iPhones and the US-China Trade Gap

Another example of the silliness of the "trade deficit" concept.

A story in today’s WSJ explains “How the iPhone 6 Fueled a Record U.S. Trade Gap With China.”

Just one more feature of the iPhone 6: It helped fuel a record U.S. trade gap with China in September.

Call it the #iPhoneEffect.

Imports from the Asian giant hit $44.9 billion, up nearly 13% on the month. Most of the $5 billion increase in imports was fueled by a $3 billion surge in buying of cell phones, a deluge that coincided with Apple’s release of the iPhone 6 and 6 Plus, both of which are assembled in China.

It’s not the first #iPhoneEffect: In 2012, iPhone 5 sales were seen boosting U.S. economic growth, a feat that Congress, the White House and the Federal Reserve had difficulty replicating at the time.

But this just shows how silly the “trade gap” concept is. It’s difficult to find precise figures, but the vast majority of the profits on each iPhone sold go to the United States, not China. Going back to 2011, the total cost for the components in each phone were under $200, with Apple netting some $368 per phone. Similar numbers were reported in 2012, when the iPhone 5 launched.

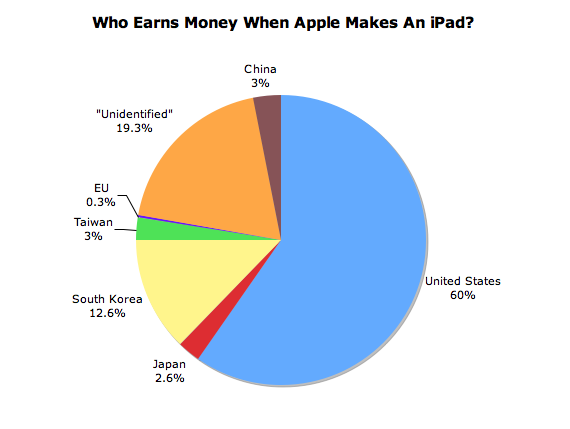

Virtually all of the intellectual property that goes into an iPhone is based in the United States or Western Europe. Almost all of the profit from the vast markup in each unit goes into the pocket of US-based Apple and its stockholders. For that matter, almost all of the ancillary profit on iPhone accessories, apps, wireless plans, and the like are American. Jordan Weissman did an interesting breakdown on how it works with the iPad a couple years back; the principle is the same here:

According to a new report from the National Science Board, [China] rakes in only about as much as Taiwan and far less than South Korea off each device. This pie chart shows the percentage each country contributes to the wholesale price of an iPad, minus the cost of raw materials.

Why is China’s slice so small, and the U.S. slice so big? It’s all about “value added.” That’s the term economists use when they talk about making something worth more than the sum of its parts (or labor). Basic assembly of a small device, the core of China’s manufacturing base during the past decade, doesn’t add much value. Creating a high-tech processor that can be sold at a markup does. Designing and marketing a must-have gadget adds the most value.

For a more in depth breakdown of the data, here is the NSB’s complete table, which is based on research from the University of California — Irvine. The consumer price gets broken down into distribution and retail, value capture, labor, and direct inputs (raw materials). Value capture is essentially the profit after labor is subtracted. For every $499 tablet, the U.S. takes home $162. Countries which manufacture high tech components, particularly South Korea, grab another sizable share. China, which handles the basic task of packing together the final tablet, only grabs about $8 from the process.*

The main reason that iPhones are built in China, it seems, isn’t even cheap labor. One estimate has the cost savings at a mere $4 per phone. Rather, by importing the phones from China, Apple saves a massive amount in taxes. Regardless, it’s silly to pretend that the country that makes $162 on an iPad is running a deficit with the country that makes $8.

Dr. Joyner,

In real terms a trade deficit is a net benefit for the importer as in this particular case: China gets digital bits on a hard drive at the Fed and the U.S. gets iPhones. So we’re wealthier because our pile of stuff gets bigger.

