The Urgency of It All

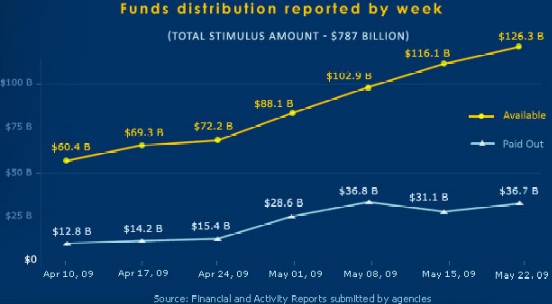

Back when there was all that big argument about the efficacy of stimulus spending to mitigate the effects of a recession one argument is that we have to spend the money fairly quickly, at least by Washington DC standards. Otherwise there is the likelihood that the spending will occur when the recession is already over. I’ve also noted that as of the Middle of May very little money had been spent. I also noted that so far what little spending there has been doesn’t seem to be doing what the Administration said it would in regards to jobs. The following graph, from our dear friends at the White House, could be one reason why,

(Link to the graph at recovery.gov)

Now, I read that graph as saying that there is $126.3 billion available in stimulus spending but that only $36.7 billion has been spent so far. Epic Fail guys. Really. Oh and here’s a thought, you need to spend $50 billion on Government Motors…well I just happen to know where there is $90 billion lying around….

And what the heck is with that already spent number going down from May 8, 2009 to May 15th, 2009? That is an accounting adjustment which reduced the amount paid out by $8.9 billion. And if you drill down for say DHHS spending you’ll see that there is $8 billion lying around for grants to states for Medicaid. And at the same time California has a serious budget crisis, but lets not use that money there. It is so much better to save that money and force a large state to cut spending at precisely the time is shouldn’t be cutting spending. And the child care and development block grants to states…$502,000 so far with over a billion just sitting around?

So, any bets on how much of that spending will take place after the recession is over? 40%, 50%, more? I’m thinking probably more. Can I report the government to itself for waste, fraud, and abuse of these funds? After all, this money is supposed to be spent, not just fatten up some bureaucracies budget, sounds like waste at the very least to me.

Via Russell Roberts

Tax cuts would have been better than this. Or how about fix the housing and banks then ride out the recession? It seems every move has been the wrong move. So much for an Ivy League education and inside the beltway thinkers.

Before it’s over the soft abuse of the bureaucrats will have cost us billions of dollars, no real infrastructure improvements will have taken place, and our children will hate us forever. Seriously, has any generation ever hanidcapped the following generations the way we are doing now?

Although I was not a fan of the stimulus as implemented, this chart isn’t 100% accurate. In my line of work, I deal with a lot of local government construction projects, and I can tell you that there has been a SIGIFNICANT uptick in activity as a direct consequence of the stimulus. So while a lot of the money may not be spent YET, the allocation of that money is a done deal, and that’s spurring activity. As we get deeper into construction season, I think you’re going to see a lot more of the money “spent” on that chart.

Remember on some of these infrastructure projects, even if they’re “shovel-ready”, there was almost certainly some re-design work to get them up to speed. Then projects have to be put out to bid. Then bids have to be awarded. Then third parties have to get taken care of (utility relocations, etc). THEN construction can start.

In large, complex systems, there are inevitably time delays as you move from step to step. There’s no way to just wave a magic wand and magically spend money. Infrastructure projects and the like still have to go through all the usual processes, and those processes take time.

Alex, what does this mean? It sounds so vague I don’t know what to make of it? What kind of activity? Moving paper around? Actually green lighting projects, what?

Right, and if the consensus on the recession ending is right (3rd Quarter this year) I’m thinking way too late for helping to end the recession.

Yes, I know. Hence my post.

I thought you didn’t want them to spend?

The good news is that if recovery comes, they can stop.

The money is essentially spent–i.e. the law is in place, we (taxpayers) aren’t getting it back, at least not directly. So, now the issue is will they spend it quickly and deliver on their promises.

The bad news is we wont know that for up to a year after the recession is over, so no, they wont.

That is officially the dopiest thing I have ever seen posted on any blog, anywhere. I’m surprised the internet didn’t break.

Unless you’re being facetious, odo, in which case I apologize.

Budgets remove programs all the time. Why shouldn’t we ask for a 2010 budget that removed some of this unspent spending?

Because we probably wont know the recession is over until the end of 2010, at which point the 2010 budget will have been set and in place for months.

Phil,

No, I don’t think he was being facetious.

First rule of holes, odo. You’re breaking it.

Are you really gullible enough to think that after all the log-rolling that went into crafting this abortion of a budget, that any of the congresscritters involved are going to stand meekly by and watch their piece of the pie get shut down? Or are you contending that some of them will volunteer to have their graft get refunded?

Seriously? That’s just weapons-grade non-partisan fantasy, right there.

Neither do I, Steve, but I try to apply the principle of charity to blog comments.

I just think it’s perverse, if in our democracy, people who oppose spending find themselves in the political position to demand it “harder and faster.”

