National Economic Trends

The St. Louis Fed released its national economic trends on Nov. 1, and in looking at the graphs it seems fairly obvious that the economy is indeed slowing. The nice thing about this report is that it collects a wide array of data and puts it all together for quick and easy reference.

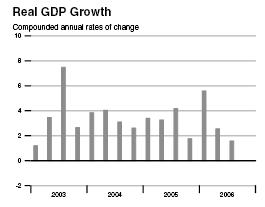

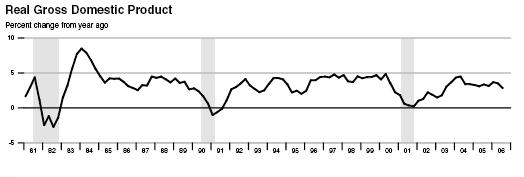

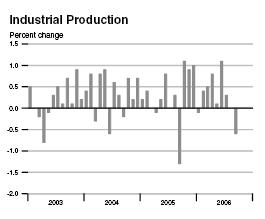

Why is it widely believed that the economy is slowing? Well here are a series of graphs from the report,

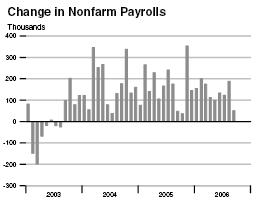

And while this one hasn’t really ever been good, it does point to the weakness in the labor market.

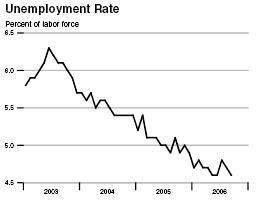

Now it isn’t all bad news, and in fact some of the good news is interesting in that the unemployment rate is very low by historical standards.

This is interesting in that the unemployment rate is low, but the Non-farm Payroll data implies that that labor market is weak. So there are two conflicting signals on the labor market. In fact, the report actually has a brief article about these two employment/unemployment series. One thing the article notes is that generally, the employment data from the Current Population Survey (CPS) and the Current Employment Statistics (CES, or establishment survey) show similar trends over time. Since the 2001 recession however, the two surveys have diverged somewhat. Since the recession the establishment survey has grown by an average of 82,000/month. The CPS survey on the other hand has grown by 148,000/month.

Just taking a quick look at some of the graphs in the report and reading the article up front are worth the time, IMO.

Steve, I have a question for you which may be somewhat off the topic of the post. Presumably some of the reason for the very low unemployment rate is that some people (who were looking) aren’t looking any more. Here’s question: do you think that improved efficiency in information may have something to do with that?

I don’t know. I know that this divergence is somewhat puzzling as is the long lag in employment rebound with the last two recessions. What is causing this kind of stuff, I don’t know.

The real domestic gross product graph shows various ups and downs through the years. My question is if the rate of growth decreases should we consider that a downturn?

Let’s say the rate of annual growth goes from 4% to 3%. While we aren’t growing as fast we are still growing at a reasonable pace. The last actual reduction in GDP came in the early nineties recession and stagnation came in ’01.

Are we seeing a real downturn or merely a perceived downturn based on those GDP stats?