McCain and ‘Privatizing’ Social Security

Quite a few commenters are accusing John McCain of flip-flopping because he favored privatization of Social security in 2004 and now adamantly rejects the insinuation that he supports it now:

This is a clumsy rhetorical game rather than a policy shift. Then and now, McCain’s position is that Social Security would remain as a government program but that younger workers should be allowed the option of placing part of the money they would have been required to remit to FICA into a private retirement account in return for reduced future government benefits. Sometime during the 2004 campaign, though, Republican learned in focus groups that “privatization” was an unpopular label for this policy and started talking instead about “reforming” or “strengthening” Social Security instead.

Hilzoy makes a more interesting, related argument, which she illustrates with a clever cartoon:

McCain talks as though letting younger workers put some of their FICA taxes into private accounts would help fix the Social Security shortfall. This is not true. Private accounts would make the Social Security shortfall much worse.

Recall the way Social Security works. I pay Social Security taxes. My taxes are used to pay the benefits of today’s retirees. When I retire, my benefits will be paid by the taxes of the generation behind me, and so on. Suppose that we start allowing people to put some of their FICA tax dollars into personal accounts. That means that I will be paying not for the generation of workers who are now retired, but for me.

As it turns out, she and McCain are both right; they’re just talking about different things. McCain’s point is that we’re trapped in an unsustainable cycle. As the number of retirees increases while the number of workers decreases, this generational transfer won’t work. Getting young people off the merry-go-round, at least partly, helps solve the problem long term.

But, yes, the short-term impact is that there are fewer dollars going into the kitty to pay for the retirees who were fed the lie all along that they were actually paying into a “trust fund” for their “own retirement.” Considering that we all agree — and McCain emphasizes — that we’re morally obligated to pay current and future retires whose potential savings we siphoned off into a Ponzi scheme, Hilzoy concludes:

That means one of three things. Either it will come from the Social Security Trust Fund, in which case it will make the Trust Fund’s solvency problems worse; or else it will come from Our Tax Dollars, which doesn’t sound very pleasant, or else it will come from the Fiscal Fairy, who makes our numbers add up by magic.

That last option is the most favored by Democrats and Republicans alike, especially during campaign season. In reality, of course, Option 1 and Option 3 are identical given that neither fairies nor the Social Security Trust Fund actually exist. Social Security payments will therefore continue to come from our tax dollars, unpleasant though it may be.

Regardless, substantial privatization of Social Security in the near future is a dead letter. The Baby Boomers are incredibly powerful politically, the Democrats will control the Congress regardless of who wins the presidency, and confidence in the stock market is lower now than it was four years ago. The debate is, therefore, almost entirely academic.

As I wrote nearly four years ago, our alternatives are rather bleak:

- The status quo. This is unsustainable without a massive influx of young people into the system willing to shell out an increasing share of their income to comparatively wealthy elderly folks retiring at what is now a relatively young age.

- A sustantial increase in the retirement age. When FDR established this program in 1932, 65 was very old. Indeed, it was past the expected lifespan. Now, people who reach 65 can expect to live another 15-20 years. We’ve already gradually increased this for the out years. But raising it to, say, 75 will be incredibly difficulty politically and doesn’t take into account the fact that even 65 is relatively old for those in more labor intensive occupations.

The “massive influx of young people” caveat is actually more plausible than I thought at the time, if we’re willing to have this happen through immigration. We’d need to do it on the books, though, so that we’re actually collecting FICA taxes. The “guest worker” option, wherein we collect FICA taxes but then send them from whence they came before they can collect benefits would be even better from a fiscal standpoint but has the drawback of being horribly immoral.

Um…did you miss the rest of Hilzoy’s post? The part where she points out that, for example, over the last 12 years the ‘insolvency date’ has been pushed back…12 years? (That’s under the pessimistic scenario, by the way.) You’re buying into the whole ‘crisis’ meme even though there’s no real support for the idea that there’s anything like a crisis here.

Also: in enumerating the ‘bleak’ alternatives for fixing the non-crisis ‘crisis’, you leave out the really obvious one: lift or alter the earnings cap (see, e.g., Obama’s ‘donut’ proposal).

