The Fed, Inflation, Interest Rates and Oil

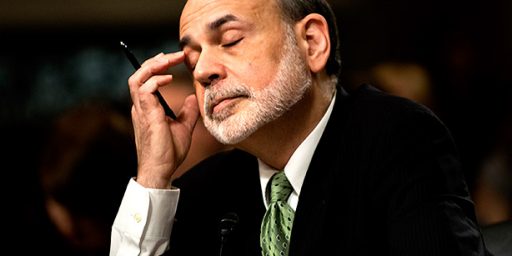

Fed Chairman Ben Bernanke testified before Congress that the higher oil prices could make inflation worse. This in turn could lead to higher interest rates.

Federal Reserve Chairman Ben Bernanke told Congress Wednesday that although economic activity is moderating, record-high oil prices have the potential to make inflation worse.

It’s a development that bears close watching, he said.

Delivering his second economic report to Capitol Hill, Bernanke also stressed that these are difficult and uncertain times for Fed policy- makers, saying the climate of slowing growth and rising inflation puts the Fed in a tricky spot in terms of setting interest rates.

No kidding. Bernanke is a new Fed Chairman and if he wants to be seen as a hawk on inflation he may be willing to send the economy into a recession to build up that reputation. Higher interest rates coupled with higher oil prices could push the economy into a recession.

OPEC President Edmund Daukoru has stated that the run up in oil prices is “very uncomfortable” and that there are worries it could have a negative impact on the world economy.

Daukoru, who is also Nigeria’s top oil official, told Reuters the Israel-Hizbollah conflict was responsible for the latest spike, which saw U.S. crude oil futures hit $78.40 a barrel last week, and that OPEC had plenty of spare production capacity should it be needed.

“If it would have stabilized around the mid-60s, I don’t think people would complain too much. We are getting used to that, but the latest shootup to the mid-70s and above is very uncomfortable,” Daukoru said on the sidelines of a conference in the Nigerian capital.

“Clearly the latest flare-up between Israel and Hizbollah that is really the reason for the latest spike,” he said. “It is always unfortunate if we have to address issues outside the power of OPEC.”

High prices bring more revenue to OPEC in the short term, but exporters worry that sustained increases hurt the global economy and encourage consumers to invest in alternative energy.

From an economic theory perspective this contains some interesting issues. Note there is the short term/long term trade offs facing OPEC. Higher oil prices today mean higher oil revenues today, but down the road consumers will cut back, look for alternatives/substitutes and future revenues could be lower at all prices. Similarly, consumers have a trade off, wait and see if the high prices are transitory or take the plunge and invest in more expensive alternatives such as a hybrid car, or something else.

On top of this there is the consumption from growing economies like the Chinese economy as well. The CBO is estimating that under their slower demand growth scenario the impact on U.S. gasoline prices could be $0.19/gallon, and under the higher growth scenario as much as $0.38/gallon.

Steve, you’re the economist: why is inflation the Great Satan that must be avoided, even at the cost of a recession?

Inflation can certainly be bad, but so are unemployment, stagnant wages, etc. What gives?

Anderson,

Inflation has costs associated with it. If you hold cash, the value of that cash is eroded. Adjusting prices to keep up with inflation is also costly (e.g. the cost of new menus). With low or zero inflation those costs are minimized.

Also, it isn’t that the recession is preferred, but that the Central Banker is trying to signal that he is an inflation hawk. Sending the economy into a recession to stop inflation from accelerating sends just that signal. The problem is that there really is no way, other than reputation building, to promise not to let inflation get out of hand or change policies “mid-stream” to get even better outcomes. For more clicky.

I’m barely even a student of economics, but let me see if I interpret this right… It sounds like high inflation actually encourages market investment (and maybe material goods purchases), since that inherently links your money to the economy. But does the market generally continue to rise when inflation falls, or does that trigger a backlash as people convert back to liquid assets?

So long as the inflation rate is zero (positive yet small) and the real interest rate is positive you wont have this problem.

Wow:

Another excuse for the oil companies. With your “theory’s”, inflation can now be blamed on the “Fed” and the high intrest rates. What a deal.

Now the oil companies can lay the blame on high prices on someone else instead of themselves. Just wait until the oil companies post their next earnings reports and we will see who is getting filthy rich and who is paying the price for high inflation and greed.

Steve, you can make all the excuses for the oil companies you want, but myself and every other American are getting it shoved into us by the Greed of the oil companies. I don’t expect you to agree because you work for an energy company and I bet your job depends on the positions you take.

It wouldn’t supprise me to see Exxon Mobil profits exceed 50 Billion the next quarter.

As for me, the oil companies are taking away my ability to take a Sunday drive and limiting my ability to go shopping because of the high gasoline prices and believe me I am not alone.

That really means that the Oil Companies have “Taken away One of my Freedoms” as well as with millions of other Americans.

