What Recovery?

Following on Doug's cheery post about the weak state of the economy here are some more things to consider.

Following on Doug’s rather depressing post about the economy, here are some more things to consider regarding the economy.

Phil Izzo has a big round up of economists and their view on the economy. The view is rather grim, that the recovery is very weak.

Some of the views expressed,

– Consumer spending was essentially unchanged versus [the first quarter]. With roughly 70% of real GDP not growing, and government spending shrinking and subtracting from growth in the span, it was up to capital spending and exports to do the heavy lifting in [the second quarter]. Partly offsetting these contributions, in addition to the aforementioned government sector, was an increase in imports. All in all, we do not believe that the composition of today’s report alters the likelihood that real GDP growth in the second half and into 2012 will be modest at best as the economy continues to struggle with the aftermath of the credit/asset price bubble. -Joshua Shapiro, MFR Inc.

– The bright spot is better capital expenditures (business, non-residential property and housing) than we expected, but overall this is grim. Expect better in [the second half] — debt ceiling permitting.-Ian Shepherdson, High Frequency Economics

-Final sales to domestic producers increased only 0.5% in the quarter, compared with 0.4% in the first – such sales grew 1.8% last year. Real growth in business spending on equipment and software was up only 5.7% compared with 8.7% in the first, [at a seasonally adjusted annual rate] — it grew 14.6% last year. In other words, after the recession catch-up, growth in business spending is running about equal to depreciation. Not the stuff off of which dynamic recoveries are typically built. -Steven Blitz, ITG Investment Research

In looking at the Bureau of Economic Analysis Personal Consumption Expenditure (PCE) data we also see that PCE is declining in real terms since March of this year. Considering that PCE makes up well over 70% of GDP such a declines do not bode well for future growth unless that trend changes.

On July 29 James Hamilton had this post.

The Bureau of Economic Analysis reported today that U.S. real GDP grew at an annual rate of 1.3% during the second quarter of 2011, and revised down its estimate of first-quarter growth to an even more anemic 0.4%. We knew the first half of the year was disappointing, but this is even weaker than most of us were anticipating.

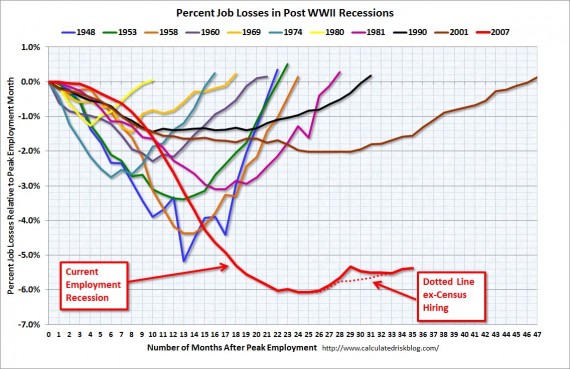

From the Economics Roundtable we get the following graphic.

Clearly there is a long rough road ahead.

Add to this that it’s pretty clear that the recovery has peaked. Its duration has been pretty typical of post-war recoveries but it has been extraordinarily weak. My explanation for that is that we have been furiously attempting the impossible: reinflating the bubble. I guess that intelligent people can differ on this.

However, if you turn to the Japanese experience for encouragement (along the lines of “it takes a long time to recover from a balance sheet recovery”), the Japanese still haven’t recovered twenty years later. Growth there has never returned to anything resembling the pre-downturn average. It’s essentially been stuck between -5% and +3%.

Thank gawd the booming Communist Chinese economy is preventing the world from sliding into a depression.

Oh…the irony.

None of the economists are saying anything new. It is just the same rehash. Like, “the economy is slow.” Yeah, we know that. Or, consumers are not spending. Yeah, we know that too. Not a word on globalization and its effects.

I can speak mostly for the Midwest, and we have seen 57,000 factories close over a decade. So, no one has said what will replace those 57,000 factories. Also a housing industry in the dumps.

On a bigger scale, the problem we have is 2 billion cheap laborers who entered the free market system when communism fell. Add to that automation and the loss of jobs, add to that lean principles and more loss of jobs, and mergers and consolidation and more loss of jobs. And that is going to put pressure on the middle class wages, jobs, more uncertainty, and we had nothing to fill in or to back up those lost jobs. So, we are experiencing a once in a lifetime phenomenon where there are too many people for too few jobs. And the middle class will suffer. Most economists and politicians figured that it was going to be a two way street that jobs would be created on both sides, but it did not happen.

And then, as you watch the politicians, you have the democrats spending in the wrong areas, the republicans want more tax cuts on top of the Bush tax cuts, the fed printing money for low interest rates and a low dollar so that we can export more with 1/3 less manufacturing, and the states wants casinos for jobs. It is all hilarious.

But what I saw, was the same as what Roosevelt was confronted with. Bush had his roaring 20’s and now we face a depression. With no jobs, no demand, and all the stimulus used up, there is no way out of this. And now, being in Roosevelt’s shoes, how do you get out of this?