Medicare funding: crisis. Social Security: not so much. And the Medicare crisis is really a healthcare crisis–the cost of healthcare is spiralling out of control across the board–rather than a crisis specific to government funding.

The collision is ahead; that it’s not going to happen immediately isn’t a rationale for not avoiding it. And, indeed, it’s an argument in favor of, not against, starting to shift today’s young people away from the system now.

I.e., “raise taxes.” But that just increases the generational transfer; it doesn’t make the system more sound.

Nailed that one, Mister Joyner.

Any private company running a “ponzi scheme” such as Social Security would have long ago found their executives languishing in a Federal prison.

To Me, there are only a few ways to fix Social Security if you leave the present plan in effect:

Increase the retirement age.

Perform Means testing of people of retirement age.

Increase taxes on individual wage earners.

Increase the amount employers pay.

Lower benefits.

Why don’t we just try making individuals responsible for their lot in life.

Privatization…

Any private company running a “ponzi scheme” such as Social Security

Obviously, you simply don’t know what a “ponzi scheme” actually is. Look it up sometime and then come back with an actual argument as to why SS is a “ponzi scheme”. Only right wing tools characterize SS as a “ponzi scheme” and the only that reveals is the ignorance of the person making the comparison.

James:

This is a clumsy rhetorical game rather than a policy shift.

Actually, you’re playing the clumsy rhetorical game. The issue came up because McCain doesn’t want the term “privatization”, which polls slightly worse than Lime Green Backgrounds and having Zombies eat you for dinner. No one is claiming that McCain is making a policy shift. In fact, it’s precisely the opposite of that claim. Democrats are claiming that McCain is *still* for privatization, and is simply trying to call it something different because when people hear it characterized as “privatization” they don’t think it’s a great idea.

Now, McCain is claiming people are *falsely* saying he’s for privatization of SS when, as you point out, it’s simply the exact same policy he used to call “privatization”.

You can try to make this into an argument about SS and such, but it’s really just the Democrats labeling the policy in an honest fashion which used to be used by the right – until focus groups showed them what a stupid policy it was.

The collision is ahead; that it’s not going to happen immediately isn’t a rationale for not avoiding it.

“The collision” is a state of mind, a rhetorical device. What *might* happen is some degree of rise in the ratio of people receiving benefits to people paying them. Now, if that ratio rose in a really, hugely, enormous manner, it might possibly become a ‘crisis’ in that taxes on workers might have to rise so high as to impoverish workers.

But what I’ve read in the stats on the topic suggests that our “collision” – in the worst case scenario, at the peak of the ratio plunge – the ‘crisis’ involves a tweak in payroll taxes not much larger than Barack Obama’s.

That’s no collision in my mind.

I’d be happy and interested to see a blog post from you that thoroughly reviewed the math and the suite of projections here: maybe I’m wrong. You could even demonstrate it. But you haven’t.

The viability of Social Security would probably be greatly increased if congress stopped raiding the “trust fund”.

As far as McCain’s position, it is pretty simple, he was for privatization before he was against it.

My sense is that the “crisis” we keep hearing about from the right is sort of like the imminent collapse of the French health care system they have been going on about for 25+ years now…

I wish for once we could all be honest about Politics and say that for ANY politician to bring up SSA or Medicaire/aid is to pander for votes.

Forget privatization, if we truly want and desire to fix this mess we should A) Close down SSA once and for all. All of the people on SSA would get said money until they die, and all the people currently on MedicAIRE/AID would get that until they die.

Everyone else would be cut off from the coffers and be allowed to throw their money into tax free IRA’s that they could borrow against, but not take out until they retire (at what ever age they retire). Then we put the responsibility of building a retirement plan on each individual.

It may sound callous, but let’s be real, killing the problem is what fixes it, not “all talk and no action” like every politician has spun it.

I wish for once we could all be honest about Politics and say that for ANY politician to bring up SSA or Medicaire/aid is to pander for votes.

Forget privatization, if we truly want and desire to fix this mess we should A) Close down SSA once and for all. All of the people on SSA would get said money until they die, and all the people currently on MedicAIRE/AID would get that until they die.

