More Jobs than Expected in July

Things are better than expected.

I am not an economist, and I don’t play one on the internet, but I will say that while there are signs that point in a recessionary direction, it is hard to look at other indicators and see a recession.

So, on the one hand (via the NYT)

Last week, the government reported that the nation’s gross domestic product, the broadest measure of economic output, had contracted for the second consecutive quarter when adjusted for inflation. The data showed a sharp decline in home building, a slackening of business investment and a sluggish rise in consumer spending.

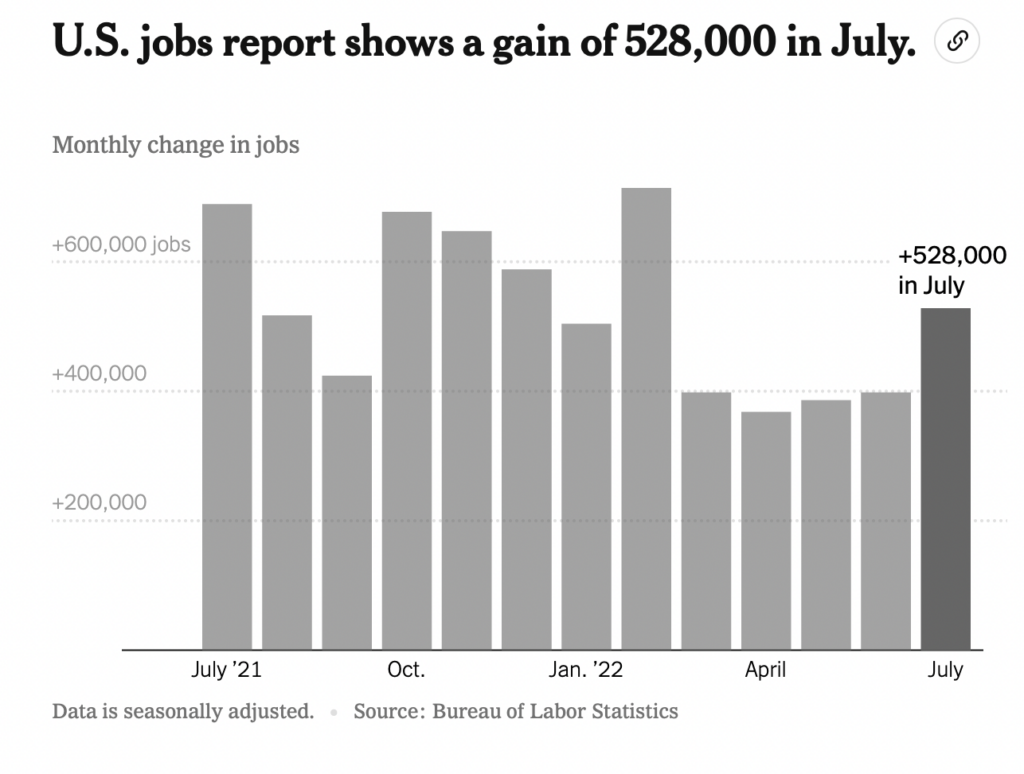

Yet on the other, the job market remains strong. Indeed, stronger than expected:

The impressive performance — which brings the total employment back to its level of February 2020, just before the pandemic lockdowns — provides new evidence that the United States has not entered a recession.

[…]

The unemployment rate was 3.5 percent, down from 3.6 percent in June, matching its 50-year low on the eve of the pandemic.

This is all part, I think, of a broader pandemic-related picture that we just don’t fully understand as yet.

Is it possible that the pandemic was strange enough and disruptive enough that standard economic prognostication doesn’t apply?

We’ve had more than a million deaths due to the pandemic in the US. Some families are still grieving, some had to move to adjust to new situations, some are still without reliable child care–all of this and the economy spins on.

I think it’s going to take a decade to shake out all of the knock-on effects, and we’ll likely have some surprising economic data as a result.

Indeed. 3.5% unemployment =/= recession.

@gVOR08: ETA without edit: Yes, unemployment is at or near a record low, but never fear, the FED has the tools and the will to fix that.

But, but…Joe Biden is causing a recession, and has been ever since he took office almost 20 months ago! And, he’s still trying to raise gasoline prices, despite 7 weeks of falling gasoline costs!

