USA a Low-Tax Country?

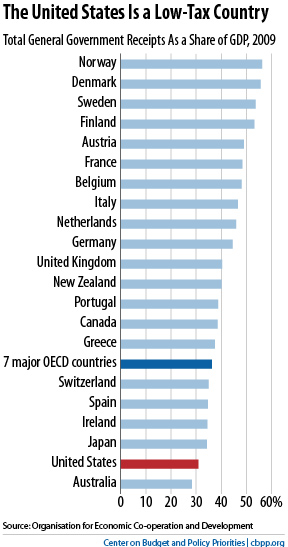

Australia is the only major country with lower tax rates than the USA.

This chart from the Center on Budget and Policy Priorities is making the rounds:

Now, I don’t doubt the essential thrust of the chart. The United States is in fact a low tax country compared to the more socialistic states of the other developed economies. And, off the top of my head, around a third of the entire economy going to the government sounds about right.

But I wonder what, exactly, this is comparing. The chart is on a Flickr page and I couldn’t find any methodology for it on the CBPP’s website. It’s also on their blog, along with some other charts, but without any explanation on how it was compiled aside from the notation that it’s based on OECD data. Off the top of my head: Do these figures include state and local collections, or just those of the central government? Social Security and Medicare collections?

It’s also not clear that looking at taxes as a percentage of GNP is the most useful means of cross-national comparison.

@ James,

Ok how did the higher taxed Country’s fair as far as needing bail out ?

We are a cognitive dissonance nation. We grant ourselves benefits like a more mainstream OECD country, but refuse to tax ourselves too match.

BTW, if you are going to throw around “socialist,” you can use this graph to find the breaks. It looks like Finland is the first nation (from bottom up) to take more than half, and by that measure, they are the first “more than half socialist.”

If you call countries in the 30’s, like us and Switzerland, socialist, you’ve pretty must discarded any meaning for the term.

What’s preferable?

What would be interesting to see is a graph of median tax burden as a function of median income on a Purchasing Power Parity basis.

Oh look, someone put together a list of all the world’s successful countries.

And look, they’re all to some degree, “Socialist.”

You know, it’s almost as if a degree of socialism is a prerequisite for being on the list of successful countries. As opposed to the list of violence-wracked, disease-ridden, tyrant-run sh*tholes.

@john personna and @michael reynolds

I use “socialist” as a non-judgmental shorthand for a social welfare state, democratic capitalism, Christian democracy, or whatever other label you prefer. And I say “more socialist” because it’s a scale, not a binary measure.

The United States adopted a certain degree of socialism with the New Deal and a greater degree with the Great Society but are less socialistic by comparison with the Nordic states and other parts of Northern Europe. In some ways, we’re more free as a result. In other ways, including provision of health care services, we’re probably less free–and certainly less efficient–by having created a bastard hybrid system.

A social safety net and some degree of government regulation are necessary in a modern system, in that they enable risk taking and thus progress. Too much of either can stifle incentive.

Assuming the chart is measuring the right thing the right way–and I simply don’t know enough about the methodology used–I’m skeptical of the notion of the state taking more than half off the top. But all four of the countries over the mark on the chart are in fact reasonably productive–and reasonably free–societies. So I’m skeptical of the numbers.

For an interesting set of numbers (from a source that is probably not very biased towards Socialism), see the Heritage Foundation’s Index of Economic Freedom:

http://www.heritage.org/index/ranking

According to their numbers, for the United States, which ranks 9th on their list:

This is lower than many of the countries that rank above the US or rank below the US, but not by much.

@James, I’ve mentioned before that I like government spending as a percentage of GDP as a better measure of government involvement. Or show them both, side by side. Either way, taxation in a broken budget situation doesn’t tell the whole story.

I do think “more socialist” is a red flag to the Tea Partiers. To them you might as well say “more evil,” right?

@jp: I suppose. It’s not a perfect shorthand, in that there’s not a lot of government control of the means of production even in Europe’s most robust welfare states. But I don’t know of a pithy, universally understandable alternative to convey the same concept.

James:

Of course I know how you’re using the term socialist, and I think I’m using it roughly the same way. Binary systems — black/white, this/that — don’t exist in the real political world.

Like you I don’t know exactly what this chart shows.

But it’s unarguable that all of the world’s successful nations share the wealth to a fairly impressive degree. And those that seem to share it the most do not seem to be terribly disadvantaged by it. Although I understand that the price of booze is shockingly high in Scandinavia, I think we’d both prefer living in Sweden to living in Somalia or Congo or one of the many nations that do not manage to share the wealth.

Socialism is a feature of approximately 100% of countries either of us would consider living in. To turn it around, the price of civilization appears to be taxes that are used to support democratic governments and to build safety nets. So maybe we should conclude that within some limits taxes = good, and safety net = good, and then someone could explain it to the Tea Party and the Money wing of the GOP.

Michael:

Yes, I think government is the price we pay for modernity. You don’t need much of it when you’re 20 miles from your nearest neighbor.

I do think we’re too prone to legislate over minor inconveniences now. And, having come up with substantially less means than I have now, I’m aware of the cost that over-regulation puts on choices for those who can’t simply pay the higher price.

(Indeed, while part of it is probably age and wider exposure, it’s amusing that I’m much less dogmatic on the issue now than I was when I was making a hell of a lot less. So, I was against my interests in my youth and somewhat against them now, having moved in a way that was disadvantageous!)

I’ve actually done the same. I was quite libertarian in my misspent youth when I was in essentially zero danger of being either taxed or regulated.

Obviously there’s something not quite right about either of us.

That chart is misleading in that it doesn’t show effective tax rate. The us should be closer to 17%. Pretty frigging low.