And B)everyone else would be cut off from the coffers and be allowed to throw their money into tax free IRA’s that they could borrow against, but not take out until they retire (at what ever age they retire). Then we put the responsibility of building a retirement plan on each individual.

It may sound callous, but let’s be real, killing the problem is what fixes it, not “all talk and no action” like every politician has spun it.

FireWolf: ROFLMAO!

First, pandering for votes is the very definition of politics! I mean, really. What on earth do you think happens in politics.

Second, where’s the mess? Do you actually have any evidence of a mess? SS is the most popular social program in the US, is the most efficient government run program in the US and is solvent all the way to 2041, currently – and for every year forward, that date will be pushed out a year as well.

So, where’s the mess? The only mess I see is the right, in that they are completely confused, and unable to even back up their assertions with actual, verifiable facts.

Ok, at the start of SSA there were 43 taxpayers into the system for every 1 person drawing out.

Now that ratio is 3:1.

I ask you…. “Where is the f@@king efficiency in that?”

To pay into a system for people retiring now with no guarantees that you yourself (the payee) will ever see a return is insane.

That is not efficiency that is a racket/pyramid scheme if I ever saw one.

Hal, you can laugh all you want, but until you show some intellectual honesty, clearly you are debating way out of your league.

Hal, you can laugh all you want, but until you show some intellectual honesty

Yes, I’m the one who’s holding a dishonest debate.

The problem at the moment is that the right wants to dismantle the system I have been paying into for 30+ years, then tell me “tough luck, its the Democrats fault”.

You’re right. It is a clumsy rhetorical game rather than a policy shift. McCain is for privatizing Social Security, er, putting their FICA taxes into “personal accounts” instead of Treasury bonds. His policy hasn’t changed, but his rhetoric, which polls poorly when people find out what he’s actually talking about, has changed.

But guess what? Workers can already put some of their money into “personal accounts” for retirement. They are called 401(k)s and 457s and the like. How have they fared this year, I wonder? Umm. Not very well. Wonder how the Enron workers like having their retirement money in their “personal accounts”? How about those Countrywide folks? And this past year, yeah those Wall Street managers sure managed those “personal account” portfolios, didn’t they? All those mortgage bonds? Managed them right into bankruptcy. Have you seen your “personal account” statement yet this year?

Meanwhile, the outlook for SSA has improved over the last four years. Pushed the so-called “crisis” interval, meaning not bankruptcy but *if* nothing changes, the payout would be reduced by some percentage, to around 75 years from now. Some “collision” we are talking about. Social Security doesn’t look like such a bad deal now, does it?

The problem at the moment is that the right wants to dismantle the system I have been paying into for 30+ years, then tell me “tough luck, its the Democrats fault”.

Well, there’s that point which they simply conveniently shove aside in all their “debates”. However, FireWolf’s claim of “no guarantees that you yourself (the payee) will ever see a return is insane” is the same argument the right has been making since 1935 and it simply has failed to materialize – ever.

It’s whining, pure and simple – ignorant whining, at that.

Tom, the problem with your statement is that while yes we have Roth IRA’s and others, mutual fund investments, stocks, bonds, etc, you are paying twice for financial security. If you pay into FICA and then have to take what is already taken from you to pay some other type of retirement plan, that is paying twice for retirement.

I know that the government motto is “Why pay once for something when you can pay twice” but damn, clearly if you want some fairness in government and money in your pockets, not nailing you twice (once to rob peter to pay paul, and only then yourself) while you smile and take it in the rears.

Secondly, everyone who has invested in something (be it real estate, stocks and other investments) have all taken a hit. Why? Because the economy sucks right now. (Thank you government leadership)

So to say that getting social security should be the hopes and dreams for everyone is clearly hoping that society as a whole stays stupid.

This is called investment diversity. It’s a fundamental principal of investing. You don’t put all your eggs in one basket. (such as an IRA) If you personal investments all fail, well, you still have something to fall back on (social security) and you do not spend you declining years in abject poverty.

If you are going to give us lectures on investing, please try to get at least minimally informed first.

Please show me where I said that Social Security should be the “hopes and dreams for everybody.”

