THOSE LUCKY POOR

Kieran Healy has a superb discussion, sparked by an old WSJ editorial and ensuing commentary thereon by Jacob Levy, Kevin Drum, and Paul Krugman.

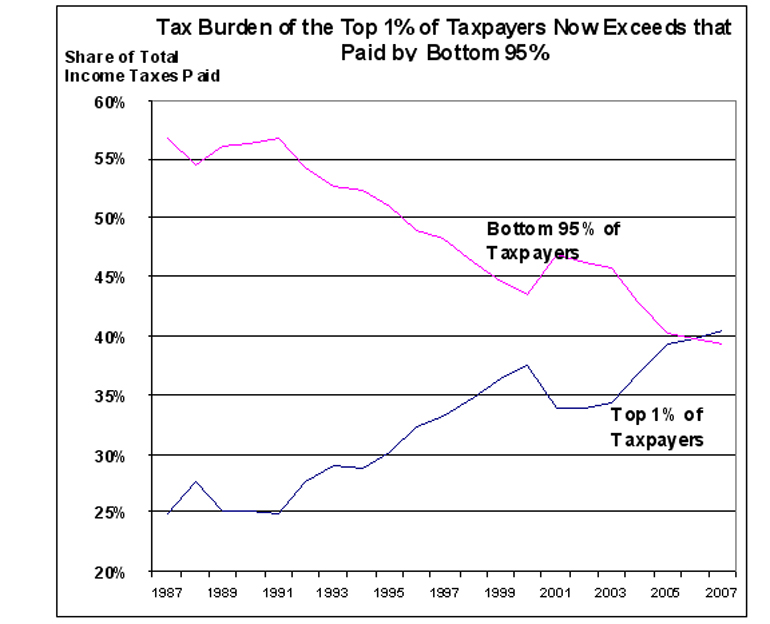

WSJ brought up the fact that the bottom quintile pays virtually no federal income tax and yet have the same voting privileges as the top quintile, which pays a third of all income taxes. They note the irony that this makes the poor essentially an aristocracy exempt from taxes. Levy brings in a philosophical discussion of stake in society; that is, do those with no property at stake have the same incentive to govern wisely as property owners? While this sounds incredibly elitist–if not insulting–by today’s standards, it should be noted that the Founding Generation believed very strongly in the principle that only those with a stake in society should have a vote. Indeed, they feared democracy as essentially mob rule, which was one of the reasons the president and the Senate were not popularly elected and why property ownership was a prerequisite for voting. It is not implausible that the masses, who by definition outnumber the rich, would vote for massive spending on themselves at the expense of the wealthy.

Drum and Healy note, correctly, that income taxes don’t tell the whole story, since Social Security and other taxes are far less progressive. Says Healy,

A big chunk at the bottom are detached from civil society and politics. A tiny, tiny minority at the top barely pay taxes at all. A small minority pay most of the tax because they have the largest share of income. These people tend to be more politically engaged. But they’re so ignorant about the shape of their own society — focused on their share of the tax burden, but unaware of their share of income — that they feel like they’re getting a raw deal. That makes for nasty politics. Class-war politics, even.

The WSJ is right: the more people who contribute to the cost of running the state, the better that is for the life of the country. The only provisio is, “assuming they can afford to do so.” So the Journal is really documenting negative consequences, like social exclusion and the politics of resentment, that flow from severe economic inequality and find their expression partly through fights about the tax system.

Right. Go read the whole thing.

One also must look at the notion that if one of the primary and legitimate functions of government is the protection of property rights, then it would be difficult to argue that ones tax liability should not have some bearing on the amount of property one owns.

This of course is a separate issue from the nothing of suffrage for non-property owners, but in an agrarian economy tying suffrage to property (meaning land) might have made sense. In a technological society the issue of what is property is far more elastic.

—