Krugman vs. Krugman

Greg Mankiw presents a quote and article by Paul Krugman that, if you didn’t know any better you’d swear were written by different people.

Krugman on This Week:

Paul Krugman: Social Security, if you go through the federal government, piece-by-piece, and see which programs are seriously underfunded and which are close to being completely funded, social security is one of the best. It’s not for certain that social security has a problem. And it’s something that the right has always wanted to kill, not because it doesn’t work but because it does. And Obama to go after this program, at this time, you have to wonder. All of my progressive friends are saying what on earth is going through his mind to raise this

Krugman from the New York Times:

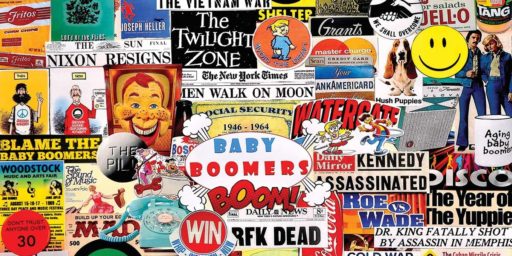

Generous benefits for the elderly are feasible as long as there are relatively few retirees compared with the number of taxpaying workers — which is the current situation, because the baby boomers swell the workforce. In 2010, however, the boomers will begin to retire. Every year thereafter, for the next quarter-century, several million 65-year-olds will leave the rolls of taxpayers and begin claiming their benefits.

The budgetary effects of this demographic tidal wave are straightforward to compute, but so huge as almost to defy comprehension. Mr. Peterson, the chairman of the Blackstone Group, a private investment bank, informs us that ”the combined Federal cost of Social Security and Medicare, expressed as a share of workers’ taxable payroll, is officially projected to rise from the already burdensome 17 percent in 1995 to between 35 and 55 percent in 2040. And this figure does not include the many other costs — from nursing homes to civil service and military pensions — that are destined to grow along with the age wave.”

Must be tough living with such schizophrenia.

However, all snarkiness aside, In the New York Times article Krugman is discussing both Social Security and Medicare. The problems facing Social Security aren’t all that serious. Some moderate policies could bring that program back into balance at least for awhile. And while I think this is the less desirable solution1, it isn’t that horrible. Medicare is indeed the 5,000 pound gorilla that could end up crippling the economy.

_____

1My view is that Social Security is “fixed” periodically but that these fixes never work for very long. A more permanent solution might be some sort of forced savings that has everyone putting money into a diversified investment fund and manages disbursements to avoid market fluctuations.

Disaggregating Social Security and Medicare does change the picture somewhat. If Dr. Krugman were speaking about Social Security only in both cases, it would improve the case that Dr.Krugman is less interested in policy than in partisan gain. As it stands the case is less strong.

Before solutions are proposed it’s probably a good idea to consider the political constraints for the solutions. We’re not going to eliminate either the Social Security or the Medicare programs. They’ll continue to exist in some form for the foreseeable future. Within those constraints what’s the best solution for solving the prospective Social Security imbalance.

I continue to believe that whatever problem exists with Social Security will be corrected as it has before: with a combination of increasing the Social Security retirement age, increasing the FICA rate, reducing the benefit level, and borrowing. One may rail against the unfairness of it all (as I’m sure will be done in comments to this post) but that’s what’s going to happen.

The prescription depends somewhat on what one thinks the problem with Social Security is. It’s generally painted as being too few workers supporting too many benefit recipients but I think that’s too narrow a view. Our society has changed (largely, in my opinion, through the confluence of government policy decisions and technological change) so that most income increases over the last 30 years have been concentrated in the top decile, indeed, in the top 1% of income earners.

Consequently, it’s not a case of too few workers supporting too many beneficit recipients. It’s an increasing proportion of income excluded from the tax. If that’s the case the solutions are to change policies so that median incomes increase (and FICA revenues along with them), or subject a much higher proportion of income to the tax either by raising FICA max substantially or eliminating it altogether.

My takeaway is that Greg Mankiw is glibly dishonest.

No kidding. Mankiw actually stopped accepting comments because too many people started seeing the hackjobs like this one for what they were.

Do flat tax plans include social security as a flat rate on 100% of income, or do they still leave it as only taxable on the first $97,500? I’m curious if taking social security taxes from 100% of income would provide it with the funding it needs, maybe even at a reduced rate.

Most flat tax plans of which I’m aware (the FairTax plan, for example) eliminate FICA entirely, replacing it with the flat tax.

And, yes, taxing all W-2 income would ensure Social Security solvency. And then some—it would be one of the largest tax increases in American history if it were done at current FICA rates.

Mankiw is a dishonest hack.

Anyone who has looked at these issue for more than 6 seconds knows that social security is relatively stable and solvent, but medicare is not.