Your assertion that people are “paying twice” for financial security? “If you pay into FICA and then have to take what is already taken from you to pay some other type of retirement plan, that is paying twice for retirement.” Huh? Please clarify that.

I don’t know about the next guy, but I pay FICA and Medicare taxes on my income, and then I put a substantial portion of my pre-tax earnings into various retirement plans. I’m not putting anything that is “taken from” me into some other type of retirement plan.

That’s what McCain is proposing. Taking your FICA taxes, i.e. “what is already taken from you” and making you put it into some retirement plan, which will presumably be taxed when you withdraw it. If there’s anything left of it once Wall Street finishes “managing” it. Such a deal! For Wall Street, that is.

Ok Tom, Anjin, let me clear up two birds with one stone.

First of all Social Security is taxation and not a personal choice. When you see your paycheck you don’t get to check or uncheck the FICA withdrawl box whenever you feel like it.

Secondly, because it (SSA/FICA) is not a choice, you cannot call it investment diversity because that “diversity” predisposes some form of CHOICE.

Thirdly, since we are going from a 42:1 to a 3:1 reduction in the number of payees versus “withdrawlees” that means that social security/FICA is inefficient and we all have seen the reports stating that it will go bankrupt soon. When it does, are you going to tell the taxpayers “Oh well, looks like we’ll just have to take more from you?” No, because you think that this is the most secure form of retirement planning that has ever been devised (next to pyramid schemes).

All I am saying is that if you want to solve social security honestly, you need to pay for those who are on it and no more. Killing the program is not the end of the world, but you have to deal with those people (the rest of the US population) who will be left holding their “packages”. To do that you need to stop collecting FICA, allow them to then use that money, or whatever amount they desire, and put those funds into some type of compounding interest, non-taxable retirement program and call it the “Personal Retirement Security Act”.

Is closing a failing program such a horrible thing to you lefties?

Damn, there are some clueless people in the world.

The point of Social Security is SECURITY. That’s why it’s the noun in the name of the program.

If you invest — this should be less shocking to y’all nowadays, but you might best sit down first anyway — you *might* lose everything. Thus eliminating your retirement.

At which point — what?

(1) “Too bad for you, Mr. Poor, Old Person — you should’ve been smart, like a right-wing blog commenter!”

(2) The feds provide an “emergency pension” anyway, roughly the size of a Social Security payout — kinda like the Bear Stearns bailout, except here it’s for people who actually need the money in order to live.

Given that old people can and do vote, which outcome do you think is more likely?

Social Security is a safety net — it’s always been a safety net — it’s done a grand job in reducing poverty among the old. (Check out the stats before the New Deal — scary stuff.)

“Privatizing” SS ignores the entire point of the program. But that’s what the foregoing commenters want to do — ignore & eliminate Social Security. God knows why. Too much free time, I suppose.

I can call it anything I want. The money I have been paying into social security for decades, while not voluntary, is a part of my retirement equation, (unless the right succeeds in ripping it off) and as such, the money I have paid in is an investment in the future. I am not all that interested in the rather silly semantic gymnastics you are trying to employ now that your arguments have been shredded.

I have seen absolutely no evidence that social security is failing. Yet another red herring.

You see Anjin, Anderson, and all of you Hal types, this is where YOU are the confused ones.

This isn’t a situation in which our retirement plans are being dwindled or stolen by some “right blogger” or open and honest discussion or debate.

This is where you ASSUME that the good ol’ government has YOUR BEST INTERESTS AT HEART and you believe them.

I’ve never said that I believe in privatization. In fact, throughout this discussion thread, I’ve stated that SSA needs to be tossed into a gutter (except for those on the payroll right now) and we derive a new solution. That’s not privatization. That’s outright GET RID OF IT!

There is a fundamental difference in my viewpoint that you need to come to accept.

As for you being the only “victim” here Anjin you aren’t. Senior citizens, middle-aged, all the way down to the lowly paper-boy all have a vested interest in this situation because WE ALL PAY.

Get it? WE?

