Housing Prices Hit New Low, But Buyers Are Staying Away

Real Estate prices continue to fall, but where are the buyers? Maybe they're acting sane this time.

Evidence continues to mount that we will not be returning to the days of the late 90s/early 2000s housing bubble, and that isn’t necessarily a bad thing:

Housing prices fell in March to their lowest point since the downturn began, erasing the last little bit of recovery from the depths plumbed two years ago, according to data released Tuesday.

The Standard & Poor’s Case-Shiller Home Price Index for 20 large cities fell 0.8 percent from February, the eighth drop in a row. Prices are now down 33.1 percent from the July 2006 peak.

“Home prices continue on their downward spiral with no relief in sight,” said David M. Blitzer, chairman of the S.& P. index committee.

Housing is in persistent trouble, industry analysts say, not only because so many people are blocked from the market — being unemployed, in foreclosure or trapped in homes that are worth less than the mortgage — but because even those who are solvent are opting out.

The desire to own your own home, long a bedrock of the American Dream, is fast becoming a casualty of the worst housing downturn since the Great Depression.

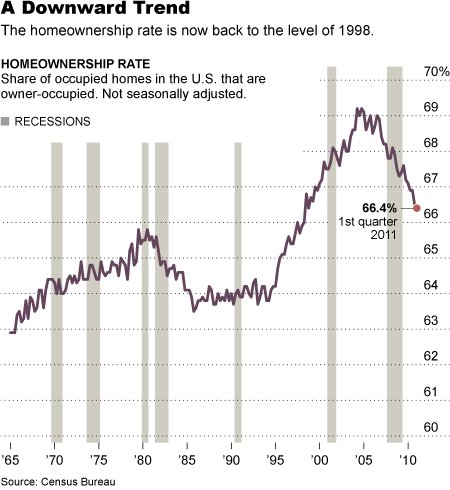

Even as the economy began to fitfully recover in the last year, the percentage of homeowners dropped sharply, to 66.4 percent, from a peak of 69.2 percent in 2004. The ownership rate is now back to the level of 1998, and some housing experts say it could decline to the level of the 1980s or even earlier.

“The emotional scars left by the collapse are changing the American psyche,” said Pete Flint, chief executive of the housing Web site Trulia. “There was a time when owning a home was a symbol you had made it. Now it’s O.K. not to own.”

Trulia, a real estate search engine for buyers and renters that is based here, is a hive of renters, including Mr. Flint. “I’m in no rush at all to buy,” he said. He expects homeownership to decline further to about 63 percent, a level the country first achieved in the mid-1960s.

The new Case-Shiller data did not offer much room for short-term optimism. The national housing index, which is reported quarterly, fell 4.2 percent in the first quarter after a drop of 3.6 percent in the fourth quarter of 2010. This, too, is a new recession low.

Twelve of the 20 cities in the index hit a new recession low in March. Washington was the only city where prices rose both in March and over the last year.

Of course, thanks largely to the Federal Government, the area around Washington DC is one of the few parts of the country that has seemed to recover steadily over the past year or so. It isn’t entirely surprising then, that the real estate market would reflect this. Nonetheless, prices across the country have fallen dramatically. Ordinarily one would expect lower prices to start bringing buyers back into the market, notwithstanding the state of the economy, instead, we seem to be seeing a re-evaluation of the way Americans have looked at housing over the past 20 years or so:

It’s possible that this will turn itself around in a year or two. The economy may turn around enough that people start feeling confident about buying a home again. When that happens, though, I suspect we’ll see a different kind of housing market than the one we experienced in the 90s and 00s. Instead of flipping homes every few years, people are more likely to hold on to a house for a longer period of time. Instead of viewing their homes as a source of income and refinancing at the drop of a hat, we may even see a return to the days when people actually paid off their mortgages (I remember when my parents did, it was a big deal back then).

