Misleading Chart of the Day

A graph on public debt making the rounds is being used to misdirect rather than clarify.

A graph on public debt making the rounds misdirects as much as it clarifies. [Actually, as Daniel Larison correctly points out via Twitter, the chart’s fine; it’s the spin being put on the chart that’s the problem.]

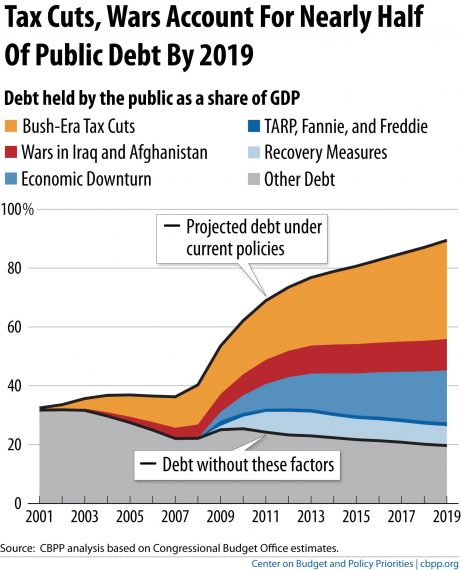

Ezra Klein helped take this graph viral yesterday:

He explains:

The single thing you should look at to understand the debt clock and what it is — or isn’t — telling you is this graph from the Center on Budget and Policy Priorities. It does something very simple. It takes public debt since 2001 — which is when we last saw surpluses — and breaks it into its component parts.

You can see it kind of looks like a layer cake. In fact, the folks at the Center on Budget and Policy Priorities call it “the parfait graph.”

The top layer, the orange one, that’s the Bush tax cuts. There is no single policy we have passed that has added as much to the debt, or that is projected to add as much to the debt in the future, as the Bush tax cuts, which Republicans passed in 2001 and 2003 and Obama and the Republicans extended in 2010. To my knowledge, all elected Republicans want to make the Bush tax cuts permanent. Democrats, by and large, want to end them for income over $250,000.

In second place is the economic crisis. That’s the medium blue. Recessions drive tax revenue down because people lose their jobs, and when you lose your job, you lose your income, and when you lose your income, you can’t pay taxes. Tax revenues in recent years have been 15.4 percent of GDP — the lowest level since the 1950s. Meanwhile, they drive social spending up, because programs like unemployment insurance and Medicaid automatically begin spending more to help the people who have been laid off.

Then comes the wars in Iraq and Afghanistan. That’s the red. And then recovery measures like the stimulus. That’s the light blue, and the part for which you can really blame Obama and the Democrats- though it’s worth remembering that the stimulus had to happen because of a recession that began before Obama entered office, and that the Senate Republicans proposed and voted for a $3 trillion tax cut stimulus that would have added almost four times what Obama’s stimulus added to the debt.

Then there’s the financial rescue measures like TARP, which is the dark blue line. That’s almost nothing, as much of that money has been paid back.

If we didn’t have all that? If there’d been no Bush tax cuts, no wars, no financial crisis and everything else had been the same? Debt would be between 20 and 30 percent of GDP today, rather than almost 100 percent.

Now, up to a point, this is an important argument. Republicans are trying to place all of the blame for the skyrocketing of the debt under Obama on Obama when a huge chunk of it is a result of policies they support. Fair enough.

But it’s too cute by far to credit all of the yellow, red, and blue to Republicans while only assigning the “recovery measures” to Obama and the Democrats.

While it’s true that the Republicans have fought tooth and nail to make the Bush tax cuts permanent, Obama has not only gone along but has embraced with great fanfare extending all of the Bush tax cuts except those on the tiny sliver at the top. It’s not like the Democrats have gone out on a limb of fiscal responsibility and said, “Sorry, middle class Americans, we’re going to hike your taxes during the middle of a sluggish economy because we need the cash to pay for the government programs that you love.” So, Republican recalcitrance is the cause of only a small portion of the yellow from January 20, 2009 onward; the rest is bipartisan pandering.

Obama won the Democratic nomination largely on the strength of having opposed the Iraq War from the beginning while most of his major opponents supported it. But his predecessor had already set into motion a plan that extracted the country from that war; all Obama did was follow it. (And, to be fair, resisted pressure from some Republicans to somehow pressure the Iraqi government into keeping it going.)

On Afghanistan, he not only did nothing to wind down a war that was obviously unwinnable by the time he took office but doubled down on it. He’s not only gotten a lot of American soldiers and marines killed needlessly, the continuation of the war and the debt incurred fighting it is on him. (Not that there has been much leadership in the other party on this matter, either. A President McCain may well have done the same stupid thing. But we’re running the accounting based on who’s sitting in the big chair, not a hypothetical alternative history.)

Under Bush and a Republican Congress, we recklessly ran up the debt through a combination of prolonged wars, expansion of popular entitlement programs, and tax cuts. An internal revolt has brought to power Republican True Believers who actually want to cut back government spending and get the debt back under control—although not if it means raising taxes.

But Obama continued the popular tax cuts and refused to take the heat for backing us out of Afghanistan, preferring to get American troops killed in a fruitless effort than risk being painted as “weak” by his opponents. At the very least, he can take the blame for the fiscal consequences.