Now is the time Steve for you and all the other “Excuse Makers” and to learn to be Americans and stand up to the oil companies and their obscene profits without aiding and abetting this rape of the American people/

Herb reminds me of a comment by Atrios:

As I was attempting to express on the radio, there’s a certain imagined view of what the political center is, which fits well into what the basic Beltway press view of what the political center is – somewhat economically conservative (or Liberal in the European tradition), and somewhat socially liberal. Miraculously this political center matches up just perfectly with the set of people who imagine a new wonderful politics above the partisan fray, and their agenda is presumed to be universally popular.

While this party of The Economist magazine (or, The Economist magazine circa 1997 when it wasn’t as crappy as it is now) perhaps has its adherents, it’s more likely that a successful third party movement (meaning, popular), would be more of an economic populist-nativist-socially conservative one. Some charismatic individual with a hybrid of the views of Ross Perot and Pat Buchanan who, coincidentally, were the standard bearers of the Reform Party…

–I suppose another populist take on the evils of inflation is that creditors get paid back in inflated currency, and we wouldn’t want *that* happening to Chase, Citibank, etc.

Want to put the kibosh on all this nonsense?

Want to win in the Middle East?

They both have one answer:

Increase Domestic Oil Production.

Bithead,

Unless therea are huge here-to-fore undiscovered deposits of oil in the U.S. that is just a complete pipe dream. You’d need such a massive amount of oil, that the U.S. would become the price setter and drop the world price of oil.

Now, since in reality this is not going to happen, ever, perhaps we can stop wasting time with this kind of talk radio bravo sierra.

Oh bullshit. Nothing has been taken away, it has merely gotten more expensive. That is life, somethings become more expensive.

Anderson:

Is there any limits to your knowledge. You seem to be an “Expert” and “Authority” on everything.

To bad you expose yourself to being the “Phony” you actually are. You sit at you computer and search for answers, then express them on OTB like it was all your of your own.

I wonder just why you comment here on OTB and want to communicate with those who are not as intelligent as you. I bet you really get your jollies communicating with those of less intelligence that yourself.

You know Anderson, you really are the biggest “Phony” I have ever come across.

Steve,

I am amazed that you can’t see the value of increasing domestic oil production. Will it bring back sub-$1 gas, no. Would drilling in ANWR 10 years ago mean lower prices today? Absolutely. Supply increase, price tends to go down. Especially since not withstanding the NK missiles, Alaska is hardly in danger of having its supply turned off.

At some price point, shale oil becomes viable. Following your absolute statement, we shouldn’t bother with that.

The energy solution is varied. More domestic production as a bridge. More nukes for electricity. More market driven conservation (e.g. hybrids). More alternatives (Hydride, ethanol, etc.) which today don’t make sense but have potential in the future.

Huh. Anderson grabs an old post of Atrios’, and quotes it, with attribution link. Then Herb blasts Anderson for being a “phony”, pretending he’s an expert, and digging up info & presenting it here “like it was all your of your own(sic)”.

One wonders what the laws of physics are on Herb’s planet, since it’s plainly not of this universe…

And YAJ, if pulling oil out of ANWR would actually have the impact you describe, I might support it. But the driver for gas prices is refining capacity as much as (if not more than) raw crude production.

I agree that the actual long-term solution is encouraging broader variety than “let’s try drilling over there”; I just don’t think there _is_ much of a short-term bridge to get us there cheaply…

You sit at you computer and search for answers,

Actually, Legion, I found that part kind of poignant …

Of course, if I want answers, then communicating with those more intelligent than myself would seem to be a good idea. Whereas Herb seems to be the one with the answers, so it’s just altruism on his part.

YAJ,

I didn’t say it didn’t have any value, but that it wouldn’t have the effects Bithead implied.

I think you are vastly overstating your case here. Sure drilling in ANWR might lower prices a few cents, maybe even quarter or two, but that is about it at best. As for volatility, sure it would help, but since the world would still depend on ME oil, and since oil is traded on a global market that would mean flare ups in the ME would still cause price volatility…even for oil coming from ANWR.

In general most people don’t give two sh%ts where their oil/gasoline comes from so long as it is available. So, if a flare up takes a significant portion of oil production off-line or even threatens to, prices for all oil will go up since if people can’t buy from the ME they will buy elsewhere.

As for things like oil shale, that’s fine, but it still requires a high price. Thus, there is no cost savings there. If the price of oil has to be say $85 to make oil shale economically viable, then that is the imputed price for oil shale as well.

This idea though that we can “win in the ME” by producing more at home is just nonsense.

Anderson:

You remind me of the boss who listened to a good idea from an employee and told the employee that his idea would not fly, then you went to your boss with the idea and told him that it was your good idea and feathered you own nest at the employees expense.

In other words Anderson, PHONY.