One of the biggest problems with the housing bubble was that housing went from being a long-term investment where people stayed for a long time, it turned into a short-term get-rich-quick scheme. Many people made out very well, which is usually what happens at the beginning of a bubble, but there was no way it could last forever (especially when sustaining it meant convincing lenders to give money to people who had no realistic possibility of being able to meet their obligations) We’re paying the price for that foolishness now. Hopefully when its all over, we’ll be a little anser.

When I bought my house 5 years ago the plan then, as it remains today, was that it would be the last house I ever live in. It will be paid off about 3 months after I turn 65.

What’s striking to me about that last chart is that despite all of the government efforts to increase home ownership, it’s not changed drastically since 1960 (62.1%).

One answer to the question of “where are the buyers?” is: they can’t sell the houses they currently occupy.

If you look at the Case-Shiller numbers (calculated risk), it does look like the special homebuyer credits & etc bought a deflection in the trend. They stopped a crash, bought a pause, and now … probably a more sedate adjustment.

I didn’t really favor those credits, but this is the outcome I expected, and predicted here.

This tidbit will tell you what’s going on in the market right now:

Cash purchases for homes hit record in [California]

These are people with significant resources looking for ways to hedge inflation. It’s another “unnatural” purchase cycle.

Steven Taylor provides part of the answer

I think a number of factors are involved:

1. First time buyers are having a hard time qualifying for loans.

2. Current owners are having a hard time selling the current houses (at least at

prices they find acceptable)

3. Lower rate of household formation

4. Falling prices don’t attract speculators the way rising prices do.

5. The classic deflation scenario: people believe that prices are more likely to go down than up.

Perhaps this is just another way of saying what you’re saying but to me it looks as though they time-shifted some purchases.

If there is one thing that I fault Bush for (and there are really a lot of things I blame Bush for) it was not recognizing the housing bubble and claiming that the economy was strong when in fact it was only being powered by imaginary equity.

but it’s not all Bush’s fault. I remember re-financing in ’06 and the bank telling me I had all this equity and don’t I want to borrow more. being fiscally conservative I said no – and my mortgage remains right-side-up to this day. now this bank is no schlock mortgage broker – this is a respectable old-school local bank that knows your name, holds your mortgage and does not sell it – and even they were being schnookered.

so – maybe we are close to the bottom, and maybe we aren’t close yet. the bigger holistic point is that nothing has yet taken the place of that equity – imaginary or not. yet so-called conservatives want to cut spending. you can’t make up how stupid that is at this point in a recovery.

@JohnPersonna

I think Dave Schuler hit the nail on the head. As with the “Cash for Clunkers” boondoggle, it’s fairly clear that the homebuyer credits merely time-shifted purchases rather than actually stimulating the market. If those credits had not existed, it’s arguably the case that the housing market would have bottomed out already, or at least would be close to bottoming out.

Way more houses than averagel were sold during the bubble years.

Why is it odd that the number of houses sold is now below normal?

Sorry Doug, you just ignored the data.

The rate of decline now is less than it was, and prices are certainly higher than they would have been with a projection of the pre-credit decline.

Now, if you want to maintain “time-shifting” you better explain why rate of decline is lower now, or step right up and assure me that it is about to go as critical again.

John,

sales of homes jumped up in the months prior to the credit ending and then they fell off sharply in the months following. Then they rose a bit back to the pre credit trend. Its pretty clear that most of the new sales where just moved forward. How many people are going to buy a home who were not planing to for just $7k? Most where people who were in the market already but jumped on a house before the credit expired.

This was a very similar pattern to car sales durring the cash for clunkers months.

The fact that now a year later the decline in prices is slower than before doesnt change that. Prices where not going to fall for ever until they are nothing. The price declines should be gradually slowing as it approaches a correct market value.

Hey Norm, what do you think of the idea of a 1 year FICA holiday? Let people keep that 15.3% and see if that doesn’t spur more economic activity? Rather than the government spend on things which may have questionable stimulus benefits, let the people decide how to spend the money. What say you?