My point is that in a Utopian world we could live and be happy knowing Uncle Sam will always be there for us, this two party sham you call a democracy wouldn’t have a place in that world because we’d be taken care of. No Democrat, and No Republican in this governmental system is here to see that YOU “Anjin Q Public” will be safe, secure, and happily living off your Social Security.

I think I like the “anjin a public” line the best. I could almost see firewolf in his pink bathrobe and bunny slippers shaking his golf club at us kids on his lawn.

As opposed to believing that corporations have our best interest at heart? Ask Enron employees if they are enjoying their retirement, or any number of folks who have been screwed out of their pensions.

At least with the government, there is some accountability and some recourse. In my view, the best course for our society is a balance between government and the private sector, attempting to utilize the strengths of each while mitigating their shortcomings. I certainly do not endorse free booting capitalism, where we can all enjoy the tender mercies of men such as Pres. Bush’s good friend “Kenny Boy” Lay.

You are degenerating into rant mode Wolf. You have presented zero proof that SS is in a crisis or is not viable for decades to come.

GAO Report on SSA and Medicare Shortfalls

SSA Solvency

Social Security in jeopardy

I mean seriously, don’t you have google Anjin?

Social Security is not going bankrupt. It will not go bankrupt. You have been misinformed.

Social Security funds are guaranteed by the full weight and credit of the United States of America Treasury Bonds. Now, according to projections, if we continue along the exact same path we are headed, 75 years from now payout might have to be reduced by 10 to 20% in order to sustain the number of people on the program at that time. That situation could easily be remedied by raising the wage ceiling from the first $102,000 per annum (in 2008) to something a little higher than that.

Unless you think that the United States itself is going to go bankrupt. I don’t.

Still waiting. The links you provide show no evidence of a crisis, simply that there is a possibility of serious problems many, many years from now. Even if we accept the 2041 insolvency date, that would mean SS is viable for decades to come, which is after all, what I said, your mastery of Google non withstanding.

What is happening here is quite clear. There is an attempt to manufacture a crisis. The Bush government has show that is about as far away from practicing any kind of fiscal responsibility as you can possibly be without leaving the solar stem entirely, so I take anything they say with a couple of tons of salt.

But hey, if the GOP does succeed in scuttling SS, there will be dignified, gainful employment for all those 80 year olds left in the lurch, cleaning toilets for people like Jenna Bush…

Or we could use the McCain retirement plan. Dump your wife and marry an heiress…

BTW, no one “has” Google. It is a web based application accesses by means of a browser, which anyone who is posting to a blog obviously has. It is not an application which lives on ones local system.

Learn how the internets work Wolf…

Tom, I don’t mean to hurt your feelings here but what you just stated clearly illustrates that you don’t know where the government gets its money from.

Remember that “WE” part I mentioned a few comments ago? Yeah, WE pay for that. The government doesn’t open up the checkbook from the bank account that said Government opened because Government had a job that paid him/her well (let’s be gender inclusive here). Not at all, government wrote the check because in the governments bank account sits all of the tax money collected from the citizens (and illegal immigrants) that paid into that bank account. Ok?

Think of it this way Anjin….

If we kick out all the criminal illegal immigrants, these 80 years olds can be secure in knowing that Wal-Mart will be hiring. Yes?

FireWolf, reading comprehension:

One has to just laugh at your ability to project 75 years into the future – no doubt far longer than you’ll even be alive and worry about a theoretical drop in benefits which may or may not come about.

Geebus.

Oh, okay. I see what you are buying into. The so-called “cash deficit.” Is that as far as you can read? That situation was foreseen during the 1980’s, son, when the Ronald Reagan Administration decided to raise FICA taxes to create a substantial surplus of FICA taxes to be put into Treasury Bonds. It’s that surplus that is projected to last 75 more years. Don’t ever let them tell you that Ronald Reagan didn’t raise taxes; he did, big time. Just not on the rich people. For example, he decided to tax the unemployed people. And waiters and waitresses. Look it up.

Remember “surpluses?” When Bill Clinton was president, we had budget surpluses. Reagan ran the biggest deficits in history, until George Herbert Walker Bush, who ran bigger deficits, but HW’s son, George Bush, beat ’em all to hell. George W. Bush has run the biggest deficits in the history of the world. Bill Clinton? Budget surplus!

