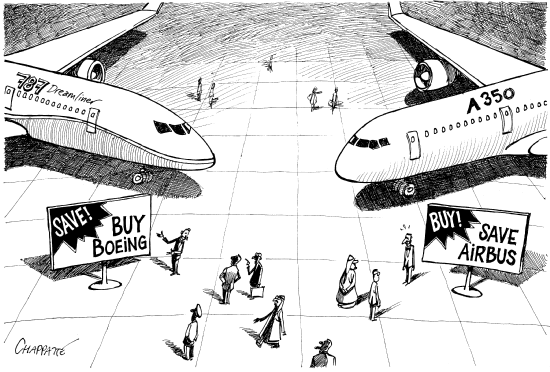

Transatlantic Plane Wars

European subsidies have given Airbus a competitive advantage over America's Boeing in commercial aircraft salesboein. The reverse is true on military aircraft.

University of Queensland economist John Quiggin has an interesting take on what he dubs the “trans-atlantic plane wars,” the WTO battle between Boeing and Airbus over state subsidies.

The World Trade Organization has completed its report on US subsidies to Boeing, following an earlier report on EU subsidies to Airbus. Although the report is not yet publicly available, both sides have received it, and are leaking/spinning like made, each claiming victory. Reading the competing claims, it seems that the WTO has found that that the US subsidies to Boeing have broken the rules (yay, Europe!), but not by nearly as much as EU subsidies to Airbus (yay, USA!).

In terms of the legal dispute, this looks like a win on points for the US side. But in geopolitical terms, it’s the other way around. Not only has Europe bent the rules more, it’s done so without suffering any real consequences, and to much greater effect than the US.

From a standing start in the 1960s, Airbus has taken the lead over Boeing in the commercial aviation market, while the rest of the once vigorous US commercial aviation industry has been wiped out. And, thanks in part to the launch subsidies against which the WTO has ruled, Airbus not only has the jumbo end of the market to itself with the A380, but has been able to counter Boeing’s successful (at least terms of orders) 787 with its own A350 (running only a couple of years behind the B787). Perhaps the WTO ruling will eventually force Airbus to give back some of the money, but as far as the global aviation market is concerned, the deed is done.

While this is only one example, it’s one that ought to give advocates of the US hyperpower theory a lot of pause. If spending more on the military than the rest of the world combined (the disproportion must surely be even larger in relation to military aviation) can’t preserve a position of dominance (or even leadership) in a closely related sector like commercial aviation, it’s hard to believe that it can be of any significant value in relation to other sectors of the economy.

One commenter notes that the Boeing 747, the original jumbo jet, is still in service and production. More importantly, however, is that the United States is exploiting its overinvestment in defense spending to dominate the market for foreign military sales. I don’t have the most recent figures at hand but this Marketwatch report from June 2009 — subtitled “Fighter jets, helicopters fill a void left by flagging commercial demand” — seems close enough:

The Lockheed Martin F-16 Fighting Falcon is a case in point. Probably the most popular Western-built jet fighter in the world, with more than 4,000 in operation, the jet first entered service more than 30 years ago. The Teal Group, an independent aerospace research firm, forecast the fighter jet market will grow about 34% over the next nine years. Jet makers are projected to sell 2,909 fighters for $163.7 billion between 2008 and 2017, compared with 2,355 sold between 1998 and 2007 for $122.4 billion, after adjusting for inflation. “This is a strong market,” said Richard Aboulafia, an analyst with teal. “The past three years all saw deliveries above $15 billion per year…a strong recovery form the doldrums of 1995 to 2004, when annual deliveries averaged $10 billion.”

It’s also a market set to be dominated by just a couple of key players: Lockheed Martin and its next-generation F-35 Joint Strike Fighter, and the Russian Sukhoi Su-27/30, a lower-cost fighter.

Earlier this week, Lockheed said it expects to sell about 1,000 to 2,000 stealthy F-35s to Israel, Singapore and Spain, as well as Japan, Finland and South Korea. And that doesn’t include the more than 3,100 F-35s slated for the U.S. and the nine partnership countries that helped develop the plane.

Also in the running is Boeing Co.’s F-18 Super Hornet jet, popular with the U.S. navy for its carrier capability, and the F-15 Eagle. But the plane’s last deliveries are estimated to occur in 2016, according to data provided by Teal.

Meanwhile, the Eurofighter 2000 jet, being built by Alenia Aeronautica, BAE Systems and the European Aeronautic Defence & Space Co., is getting elbowed out of the race by the F-35. “Unless some kind of counterweight to the F-35 emerges, everyone other than Lockheed Martin and Sukhoi will either have moved on to different types of defense work, be a fighter subcontractor, or merely be on borrowed time,” Aboulafia said.

[…]

There is some hope for Boeing, with big contracts up for grabs out of India, Brazil and Switzerland. Meanwhile, the U.S. and its allies may order more F-15 and F-18 jets to fill in gaps ahead of F-35 deliveries. Boeing Integrated Defense Systems’ vice president of international strategy, Jeff Kohler, said in an interview that he believed the company could easily sell around 200 to 250 F-15 jets over the next several years, and at least 250 of the F-18. He’s also seeing interest from several overseas buyers for the V-22 Osprey, a tilt-rotor aircraft capable of vertical takeoff and landing.

There’s much more in the piece, including a long discussion of the helicopter market.

There are some serious European players in the competition but the older American companies remain dominant. And the fact that the United States military has large fleets of these aircraft and has proven their capability in active combat operations is surely a key reason.

To be sure, gaining an edge in competition for sales of military equipment is a poor justification for massive defense spending. But it is nonetheless one small benefit.

Cartoon credit: Chappatte/International Herald Tribune