Blaming Obama for continuing the tax cuts he wanted to stop is like blaming a parent for handing over his wallet when someone has a gun to his kid’s head.

I’d submit James, that when you have to construct a sentence like this, you’ve lost:

IOW, while my party is totally screwed up, it’s not so bad because the other guys are a little screwed up too.

“Both sides do it.”

(Not only that, your “we can’t even start with tax cuts for the rich” is indefensible. It is standing with the worse, as enemy of the better.)

James… yes, you are right… but the important thing to note is that Obama’s main contribution is to the debt is supporting tax cuts and the Afghan War, not taking money from hardworking white people and giving it to undeserving blacks as the GOP would largely like us to believe.

Obama gets a lot of blame in my book for creating a condition where the debt is difficult to manage, but it isn’t doing the things he’s usually accused of — transferring wealth from the successful to the lazy. The problem with Obama’s approach to fiscal matter is that he’s a continuation of Bush, not some sort of radical leftist overseeing a dramatic expansion of the welfare state.

It’s methodologically suspect: increases in transfer payments are “baked into” the figures and, consequently, don’t show up in that graph.

Don’t get me wrong. I opposed the “Bush tax cuts” ten years ago and think that the president was unwise to support re-authorizing them in 2010. I also opposed the invasions of Afghanistan and Iraq and the consequent run-ups in defense and security spending.

However, attributing everything to the tax cuts, increased defense and security spending, and the economic downturn leads one to draw an incorrect inference: that there aren’t other factors at work as well.

Romney’s new tax proposals add $3.4 trillion to deficit

Seriously. The old complaint is that someone has made the perfect the enemy of the good. In this cycle “fiscally responsible conservatives” have made the terrible the enemy of the good.

@Dave Schuler:

I think “methodologically suspect” is incorrect. Any measurement that is clear in its method is correct. It’s just true that any graph cannot be “every” graph.

What you’ve suggested is that automatic increases, in response to change in demographics and changes in employment, would be large relative to factors on this graph.

I’d need to see a different graph to believe that. Right now I don’t.

@Dave Schuler: Yes, growth in spending was “baked in,” but the point is that even with those baked in, debt/GDP was projected to decline. In other words, our there was no “entitlement crisis.” Had we paid down debt and “lock boxed” social security in 2000, we could have sustained social security and medicare expenses for the credible time horizon (yes, things still got screwy 30 years out).

Now 9/11s, economic slowdowns, etc. can happen regardless, so those projections are problematic in that sense. But they not problematic because growing entitlements are “baked in.” Rather the point that they were baked in and still projects showed sustainability is precisely the key.

Your point would be relevant if those increases were not baked in, that is, if the 2000 projections assumed SS or Medicare were flatlined. But they didn’t.

@Dave Schuler:

Can you develop this further so we can see it?

That really is a funny chart. Klein and the CBPP folks must recently have had lobotomies.

It equates tax cuts directly with public debt, as if not taxing is identical to spending public money. The underlying implication being that the government must spend its citizens’ tax dollars. It’s insouciant to the rather obvious fact that any shortfall in government revenues simply could be offset, duh, by spending less money. That’s what states do. States have to balance their budgets. The Feds do not. This “chart” and its underlying premises also are insouciant to the proven fact that lower tax rates can and often do lead to higher tax revenues, especially in connection with such items as capital gains taxes.

There are around a half-dozen or so other obvious fallacies with this meme, several of which are addressed in the main blog post. Suffice it to say that if you actually believe this tripe then I’ve got a bridge in Brooklyn to sell you, sight unseen.

@john personna: Much of the time, both sides actually do do it. Obama doesn’t want the Bush tax cuts to expire, because he’d be painted as raising the taxes of middle class Americans. The only fight, then, is whether to extend the cuts for top earners (variously, over $250k or over $1 million).

@Dave Schuler: A fair point, indeed.

Under Bush and a Republican Congress, we recklessly ran up the debt through a combination of prolonged wars, expansion of popular entitlement programs, and tax cuts. An internal revolt has brought to power Republican True Believers who actually want to cut back government spending and get the debt back under control—although not if it means raising taxes.

Yet it’s a reasonable bet that if elected, the GOP will behave exactly the same as when Bush was in office. Your revolt was about scaring ignorant whites who somehow believe that there are Other People that can be screwed in order for their benefits to live on. Romney wants to cut government spending, but he won’t say where. Ryan wants to reduce Medicare costs, but he operates under the pretense that the private insurance market will somehow reduce costs without affecting medical care of the elderly. None of the numbers add up. They don’t even try to defend them anymore. It’s just Paul Krugman v. paid hack from the AEI, for eternity.

The GOP is in the exact same fantasy position as it was in 2000. Then we heard so much about how ‘adult’ Cheney and Bush were compared to the irresponsible Bill Clinton. They would run America like a business. Remember how that turned out?

Now, we’re being sold hard truths and tough love. The same vulgar schtick, the same results. The truth is that the only way the GOP will ever reduce the scope of government is by intentionally setting it on fire.

