Misleading Recovery Charts

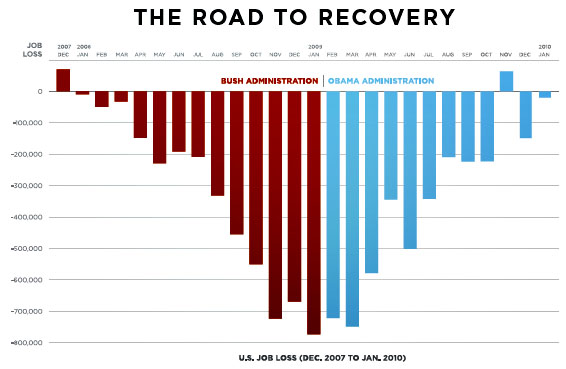

Yesterday, I explained why this Obama chart purporting to show that the stimulus created a lot of jobs was misleading:

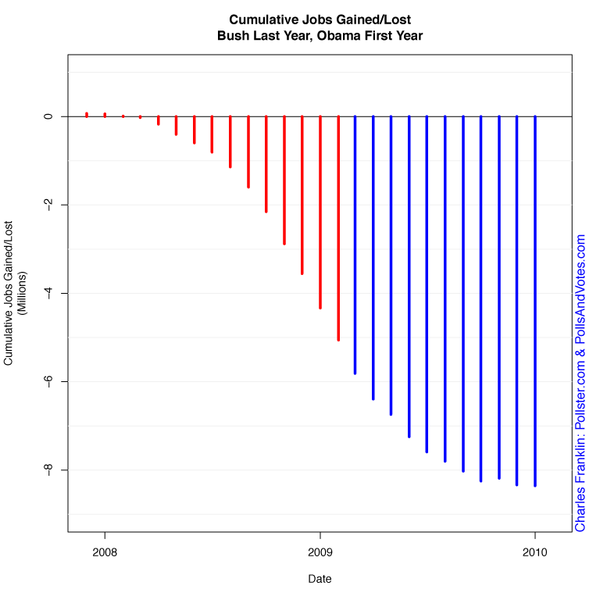

Today, Pollster.com’s Charles Franklin displays the chart’s information in a different way to point to an even more glaring problem:

The OfA chart gives the impression that we have “returned” to where we were in January 2008. The sharp rise since February 2009 gives the impression that what was lost in red has now been regained in blue. But of course, that isn’t right. The rate of loss has indeed slowed tremendously in the first year of the Obama administration, something the White House has every right to crow about. But that doesn’t mean we’ve returned to previous employment levels. In fact, we’ve continued to sink lower throughout the last year, just at a slower and slower rate.This second chart makes that perspective on the data more clear. It is visually clear, if less dramatic than for OfA’s chart, that the rate of job loss has slowed. But my version of the chart drives home the point that we have continued to lose jobs and now stand at over 8 million jobs lost since December of 2007. That is the other “deficit” the administration must worry about. The recovery, which GDP data show has started and at 5.7% growth in the 4th quarter is quite strong, will take a very long time to regain these lost jobs. This fact is made clear in my chart, while it is obscured in the OfA presentation.Interestingly, my chart is also subtly deceptive. More jobs were lost in the last Bush year than were lost in the first Obama year. But the red lines look shorter and smaller than the blue Obama lines. That makes the graph appear to show that things are worse for Obama, even though his job losses are actually about 3 million compared to Bush’s 5 million.

Of course, Obama took over near the end of recession whereas Bush was in power during the worst of it. And, no, I don’t think Bush is significantly responsible for the global recession that took place under his watch nor do I think Obama’s fundamentally responsible for the jobs that were lost once he took over — much less those that weren’t.

But it’s interesting to see how the perceptions of data can be manipulated with clever graphics.

The Franklin chart is better for Obama: It still makes it look as though his policies have been able to stop the slide, without giving the impression that we’ve already recovered to where we were in 2008, giving him room to continue pursuing those policies.

If I were in Obama’s press shop thinking long term, I’d push the second graph (though I’d present it as a line graph, rather than a bar graph, to avoid the subtle deception Franklin mentions in that last paragraph.)

No doubt. One of my big pet peeves about politics is the overstated importance of a single individual. Like Obama or Bush has THAT level of control over the economy that they could be single-handedly responsible for any of it.

To be sure, the actions and/or lack of actions that they take are weighted given their position, but not THAT much.

The economy is just too big and complex, likewise with the regulatory systems, to be affected to the extent that some would state for or against a sitting president.