Some guy (a returning vet from what I hear) who had some kind of income windfall built two new homes for sale on my street around 12 months ago. They were well designed, quality built, and priced right for the market at that time. It was my guess that he was planning on selling them in a hurry to make a quick profit on his windfall. Since then, he has had two different realtors, not a single person even look at them, and he has dropped his asking price by nearly 50% with no closing costs to the buyer.

I feel sorry for him because, unless he can absorb the cost of sitting on these two houses, I expect them to be liquidated under a bankruptcy where he will be lucky to get 20% of his asking price.

The point of this story is that, if I had the money, I would buy one of them. But I don’t have the money, don’t want to get a mortgage (my house is paid and I have no debt), and live in trepidation each day of the increase in cost of living. I think that I am somewhat representative of the buyers in my area and suspect that it’s the same elsewhere.

ej, my comment was all about the shape of the curve.

Kinda crazy to ignore the first derivative.

It’s really another example of “I’ll believe what I want to believe, data be damned. Now if the rate accelerates, the first derivative returns to the pre-credit trend THEN you will have actual data to support a “time-shift only” argument.

If cutting taxes solved recessions, why did Bush’s massive tax cuts cause one?

ponce… please explain to me the logcal flow of how a tax cut caused a recession?

Especially one that started before his tax cuts..

pete,

as stimulus goes that would probably have a big bang for the buck.

however the point i was making was not about providing more stimulus. it was about the importance of not doing reverse stimulus – slashing government spending and employment. you had mitch the turtle mcconnell on the tv sunday morning again spewing the idiotic line that we do not have a tax problem we have a spending problem. well i, for the life of me, do not know how anyone can look at an effective tax rates that are at a 60 year low and conclude that we have just a spending problem. keep in mind that the republicans started two wars, cut taxes, and expanded entitlements – all without paying for them – and these are the biggest drivers of our future debt. so yes we need to stop the republicans profligate spending habits. we also need to raise revenue. slashing spending right now…in the midst of a fragile economy, and when the bond markets are not indicating for it, is about the most unproductive thing we can do.

norm,

effective tax rate is only this low due to the current recession and the temporry payroll tax cuts. At full employment effective tax rates are right at the historical norm – in fact they are in tthe higher range of the norm. Look at any of the budget projections from CBO, the WH etc. Its not the tax side of things that is out of the historical norm.

Taxes were at record low levels when the Great Recession began under George W. Bush.

norm… look at the following: Which one is out of the historical normal over the next ten years? tax revenue or spending? http://www.finfacts.ie/artman/uploads/3/US_budget_revenues-outlays_august252009.jpg

ponce –

1. no they where not… look at the graph i just linked above.

2. more importantly, correlation is not causation – i had a broken tv in 20098, therefore that mush have caused the recession.

once again, tell me the logical flow of how a tax cut causes a recession.

ponce, c’mon, use your head. It is not simplistic like you enjoy portraying it. Cutting taxes CAN stimulate more economic activity and it can stifle it, if taxes are too high. So stop with the usual lefty canard about cutting taxes.

pete,

what i love is the claim that the tax cut caused the recession. There is no possible way you can connect those dots. You may think cutting taxes only has a minimal posative benifit or that the benifit is not as great as what you wanted the money to be spent on. But unless you are in a sovereign debt crisis with upward spirally interest rates (which was not the case in 2008) a tax cut can’t cause a recession.

Ponce is either a really simplistic partisan hack and/or he doesn’t know anything about economics or logic for that matter.

i’m still waiting for him to explain how a slightly lower tax rate caused the housing bubble (that started before the tax cuts) and ultimatimately its collapse.

Never mind the fact that wil bracket creep, even with the lower rates, tax revenue was the same as a percent of GDP in 2007 as it was in 1996.

ej,

You have read the chart you posted wrong.

Taxes were at a record low 14.8% of GDP during 2009.

And yet the economy continued to shrink during 2009.

You said this:

“Taxes were at record low levels when the Great Recession began under George W. Bush.”

The recession began in dec 2007, not 2009. Look where taxes were in 2007 via the graph – at about 18.5% – about the historical norm.

More importantly, you are still ignoring me.