What I haven’t seen mentioned here unless I missed it, and I think is key to proper reference, is that things were far worse than anyone realized. In the first quarter of ’09 the Bureau of Economic Analysis was claiming that the economy contracted 0.5 percent in the third quarter of 2008 and 3.8 percent in the fourth quarter. This was just recently corrected to 3.7 percent and 8.9 percent. That’s a huge f’ing difference. Massive. None of the other recessions shown in the graph above is even close to what we now know we were dealing with. Not even close.

Now – no reasonably knowledgeable person would say that the policy response to those numbers should be similar in either case. But we are still not willing to own up to under-reacting. And yet we are still paying the price for that under-reaction. Not reacting approporiately when you don’t have the necessary information is excusable. Not acting in an appropriate manner now is not exusable.

If we listen to the Tea Stains and cut cut cut we will continue to languish and probably go backwards. Maybe that’s what they mean by taking the country back.

Actually Gerry, the data indicates PCE was going up until April then the trend reversed itself. But then again, what do facts matter?

Hey Norm,

Might want to go let Krugman and DeLong know, they were arguing that the rebound from this recession would be very robust. Others were less sure and were excoriated (particularly by Krugman).

As Dave Schuler pointed out at his blog Japan tried stimulus spending, huge public works programs, bailouts and such and yet they still had/have a problem. One notable difference is that Japan is a nation of savers unlike the U.S., what impact this difference will have I don’t know.

@Steve Verdon:

Because people really believed in a recovery, but as everyday goes by more business keep closing for many reasons in which we have not dealt with. As I eluded before.

Another factory closed in my town a week ago (going to Mexico), and yesterday the owner of a carry out said that was the last straw and he is closing too. It just keeps going and going. But as one economist pointed out a year or two ago. “we will have pockets of growth, while other areas will be in a recession.”

You mean people were fooled for months on end? I’m not buying it.

@ SV…

Actually Krugman argued that the stimulus was too small.

See “Business Insider – Krugman: Wimpy Obama’s Stimulus Already Too Small; Jan. 9, 2009 (I had a link but the spam filter ate it up.) And he made that argument based on faulty analysis – off by a factor of SEVEN!!!

In addition he was afraid that the failure of an inadequate stimulus would reflect badly on the whole idea of stimulus, which is exactly what has happened. Now I’m far more conservative than Krugman – but there is no denying he was absolutely correct.

As for Japanese v. American savings habits – one of the major problems of our current demand crisis is that Americans ARE saving, rather than spending. That’s a double-edged sword during a recovery.

@Steve Verdon:

The thing is, just how do you have a recovery when jobs are still going overseas? At what point will our country get out of this denial?

hey norm,

I know he argued it was too small, but a bigger stimulus probably wouldn’t have helped according to Rogoff. And you are not responding to the point that Krugman did in fact claim the recovery would be robust.

Gerry,

So if a single job moves overseas there is no recovery. That is patent nonsense.

@Steve Verdon:

57,000 factories (1/3 of our manufacturing) have closed down over a decade and nothing has replaced them. There will be pockets of recovery in certain areas. Small towns that relied on factories will be like ghost towns. It used to be you went back to work after a recession, but those factories have closed up. People have to drive further to find work if they find any. And if they do find work, they may not work 40 hours and they get paid less. Many will have to be reeducated. A number of negative things are going on that we did not have before.

Actually it is the reverse. In my town of 14,000 it used to be that people of 50 or a 100 would go back to work over a few months in the factories, after a recession. Now it is just a job here and there as the factories have closed. In my town, we lost one plant of 1300 employees, another plant of 500 employees, another plant of 150 employees, another plant of 80 employees, and another plant of another 100 employees. All you have left is one plant which is family owned, gas stations, and restaurants. Now, how many people are they going to hire? And what kind of pay are they going to have? How many hours of work? And what benefits?

And we are going to have a worldwide problem as we will not be able to find work for over 2 billion people. Even the people who took our jobs will be replaced by robots.

http://news.xinhuanet.com/english2010/china/2011-07/30/c_131018764.htm

Steve, please back up with FACTS your absurd notion that Krugman said that the recovery would be robust. As stated by others above, he argued the stimulus would be too small.

Methinks your bean counter mentality sometimes precludes your vision from seeing the forest for the trees.

And then you argue nonsense by stating this prattle: “but a bigger stimulus probably wouldn’t have helped according to Rogoff”

How the hell is this an argument? Thats like me saying if I were 7 feet tall I would probably be a millionaire NBA player. There is no way to prove this nonsense.

Krugman predicted exactly what is now happening and you can’t give him credit.

Bill Allen is rolling over in his grave if you were his student at UCLA (which I was) for such smug, specious statements.