The jobs gained or lost as reported immediately after the end of the month is subject to potentially enormous subsequent corrections. A few years back the initial jobs number for some month was +500,000. This was treated as a disaster by the press because economists had expected +750,000. By the time the final estimate for the month in question was released, some months later, the number was almost exactly +750,000. And the data is seasonally adjusted. I recall months where the seasonal adjustment reversed the sign of the change: eg, actual jobs were down 50,000 but the seasonal adjustment turned that into a reported 100,000-job gain.

The media ought to be ashamed of themselves, especially business media, for reporting what is a statistical guess with wide error bars as a hard number.

@Michael Cain: This occurred to me too, the adjustments can be enormous.

I think it sort of tracks what many are seeing anecdotally (which is NOT data).

Things are weird right now. We should take in all of these reports with that in mind.

We’re about to lose ~50 employees. Summer students are heading back to school. 🙂

I often wonder how much that factors into the number of jobs lost/gained.

@Mu Yixiao:

If I recall correctly (and I actually took an economics class where we discussed employment as an issue), the type of item you are referring to is part of “seasonal adjustment.” This type of unemployment needs to be counted and weighed into the statistics differently than other resignations, terminations, layoffs, hires, whatnot.

And the stock market is down on the news, confirming that what is good for the little guy is bad for investors.

It’s hard to call something “the economy” without more specifics.

@Just nutha ignint cracker:

I know that it’s factored in. I’m more curious about how much “weight” it has. I live in an area that has massive tourist industry in the summer (all those FIBs coming up to spend that sweet Chicago money), as well as a lot of agricultural jobs. It seems like millions of jobs appear on Memorial Day and vanish on Labor day, but that’s just perception.

@Tony W: Or it may simply be institutional investors pushing the market down one last bit before the buy and ride it back up. Not all market actions are cynicism. Some are greed. 😉

Hmmmm…maybe the Republican talking points of doom and gloom are wrong?

I know it’s hard to believe. I mean…they’ve only been totally wrong about the economy for the last 4 decades. Ever since they sold this country on voodoo economics, which never, ever, worked out. But seriously – that’s not a reason we should think they’d be wrong now.

The revelatory part of the article, to me, were the graphs reflecting changes in earnings.

Leisure and Hospitality and Retail earnings increased because they are drudge jobs that people left when opportunities arose elsewhere and the wages increased to attract employees.

Education and Business Services remained nearly the same.

Construction and manufacturing decreased.

Overall not a good picture for long-term competitiveness.

Hopefully this is a short-term blip and the America Rescue Plan and Infrastructure Reduction Act will boost training and wages to incentivize the teaching and nursing professions, green technology–and construction and social services to reduce homelessness in particular.

@Skookum: The disruption to the supply chain has also disrupted the Manufacturing and Construction sectors. This is where things are most murky to me. We need to bring jobs back to America reduce the carbon footprint of logistics. If I were a corporate CEO I’d be working hard to re-envision and re-vamp the supply chain.

My kind of contrarian and wholly unsupported speculation: are people taking a second job to keep up with inflation?

@Kathy: Inflation may be a factor, but those who have survived the gig economy of the last decade have worked more than one job for a long time. And they left that scene when better jobs (career ladders, benefits) opened up during the pandemic.

@Mu Yixiao:

It’s probably safe to say that the weighting is not as accurate as it could be, but it will be hard to know how much weigh it “should” have because “should” will always be contextualized in the desired outcome of the observer. Probably most of us “should” probably try to understand that these statistics have low effect on our individual outcomes and our ability to make useful decisions based on them is low. Most of us won’t try to do that, though.

@Tony W: I’ve often heard it said that the stock market goes “down on news, up on rumors”. While it is true that the Fed, for the last 30 years, attends to the needs of the bond market (which aren’t the little guys) a lot more than it attends to the needs of the job market.

@Jay L Gischer: ~50-55% of US corporate bonds are owned by mutual funds, pension funds, and insurance portfolios (typically covering various forms of life holdings and annuities). Not the typical instruments of moustache twirling evil oligarchs.

Bonds as fixed return instruments are in fact a market generally heavily driven by insurance and related retirement savings holdings, followed by institutionals. The Lefties adored “little guys” at the old end of the spectrum are typically either directly or indirectly heavily exposed to the fixed income market. Big guys tend to play with better yielding exotic instruments.

There is however a real difference in interest by age category – the near to retirement and retired interests diverging from the younger working age cohorts.