The Unreported Greek Bank Run

Tyler Durden at Zero Hedge points out a story that the mainstream press isn’t noticing yet. The Greeks are, perhaps not surprisingly, pulling their money out of Greek banks:

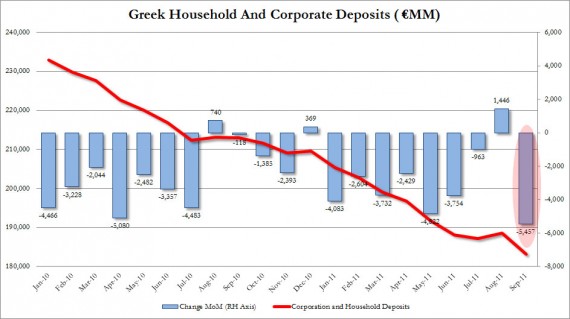

According to just released data by the Bank of Greece, the September collapse in gross deposits from €188.7 billion €183.2 billion was the largest ever, and took the total to an amount last seen in June 2007. Indicatively Greek deposits peaked at €237.8 billion in September 2009. Said otherwise, in addition to being massively undercapitalized, banks cash in the form of deposit liabilities has plunged 23% from its all time highs. Look for this number to continue dropping month after month as more and more Greeks move their cash offshore.

The chart, I believe, says it all:

I doubt we’ll see that line going upward any time soon.

I’ve been hearing about it on the Planet Money podcasts for a while now.

So what does this mean in terms of the bailout? Is the EU’s money injection just going to keep the banks afloat for a while longer & not actually salvage the overall Greek economy?

This is just really just part of the bigger picture. As Greece, Spain, Portugal and Italy continue with their austerity programs Germany is going to have fewer outlets for it’s exports. Sooner or later Germany will be circling the drain along with the others. Not sure about the solution…but without one things are going to get scary.

@legion:

As I understand it the bailout serves to enable Greek banks to continue making payments to French and German banks, not do much to help the Greek economy.

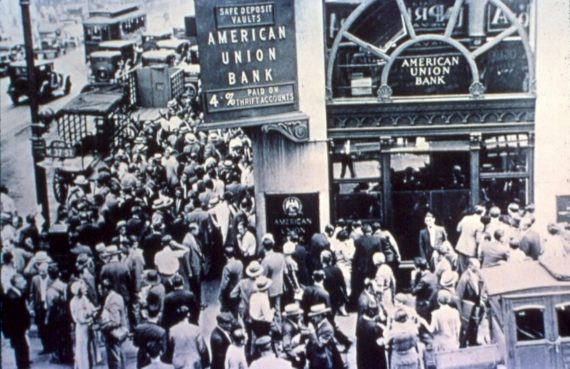

Unimpeded bank runs means Greece’s banking system collapses, period. Default is inevitable.

@Dave Schuler: So, France and Germany tell the ECB to give money to Greek banks, so the banks can hand it directly to French & Greek banks, so they can get as much as possible back on their outstanding accounts before Greece goes totally tits-up, allowing numerous layers of the process to skim their own retirements off of the package in the process, rather than simply writing off the debts they’re never going to see anyway. That sounds about right.

Has it occurred to you that there might be a reason for collapsing deposits other than a bank run?

Like a collapse in salary for much of the working population, public services being slashed and unions going on strike, unemployment going ballistic.

Have you considered that the Greek population might be burning through its savings simply to survive?