I advise you to read more about how Social Security works beyond one little scare-mongering graph, son. You’ll improve your ability to debate this kind of stuff, and as a bonus, you’ll educate yourself as well.

Firewolf, dude.

I don’t mean to hurt your feelings here

No, you aren’t hurting my feelings. I’m just greatly concerned that you have been so badly misinformed, or choose to be so misinformed about what amounts to issues pertaining to your own well-being.

I’m actually well aware how social security works, and how the federal budget works, and where the money comes from and where it goes. What worries me is that Republicans like you prefer to live in some kind of fantasy world where massive deficit spending is just great because the rich people “are due” while they worry about something like the social security program, which is solid and successful. Someday you are going to know what a dupe you are in buying into this Republican bull hockey.

Not exactly. The problem is a little more complicated than that. The key problem is that not enough income is subject to the tax. Basically, there are two ways for that to happen: James’s solution (“a massive influx of young people”) or raise FICA max (the income level at which income is subject to the tax).

Presumably, James’s answer to this is that if we raise FICA max without also increasing benefits available to higher income folks it will reveal that Social Security isn’t an insurance program but a welfare program. I don’t have any problem with that.

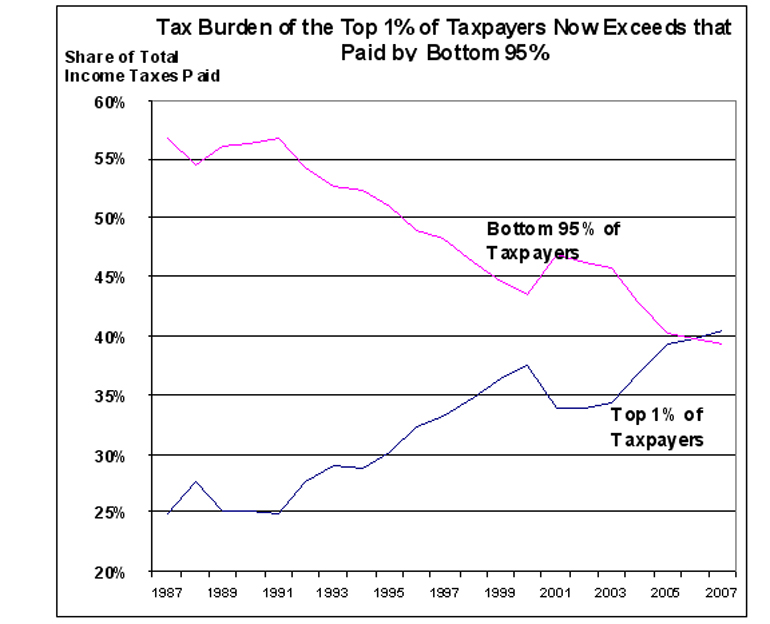

The underlying fact is that an ever greater proportion of total national income has avoided being subject to the tax because so much of the increase in income over the last 30 years has been among people most of whose income isn’t subject to the tax. And IMO that’s a direct consequence of policy decisions made along the line. I think it’s perfectly appropriate and just for policy decisions to offset the adverse consequences of previous policy decisions and that’s what we’ve got to do.

No more immoral than forcing me (25 years old) to pay into a system that can’t survive long enough to pay me out.

“horribly immoral..?”

Look, I wouldn’t claim to any superior moral code or anything, but the truth is, a “guest worker” program is a trade-off with benefits and costs. Workers wouldn’t come here to work if they didn’t feel they were getting a benefit–, i.e., they make money they can send home for their families. Paying into FICA for the privilege of working to make money isn’t immoral, if workers are still making a profit. It’s only immoral if they come here to work and don’t make a profit. The system we have now is immoral: Immigrants risk their lives to cross the desert to get into this country to live their lives either hiding in the shadows in fear, or working as slaves for corporations like Burger King, picking tomatoes for 10 cents a bushel and living in squalor. Now, that is IMMORAL. Formulating a guest worker program wherein they pay a small amount into FICA, are documented to work here, make a decent living and live without fear, would be a step toward morality in my view.