Regarding Japan, what everyone forgets is that their population is declining. Therefore a growth rate of zero actually INCREASES per capita income since the economic pie is cut into bigger slices with the decline in population, whereas we have to grow 3% to achieve stasis and the Chinese need a growth rate of 8% for stasis. We and china have to constantly grow to absorb new workers. A rate of 2% in Japan is enormous because of these population factors. Hence, the average salaryman doesn’t feel the same pressure as his U.S. counterparts.

This explains why there hasn’t been a meltdown in Japan since the effects of slow growth has not impacted the worker nearly as badly as ours has on middle class confidence.

Oh and by the way, had they followed our nostrums in the 90s and destroyed the middle class, perhaps instead of stoic civility and decorum (i.e. no looting) after the tsunami, they would have burned everything down like their U.S. counterparts because they actually feel connected to each other and not individualistic zero sum dipshi#$ts like our ruling conservative elite who pit worker against worker.

@ SV…

Did he? Seems contrary to what I linked to but you don’t link so I don’t know. No matter…I’m not defending Krugman.

The entire concept of the rainy day fund is to spend that money in tough times. Whether it stimulus or mortgage relief or whatever…reasonable people can discuss those things. But Republicans squandered money in flush times, and now are for cutting spending during lean times. This is completely upside down. How and when do we get back on track with saving during boom times and spending during lean times? Are we doomed to perpetual recession because Republicans are backwards?

@Steve Verdon:

Why the extreme response? Gerry makes a very good point, that we have lost a lot of jobs overseas. At no time did he make anything like the extreme point that if one job goes over seas, there is no recovery. You set that straw man up. I take this as an act of fear, you are afraid to debate the effects of moving jobs overseas.

Your are not alone and it is frustrating because clearly globalization has taken a heavy toll on the US economy. Why do so many economist believe in globalization as a matter of faith? As in unable or unwilling to debate its merits, just assume it is good and attack anyone who dares say otherwise.

The fact is we have seen anemic job growth and no wage increases since globalization became a major force in the economy. This has been going on for almost 15 years now covered up by first the dot com bubble (at that point, I admit, it did look like globalization was working with low wage jobs going overseas being replaced by high wage jobs in high tech) and only partially covered up by the housing bubble. By now it is clear, the promised payoff of globalization is not there ( nor for financial deregulation for that matter)

The idea of giving money to consumers to simulate the economy clearly failed due to globalization. When the vast majority of goods at Walmart are made in China, giving money to consumers means more jobs in China, not the US. And we see the evidence of that by a booming China with the high inflation many people thought the stimulus would bring to the US.

The stimulus worked. It just stimulated China.

I am seeing something going on that I dont understand. Demand being throttled by lack of supply. There was an article in the local paper today about micro-brewers reducing distribution. Their growth has out striped their production and they can not get the tanks and equipment they need to expand. My question is why cant they?

Another story, the owner of the local chandlery said he has ran out of a lot of things because the manufacturers wont make them. Demand is there but no supply. We are talking boat supplies for yachts, high dollar goods, mostly small runs built with high quality materials like high grade stainless. The last time he saw this was during the crash in 2008. Lots of stuff back ordered waiting for the manufacturer to build it.

Not sure if this is indication of bigger issues in foreign exchange or not. In many cases these are manufacturers who have moved production overseas and are using contracted factories. Maybe they can not get ahead of surging demand from other places, maybe they can not get money through to pay for the goods (that is what happened in 2008) but it is odd.

The major factors preventing a recovery are:

1) creating $16 trillion and pumping it into banks that were and are insolvent

2) failure to prosecute systemic fraud throughout the financial industry, destroying trust

3) $50 trillion in private debt, forcing consumers to cut back spending as they try to deleverage.

Until these are dealt with there will be no recovery. But we’ve wasted nearly a year on dealing with economically irrelevant public debt, and it appears that’s all we’ll be addressing in the future.

@SV…

If you are still watching this thread – an interesting blurb from Frum. (Yes I enjoyed typing from Frum)

http://www.frumforum.com/could-it-be-that-our-enemies-were-right

“…Imagine, if you will, someone who read only the Wall Street Journal editorial page between 2000 and 2011, and someone in the same period who read only the collected columns of Paul Krugman. Which reader would have been better informed about the realities of the current economic crisis? The answer, I think, should give us pause. Can it be that our enemies were right?”

@Hey Norm:

Yes he did. Both he and Brad DeLong argued that the recovery would be robust. When Greg Mankiw questioned that claim, Krugman called him evil. Arnold Kling jumped in and sided with Mankiw saying it was quite possible we’ve way over invested in the housing and financial industry, the idea that we’d see a robust recovery while possible was not as sure a thing as Krugman, DeLong and others claimed. I also think that is one of the reasons why the Obama Administrations unemployment projections were wrong as well.

I have a post here somewhere covering the Krugman-Mankiw dust up…a couple in fact. Feel free to look through the archives.

I think that this is the post you’re thinking of, Steve.

Yes, that’s it. Krugman now looks not only petty and vindictive, but foolish.