If you want responsibility, vote for Obama. If you want vague ideas sold by counterfeits to people who can’t count, vote for the GOP. Just don’t pretend anymore that there’s any degree of reality on your side.

So the Obama stimulus of $1 trillion per year as it was rolled into the baseline budget is not the main driver of our debt increase? The Obama stimulus has transferred huge amounts of capital from the private sector to the public sector. He has grown the federal government dramatically. Government i always less productive than the private sector.

@Dave Schuler: If one looks at the facts revenue dramatically increased as the bush tax cuts took affect. Remember the bush tax cuts pulled us out of the Clinton recession and the 911 downturn. Only a static analysis liberal bonehead would present a graph this way. The economy would have stayed in the ditch in 2002-2006 if the tax cuts had not been done.

Obama has retired the trophy for irresponsible spending.

Hiking taxes during the middle of a sluggish economy is not fiscal responsibilty. It is, rather, the height of fiscal irresponsibiliy. The time to raise taxes is when the economy is doing well; when the economy is doing poorly, it’s time for counter-cyclical measures, which includes keeping taxes lower.

@James Joyner:

I’m sorry, but that is a straight up math fail. If we take the simple (and accurate) position that Obama wants to drop only the top bracket tax cut, and congressional Republicans want to keep them all, then Obama’s plan is more fiscally responsible.

You’ve never actually debated that, you’ve done something deplorable. You’ve made his better tax plan morally unacceptable. You at that point made the perfect the enemy of the good, and said we couldn’t restore taxes on the rich, who aren’t hurting, until restore them on the middle and lower classes who are hurting.

Of course it gets even worse when we consider the current proposals of your guy. Mitt is proposing another $3.4 trillion in tax cuts, especially for rich guys, right?

Rather like an obese man who actually wants to get his weight under control — although not if it means eating any less.

@Tsar Nicholas:

From the standpoint of deficits and debt, that is exactly the math, yes.

Where right wingers become wing nuts is when they break the connection in their minds. They start to believe that spending is a practical issue and taxation is a purely moral one.

They actually start with what feels fair in tax, and then say that spending should (impossibly) be bent to it. Impossible because what’s “fair” is an ever falling number.

I mean, I’d rather not pay any tax. Why should I when you only ask how I feel?

@john personna:

I submit, again, the Joyner-Mataconis Theorem, by which every morally depraved action by a Republican causes an equal and opposite action of comparable moral depravity to be retroactively committed by a Democrat.

We know the Joyner-Mataconis Theorem is mathematically valid because if it didn’t work, then it might be the case that somehow, somewhere, a Republican did something wrong that couldn’t be immediately excused by pointing to something a Democrat did. And since we know that’s not the case, the theorem must be true.

Yeah…it’s on Bush…but, but, but…

That Obama spent all that money is just another of the vast list of Republican lies. Without lies they have no argument…none.

http://nymag.com/daily/intel/2012/08/mitt-doesnt-care-about-your-facts.html

@Mhc:

As opposed to a guy who asserts things without any links or charts?

For what it’s worth, there were some big economic whipsaws in the Bush years. He saw the tail of the dot-com boom, that crash, some weak recoveries (when “jobless recovery” was coined), and then the housing bubble and finally the housing crash.

Be careful when you assert that changes to tax policy “caused” any part of that, because then you might have to assert that they caused the whole thing.

James –

You’ve got this completely wrong. Ezra has presented this chart in the context of this election and the ENTIRE election is about the economy’s current state and how it would be different if the other party was in charge. It’s all alternative history… all the time.

And if the other party had been in charge over the last 4 years, based on what you have written above are the professed positions of the Republican party, the Bush Tax Cuts would still be in place (and would likely have been made permanent), our military presence in Iraq would be greater and we’d still be in Afghanistan (Romney says we shouldn’t leave as rapidly as Obama proposes) and the effects of TARP (passed under Bush) would be the same. Now, maybe as in the fevered dreams of True Believers, the medium blue portion would be smaller due to the power of austerity to grow the economy, but otherwise the Republicans, and Romney who would be their standard bearer, are completely onboard with every layer of this parfait but that little sliver of Recovery Measures.

Obama definitely owns what he hasn’t changed. But, his preferred policies would at least shrink the yellow and the red more than what Romney and the Republicans are proudly proclaiming they would do. If you are going to pull the lever for him, then you have to own that and rationalize how his policies would make up for that in the other portions or justify why it doesn’t matter. Less Bad is still a better choice than Completely Bad, unless you can convince otherwise. Blowing smoke won’t do it.

@JJ

Thanks for explicitly stating this… Most base/populist Republicans/Conservatives refuse to acknowledge this fact. See, for example, @Jan’s and @ModerateMom’s repeated recent claims that Bush and the Democratic Congress are the reason for the debt — as if, some how, magically beginning in 2007 when the Democats took control of Congress all of that spending suddenly occurred.

Of course, they will probably respond by noting how the curves start to quickly increase (without any consideration of when unfunded programs, voted for in previous years, began to kick in and that entire idea of interest thing comes into play)

@mattb:

lol, you’d think that distinction would make a difference, right?

But no, Mitt with another $3.4T in tax cuts still appeals to “the conservatives.”