I’m also not sure that guest worker program where we ask them to pay FICA is horribly immoral. As long as the workers understand what is happening, I think that they arguably should be allowed to decide for themselves whether or not they want to enter this program.

That said, I think a guest worker program where there is never any chance of citizenship is a bad idea, from a policy standpoint, in that it will create two classes of long-term residents. I would like us as a nation to decide how many new citizens we can assimilate every year, and then skim off the best and most assimilated of the guest workers for citizenship.

Obviously, you simply don’t know what a “ponzi scheme” actually is … Only right wing tools characterize SS as a “ponzi scheme” and the only that reveals is the ignorance of the person making the comparison.

Hal:

Paul Samuelson famously praised Social Security as a “Ponzi game” in his 1967 article, “Social Security, a Ponzi Scheme That Works”

Later, Paul Krugman was concerned about it as a “Ponzi game”.

“Social Security … has turned out to be strongly redistributionist, but only because of its Ponzi game aspect, in which each generation takes more out than it put in. Well, the Ponzi game will soon be over, thanks to changing demographics, so that the typical recipient henceforth will get only about as much as he or she put in (and today’s young may well get less than they put in).”

And Milton Friedman damned it as a “Ponzi game”.

Samuelson, Krugman, Friedman, “ignorant”?

Samuelson, Krugman, “right wing tools”??

Personally, when I hear three such great economists with such disparate points of view all describe Social Security with the words “Ponzi game” I think, who am I to argue?

Personally, when I hear three such great economists with such disparate points of view all describe Social Security with the words “Ponzi game” I think, who am I to argue?

Geebus. I think, “gee, why are they getting it wrong and what reason would they have to purposefully misinterpret something”. But hey, I’m not an authoritarian and don’t worship at the feet of those who would claim to be my betters.

I guess those on the right are different.

Oh, and if you actually read, rather than just google and grab links, you’ll find that Freedman and Krugman don’t claim SS actually is a ponzi scheme, rather there is a ponzi *aspect* to SS. And if you’re going to claim that because it has aspects of something then it must be the thing itself… well, you and Jonah Goldberg can go retake your intro to logic courses.

The so-called “cash deficit.” Is that as far as you can read? That situation was foreseen during the 1980’s, son, when the Ronald Reagan Administration decided to raise FICA taxes to create a substantial surplus of FICA taxes to be put into Treasury Bonds.

Ah, the myth of the Trust Fund being created in 1983 to hold savings to finance future benefits.

Alas, it is just not so. It’s a story made up later. Now a political urban legend. If you believe it is so, you don’t know how Social Security works, or politicians either.

Here’s Robert Meyers, SSA’s long-time chief actuary and Executive Director of the Greenspan Commission on this subject, in the SSA.gov oral history section…

~~ quote ~~

Q. As we look at it today, some people rationalize the [trust fund] financing by saying that it’s a way of partially having the baby boomers pay for their own retirement in advance. You’re telling me now this was not the rationale. Nobody made that argument or adopted that rationale?

Myers: That’s correct. The statement you made is widely quoted, it is widely used, but it just isn’t true.

It didn’t happen that way, it was mostly happenstance that the Commission adopted this approach to financing Social Security … The main thing that was talked about was how do we fix up the short-range problem. Are you sure we aren’t going to have another crisis in 2 or 4 years? …

~~ end quote~~

The 1983 Commission never even thought of using the Trust Fund to finance benefits, the idea never entered their heads. It was never discussed at all.

All the politicians wanted to do was make dang sure that the tax increase they put in then was high enough so they wouldn’t have to go through this political tax increase hell again on their watch!

If you want to full story you can get it in this report (.pdf) from the Congressional Research Service.

Read it and learn about how both Social Security and politicians function in real life.

The idea of privatizing Social Security may have some merit. After all, we do live in a society where businesses are revered and viewed as helping everybody. But why give the money to the individual? What would have happened to such funds if they had been invested by individuals in, Bear Stearns, or Exxon, or World com, or so many other companies that have gone belly up, or suffered a loss of income. If, however, the Federal Government was made to invest in private enterprise, and the companies they invested in had to fold, then the government would have to make up the loss. What’s wrong with such a scenario?