The Obama chart is job loss rate (rate of change), the Franklin chart is job losses (total change). Look closely at the Franklin chart and notice that we were losing jobs at the greatest rate (inflection point for the calculus students) at the Bush/Obama transition. In other words, both charts show that things have gotten markedly better since Obama took office. But, correlation does not imply causation.

Did Bush cause the recession? He at most contributed, by virtue of having an anti-oversight approach to business. People lied on their mortgage applications. Mortgage brokers did not pass on this germane information. Banks and other financial institutions blithely purchased these mortgage backed securities. And then insurance was sold against their failure by companies that did not possess enough capital to support the insurance. And then everyone went batshit crazy with derivatives and other forms of leverage.

Oversight was sorely needed, and was singularly lacking. For this Bush and Greenspan deserve significant blame.

Now, does Obama deserve credit for the recovery? Mmm. The financial meltdown was largely averted by the combined work of Bernanke and Paulson under Bush and then continued by Bernanke and Geitner under Obama. As galling as “saving the banks” was, I continue to think that it was preferable to the alternative. So in that sense credit for the financial recovery goes pretty evenly to Bush and Obama.

Finally, let’s look at the (overused term alert) “main street” recovery. This has been all Obama and has been rather weak. We have averted miserable economic conditions with the stimulus (see my comment yesterday, it likely averted 1.5% additional unemployment over a 2 year period). But what would have accomplished more? A more efficient stimulus would have had no tax cuts (at most eliminating an additional 0.5% unemployment), but those were politically necessary to get GOP votes. A larger stimulus would have had a larger effect, but I don’t whether that was politically feasible either.

[For the tax fans: individual tax cuts tend to go toward paying off credit cards and have minimal stimulative effect. Cutting payroll taxes can, however, be quite effective — perhaps a 1.5 multiplier. The stimulus bill contained the former (per GOP insistence) and not the latter.]

So ultimately I think that Obama has done the right thing, but an insufficient measure thereof. Faint praise, but perhaps the best he could have accomplished in our hyper-partisan state.

Yeah, nothing has changed at these banks. They still have the toxic assets. They’ve been sent a very clear signal, “Screw up and Uncle Sugar will bail you out, just make sure you screw up really big.” We have basically copied Japan’s policies of propping up zombie banks. We’ve merely put off the day of reckoning. How many bubbles have we had in the last 20 years? How many will we have in the next 20?

Congratulations Scott, you are arguing a “conservative” position. Paulson, Bernanke and Wall Street are very thankful.

You made a number of errors in that comment.

1. You treat unemployment and employment as interchangable in your description of Okun’s “Law”.

2. You assume that Okun’s “Law”, a statistical relationship, has to hold when the exact composition of the law varys from country-to-country and over time.

3. The numbers you use are “averages” and hence may or may not be accurate at any given date.

4. And finally, the full statement of Okun’s findings actually allow for a jobless recovery.

Steve,

When I support the bank bailout it is not gladly. Look at Lehman Brothers’ failure: the Dow dropped from 11,500 to 8,500. Now let’s say it had been followed by the weakest of the large banks: BofA and Citi. I support the bank bailout because I think the alternative was very bad indeed.

Yes, that entails enormous moral hazard. But then what? We could limit the size of financial institutions, but this is difficult on a few fronts. We could require that FDIC supported institutions only engage in FDIC business (a current proposal that I rather like, and which the banks clearly do not). But significant regulation and oversight of banks and other financial institutions will take a bipartisan effort, and thus far the GOP has opposed every such bill.

And yes, my Okun’s Law numbers are very back-of-the-envelope. And yes, employment and unemployment are not inverses — however, the higher unemployment is the more closely they move. Lots of folk are looking for jobs and will move very readily from the unemployed to the employed given a chance. That said, I think that the rough numbers are reasonable.

One last note on my employment/unemployment estimate. The US labor force is 150 million. A 1.5% change in employment is then 2.25 million people, which broadly matches the CBO estimate of 2 million jobs saved.

Scott,

You are incorrect with regards to Okun’s “Law” it applies to rates not the absolutes. That is it applies to unemployment rates, not unemployment or employment. Thus your numbers are questionable since you seem to have made a serious error.

In short, you are looking at model numbers as if they are real numbers when in fact they aren’t. Dave Schuler pointed that out, but you ignored his comment.

Can we say false dichotomy? It wasn’t bail them out vs. do nothing.

