Two Incomes Better Than One!

According to some new studies by crack economists, it's helpful to have a spouse bringing in some money if you happen to lose your job.

According to some new studies by crack economists, it’s helpful to have a spouse bringing in some money if you happen to lose your job. Revolutionary, I know, but it’s science.

Amherst economist Nancy Folbre explains “The Spousal Safety Net.”

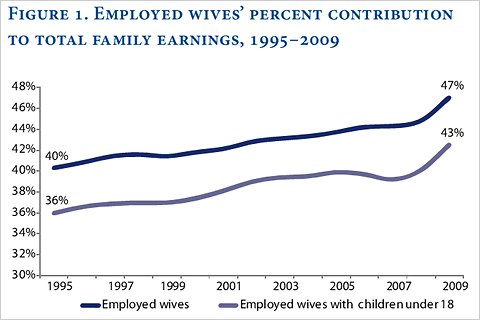

A recent briefing paper by Kristin Smith of the Carsey Institute of the University of New Hampshire documents a sharp uptick in historical trends. Wives now contribute 47 percent of family income in married-couple households where the wives are employed.

Professor Smith explains that increased reliance on wives’ earnings largely reflects a recession-related decline in men’s employment and earnings.

So, apparently, the wife’s percentage of overall earnings goes up when the husband starts making next to nothing? Tell me more!

Past estimates have suggested that the effect of a husband’s unemployment on his wife’s participation in paid employment — termed the added-worker effect — is small.

But in the past, unemployment was often temporary. Today, the average duration of unemployment has reached a record high.

Not surprisingly, we now see evidence of a significant added-worker effect – more specifically a husband-without-a-job effect.

Where do they come up with these catchy names? But, essentially, the value of a wife’s added income is greater the longer the husband isn’t bringing in a paycheck. I can see how that might be the case.

In a just-published article in the journal Family Relations, Professor Smith and her colleague and co-author Marybeth J. Mattingly offer a fascinating comparison of how wives responded when husbands moved out of paid employment between May of 2004 and May 2005 (a period of economic expansion) and between May 2008 and May 2009 (a period of recession).

Wives increased their hours of paid employment significantly more in the second period, helping explain why their relative contribution to family income increased. Declines in family wealth (such as the value of a home) probably intensified the effect of persistently high unemployment rates among men, pushing married women to accept jobs they might have refused in the earlier period.

So, stay-at-home spouses are more likely to seek work if their husband loses his job in a bad economy — and thus will be expected to be out of work longer — than in a good economy? Got it!

The spousal safety net didn’t help all couples, because not all wives were able to find employment.

Not overly surprising, this.

Also, it’s unlikely that the increase in wives’ earnings fully compensated for the decline in husbands’ earnings, because, as Professor Smith points out, women employed full-time year-round earn, on average, about 83 percent of what their male counterparts earn.

And, one imagines, even less if they’ve had a long period outside the workforce prior to rejoining it.

sss

The interesting observation by Elizabeth Warren was that there was one condition in which two working spouses produces less safety. That is when two people work and allocate a high percentage of their cash flow to fixed expenses. If you need two paychecks to make a house payment, then if either income is lost, the mortgage is lost. (AKA “two income trap”)

Now, I know prudent people who planned it very differently. I know a young couple who planned it so that either income could cover fixed expenses, and they enjoyed the other as variable lifestyle improvement. They were 1st gen immigrants, which might have something to do with their choices.

And of course you hit some other combinations. One spouse working, job lost, two people looking … that’s better at that point than one looking, etc.

BTW, I mentioned yesterday that the new Nobel (memory) prize relates to all this, and how it affects the overall economy:

http://blogs.hbr.org/fox/2010/10/nobel-lesson-economics-messier.html

Having a working spouse ranks second only to marrying money. A course which I urge on all young people. The reality of course is that two incomes are usually necessary to sustain the upper middle class lifestyle to which most Americans aspire. So when a period of high cyclical unemployment strikes as at present, a necessity becomes quite a useful life raft.

When the women’s movement begin one goal was to open up opportunities for women to work outside the home. A worthwhile goal overall, and one that provided for many opportunities. Today business has made it necessary for women to work outside the home, despite any desire by some women to be stay at home women exploring opportunities and goals. Thus we see how some people can ruin otherwise laudatory goals.

BTW, has anyone ever explored the problem of overemployment? That is, the holding of two or three jobs by individuals, when those jobs could go to others?

So, even a “Crack” economist could see that two Incomes are better than one! [lol]