Tell me how a lower tax rate caused the recession.

Actually ej,

The Great Recession began late 2008.

Remember poor ol’ John McCain and whatshername’s campaign going down the tubes because of it?

Still waiting Ponce – Tell me, how did a lower tax rate cause the recession? Consider this an opportunity to enlighten me and others reading here.

PS. NBER dated the recession to be Dec 2007 to June 2009.

http://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States#cite_note-51

You’re the one who offered up tax cuts as a fringe right snake oil recession, cure, ej.

But, if we’re going by NBER, the recession ended two years ago, so no need to test your “theory,” is there?

“If cutting taxes solved recessions, why did Bush’s massive tax cuts cause one?”

This is what you said. Are you denying you said this?

So please tell me, how did the bush tax cuts cause the recession?

PS. And no i did not say tax cuts cure a recession – you need to go back and read the thread.

the only reason why the NBER came into this is because you falsely stated that taxes where at the historical lows when the recession began.

But lets even assume that they where. How did the bush taxes cuts cause the recession?

Is this not a straight forward enough of a question for you ponce?

More importantly, why was the economy roaring under Clinton when the tax rates rose steadily from 17.5% of GDP to 20.6% of GDP?

And then when they fell from 20.6% to 19.5%, Bush’s first recession began.

How did the bush tax cuts cause the recession?

So ponce…

A. Doesn’t know how to read

B. Doesn’t know what he is talking about

C. Is a brainless partisan hack

D. All of the above

this little exercise is going from amusing to just sad

Taxes fell->recession began.

Correlation implies causation.

At least, that’s what the Republicans have been telling America since they became the stupid party.

Tax cuts clearly didn’t stimulate squat… it’s possible that tax cuts could have a stimulative effect if tax rates are high enough to start, but we’re nowhere near that level of taxation. To the extent there really was any boom under Bush, it ended up being a dangerous bubble that, when it burst, was immensely damaging.

Bush/Obama tax cuts haven’t spurred economic growth (or, if they have, it’s been a small impact). So I don’t see how further payroll tax cuts (we currently have a small one in effect – the employee side of the payroll tax is 5.65% this year instead of the usual 7.65%) are going to fix the problem.

As for housing, the market has to bottom out and the government incentives simply delayed the inevitable. If the government intervention helped create a softer landing, ok I suppose.

It’s a great time to be a renter who has been able to save a bunch of money: you can get a great house cheap. But there aren’t too many of those people. For me, well, I bought/sold as the bubble was starting to burst, in June of 2007. It’s not fun to think about the decline in market value of my house, but then it’s pretty fun to have a 4.99% mortgage rate (30-yr fixed). So it’s not all bad 🙂

People who wonder about the origins of the world wide housing bubble need to Shiller’s Irrational Exhuberance and/or NPR’s Giant Pool of Money

Bush’s capital gains cut probably did matter, at the margin, but you can’t explain a cycle true from California to Finland with just US policy.

“Taxes fell->recession began.

Correlation implies causation.”

Great logic there Ponce – you are finally coming around to admitting you know you are spewing BS.

You’re the one was in favor of cutting taxes in the face of record deficits, ej.

I think we can all agree cutting taxes increases deficits.

ponce,

“You’re the one was in favor of cutting taxes in the face of record deficits”

1. i did not say that – now you just either don’t read or you just outright lie

2. you are not answering again.

how did the bush tax cuts cause the recession?

“…you can’t explain a cycle true from California to Finland with just US policy.”

True dat. But could one not make the argument that it was the rottenness at the core of the US financial system that spread throughout the world? I mean, didn’t our flaky financial instruments get cloned all over the place — with the same deleterious effect ?

Oh, and one possible answer to this, “how did the bush tax cuts cause the recession?” is that the tax cuts created a large, really large, pool of cash that was casually related to the bubble that burst, which bursting caused the recession.

Does NPR’s Giant Pool of Money argue this, JP?

It’s tough to buy a house when you’ve got no job and it costs 4 bucks a gallon to fill up your car to get to a job interview where 30 guys a vying for one or two spots.