Dan Kanoza

I can’t understand the overwhelming liberal support for a program that takes money from poorer young people and gives it to wealthier old people.

Social Security has a horrible rate of return and the younger your are the worse the rate of return is. Typical Ponzi scheme, those who get in early do well. The late arrivals (younger people in this case) do very badly.

Social Security Ripoff

Hilzoy makes a more interesting, related argument…

“McCain talks as though letting younger workers put some of their FICA taxes into private accounts would help fix the Social Security shortfall. This is not true. Private accounts would make the Social Security shortfall much worse.

… My taxes are used to pay the benefits of today’s retirees… Suppose that we start allowing people to put some of their FICA tax dollars into personal accounts. That means that I will be paying not for the generation of workers who are now retired, but for me.”

This just the old “transition cost” argument — who will pay the “transition cost” of paying for current retirees if SS funds go into private accounts? — and Milton Friedman pointed out how totally false it is.

Social Security is underfunded. That is the Status Quo.

Any move to private accounts obviously must cover this underfunding somehow — by issuing more bonds, with tax increases, benefit cuts, whatever.

But staying with the Status Quo requires dealing with the same amount of underfunding to the dollar, to be covered the exact same way — by issuing more bonds, with tax increases, benefit cuts, whatever.

Dealing with this shortfall is a consequence of the Status Quo. And calling a cost of the Status Quo a “transition cost” of switching to private accounts is incompetence (or dishonesty).

The trick the Hillzoys of the world play on others (and/or themselves) is in the statement “When I retire, my benefits will be paid by the taxes of the generation behind me” — they won’t be, not without issuing more bonds, tax increases, benefit cuts whatever, because those benefits are underfunded. That’s when the “transition cost of the status quo” hits.

So the Hillzoy “transition cost” argument is this: “Social Security is underfunded. You have a proposal to deal with this undefunding. We don’t. Therefore you are making things worse!”

The effect of going to private accounts is to move the financing of the underfunding forward to today, using more borrowing (when interet rates are at historic lows) or tax increases (when taxes are the lowest they ever will be again) today. Then, that transition cost covered, 30+ years from now SS would be paid for and solid forever.

The Hillzoy solution is to wait to deal with the underfunding until 30+ years from now.

But not even 30 years from now, in 2030 — just 22 years from now — CBO projects that income taxes will have to be >50% higher than today to cover the cost of Medicare and Social Security! Or else deficits will be economy-crushing (without these tax increases S&P projects US bonds reach “Junk” status by 2027, and CBO projects the economy collapses when deficits exceed 20% of GDP soon after.)

The Hillzoys of the world want to wait to borrow more, increase taxes, or cut benefits THEN! Good luck to us all that way!

In short, as per Friedman, the present value of the “transtion cost” to the govt of moving to private accounts is exactly $0, because each dollar of cost incurred up-front saves a real dollar later.

Moreover, it would be a whole lot easier to incur that cost up-front today than after 2030 — because as per CBO, the tax increase needed in 2030 as a % of GDP will be larger than those enacted post-Pearl Harbor to fight World War II, and will be only increasing from there.

IOW, we’re not going to be able to afford to save SS “later”. The Hillzoys of the world are cutting SS’s throat, come 2030. (Just like Karl Rove planned!)

Well, let me just take a moment to educate you, Mr. Glass. Medicare and Social Security are two different programs. You may be confusing the two because both are programs that protect senior citizens. But they are funded by different funding streams and are administered by different entities.

Social Security program is in very solid shape for the foreseeable future. And yes, Congress and the Reagan Administration worked in a bipartisan manner to ensure the viability of the program for the foreseeable future. I encourage you to read the GAO reports to assure yourself of this.

Medicare, a completely different program that ensures health care for our senior citizens, has major problems, due to a number of factors. Republicans like John McCain love to fool people like you into conflating the two different programs. They do this to strike fear into the hearts of people who aren’t able to understand the idea that these are two different programs funded by two different tax streams, and who can’t understand that the two programs are administered differently and have different purposes. I encourage you to do some more reading about that.