There is no such thing as a $1T/yr stimulus. There is a ~$1T deficit.

There was a stimulus bill that was ~$800 billion, of which ~40% was in the form of tax cuts. That’s almost entirely done now (the payroll tax cuts were extended).

The continuing deficits are driven in large part by: a) drop in revenue because of the recession; and b) the automatic stabilizers Dave Schuler referred to when he talks about spending that is “baked in.” [Things like UI, or food stamps. If a bunch of people lose their jobs, they qualify for programs they otherwise wouldn’t, with no change in policy at all]; c) continued high military spending due to the “War on Terror” and continuing operations in Afghanistan.

Because of population growth and economic growth, even if you cut taxes you would still expect to see revenues rise over time. The big questions are: 1) did the tax cuts spur increased economic growth over what otherwise would have been (almost certainly) and, if so, how much? (this one is KEY); and 2) If you pull out that extra growth but apply the old, higher taxes, what’s the net revenue change?

This has been studied. I don’t have the link handy, but Bruce Bartlett did a review of this a while back and if I recall correctly the net was that you got back roughly 30 cents out of each dollar in tax cuts in the form of revenue. That is the tax cuts cost you $1, but the spur increased economic growth such that you get 30 cents back. Which is nice and all, but from a balance sheet point of view, you’re still down 70 cents. You do remember the deficits we ran during that 2002-2006 period, don’t you? Those didn’t go down the memory hole, did they?

Overall, economic growth during the 2002-2006 period was underwhelming, and as we now know some of it was due to the real estate bubble (though I believe the really crazy bubble years were 2005-2007). And it all came crashing down in ’08.

There is no way to close the deficit *now* without raising taxes and/or cutting spending such that you reduce economic growth. This was the point of the recent CBO report on the “fiscal cliff” (it should be noted that the sequester cuts don’t close teh deficit all the way). The upshot was it takes projected 1.7% GDP growth and turns it into -.6% contraction.

I’m reminded of a quote from Bull Durham. “Trying to have a conversation with you is like… like… a Martian, talking to a Fungo!”

Shorter James:

Obama is not perfect, so let’s vote for Romney, who based on his propsed budget, will make things much worse.

Why don’t you face the truth, James, and vote based on the choices in front of you, and not on whether some mythical perfect third choice would have done better.

What “Clinton recession”? The 2001 recession began in March 2001, when Bush, not Clinton, was president.

You know, some of us were actually alive 11 years ago. Our memories (and the Google) do go back that far, you know.

“The NBER’s Business Cycle Dating Committee has determined that a peak in business activity occurred in the U.S. economy in March 2001. A peak marks the end of an expansion and the beginning of a recession. The determination of a peak date in March is thus a determination that the expansion that began in March 1991 ended in March 2001 and a recession began.”

http://www.nber.org/cycles/november2001/

Ah, found it.

http://www.thefiscaltimes.com/Columns/2011/06/17/No-Gov-Pawlenty-Tax-Cuts-Dont-Pay-for-Themselves.aspx#page1

Tax cuts can spur economic growth, it’s true. But this myth that they pay for themselves must die. It’s a fairy tale that tells you that you can have your cake and eat it too, and it leads to bad policy.

Also, dynamic scoring (with small-c conservative assumptions) is ok with me if and only if it is also applied to spending programs. Same coin, two sides. Unfortuantely, the present House of Reps actually passed a bill demanding the CBO use dynamic scoring for tax cuts… only.

This is called rejecting reality and inserting your own.

@john personna:

While there’s some debate as to whether raising taxes even on the rich rich now is a good idea—Bill Clinton, for examples, argues it isn’t—I tend to agree. I’m rebutting a very specific argument here, though: Klein’s charge that the yellow “Bush-era tax cuts” graph should be credited against the Republicans and not Obama. I’m pointing out that almost all of that yellow is supported by Obama, too, which means it’s a wash.

@Modulo Myself:

Thank you.

@James Joyner:

Though if you take this line of thought, and believe that the Bush Era Tax cuts were a good idea (as many of our commentors do) then it seems like that portion of the debt should not be used to propegate the idea that Obama is responsible for a reckless growth of the deficit.

I’m not suggesting that you’re making that argument James. However, there are definitely some commentors here who are.

@James Joyner:

Even if I were to accept the subjective call “almost a wash” (I don’t consider it useful), I could ask why the heck we are talking about it with another $3.5 trillion in Republican tax cuts on the table?

The whole meme looks strongly like a canard.

@Rafer Janders:

While I object to the term “Clinton Recession” for a variety of reasons (and the move by GWB’s economists to argue that the recession actually started Q4 of 2000) the newly elected president should not be blamed for economic events like this that occur two months into this Presidency.

To the degree that GWB has to own at least the first few economic month’s of Obama’s term, Clinton also needs to own the first few economic months of GWB’s term.

@john personna:

Seriously. The Dems are trying, very cautiously, to roll bits of it back. They’ve picked the once piece they think they have solid poll backing on, because they know damn well that if they actually proposed rolling it all back the GOP response would be the usual “biggest tax increase in history!!!!” stuff and it would probably work. Also, raising taxes that broadly right now is dumb, given the economic situation.