I mean, what do you actually have to lose, by asking that the stimulus be clawed back?

Alex, My county’s stimulus projects ended up being road resurfacing since it was the only thing that could be ready in time. Projects requiring any design work could not make the time frame. As a result we are resurfacing roads a little too early and missing the opportunity to get some needed projects done. That’s a form of waste when your priorities are ignored.

The resurface projects also provide fewer jobs than the general improvement projects.

Odo needs to work with some local government agencies to see if they ever stop spending.

Steve Plunk, no one stops spending until pressure mounts to stop them. But certainly, when ALL voices, right and left, demand that the stimulus be spent, it will.

Are you guys familiar with Pascal’s Wager?

This is a little like that. Asking that the stimulus be clawed back costs me nothing. It cannot make the situation worse. It is unlikely that my asking will cause the stimulus to increase. Either it will stay the same, or it will drop.

Hence, it is the logical, no-downside position.

Hmm, need to go look up the econ paper, but there have been a number suggesting it is better, if you are going to go the stimulus route, to not suddenly stop the stimulus. Also, that is a big graph, but it only covers one month and 12 days.

Steve

Are you really gullible enough to think that after all the log-rolling that went into crafting this abortion of a budget, that any of the congresscritters involved are going to stand meekly by and watch their piece of the pie get shut down? Or are you contending that some of them will volunteer to have their graft get refunded?

This in a nutshell is why they won’t stop or roll back any of the stimulus spending. If the recession ended tomorrow and we magically knew it had ended tomorrow, the congress members that got that bacon for the people back home aren’t going to step forward to ask that the bacon be returned. They want and need that bacon and will probably demand more.

I just think it’s perverse, if in our democracy, people who oppose spending find themselves in the political position to demand it “harder and faster.”

Well remember back when they were passing the trillion dollar stimulus bill-the argument then was that they couldn’t take time to debate it or read it before they had to pass it, because they had to get it passed so all that money could be spent and the economy stimulated?

Well the majority of the money isn’t spent, and I am not convinced there is much stimulating going on, and even if the argument is that all that spending was and is needed, i am having trouble seeing why we needed to pass the bill before anyone had a chance to read it.

Well, if you don’t ask those congress members to cut, what message will they take away? Will they leave things along, or spend even more? You need to weight things on the “cut” side even if you want to hold the line.

There should be some constituency for cuts and clawback, to counterweight all those who truly love the spending.

OK, maybe this is a stupid comment, I apologize for my ignorance if so. But, couldn’t this just be a lack of knowledge and action on the part of those who have these funds available? Meaning – the money is there but there is a lack of awareness of them or a lack of knowledge in how to obtain them.

I’ll be honest, I had a “chldrebate” payout in my check this past week. I have no clue what that is. I assume it’s some part of stimulus spending but, could not find any reference for it on-line.

Again, pardon the ignorance. Educate me if so, please. 🙂

Sounds like 99% of your Posts Steve… 🙂

Alex is saying that the availability of stimulus money is spurring economic activity, even though the money hasn’t been spent. Your counter-argument is that, since the money will be spent after the activity is done, the money played no part in it.

When I want to buy something, having the money available spurs me to make the purchase, in which case the availability of the money was the stimulus, not the physical spending of it.

Since the end of the recession is when when things stop getting worse, I don’t see why the availability of money activating projects that necessitate the creation of jobs and goods shouldn’t be considered a factor in the growth of the economy, just because the checks hadn’t been cashed at that point. If someone who was unemployed gets hired, technically their unemployment ends on their first day or work, not when they get their first pay check, and their economic decisions will reflect that.

FWIW, Benanke is testifying this morning. In CNBC’s coverage he talked about the importance of getting a deficit reduction plan in place before the recovery begins.

Now there certainly may be political difficulties, but I’d think any monies truly unspent would be ripe for such a plan.

The tension should be between people who believe we won’t have a natural recovery, and so still need true stimulus, and those who think that a natural recovery is sufficient (now or soon).

(The interesting opportunity here is that everyone is willing to say they are for deficit reduction. No one is crazy enough to believe trillion dollar deficits are sustainable. And so cost cutter have allies, if they choose to use them.)

Odograph,

I wish it could be undone, but the reality is it wont.

But you are ignoring my point, that one of the main issues with stimulus spending is that it is done fast, if it is to work at all. We aren’t seeing that fast spending, yet. Unless Alex is right and something like 70+% of economic forecasters are wrong, we aren’t going to see it spent when it should be spent. And this, was one of the arguments against the stimulus spending.

Do you understand now, or must I use smaller words?

Michael,

I find this a weak argument considering that the unemployment rate is so high. We are on trajectory as if there were no spending. I’m just finding it hard to reconcile the nebulous claim with actual data.

Odograph again,

But those who argued for stimulus have also argued we’ll have a very strong recovery. Brad DeLong, Paul Krugman, et. al. You sure do read things selectively.

So you were disagreeing with his evidence, not his conclusion?

You seem to pick and choose about what you think other people are thinking, Steve.