However, as we live in a heavily monetized society we require enough currency in circulation to purchase everything our domestic economy can produce, otherwise our potential on the supply side will degrade through hysteresis. In a balance of trade this would not happen as we have an endogenous (created from within) monetary system which expands and contracts according to demand for credit; wiith good underwriting standards the debt produced by banks will very nearly equal what is needed for productive growth.

When more financial assets leave our economy than enter it from the foreign sector (this is generally referred to as financial leakage) that debt must expand to replace those lost monies: the larger our deficit the more quickly it must grow, which is a prime reason for the mountain of debt so many American households find themselves currently buried under.

In our present situation there is no appetite for a debt-induced boom and so our trade balance is exerting downward pressure on employment and inflation. In other words the Chinese are importing demand from our economy and leaving behind a deficiency.

Also if you look at the definition of “exports”, you find out that a lot of the stuff we do sell to China (education, financial services, airline jets, movies, etc.) is excluded.

In some sense, the idea of a long term trade deficit is inherently ridiculous. It supposes that China is using its resources to make lots of stuff which it then gives the the US and gets nothing back in return, apparently because they’re just such nice guys.

@Stormy Dragon: @Stormy Dragon:

Running a trade deficit against the U.S. is a form of protectionism which allowed China to develop its own industries until they could be competitive, in the same way protectionist measure adopted by the U.S. until the 20th Century got its agricultural and industrial bases off the ground.

Is it? The money that starts in the US and stays in the US is irrelevant to the inter-country cash flow, as is the money that starts in China and stays in China. The US doesn’t ‘make’ $162 on an iPad — the US already had that money.

When Apple makes and sells an iPhone, how much money that started out in the US moves to China? And how much money that started in China moves to the US? It looks to me like the answer is “$8 from US to China, essentially zero from China to US.” I don’t see what’s so silly about calling that a trade deficit, especially when you multiply it by the volumes involved. A leak is a leak, even if most of the water stays in the bathtub.

“Rather, by importing the phones from China, Apple saves a massive amount in taxes. ” Only sort of. It costs money to buy and ship all those items from around the world and how do you keep track of all that.

What Apple really gets from China is the ability to have a factory wake up 20,000 people, give them a quick breakfast and start making changes to a product on the spot. In the USA, you need 3 months notice, labor union OK, state labor ok, etc. We just are not focused on the customer.

Just saying.

@elder norm: Yes, American manufacturers locate in China not to reduce costs but to increase control over their labor force.

@Ben Wolf:

Except that the trade deficit doesn’t actually measure monetary flow. It’s an indicator, but it’s only one indicator and a poor one at that.

Best example I can think of, I have to steal (and adapt) from Bastiat. Let’s say I go to northern California and purchase $10,000 worth of wine and export it to Japan. There it’s sold for $20,000 denominated in Yen. We have a $10,000 trade surplus. I now take that entire $20,000 worth of yen and invest it in Sake and import it to the US. I now have a $10,000 trade deficit — but not a single dollar or yen left its economy.

And what happens if one of those shipments gets lost at sea? Still, not a single dollar or yen left the economy … no matter what the Trade Deficit might imply. My pocket, yes (until/unless the insurance companies pay up); but not the economy.

What if I didn’t purchase something in Japan? What happens to the Yen? That depends on what I do with it. Do I deposit it in a Japanese Bank? Invest in a Japanese Stock/Company? Do I convert it to Dollars and send it home?

Only the latter actually results in international money flow.

@John D’Geek:

If you sell wine in Japan your account in Japan will be credited with yen. Perhaps you spend the yen in Japan— most do. Some, however, choose to exchange their foreign currency for their domestic currency. Through your bank as intermediary you will exchange your yen for dollars at the Federal Reserve which, if your government pursues a trade surplus, will likely deposit the yen in a reserve account, accumulating them to drive down the relative exchange rate. This will make goods produced in the United States more competitive against Japanese goods, increasing the deficit. Over time the Federal Reserve will acquire large reserves in yen which do not return to circulation in the Japanese domestic economy, just as China holds trillion of our dollars in reserve and securities accounts. Hence many financial assets (dollars) used for payment of Chinese goods leave circulation in our domestic economy.

