News Flash: People With Income Pay Income Taxes

WaPo – Tax Burden Shifts to the Middle

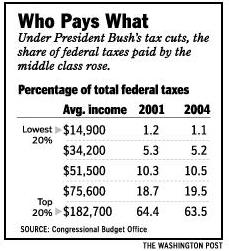

Since 2001, President Bush’s tax cuts have shifted federal tax payments from the richest Americans to a wide swath of middle-class families, the Congressional Budget Office has found, a conclusion likely to roil the presidential election campaign.The CBO study, due to be released today, found that the wealthiest 20 percent, whose incomes averaged $182,700 in 2001, saw their share of federal taxes drop from 64.4 percent of total tax payments in 2001 to 63.5 percent this year. The top 1 percent, earning $1.1 million, saw their share fall to 20.1 percent of the total, from 22.2 percent.

Over that same period, taxpayers with incomes from around $51,500 to around $75,600 saw their share of federal tax payments increase. Households earning around $75,600 saw their tax burden jump the most, from 18.7 percent of all taxes to 19.5 percent.

NYT is similarly excited: Report Finds Tax Cuts Heavily Favor the Wealthy

Fully one-third of President Bush’s tax cuts in the last three years have gone to people with the top 1 percent of income, who have earned an average of $1.2 million annually, according to a report by the nonpartisan Congressional Budget Office to be published Friday. The report calculated that households with incomes in that top 1 percent were receiving an average tax cut of $78,460 this year, while households in the middle 20 percent of earnings – averaging about $57,000 a year – were getting an average cut of only $1,090. The new estimates confirm what independent tax analysts have long said: that Mr. Bush’s tax cuts have been heavily skewed to the very wealthiest taxpayers. Those are also the people, however, who pay a disproportionate share of federal income taxes.

Exactly.

We actually commissioned a government study to demonstrate that, given an across-the-board tax cut, the people who pay the most taxes are going to get the biggest cut? That a guy who pays more than $57,000 a year in federal income taxes gets a bigger cut than a guy who only earns $57,000 a year? Really?

Further, if the guy making $57,000 a year gets a tax cut of $1090, does he really think it’s a tax hike because he’s now paying a slightly higher share of the overall tax burden than he once was?

UPDATE (1138): Sean Davis, a policy analyst for Senator Robert Bennett on the Joint Economic Committee (JEC) has a decidedly different take on the numbers, which he shares via electronic mail:

* As a result of the tax cuts since 2001, all taxpayers face lower effective federal income tax rates than they would have without the tax cuts.

* While many characterize the CBO report as evidence that the tax cuts shifted the burden of taxation to the middle class, CBO data show precisely the opposite effect. The tax cuts actually made the tax system more progressive. The highest 20 percent of earners now pay a larger share of federal income taxes than they would have without the tax cuts, while the share of income taxes paid by all other income groups fell.

* The overwhelming majority of federal income taxes are paid by the very highest income earners. The top 1% of income earners pays 31.6% of all income taxes, the top 5% pays 51.4%, the top 10% pays 63.5%, and the top 20% of income earners pays 78.4% of all federal income taxes. The bottom four-fifths of income earners pay just over one-fifth of all federal income taxes.

* Some analysts cite total effective federal tax rates, as opposed to effective income tax rates, as the best measure of the effects of the tax cuts across income groups. This method can be misleading because it measures the burden of payroll taxes without accounting for the highly progressive Social Security and Medicare benefits to which payroll taxes are linked.

The full report (PDF) is available here.

Update (1549): Steve Verdon has more.

Who cares this still shows that the top 20% of Americans pay the taxes for 64% of the population. And the top 30% pay 80% of the taxes. These progressive taxing advocates want to make this an issue?

And yet its the bottom 80% that use more public services than the top 20%. From unemployement,to welfare, public education, medicaid, HUD, Disablity Benefits.

It’s amazing how the welfare state continues to exist in plain site.

I must need new glasses, because I don’t see much of a difference between the 2001 and 2004 numbers. WaPo and NYT are getting all uppity about a total of 1 percentage point for the third and fourth quintiles (which is how I would define “middle class)?

I assure you, people in those segments are far more concerned with Social Security taxes and state & local taxes, not with this (microscopically) changing distribution.

We actually commissioned a government study to demonstrate that, given an across-the-board tax cut, the people who pay the most taxes are going to get the biggest cut?

I may be misinterpreting, but your analyis seems to be doing a little of the same thing that the media is doing; cherrypicking or selectively interpreting a point and applying it to buttress your angle. In my interpretation (of primarily the WaPo article), the point is, the percentage of the overall tax burden shifted to the middle 20%.

So when the taxes were cut, not everyone benefited in equal proportions, and I don’t mean the old argument that “of course richer people are going to save more money, they naturally make and pay more”, which one COULD interpret as YOUR point. The real point of these articles is: the tax cuts have made teh real marginal tax rates LESS PROGRESSIVE, which upsets many people’s sensibilities.

re: Further, if the guy making $57,000 a year gets a tax cut of $1090, does he really think it’s a tax hike because he’s now paying a slightly higher share of the overall tax burden than he once was?

From the point-of-view that state and local taxes may increase, or the average wage owner is associated with a ceratin amount of benefit from and responsibilty for the government’s budget, yes.

You can argue that the top 1% put that money to work as investment capital and drive the standard of living and real wages higher for wage earners as a whole, but I’m not feelin’ your analysis.

Bill,

Yes, the percentage of the overall tax burden going borne by the middle quintile rose 0.2%. Of course, the burden of the bottom quintile actually declined slightly as well.

I’m not analyzing the utility of tax cuts, just that the natural consequence of an across-the-board tax cut in a steeply progressive system is to redistribute the burden among the quintiles. There’s no surprise there–the people paying the most taxes will benefit disproportionately.

Of course, we’re comparing quintiles and not people. People don’t necessarily remain fixed in one quintile their whole lives.

Not “disproportionately” – “proportionately” (to their income). Isn’t that the whole point?