The GOP wants to double-down.

WTF?

@mattb:

Quite so, and fair enough. I certainly don’t blame Bush for the 2001 recession. And of course, if we all calm down for a moment, we know that POTUS doesn’t have *that* much impact on the economy. Even Congress doesn’t.

But the “Clinton recession” garbage is just that. Garbage. Similar to trying to pin the 2008-2009 financial panic on Obama.

@James Joyner:

Andd you’re ignoring the fact that the Bush tax cuts were instituted during an expansion, while Obama supports keeping them during a savage recession. You’re completely ignoring all economic context to cling to your frail “both sides do it” reed.

Cutting taxes during an expansion, when we should instead have been using that money to shore up our balance sheet, was irresponsible. Maintaining those tax cuts during a recession, when raising taxes would take money out of the pockets of already stretched consumers and thus endanger a recovery, is on the other hand responsible. Simillarly, dieting is a good thing to do if you’re 100 pounds overweight. It’s not a good thing to do if you’re 100 pounds underweight.

The right thing to do in 2001/2003 is not the right thing to do in 2012. Circumstances change.

Really, I wonder if some Republicans are introspective enough to examine their own logic. Obama, in extending the Bush/Republican tax cuts was irresponsible, so let’s trust the authors of those cuts, who have more cuts on their schedule.

Then someday we can blame a future Democrat for Romney’s plan too!

@Rob in CT:

I’ve always said that they should “bend the curve” on taxes, coming out of the recession. We are far enough out to start that. The best rationale for starting with the top brackets in my opinion is that those brackets will suffer the least harm.

I mean, it’s not a snark to mention that Mitt pays 16% tax. We are somehow supposed to pass on that, and forget that the Buffett Rule was opposed as rank “class warfare.”

@mattb:

Quite so, and I agree with this. But we know what people are trying to do when they use terms like “the Clinton recession” or “Bush inherited a recession”, they are trying to paint a rosier picture of the economy under Bush by retroactively making things seem worse under Clinton. It’s simple fact that there was no recession in the US economy during Bill Clinton’s entire term as president.

@Bernard Finel: Agreed. People have grossly distorted views of how the budget and the deficit are allocated.

@Rafer Janders: I’m not assessing an alternative history of the Bush administration but rather Klein’s assignment of “blame” for spending and tax policies during the Obama administration. And I’m saying that, given that Obama supported the policy, you can’t assign the blame to the Republicans; at most, you can split it evenly except for the delta between the rate changes Obama favors for high earners.

@Rafer Janders: Actually, Bush inherited a recession that began under Clinton and in turn handed Obama a recession that began at the end of his term.

Incidently, the extension of the “Bush tax cuts” was the product of negotiations. Obama & Co. wanted to extend UI benefits, as I recall, and the GOP wouldn’t do it unless the tax cuts were renewed. Granted, I think the Dems would probably have wanted middle class tax cut renewal anyway, but that’s how I recall the negotiations developing.

But seriously, we’re sitting here talking about a party that: a) racked up huge deficits during a time of relative economic health (it wasn’t great, but it was positive) via a combination of tax cutting and spending increases (all supported by their new VP candidate); b) started a totally unnecessary, very expensive and harmful war; c) played chicken with the debt ceiling, which was a new and wildly irresponsible tactic; and d) wants MORE tax cuts, and remains bellicose on foreign policy (having apparently learnt nothing).

This is just crazy. The faults of the Dems – and they sure have ’em – pale in comparison. Libya, for instance. Bad policy, and I will long remember it (unlike many Conservatives, my memory still works). But put up against Iraq, it’s nothing. Point by point that’s how it goes.

JP,

I agree with that, but I’d add that it’s not just about the high-end increase causing little (if any) suffering. It’s that those folks are by and large not revenue constrained. Of all income groups, they’re the least likely to pull back on spending due to a (fairly small) tax increase. They might save a little less/spend a little less. For people at the bottom or even the middle nowadays, saving less ain’t an option. So you’re left with reduced spending, which has obvious economic impact.

I mean… I was looking at the next couple of months and decided I might have a small cash flow crunch. What did I do? I reduced my 401(k) contribution from 21% to 15%. How many people in America are even contributing 15% to their 401(k)/IRA?

With regard to Mitt’s ~14% tax rate, that’s mainly outside of the mainstream tax discussion isn’t it? That’s mainly about capital gains/carried interest, right? The big fight right now is over income taxes (though yes, I know Ryan wants to do away with or at least cut capital gains taxes… again).

@James Joyner:

While maintaining absolute radio silence on the Romney $3.4T cuts.

Seriously, Obama comes across as a guy trying to bend the curves, do incremental improvement of the financial picture. You actually fault him for that, say that improvement is equal to no improvement, while studiously ignoring where the GOP wants to go next.

I mean do I, the amateur, need to remind you of who Grover Norquist is and his impact on this decade’s Republican strategies?

The chart is being presented in political environment where the GOP is blaming the entire deficit on Obama and the Democrats reckless spending. Not only that, but one where the GOP claims to be the fiscally responsible party, so it seems to me it’s a pretty useful chart.