If everyone allowed their currencies to float freely then yes, there would be a rough balance in net financial flows but in practice it doesn’t happen when countries focus on net exports.

@James Joyner:

Well, up to 60% of Apple’s profits are kept in Ireland.

Ben is doing such a great job of explaining the problems that our trade deficit with China is producing I don’t have much to add.

Let’s just sum it up this way. Our trade deficit with China is one of the major contributing factors to the increase in income and wealth inequality in the U. S. If you are indifferent to the trade deficit you are necessarily indifferent to the increase in inequality.

“The main reason that iPhones are built in China, it seems, isn’t even cheap labor…. Rather, by importing the phones from China, Apple saves a massive amount in taxes.”

Actually, this is wrong in two ways. The tax issue isn’t based upon where the phones are manufactured, but where they are sold. Even if the phones were made in the US, the tax situation would be exactly the same. Second, Apple doesn’t save on taxes, they defer the payment of those taxes. When Apple sells overseas, the profit on those sales are taxed overseas at a low rate. However, the foreign-earned income is also taxed by the US Treasury, but the bill doesn’t come due until the profits are repatriated.

Yes, you think, they won’t bring the money back. Many companies don’t and they sign a declaration that they won’t with the US Treasury and so don’t account for any US tax on that money. eBay is one such company, and their net effective tax rate is about 15%.

As for Apple, they state that they intend to repatriate about 2/3rds of their foreign-earned income and thus account for those US Taxes on that income. The taxes aren’t paid yet, but they are booked. As far as Apple’s financials look, it’s as if the taxes have been paid, there’s no benefit to Apple or the shareholders. Unlike eBay, Apple’s net effective tax rate is 25 to 26%, far higher than the average US company of about 20%. If they were to follow eBay and not to book any US tax on those foreign earnings, they’d have a net effective tax rate of 12%.

So, for those two reasons, I completely disagree with the notion that Apple mfrs in China for tax savings. There aren’t any savings and any deferral is not due to anything to do with China.

I concur with Schuler on bens trade points, but this: ” Yes, American manufacturers locate in China not to reduce costs but to increase control over their labor force.” is not really true.

The total components of value buildup to sale price for an iPhone make the Chinese savings look insignificant. For many products this is not so, and the labor cost savings are large. Given that some manufacturer will avail itself of the savings, all manufacturers will be forced to do the same as consumers will in turn avail themselves of passed on savings. Other products where considerations other than labor savings trump include those prone to intellectual property theft (reverse engineering), or where short lead times and/or frequent change orders matter.

if it was so silly why don’t they make them here? iphone users area essentially a cult that’s hooked on image to the point that expense is just nothing anymore- sure it’s good product and such but at the end of the day it’s mimicked by everyone to the point of who cares?

if making them here cost another $100 how many drones would really bat an eye about it- they’d downgrade their daily latte a bit to atone for it….or not.

that goes against the grain of the ilk though- these peeps worship tech firms that generate very little in jobs and do all they can to dodge taxes (apple does too- to the extreme) yet berate successful manufacturers and such as “greedy bastards intent on screwing everyone over”. it’s gotta be tough keeping up with that kind of insanity.

Lotta stuff wrong here.

Say Apple ships $90 worth of chips and IP to China (causing a trade surplus of +90 to the US). China adds $10 of assembly costs and ship it back at a price of $100, for a net trade deficit of $10 to the US (and causing a concurrent increase in the Federal Deficit, everything else held constant).

Apple then sells the product in the US for $600, reaping a $500 profit. This does not affect the trade deficit, and would only do so if Apple sells the product in China.

On the $500 profit, Apple supposedly pays 35% (actually only about 9% in reality) in tax, or $170. If the product was made in the US, and cost an extra $100 to make, Apple would only pay $140 in tax on the resulting $400 in profit. There are no tax benefits to making the product in China.

@Ben Wolf: I think we’re actually agreeing here. While there is a correlation, it’s a rather low one and depends more upon political chicanery than anything else.

It’s really not the trade deficit; it’s what happens to the cash … which may or may not have anything to do with the trade deficit.