And look at your example, prior to Lehman we had Bear Stearns. Then the government reverses course on Lehman. That seriously inconsistent policy is part of the problem.

But the government is all in now. They can’t afford to back out now because the very thing you feared would have happen will if they back out now.

And no, I have no solution. At least not a nice one. Any solution to “solve this problem” would entail quite a bit of economic pain.

“Oversight was sorely needed, and was singularly lacking. For this Bush and Greenspan deserve significant blame.”

I believe Mr. Verdon has cleaned up much of the mess.

I would point Mr. Swank to a very interesting documentary produced by PBS’s “Frontline” (PBS !!) which tells the story of a regulator determined to bring oversight to the securitization market. Unfortunately, she was mercilessly (figuratively) beaten about the head and shoulders by powerful government officials who shouted her down in Congressional testimony. Yes, it included Greenspan, but also a certain Larry Summers and Tim Geitner. Isn’t it shameful Bush didn’t step in?

Well, that’s because it was 1997 and a certain Clinton, William Jefferson was in office. And what eventually happened?? Long Term Capital Management went cablooey in 1998! Exactly what this regulator was concerned about. And of course we know what happened 10 years later.

Of course its good to know that Summers and Geitner have prominent financial positions in the Obama Administration!! Makes you sleep comfy, eh?

The Bush Administration made a foray into regulatory reform in 2003. They stopped pressing it for other political reasons and should be roundly criticized for doing so. But an honest commentator would be advised to look at the CSPAN tapes of the associated Congressional hearings, where the likes of Chris Dodd, Maxine Walters and Barney Frank absolutely toasted regulators called to testify. The Barney Franks of the world lashed out vehemently against the notion that the housing market was bubbly, that credit for uncreditworthy people was too EZ (even calling them racists) and so on. They told us Fannie and Freddie were just fine.

Its all on tape for anyone who isn’t just intellectually lazy and desirous of the neanderthal “Bush baaaaaaad regulator” storyline.

Steve,

You saw me discussing employment rates (and extrapolating a commensurate change in the unemployment rate). Pointing out the fact that I used the terms employment and unemployment without appending “rate” every time is a bit of word play that I don’t find productive. The only time I talked about employment was in my last little post where I pointed out that the rate estimate (1.5%) times the labor force (150 million) gives an estimate of 2.25 million jobs — which roughly matches the CBO estimate of 2 million jobs. Please point out any place where I mistakenly swapped rates with quantities in my calculations.

Dave Schuler’s point is correct, in that multiple models agree on the same rough number: 2 million jobs. Individually counting the jobs is rather difficult, as you know. Let’s look at a payroll tax cut. Find every person whose job it created — mmm, hard isn’t it. What about an income tax cut, which specific individuals’ jobs were created by the increased spending it generated? Only a specific types of stimulus allow for direct counting of people impacted, and even then that ignores secondary effects, such as the number of restaurant jobs that are created or saved when a greater number of construction workers buy their lunches. So yes, it’s all models — but that’s not terribly surprising.

I still say the steep rise in oil prices was the catalyst for the recession. That panic spooked business first and was soon followed by the Obama panic and the bank panic. Confidence is still shot and no one will expand or hire without confidence (except the government).

As for the original chart many of us knew it was intended to mislead.

Did Bush cause the recession? He at most contributed, by virtue of having an anti-oversight approach to business.

Your rhetoric doesn’t jibe with reality:

Drew,

Yes, repealing Glass-Steagall was (my opinion) a mistake. Gramm(R) & Leach(R) wrote it, it pass on a party-line GOP vote, and then Clinton(D) signed it. I see that as the low point of his presidency.

I didn’t see the PBS show you reference. I found this:

http://www.pbs.org/newshour/bb/business/july-dec98/funds_10-1.html

But that is Barney Frank arguing for regulation of hedge funds while Greenspan says we cannot.

Scott,

You’ve seriously misunderstood Dave’s point. His comment is not that multiple models agree (and why shouldn’t they, they are all very similar) but he is wondering if the models agree with reality. In other words, are they well calibarted. I responded in the other thread on that point. I say this because over at his website Dave has a post that goes into this point in much more detail. You are quite simply, incorrect in your reading of Dave’s comment.

Did you just finish your first year of macro economic theory or something as an undergrad? Models are only as good as their approximation to reality. Thus, you compare their output to the real world data such as unemployment, and other macro indicators.

See here is the problem:

1. Are the models well calibrated and consistent with one another?

2. Are the models poorly calibrated and consistent with one another?

You can’t look at the output of the models and make a determination between 1 & 2. That is Dave Schuler’s point and it went right over your head.