@Rob in CT:

I as I understand it, Bain “converted” some fees to carried interest in a way that is not per the IRA guidelines, but in a way “everyone does it” and where the IRS has not filed suit.

That should matter to any conservative who really wants tax fairness … unless fairness to them really means that no one (rich) pays tax.

@James Joyner:

No, the last recession began under Bush. Multiple economic factors led to the recession, and Bush is not solely to blame for it since many of those factors dated to economic circumstances under Clinton. However, as I’ve pointed out above, according to the National Bureau of Economic Research, which is how we officially determine when recessions begin, the kast recession began in March 2001. If you have some contrary data you are relying on, please cite it.

“The NBER’s Business Cycle Dating Committee has determined that a peak in business activity occurred in the U.S. economy in March 2001. A peak marks the end of an expansion and the beginning of a recession. The determination of a peak date in March is thus a determination that the expansion that began in March 1991 ended in March 2001 and a recession began.”

http://www.nber.org/cycles/november2001/

JJ: This chart has been around for a while and this is the best you can do- that the president wants to continue some of the tax cuts (in a recession mind you) which he previously opposed (makes you wonder whether he is merely posturing)- the chart is 100% correct- they reflect the policy preferences of the prior administration, one that apparently will continue if Romney is elected. Do you know what is misleading? Your heading.

@James Joyner:

Making do with a policy that your predecessor stuck you with, and that you have to continue with in order for there not to be worse effects, is not the same as “supporting” it.

Poe’s Dupin explained all of this in The Purloined Letter. If you hide something in plain sight, you will fool the police forever.

James is a cop. He’s been trained to look for evidence that the Democrats will spend money like crazy and the GOP will be good Republicans and conserve. Note: there will never be evidence for this proposition. So he’s tooling around in charts, desperately looking for a clue about the true nature of the universe. But even his clues point back to what’s sitting out in the open! So he has to try to find a way to banish the fact that there are clues.

So now it’s just random facts. “Obama continued the Bush Tax Cuts, thus the GOP isn’t completely financially irresponsible.”

not taking money from hardworking white people and giving it to undeserving blacks as the GOP would largely like us to believe.

What a sick mind you have.

@Modulo Myself:

Maybe James will pause and consider why this thread looks like a slow pitch over home plate, and not a smoking fast ball.

@Drew:

That’s the entire basis of the welfare work requirements ad.

Further, I’ve heard that claim from Conservatives all my life, sometimes with the white/black part explicitly stated and, more commonly, with it thinly veiled. It was the basis for a heated argument with an acquaintence from work in the summer of 2008 (Obama will give all the money to the blacks. Effing verbatim. En vino, veritas).

So come off it.

@Drew:

I’ll admit that leftists sometimes group attacks on the undeserving poor with race issues.

But there is not doubt that a deserving vs undeserving argument is playing out in the Great Recession:

The return of Reagan’s ‘welfare queen’

@Drew:

What a sick mind you have.

Yes, if you notice what the GOP has been doing for decades, and is continuing to do in this election, you have a sick mind. A healthy mind would delude itself, obviously.

@Mhc:

I trust you’ll exempt the one-third of the stimulus that was tax cuts, no?

@john personna: What? Bush tax policy pulled us out of recession and led to unprecedented growth. Just Like Reagan and JFK. When the Democrats got control of congress January 1, 2007 the smart money knew enough to pull back and did. Some idiot stated that Bush lowered taxes in an expansion? The economy needs lower taxes to grow and create opportunities for all. Higher taxes and spending lead to lower growth.

Obama has stated and executed anti growth tax, spending and regulatory policies that have caused our recovery to be very slow and shallow. The regulatory policies and Obamacare are probably worse (for recovery) than his stance on taxes and spending(still bad) in general.

Our economy cannot sustain and no tax rate can deliver the revenue to support spending at these levels.

@Mhc:

You’re pretty much illustrating why this chart was needed.

@Mhc:

If you are factually wrong in the first sentence, why should I continue?

GDP Growth Per Decade, found here:

1950s (1950-1959): 4.17 percent

1960s (1960-1969): 4.44 percent

1970s (1970-1979): 3.26 percent

1980s (1980-1989): 3.05 percent

1990s (1990-1999): 3.2 percent

2000s (2000-2009): 1.82 percent

You clearly don’t understand what the word unprecedented means. The 2000s had low growth rates when compared to other time periods. It was certainly slower than the 90s. Also the 80s. Also, too, the 70s. And the 60s. And the 50s…

There were two rounds of tax cuts. The first was in 2001. That was certainly sold as a stimulus measure. The second round came in 2003. Were we in a recession in 2003?

Which taxes have been raised, exactly? Not federal income taxes. Not FICA taxes (actually, those have been cut).

Your post is simply riddled with falsehoods.

In fact, the smart money was so super smart that it started pulling it money out of the housing market in 2006, well before the Democrats even took control of Congress.

“On the basis of 2006 market data that were indicating a marked decline, including lower sales, rising inventories, falling median prices and increased foreclosure rates, some economists have concluded that the correction in the U.S. housing market began in 2006. A May 2006 Fortune magazine report on the US housing bubble states: “The great housing bubble has finally started to deflate … In many once-sizzling markets around the country, accounts of dropping list prices have replaced tales of waiting lists for unbuilt condos and bidding wars over humdrum three-bedroom colonials.”

