Oil Prices to Continue to Fall

Via the BBC: Oil prices likely to fall further, says IEA

The IEA, a consultancy to 29 countries, said weak demand and the US shale gas boom meant crude’s recent fall below $80 a barrel was not over.

On Friday, Brent crude, one of the major price benchmarks, traded at $78.13 a barrel, near a four-year low.

“It is increasingly clear that we have begun a new chapter in the history of the oil markets,” the IEA said.

“Barring any new supply problems, downward price pressures could build further in the first half of 2015.”

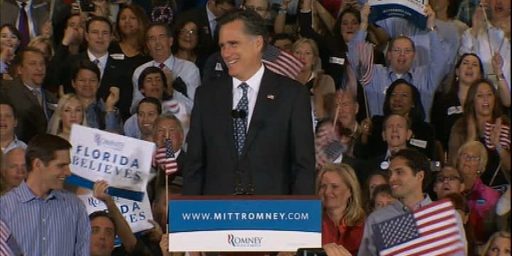

Good thing we elected President Gingrich! (Indeed, I paid $2.50-something this afternoon for gas).

In all seriousness, I am curious as to what falling prices will mean to countries where political power is linked to petroleum (e.g., Venezuela and Russia) and why global demand has waned.

I work in the industry and I’m told that a lot of it has to do with Saudi Arabia, which functions as a swing producer. They’re trying, supposedly, to disrupt tar sands production in the US. This is hearsay, but I’ve heard it repeatedly.

@Rob Prather: I suspect it has more to do with world wide economic conditions.

In this instance, a combined explanation perhaps is more useful. Rather clearly overall economic conditions have slowed demand below producer expectations, with more production having come online following sustained high(er) prices. That is without doubt a primary driver.

However, the very short-term Saudi behaviour in the face of the price decline does have an air of market seeking behaviour. It is well known they do consider their sales to USA to be partly political.

this will make the New York Times happy because it will slow down the exploration for energy in places like North Dakota and Texas. One needs to remember that the New York Times does not like blue collar whites in those states from making above minimum wage.

This has been a welcome relief. I looked at my receipts from last year and calculate that I have already saved $120 over last year for October alone. Think of the savings for businesses and people who have to use vehicles for work. Hopefully this will bring some relief in the food price spiral. $1.50 is way too high for a can of soft drink or a cup of coffee.

It is hard to believe that some people are actually saying that this is not good. I guess it is not good for investors and oil companies to make a few million less each day. How awful !

@superdestroyer:

Huh? What does the NYT have to do with anything and what makes you think they have something against blue collar, um, “whites” making $.

Sometimes wingnuts seem to forget that those of us in the reality-based community don’t speak your weird, conspiracy-tinged language.

Very timely. I’m going to be driving a 2K round trip for Christmas, so cheap fuel is great.

I don’t see the current price of oil as a result of Saudi machinations. They really aren’t the “swing producer” they used to be and are pumping at near capacity. Their market, though, has dramatically shifted to Asia. If Asian demand goes down, then sales go down and when global sales are aggregated, then global sales go down, along with the prices.

The Saudis aren’t sad that certain countries will get hammered by low prices, of course. Those that depend on every penny of oil income to balance their budgets — Iran and Russia, foremost — are getting pinched. The Saudis can live quite a while with oil prices in the $80-$90 range as their production costs run around $75/bbl. And of course, they have huge sovereign funds ($737.6 billion, as of October) to call on to fill any economic shortfalls.

@superdestroyer: Weren’t you complaining not all that long ago about how the high price of gas was a liberal conspiracy to force energy conservation upon the unwilling white masses? Now you are complaining that the low price of gas is a liberal conspiracy to force low wages upon the unwilling white masses?

I love white conservative victimhood. Everybody is against you and no matter what happens you lose and it’s not your fault. It’s a Lose/Lose proposition.

@superdestroyer: Are you mentally ill or simply developmentally challenged?

What the bloody hell does the NYT have to do with anything here (nevermind the supposed childish orientation of their writing, which whatever its flaws, hardly emerges to the rationale reader).

Yes, we can!

Hey Koch-paid GOP: Wildly unprofitable and unnecessary Keystone Pipeline says… what?

https://www.youtube.com/watch?v=–BslU44vWU

Putin must be sweating bullets at present….the Russian economy runs on the selling of expensive oil. Can we say “deficit”, anyone?

I have no idea if this is true or not, but the Guardian thinks Kerry cut a deal with the Saudis. It hurts Russia, Iran and IS. Whatever is going on, the fundamentals haven’t changed. Don’t expect this to last unless the Europeans pull the world into depression. The Saudis may need oil dollar cash flow right now to fight IS, which they created with oil dollar cash. And if Kerry did cut a deal, what did we promise them?

Global demand has not really waned all that much, but the Saudi’s have flooded the market to make US shale exploration less attractive, combined with already developed US shale deposits, are driving down the price.

Likewise, I look forward to seeing what this does to the budgets and governments of Russia, and particularly Venezuela. The former is probably going to be just fine, but I hope this can spur some type of change in Latin America.

The Good News:

The Bad News:

The Forecast Calls for Pain:

https://www.youtube.com/watch?v=1IrdMyQSKr8

Thank You Robert Cray.

@ernieyeball:

I’m paying almost a dollar more per gallon here and McDonalds refuses to give me a senior discount even though the palm reader at the farmers market told me I have an old soul.

Per GasBuddy you must be in Anchorage, Alaska.

http://www.gasbuddy.com/GB_Price_List.aspx?cntry=USA#us_cities

@superdestroyer: Where de f*** did THAT come from???

And, while I’m on it. Watch what you’re saying here. You’re intruding on my territory. This blog isn’t big enough for TWO ignorant crackers!

@Let’s Be Free: When I first saw the picture, I thought it was a strip mining site. I didn’t realize until later that it was supposed to be a park. Perception is a significant part of message. Until I read the text, I also thought it was some greenie being snarky.

@ernieyeball:

Thankfully no. I’m in the middle of the Pacific.

@Just ‘nutha’ ig’rant cracker: Dude, that banner photo was the Painted Pots in Yellowstone, National Park, down the road a spell. It’s probably hard for most of the people who comment on this blog to believe, but fracking isn’t going to negatively affect the geysers, the grizzlies, the elk, the wolves and the bison one iota. They are doing better than at any time since the mid 1800’s, at least.