I find this so amusing. You keep looking at the world with your partisan blinders on when in reality, both parties are owned by Wall Street. Where do you think Larry Summers worked 1 day a week and earned millions/year? But lets get those D’s and R’s right! Its oh so important.

Hi Bernard.

Steve,

I may well have missed a more detailed post of Dave’s, I responded to the one you referenced. As for the models, the combination of independence and agreement implies accuracy.

As for the Glass-Steagall comment — I was responding to a rather partisan post by pointing out that it was instead a bipartisan failure. And frankly I agree with you that financial institutions have out-sized influence because of our contribution-driven political system. I blame Buckley v. Valeo and more recently Citizens United. I fundamentally disagree with the notion that money is speech.

Finally, I’m not sure it why gives you such apparent pleasure to be condescending and pedantic.

No, it does not. It implies consistency in the models, not accuracy. Accuracy of models is checked by comparing them to reality, not each other. You can’t compare abstractions from reality to each other and then conclude that they are accurate. It is patently illogical.

The problem is that we have fetishized democracy. Many from across the political spectrum agree with Winston Churchill’s comment on the efficacy of democracy,

Let us look at some of these “others”:

Dictatorship,

Communist state,

Monarchy,

Kleptocracy,

Theorcracy,

Oligarcy,

Doesn’t look like a very high bar, if you ask me. Its like saying, this dog shit sandwhich is the best dog shit sandwhich. Its still a dog shit sandwhich though.

When something cannot be directly measured, then basic science says to construct independent models and look for agreement or disagreement. In the case of the former accuracy is presumed (but not certain), while in the case of the latter the models are examined for problematic assumptions, measurements or calculations.

Well silly me. I took Obama’s chart as representing the rate of job loss. I knew if I looked around long enough I’d find someone telling me how that is not so. Kidding. We all know how many jobs have been lost (cumulative) and are glad to see the rate of job loss slow/ stop. All except the naysayers. Ever worked at Heritage Foundation?

Alternatively we can compare them to reality. We can look at our statistics on unemployment, employment, and other such macro variables for macro models. You are arguing against empiricism.

In other words, if a model predicts x at time t+1 we then look at the value of that variable at time t+1 and compare it x. If they are close, then we conclude the model is reasonable, good, etc. If on the other hand, they are far apart then we conclude the model may need more work or is simply no longer valid.

Is our measure on unemployment perfect? No, but then that is merely letting the perfect be the enemy of the good.

The hidden conditional statement in all these pronouncements about the the stimulus and its impact on jobs is: if the economy is behaving as our models indicate. Is that true? I don’t have a clue as nobody has told us.

What I’d like to see, for example, is what was the IHS Global Insights prediction for unemployment for the past year from last January?

Now, as to the question has the stimulus created jobs? Probably. But I’m skeptical in that I’d say the recession’s worst effects were likely done shortly after Obama took office. Look at the top chart. When was the ARRA passed? February of 2009. That is the first blue bar in the first graph. Are we to believe that mere passage of this bill brought about substantial drop in jobs lost (the April bar)? I find that hard to believe. And that the impact was even larger in May?

Here is a question, what shape did the “spending” take in the early months? Is most of the 2009/2010 “spending” tax cuts? Well, since it works so damn fast how about more of that? No? Gee…why not?

Fascinating.

“I was responding to a rather partisan post by pointing out that it was instead a bipartisan failure.”

So when you – factually – point out that the housing bubble/securitization initially arose under a previous Administration, and the housing bubble was in at least its 4th year when the subsequent Administration took office…… and when you – factually – point out the vicious (and I mean vicious – look at the tapes – its withering criticism) Democratic opposition to an inquiry into mortgage regulation………while also observing that “The Bush Administration made a foray into regulatory reform in 2003. They stopped pressing it for other political reasons and should be ROUNDLY CRITICIZED for doing so.” You have made a “rather partisan” post.

But when you come here and simple mindedly post: “Oversight was sorely needed, and was singularly lacking. For this Bush and Greenspan deserve significant blame.” I guess you’ve come here with a balanced view?

You gotta love it. Is this what people mean by the new normal?????????

Also, the reference to Glass Steagall is off base. A whole debate can be had about that. But as a cause of the housing mess? Bear and Lehman sold an awful lot of MBS’s…………and they weren’t commercial banks last time I looked.

Nice try Scotty, no sale.