“….National home sales and prices both fell dramatically in March 2007 — the steepest plunge since the 1989 Savings and Loan crisis. According to NAR data, sales were down 13% to 482,000 from the peak of 554,000 in March 2006, and the national median price fell nearly 6% to $217,000 from a peak of $230,200 in July 2006.”

http://en.wikipedia.org/wiki/United_States_housing_bubble#Timeline

This one, though, has got to be the best one of all:

Yeah, of course it had nothing to do with the utterly massive (and global) real estate/financial wizardry bubble that finally burst in late 2008. The worst financial panic since the Great Depression was caused by Republican electoral defeat. Not policy, mind you. Just the fact that they lost a mid-term election. That’s gotta be the funniest “confidence fairy” argument I’ve ever seen.

Ah, so the smart money runs from Democrats?

That would explain why the DOW is up, what, 70% under Obama. And why the stock market performs better under Democratic presidents than their Republican counterparts, more or less like clockwork.

@James Joyner:

“I’m not assessing an alternative history of the Bush administration but rather Klein’s assignment of “blame” for spending and tax policies during the Obama administration.”

Actually, you’re doing more than merely assessing who’s to blame. You’re using the argument that Obama is partially responsible for the debt caused by the Bush tax cuts in order to justify your support for Romney. That is why you’ve repeatedly tried to re-focus commenters on the very narrow issue presented by Ezra Klein’s argument instead of looking at the larger implications.

The only reason any of us are even talking about debt is that we’re in the middle of an election where the country has to decide who’s better able to manage the country’s finances. You apparently believe that Obama should not be re-elected since his support of tax cuts contributed to the debt even though Romney has pledged to enact policies that will increase the debt far more than Obama.

The fact of the matter is that unless you are a die hard social conservative or you believe that the wealthy need more tax breaks, there is absolutely no rational reason to vote for Romney. I think you’re smart enough to recognize that, but you’re going to vote for Romney anyway because he wears the same jersey that you wear. It’s tribalism pure and simple.

@Mhc:

You are wrong sir. Once we lower the top income tax rate to 1% our coffers will be overflowing and we’ll have the debt paid off in no time.

@Scott O:

Related: Romney Party Yacht Flies Cayman Islands Flag

Two things I admire about Conservatives:

1. The ability to ignore and/or rewrite facts and history in the name of ideology

2. The conviction that a loss at the polls does not mean the Party has the wrong message but that the public simply didn’t understand it (2008).

Liberals, OTOH

1. Will, eventually, with much kicking and screaming, admit that some policies were wrong or poorly implemented (Vietnam, welfare).

2. When faced with electoral defeat, assume that they are wrong, the public is right, and the correct choice is to follow the public.

We would no doubt be a better country if Conservatives were somewhat more flexible and Liberals were somewhat more inflexible.

My point: the debt and the deficit. Bush inherited a surplus. Repeat: a surplus. At the time, some intellectuals/economists/politicians were worrying about what would happen to the U.S. Treasury market when the deficit dropped near to zero. Bush and a Republican, emphasize Republican, Congress cut taxes (mainly on the rich), started two wars (one of which was completely unnecessary) and refused to pay for them, added Medicare Part D and, guess what, refused to pay for it. But Joyner insists that responsibility for the current deficit, and for a financial crisis directly caused by Conservative-lead deregulation in, yes, both Republican and Democratic Administrations since Reagan, is shared equally between both parties.

National Debt by President, Congress:

http://zfacts.com/p/gross-national-debt.html

From Google, dozens of charts showing the growth of debt under Democratic and Republican Presidents (deficit growth by president) least you think I am cherry-picking:

http://www.google.com/search?q=deficit+growth+by+president&hl=en&prmd=imvnsu&tbm=isch&tbo=u&source=univ&sa=X&ei=JVY-UOPED-TyigKg44CAAQ&ved=0CE8QsAQ&biw=800&bih=1092&sei=N1g-UL_jNM_kiwL0rYGwBg

Yet Joyner and his fellow Republican apologists insist that “this time” it will be different. Republicans will cut the deficit not only without raising taxes but by decreasing them even further (retaining tax subsidies to the struggling oil industry) and compensating by cutting Medicare and Social Security and welfare (all those immoral social programs) and increasing the defense budget (because having one larger than 20, 30, 40? other countries isn’t enough). Anti-science Conservatives? Simple arithmetic is too hard for these folks.

Reminds me of that ancient joke about the thrice-divorced man getting married again: a triumph of hope over experience – or, in this case, of ideology over reality.

(My apologies to readers who are economists if I have misused the terms debt and deficit.)

Oh absolutely! So when you find a majority of federal politicians who want to cut spending on the military, Social Security, and Medicare enough to balance the budget without their constituents and fat cat financial backers wanting to perform lobotomies on them for taking those actions, you let us know, m’kay?

Speaking of lobotomies…

It’s pretty hard to look at the past 12 years and avoid the conclusion that Starve The Beast is, from the PoV of those who push it, working.

