoming midterms on the success of the tax cuts in the form of a stronger economy and higher wages. Even before the tax bill was passed, public opposition to the bill was growing and the public was convinced that the Republicans never intended to pass a bipartisan tax bill. Four months later, the polling was continuing to show that the tax cuts were not popular among American voters, and Republican legislators were blaming President Trump for the failure of Americans to rally around the tax cuts. In the months that have followed, polling has shown that the tax cuts have become less popular, leaving the GOP scrambling for a message heading into the midterms even as the numbers mount against them. Given this, Democrats will no doubt use the tax bill as a major talking point heading into the midterms, arguing that Republicans failed to deliver on their promise of tax relief for the middle class and instead passed a bill that will have a far more favorable impact on high-income earners and corporations. Republicans, meanwhile, will have their work cut out for them in trying to convince anyone outside their base that the bill will be good for them in either the short-term or the long-term. If they fail to do so, then it will likely make what is already looking like a rough 2018 in both the Senate and the House even more difficult.

Whoda thunk? Trickle down always worked in the past.

This is dead on:

At the very highest levels of management a lot of compensation is run through stock options., however the same is not true of rank-and-file – they get the occasional cost of living adjustment, all the while they’re hoping that layoff notices aren’t on the horizon.

Republican legislators are truly morons if they believe that even the masterful lying of Donald Trump would have convinced most of the public that these tax cuts were for their benefit. He can convince 30-40% of the population that they are currently living on Mars if that’s what he chooses to do but the rest of the public don’t live their lives actively looking to get swindled by a con man.

When’s the last time Republicans tried to convince anyone outside their base of anything?

When’s the last time Republican tax cuts helped middle-class and working people?

This is the inevitable result of abandoning unions. The Republican idea that we were all independent contractors selling our work and thus the free market would take care of us is utter nonsense.

Only one thing gets you what you want: power. Unions were the expression of the working person’s power, and without unions surprise! No power. The rich kept their tax cuts and are not going to give any of it to workers unless and until workers pry it from their grasping little fingers, and the only way to do that is by collective bargaining.

LOL, whocoodanode? 🙂

Everyone but the Trumplicans saw this coming.

Dennison gets richer, and the dupes that voted for him get nada, zip, zilch.

In addition their gas prices go up, their helthcare goes up, their food costs go up.

But that Donnie Dennison, he’s the real deal…he’s one of them.

@Michael Reynolds:

Well, it’s not the only way …

In my experience, even the “sensible” Republicans I know just spout this nonsense out as if they were revealed wisdom from god himself. Since Reagan, rank and file Republicans have been trained to accept ridiculous statements and provably false assertions on such a constant basis that they have lost all ability to understand reality.

And, of course this is just human nature. Of course there are people of all political persuasions who accept meaningless slogans as facts. But the problem for the Republican Party is that the leadership has gone down the rabbit hole. At this point, no intelligent young person who values facts in achieving decent social goals would even consider becoming a Republican. As the party leans ever more into the twisted briar of Fox media fantasies it repels the reality based and attracts the angry conspiracy theorists. This is a death spiral.

This is OT…but 72 hours after the DOJ laid out a dozen indictments for Russian Intelligence hacking our Democracy, Dennison essentially forgives Putin on the world stage.

And Republicans? They will be afraid to say anything.

Spineless cowards. Traitors to their country.

@Daryl and his brother Darryl:

There are many that follow a correct statement like this with “when things get so bad they will finally see!” That won’t happen. Just look at the Trump states. For literally centuries the ruling elites have been able to keep the proles in line by simply shouting “the darkies are coming for your daughters!”, or “look at those urbans kneeling for the national anthem!” And of course, even people of good will get sucked into the fights and arguments.

There’s a neighborhood association thing going on in my area where the opposition are real Trumpoids. Angry, abusive, insulting, and conspiracy laden. It’s been an education for me how the association leaders are handling it. They pluck any valid concern from the pile of stinking sh*t hurled at them and address that. For example, three people got up and ranted about how they just wanted to steal money from poor people who didn’t have two nickels to their name because they were “sneaky” and “socialists”. The leadership didn’t respond to these insults and slanders except to say that it is a valid concern that some in the neighborhood couldn’t afford the modest fee proposed (for maintenance on the community boat ramp, and on the village park) and at the next meeting they introduced a motion to amend the regulations to allow someone to petition for relief in which case the general funds could be used to pay the fee.

Of course the Trumpoids can’t be reasoned with. They feel patronized because, since they can’t reason based on reality, they want to drag the entire discussion and neighborhood down to their level. But the leadership isn’t trying to win the Trumpoids over. Rather, they are winning over the people who are only peripherally involved. When those hear the Trumpoids speak all they hear is anger and bile and pettiness. And when they hear the leadership they hear competence and reasonableness. They hear the type of people they would trust with the modest fee proposed.

@MarkedMan:

It will always be someone else’s fault. That’s how delusion works.

This just in from the Republican Advanced Laboratory of Really Advanced Materials:

Seems legit to me.

Trump and the GOP only need to release a report saying that the wages for women and non-white men decreased more than they did for white men, and the Trumpers will be happy again.

Obviously, the only answer to this is more tax cuts for the wealthy.

@An Interested Party:

As you suggest, its never happened.

On the other hand, its been a long time since anything has helped them. Doing so might be all the Democrats need to start winning elections – 40% never vote. Get even a couple percent of those to vote D and everything changes. As Reynolds points out, unions were abandoned; reversing that would go a long way to cutting the GOP off from the discontent they feed on.

The GOP never does anything for middle class and working class people (their whole supply side economics is based on trickle down), but they’ve learned to sound sympathetic. Meanwhile the Dems dropped unions and often don’t even bother pretending to be sympathetic to middle class and working class people – I have to the think the common progressive tactic of telling the middle and working class people that others have it worse, which though true, is such an obviously suicidal approach that it had to have been conceived by some conservative infiltrator.

Yes, someone with a living standard of 2 out of 10 is twice as well off than those with a living standard of 1 out of 10, but when the people pointing that out are at 8 out of 10 (ie well off politicians, academics and so on) it rarely goes over well.

@Franklin: No, the other way pries it from cold, dead, fingers, but …

I’m sorry, I call BS on this one. No one in the Republican sphere of influence gives a rat’s arse about any wallet not in their own pocket or any bank balance not in their own name. Moreover, in a nation where the guiding economic principle is “the money always looks better in my wallet than it does in yours,” there shouldn’t really be any surprise about this.

Ya want a nation with better economic equality and a higher GINI coefficient? Your gonna have to move. And you’ll probably complain about how much less difference there is between you and your less economically advantaged neighbor when you get there.

@MarkedMan: ” At this point, no intelligent young person who values

facts inachieving decent social goals would even consider becoming a Republican.”A small edit, but I think it improves the clarity of your thoughts.

“This is a death spiral.”

We can hope. I wish more tangible action was possible to achieve it, though.

Hopes? Hopes???? They never gave a rats ass about increasing wages, only about concentrating wealth among the few.

Is it too obvious to point out that all the bonuses given out after the tax cut legislation were probably from Republican CEOs that wanted to make a political statement? And furthermore, that that’s the last of their windfall that any of their workers will ever see?

@Franklin: Clearly, you need to exercise your cynicism more. I never thought the bonuses were anything other than window dressing from the first announcement.