The Post-Tsunami Stock Markets

If there can be a silver lining at all in Southern Asia, perhaps the New York Times has identified part of it:

Why Stock Markets Stayed Calm in Southern Asia [RSS]

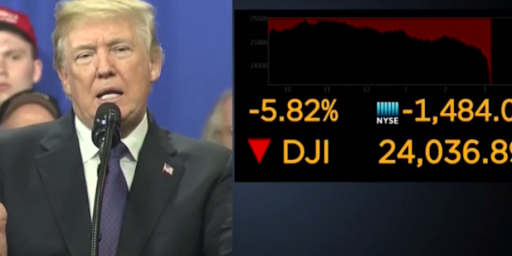

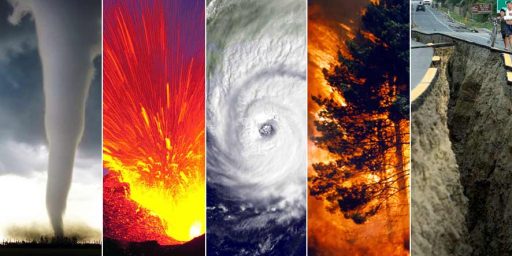

Natural disasters often provoke sharp stock market declines where they occur, usually followed by recoveries that are almost as intense. Ten years ago this week, the Kobe earthquake in Japan sent stocks there tumbling 5 percent before they snapped back.

The Sri Lankan market followed a similar path after a tsunami struck on Dec. 26, but it was the exception. Despite the huge devastation, other markets in southern Asia had no big gyrations, and ended the ensuing week flat to higher.

The bonds of the affected countries, as well as their currencies – which can be volatile even in benign circumstances – suffered few ill effects, either.

“The stock markets in the region have generally not been impacted by the disaster and, in fact, have behaved differently than expected,” said Mark Mobius, manager of the Templeton Global Emerging Markets fund, in a note to investors. Markets in Indonesia and India ended the trading week after the tsunami more than 1 percent higher, while the Thai and Malaysian markets were little changed. Sri Lanka’s market fell sharply immediately after the disaster, then got most of the lost ground back later, ending the week down about 4 percent. In the month ended Friday, stocks rose in all these countries except for India; for American investors, returns were higher in all five countries because their currencies rose against the dollar.

Paul Niven, head of strategy at F&C Asset Management, a fund management company in London, pointed out that many Asian stock markets have continued to rally this year. “Such behavior may seem odd at a time of such unprecedented disaster across numerous countries,” Mr. Niven said, “but it does appear that markets are behaving entirely rationally.”

He and other investment professionals say there was no widespread selling because the tsunami damage, though extending for thousands of miles along the Indian Ocean’s rim, had negligible impact on industrial capacity. It may seem perverse when juxtaposed with the immense loss of life, analysts say, but the disaster may even produce economic and commercial benefits as rebuilding begins.

Of course, the tsunami had such a devastating impact partly because the coastal areas were underdeveloped. The last section of the article addresses this issue:

In the long run, he said, the tsunami may help strengthen Asian economies and markets because “rebuilding takes place with more modern buildings and equipment, so it raises capabilities” of manufacturers in the affected economies.

The tsunami is “a forced way to modernize,” Mr. Chan said. When local companies build homes, factories and infrastructure, “there will be a lot of expert advice to guide them,” he said.

“All of that,” he added, “is going to enhance productivity and the productive capacity of the region.”

I do have to question the “benefit” of repair. That sounds like the old broken-window fallacy. If the earthquake had never happened, all that money (except the foreign aid) would be available for upgrades and improvements, while the existing structure would still be there.

Did 9/11 help our economy? Look at all the construction jobs to build the new WTC.