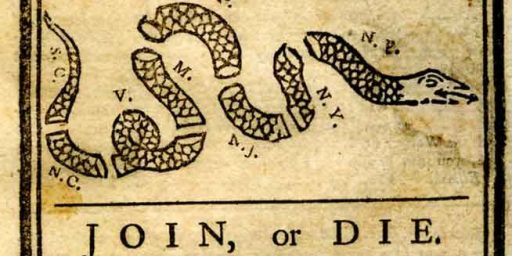

Is 2011 Another 2008? Or Another 1931?

Dan Drezner believes those worrying that we're seeing the global meltdown of 2008 repeat itself are kidding themselves.

Dan Drezner, a well-regarded expert on international political economy, believes those worrying that we’re seeing the global meltdown of 2008 repeat itself are kidding themselves.

This all sounds very 2008, except that it’s actually worse for several reasons. First, the governments that bailed out the financial sector are now themselves the object of financial panic and political resentment. Second, the tools used to try and rescue the global economy in 2008 are partially to blame for what’s happening right now. Despite all the gnashing of teeth about the Fed twiddling its thumbs, it’s far from clear that a QE3 would actually stimulate anything besides a rise in commodity prices.

With both Europe and the United States unable to stimulate their economies, and China seemingly paralyzed into indecision, it’s worth asking if we are about to experience a Creditanstalt moment.

The start of the Great Depression is commonly assumed to be the October 1929 stock market crash in the United States. It didn’t really become the Great Depression, however, unti 1931, when Austria’s Creditanstalt bank desperately needed injections of capital. Essentially, neither France nor England were willing to help unless Germany honored its reparations payments, and the United States refused to help unless France and the UK repaid its World War I debts. Neither of these demands was terribly reasonable, and the result was a wave of bank failures that spread across Europe and the United States.

The particulars of the current sovereign debt crisis are somewhat different from Creditanstalt, and yet it’s fascinating how smart people keep referring back to that ignoble moment. The big commonality is that while governments might recognize the virtues of a coordinated response to big crises, they are sufficiently constrained by domestic discontent to not do all that much.

So… is this 1931 all over again?

There are three aspects of the current situation that make me fret about this. The first is the sense that developed country governments have already tapped out all of their politically feasible methods of stimulating their economies. This is the time when both politicians and voters start to ask themselves, “Why not pursue the crazy idea?”

Essentially, we have two mutually-reinforcing problems. First, the most powerful economies in the world are in serious trouble, having come close to running out of ammunition to deal with their own problems. (See: The Fed’s announcement that it’ll respond to the recent downturn by . . . continuing to do what it’s been doing with little effect for the past three years for another two is a strong indication.) Second, the domestic political reaction to this is making it incredibly hard to muster the political will for coordinated action to fix systemic problems. (See: Angela Merkel fighting tooth and nail coming to the rescue of the PIIGS, despite Germany being in the same fiscal boat owing to the ill-advised dumping of the vaunted Deutsche Mark for the make-believe Euro.)

I haven’t the foggiest whether we’ll manage to avoid another Great Depression, and am inclined to believe that we’ll at very least have a double dip. But, hey, at least we’re not being attacked by zombies.

Pessimism does not equal wisdom.

China’s economy will keep the world afloat.

It occured to me last night that a very simple yet fundamental point is being missed.

What is the purpose of a stock market? It’s to raise capital for business ventures. It’s purpose is NOT to make money for investors. That’s a necessary side effect but it is still not the actual reason for the market’s existence. How much financial activity today is based on the primary purpose of the stock market and how much is oriented around the subsidiary result?

Perhaps what we’re discovering now is that treating the stock market NOT as a capital allocation instrument but as a casino/ATM for investors and members of the financial industry is an ultimately doomed enterprise.

Mike

It’s neither…it’s simply 2011

It’s neither 1931 or 2008. The world economy is reinventing itself – the end of cheap resources will result in the end of economic growth as we have known it so the world is going to have to de-leverage. And yes it will be painful.

QE3 would goose all asset prices not just commodities. It would boost the stock market, just as QE2 did. That’s the reason for the “wailing and gnashing of teeth”. The squeaky wheel and all that stuff.

It’s more like 1937.

Coincidentally, the market also goes up every time some Republican hack posing as an unbiased academic declares the world is ending, too.

Most folk do point to 1937, rather than 1931 … but it seems more likely that the developed world is turning Japanese. We have high savings (globally) and an aging demographic (in the developed nations in particular).

its closer to 1937…

Tyler Cowen excerpts Don Peck’s new book

(emphasis mine)

@john personna: The contrary to that, however, is that the economic contraction, localization and simplification that follows Peak Oil should negate or reverse many supposedly anti-male economic trends.

Mike

@MBunge: Yes. we will certainly need more farmers.

@MBunge:

Well ;-), one of the things about the above conversation is that it is already on a non-intuitive timescale. Even if this is a rhyme of 1929-1941, that is longer than we can really get our heads around. It isn’t suited for natural planning and strategizing. Our brains are made for ‘what should I do today?” “Should I hunt upstream or downstream?” and at very most “Do I have enough food for winter?”

I think the PO cycle when it comes will be a 3 or 4 decade thing. That’s what makes it so hard to tell if we are in it “now” and leads to all that confusion about summer gas prices.

It all comes down to “plan ahead, but not too far ahead(?)”

“But, hey, at least we’re not being attacked by zombies.”

Rick Santorum is still giving speeches. So is Gingrich.

“…turning Japanese…” I really think so.

By the Vapors. I don’t think that means what you think it doesn’t mean. Or something like that.

I think I could handle zombies better than a depression. After all, I’ve watched Sean of the Dead, Zombieland, Night of the Living Dead, Dawn of the Dead, and read the Zombie Survival Guide (hint: swords and axes don’t need reloading, and an axe is better than a sword as a sword requires skill). And cardio…the fatties will be the first to go. Yeah I know not politically correct, but when the zombies attack PC will go right out the window.

And yeah, I’m with Schuler, I’m thinking 1937 more than 1931.

@hey norm:

I mean in the economic sense, not the urban dictionary sense.

Funny cover at The Economist.

@Steve Verdon:

Shouldn’t you give Krugman credit for the 1937 call? I think he was the first.

Paul Krugman: That 1937 Feeling, published January 3, 2010

MMMM…BACON

From the Krugman column that JP cited:

I gather, in the words of Buckaroo Banzai, Yes to first, no to the second.

How much longer do markets have to shout “Deflation!” before we give the private sector the tools it needs to pull us out of this slump? We need to increase spending.

The FT opinion piece How to make monkeys out of rating agencies makes a good case for the Japanese scenario.

(While also undermining the idea that these “quasi-legal” ratings have power.)