Unfortunately for the housing market, Rambobama can’t send a SEAL execution squad to slay the ongoing recession. Not that housing directly is Rambobama’s fault. Of course not.

Housing bubble inflated due to cheap money; bubble burst due to reality biting.

Now, however, we have even cheaper money. But the job market is circling the drain. Courtesy in large part of Harry, Nancy, Timmy, Ben, Rambobama & the rest of the gang. Bad job market = worse housing market. Kitchen table econ., 101.

We’re relocating for personal reasons. We bought our house in ’07. We haven’t done any major renovations, but every surface in the house has been redone. We sold our first home within a month for a huge profit. With this one we’re asking 10K more than we paid for it, and I spent the last 6 months making sure it was in the best condition possible. We’re more concerned about how long it will take than what the price will be. We plan to take the first reasonable offer and run.

One commenter said something about planning to stay in his house forever. I think part of the problem was that people wanted their first home to be a “forever” house. We forgot about the property ladder. There’s a big difference between people that used their homes as atms and people that climb the property ladder in a responsible manner.

Sam, our declining regulation was certainly a factor, but I think most of the actual money came from Asia and other emerging economies. We are net debtors.

That’s the danger in a “property ladder.” We might build equity, but at each rung match it with increasing debt. Maybe you start with a $200K loan for a $250K house, and end up with a $500K loan for a million dollar house. That works if, and only if, the million dollar house stays a million dollar house.

And of course if it fails, you might not have the diversification of the guy who stayed in the $250K home, bought index funds, muni bonds …

Maybe you start with a $200K loan for a $250K house, and end up with a $500K loan for a million dollar house. That works if, and only if, the million dollar house stays a million dollar house.

Only if you can continue to service a $500k loan, that would require quite a job and those are being lost rather significantly in the last 2 years. Also other taxes on those jobs are leaving a lot less to service the loan of that size and if most of the commenters here had their way there would be even more taxes on those jobs. So no it doesn’t work most of the time. The idea is to keep the $200 k loan and move up in value of home so you can continue to service the loan with your current job and bank the rest while owning a better home.

mpw

I don’t think that’s the way Californians did it, mpw. Since property always went up, they were using increasing, not decreasing, leverage over time.

“But the job market is circling the drain. Courtesy in large part of Harry, Nancy, Timmy, Ben, Rambobama & the rest of the gang.”

How, exactly? I’ve read arguments that the stimulus was bad, that it was good but too small, that the fed did too much of this or too little of that… etc. What’s your theory on what the Federal Government should have done (or, more accurately, that group of people you listed should have done)? Cut taxes some more? Slashed Federal spending? Tightened the money supply? I’m curious.

“That’s the danger in a “property ladder.” We might build equity, but at each rung match it with increasing debt. Maybe you start with a $200K loan for a $250K house, and end up with a $500K loan for a million dollar house. That works if, and only if, the million dollar house stays a million dollar house.”

Well, yeah. You have to not be an idiot. You have to keep the place up, make smart improvements, make smart decisions about how and when to move on and make sure you’re not just putting yourself right back where you started each time. If you do it right, when you’re an empty nester you own it outright, can downsize and have some kind of safety net for a more comfortable retirement.

Over the course of a lifetime it’s still a better investment than renting.

We’re usually happy when the stuff we buy gets cheaper. If you want to buy a house, falling home prices seems like a good thing.

Home ownership is a good idea as long as the housing market is liquid and prices are stable or rising. Unfortunately, many families are stuck in houses they can’t sell either because there is no buyer or because they are underwater on the mortgage. And worse, if you’re in such a situation and you lose your job, your immobility makes it harder for you to sell your labor. Today, it makes much more sense to rent.

From the chart I would say that the market still needs to readjust to 100 everywhere which may be a double dip but actually will reflect what houses are worth based on whose working.

We’re usually happy when the stuff we buy gets cheaper. If you want to buy a house, falling home prices seems like a good thing