I don’t know why you’d make the “stimulus must be fast” argument to me. I’ve acknowledged it in the past, and talked many many times about counter-cyclical spending. Stimulus spent post-recovery is not only “not fast” it is not “counter-cyclical.”

Of course, your standard tick is to make up a position for your oponent, and then be insulting about it:

Geez Louise, yesterday you called Felix Salmon a “partisan hack” but I see him making much less emotional, and more reasoned analysis.

Here he is on the dangers of mixing fiscal and monetary policy at the Fed.

I think some did and some didn’t. I can remember some of those talking about the danger of 10-year Japanese style scenarios. Oh, here is Krugman:

That was on May 11, 2009.

If you are going to call my memory selective, get your ducks in a row.

Michael,

It is anecdotal evidence, and of the type that I’m not even sure multiple instances of it would constitute data. No data, the conclusion is seriously in doubt, IMO.

Odograph,

Rather ironic coming from you.

Use the search function on this site. All along one of the objections to stimulus spending is that it doesn’t get spent fast enough.

Skip google, it wont work, use the site’s search function.

So what is your beef with this post. The spending is slow, and there are places to spend it. At the very best, they are failing at implementing their own policy. Now maybe Alex is right and most economic forecasters are wrong and the spending will be timely and helpful. But I’m still skeptical.

Anothter ironic comment from you.

From Felix Salmon,

This doesn’t square with your position that it is primarily the Fed/Monetary policy angle (since your memory appears worse than mine, I’ll point out you linked approvingly to a seekingalpha article on this and then claimed that that article was exactly what bond market participants were thinking). In fact, it fits in nicely with the argument made by Niall Ferguson.

By the way, let me spell out what Salmon is saying: that Fed policy is less of a factor than Fiscal policy. That it isn’t necessarily just quantitative easing that is the issue with bond markets, but also the fiscal spending. In fact, so much so, that it is reasonable for the Fed Chairmen to spend very little time talking about Monetary policy.

Salmon continues,

I agree with this, and it goes to support Ferguson and those who are arguing that fiscal policy is one reason why bond markets are reacting the way they are.

And yes, when it came to GM, Salmon was just spouting Administration talking points. Was he presidentializing?

Krugman argued that the rebound in terms of employment would be stronger than in previous recessions. In fact, he chastised Greg Mankiw for being skeptical. Mankiw offered a wager, and Krugman was curiously silent, then he wrote either an op-ed or blog post where he pretty much conceded that the argument for a strong recovery was less than what he initially argued.

I believe your quote for Krugman comes after that concession.

Oh and yes, your quote comes after Krugman’s concession. I posted on it here. Oh and looky, you commented in that thread. Maybe we’ll have to go with a bad memory on your part.

Before we begin, let me ask you why you turn away from opportunities like these. I wrote:

You skipped that, to go off in your Krugman direction:

Why was it important for you to find division at that point, rather than say “Yes! Time to get that deficit reduction plan in place?”

(in that old Mankiw/Krugman thread I put low confidence in administration projections)

I didn’t disagree, I went beyond it. I said if it isn’t fast enough, lets ask for it to stop.

For some reason that was taken strangely.

Well, I can go with it for a day, and turn it off. I don’t think I’ve seen the same self control from you. I mean, can you go a day without going off on someone?

I never would have objected to a balanced post, contrasting the fiscal and monetary elements. I only called you out because in your OTB post it was all fiscal, and … Presidentialized.

BTW, remember your previous question to me an my response:

My questions to you:

Do you think Republicans will come forward with a deficit reduction plan? Will they support one?

Three responses…impressive. I wonder if someday I can get it up to 4 maybe even 5.

Not going to happen. As soon as someone starts Obama will pull the old, “We are in a crisis, do you want to make it worse!??!?!” He’ll use fear and garner support that way. The Republicans are weak and fear being made even weaker, and quite frankly they have little to no credibility in terms of deficit reduction.

You are extremely naive at this stuff. You seem to think this kind of spending can be turned on and off like a faucet in your bathroom. Sure in a theoretical world maybe….but that is rather funny considering your scorn and disdain for economists whose work is based on theory.

I can separate what I think will happen from what I think I should ask for … the parallel to Pascal’s Wager

Actually, my cynicism about what can be done with deficit reduction is what really demands that I do at least ask for it.

BTW, you didn’t really make it one post without an insult.

Paraphrasing my grandmother,

“Ask in one hand, spit in the other and see which gets full the fastest.”

Get back to us when you get a response to your asking for a claw back in the stimulus spending.

As said, per the Wager, there isn’t really a downside to asking … which is why resistance to asking, esp. from spending foes, seems strange.

Odograph,

Sure there is, I’m going to spend time writing a letter, sending it and that time I’ll never get back. I’d rather spend that time clipping my toenails. Not because of some nefarious reason as you are implying, but because they aren’t going to claw anything back. Ever.

It isn’t that there is a small chance of success, there is no chance of success. The payout in that case is trivial: 0.

Pascal’s wager does not apply.