Cut taxes, reducing revenues.

Increase spending.

Then, the next time the Dems are in power, loudly demand that the scary long-term fiscal projections (which are, of course, legitimately worrisome) be fixed via cuts to social programs you hate and would like to roll back. Bonus if people are enduring hard times (crabs in a bucket).

If the opposition caves and does this, you win even after electoral defeat. If the opposition refuses, you have the campaign material you want and you can hopefully win the next election.

Rinse, repeat.

Run up the credit card when you’re in power, and then use the resulting debt to hamstring your opponents when they win. And count on the public not figuring it out.

That last bit should be the flaw. But, alas, not so far.

[I admit I’m getting into conspiracy theory territory here. If it wasn’t for the existence and influence of Grover Norquist, I wouldn’t go there. And I concede that the simpler explanation, that the GOP has come to really believe their own bull – is probably correct]

@ Mhc…

So using that logic I assume you are willing to focus responsibility for the slowdown in GDP growth and Employment growth since the 2010 election to the Republicans who took over the House?

Tax cuts were good economics. The ensuing deficits during the Bush years avoided a protracted recession from the dot com bubble and current deficits are preventing a recession now. It’s bemusing that so many live in fear of the deficit bogey-man, even though it has only been a net economic benefit.

@Ben Wolf:

Some might have been good. The 2003 cuts were not. They, like the co-incident 1% federal funds rate, were throwing gasoline on a dying fire. They helped inflate the last gasp of the bubble before the crash.

@Rob in CT:

No, you are right. Conservatives have been trying to destroy FDR’s New Deal since the New Deal, and Conservatives decided, quite openly, 30-40 years ago that the only way to get rid of the social programs they despise was to make it impossible for the government to pay for them.

The “cutting taxes” part was, unfortunately, easy to sell because nobody likes to pay taxes, and average Americans have less than no idea about where their taxes go or what they do (except to the extent that they have bought into the Conservative “waste, fraud, and abuse” meme). The “cutting services” has been only a little bit harder because most of the services in question affect veterans, the sick, the disabled, the old, and, of course, the “undeserving” poor.

The best illustration of this well-planned strategy is Medicare/Social Security. The Boomer demographic has been well studied since the late 1940s and its effects have been easy to predict (the proverbial pig working its way through a boa constrictor). It should have been easy to raise taxes slowly, minimally and appropriately over the past 40 years to fund their retirement (removing the limit on salaries subject to the tax, taxing older workers proportionately more than younger workers to compensate for the Boomer bulge, etc.).

A couple years back there was a web site that let one play with budget numbers and taxes, and I found it relatively easy and painless to save Social Security and Medicare – but then I was willing to raise taxes and Conservatives have opposed raising taxes for anything, even the things they believe in (e.g., war and subsidies to Big Business).

@James Joyner:

I’d still like to see a cite for your claim that the last recession “began” under Clinton, contrary to the claims of the NBER. You made that claim even after I’d provided my NBER cite, so unless you’re just completely making it up, you must have some source of your own….

@ Rafer…

For Republicans 9.11 happened on Clintons watch too.

@C. Clavin:

If I recall correctly, the wingnut dogma goes like this:

1. Clinton orders a missle strike that narrowly misses OBL. WHAT A FAILURE.

[neglect to mention that outgoing Clinton staff raised the issue of A-Q with the incoming Bush people and were essentially laughed at]

[neglect to mention the briefing concerning possible A-Q attack that was ignored]

2. 9/11 occurs. No one could have predicted! But Clinton is to blame because the cruise missle strike didn’t work.

@Rafer Janders: We cross-threaded. The Wikipedia article on the “early 2000s recession” discusses the controversy quite well. Essentially, the definition of “recession” has changed from “two consecutive quarters of negative growth” to a more obscure NBER formula.

The dotcom bubble burst toward the end of the Clinton administration and the economy became stagnant, with the old definition recession overlapping the two administrations. As I’ve noted plenty of times over the years, I don’t blame the recession on Clinton. Nor do I give him more than some marginal credit for the boom the preceded it, which was largely a speculation bubble. What I always gave him credit for—even in my darkest days of Clinton hatred—was his politically risky standing up for free trade principles, which did contribute to the overall boom.

@ James…

He also raised taxes, which Republicans said would decimate the economy, yet actually helped lead to the longest period without a recession in recent history. Today we hear the same alarmist BS from Republicans…as if they are some kind of authority.

@john personna:

Budget deficits do not fuel credit bubbles. Lack of deficits fuels credit bubbles because the non-government sector turns to debt when it can’t obtain sufficient net financial assets to satisfy its desires. If anything the tax cuts should have been larger and targeted primarily at households earning less than $200,000.

@Ben Wolf:

I’m saying Bush pulled every lever to stimulate growth despite a dearth of good investment opportunities. That created spindly unnatural growth.

Are you saying easy credit creates good opportunities?

@nitpicker: he campaigned to stop them, and now he supports them. no gun is held to his head, he has the senate behind him!

@Rob in CT: the tinfoil brigade is here…..

@Rafer Janders: If I go with you conclusions on taxes, you would then support that we have never had a president go to war in two countries and lower taxes either.