How to Blow Through $2.8 Trillion

How do you blow through $2.8 trillion…in a year? Beats me I couldn’t do it if I tried, but the U.S. government can do it, no problem. However, what is interesting is exactly what happened with spending over the past 16 years.

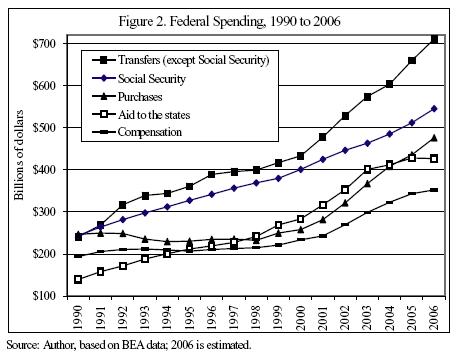

In looking at that graph I’d say that there was a change in the rate of spending after 2000. Further, the Cato report notes that there are five basic ways for the government to spend money.

- Pay workers.

- Buy goods and services.

- Transfer wealth to preferred interest groups.

- Subsidizing state and local spending.

- Pay interest on the debt.

Any government program will likely fall into one or more of the above catagories. For example, the Section 8 housing subsidy program would fall into pay workers (i.e. paying the government workers administering to the program) as well as transfer wealth to a preferred interest group.

If you look at the growth rates in these programs from the 1990’s and after 2000 you see dramatic differences in growth rates across all five catagories. Granted some of this increase in spending is due to increased defense spending in relation to 9/11, and the wars in Afghanistan and Iraq. Still the growth rate of things like (non-Social Security) transfers of wealth from one interest group to another went from 6% during the 1990s to 8.6% after 2000. And looking at non-defense spending on purchase of goods and services growth went from 3.9% in the 1990’s to 8.4% after 2000. The bottom line is that spending went from a growth rate of 3.8% during the 1990s to 6.7% after 2000.

The bottom line is that since 2000 there has been little to no restraint on spending. Holding spending down at the average during the 1990s for nondefense spending listed in the linked Cato report would cut the current deficit by another $140 billion dollars. The federal government is bloated on pork and if anything it has gotten worse in the last several years. Perhaps the best thing that could happen in regards to controlling spending if is the Republicans indeed lose one or both houses of Congress. I know some will then point out that the Democrats might force the President to withdraw troops from Iraq and that this could be disasterous. While there maybe some truth to this, my response would be, “Perhaps the Republicans should have thought of that before throwing out the ‘fiscal responsibility’ plank of their platform.”

Pretty amazing how “conservative” President Bush blows through cash. True conservatives are appalled.

Uh, what is Medicare for $1,000, Alex. The increase there dwarfs the other increases and it’s extremely thorny. If you simply abolished Medicare (politically impossible), many of the elderly currently covered by Medicare would become eligible for Medicaid, an even less tolerable situation. Many if not most states are struggling with their Medicaid systems as it is. Abolish both? Rots o’ ruck, Charlie.

Healthcare is the dog in the manger. We’ve let it fester for so long that no good solutions are evident. My own preference is for attention to both the supply and demand sides in healthcare since I believe that demand-side only proposals (most of what’s on the table) won’t achieve the goals. When faced with reduced income (which is what would happen with a reduction in demand), healthcare providers would respond by raising prices.

At least the advocates of single-payer have the virtue of proposing something that would actually reduce costs at least temporarily. The three most significant costs in healthcare are administrative costs i.e. private insurance companies, physician salaries, and hospital costs. Single-payer (castigated as socialized medicine although I don’t see how it’s much more socialized than what we have now—arguably less so) tries to address the administrative cost portion of rising costs.

Other major components of federal spending increases are rising oil costs, defense procurements, and larger federal payrolls (TSA, anyone?).

And then there’s good old highway spending, an effective subsidy to oil consumption, AKA pork-barrel spending AKA Congressional employment insurance.

So you would rather lose the war in Iraq than suffer the hardship of a budget deficit that’s 2% of GDP?

Aaannd there’s your first use of the old “the war on terrah justifies ANYTHING!” meme.

A little quick on the trigger there Legion. What I wrote doesn’t match up well with your strawman.

Hey Joe. The sad thing we are losing the war in Iraq AND our budget deficit is going thru the roof.

Question from your kid in 15 years: Why am I paying for a budget deficit from 15 years ago. Father: Because there was a war. Kid: Did we at least win?

2% of GDP if you only count the official deficit. Count all that spending that is “off the books” as well and it is more than double that 2% and, here is the real kick in the nuts for you people who think the war on terror trumps all other issues, spending on Social Security and Medicare is about to ramp up big time. Throw in the Medicare drug program and we wont have to worry about the “Terrorists to destroy our way of life” we’ll have done it for them.

I don’t believe this “administrative cost” thing. The government and private sectors have different requirements for keeping track of administrative costs. For example, are the costs employers bear in traking medicare payroll deductions factored in? My guess is that they are not. Hence an true apples-to-apples comparison is difficult at best.

Think about what your position implies Dave. You are saying that the government, the primary example of Waste, Fraud and Abuse is actually the paragon of virtue when it comes to keeping administrative costs down. Highly counterintuitive…so much so I am not going to buy it without extraordinary evidence in favor of this hypothesis.

That being said, I do think you are right that the problem has been left unaddressed for so long that there is no real simple solutions.

I’m not proposing a single-payer system, Steve. I’m just pointing out that those who do have at least the pretense of an argument about reducing costs.

As I said in my comment, my preferred solution would be reducing costs by increasing supply and reducing demand. I see this as being politically impossible. But as you quite rightly point out the real increases in Medicare (and Medicaid) are yet to come and the pressure to do something will become irresistible.

Well given the many thought provoking and workable solutions the democratic minority put forward to solve problems like social security, its obvious that all these problems will be solved within a month of a democratic congress being elected.

I think FDR did a lot of things wrong that are still harming this country (the threat to pack the supreme court which led to the changed view of the constitution that let congress involve itself in anything no matter how tenuous the connection to trade between the states is right at the top). But I don’t blame FDR for running a huge deficit before December 7th to build up the US defense or after December 7th to win the war.

The problem I see here is that one party shows it is willing to win the war and neither party shows it is willing to control spending. As a realist, I won’t abandon the republicans because they aren’t acting purely and perfectly as conservatives. I will be looking for a president in 2008 who would count noses on the conservative coalition in congress and recognize that a presidential veto can be upheld to control spending.

Interestingly the rate of increase in Social Security looks to be constant across the Y2K divide. It’s the only category that is. FWIW.

That’s by construction of the Social Security system, Jim Henley. In that program costs rise based on the natural increase in the affected population and COLA. Control the COLA and you control the rate of increase.

Medicare, on the other hand (which I believe accounts for a significant amount of the increase in transfer payments) rises based on the natural increase in the affected population and the cost of healthcare.

Something should be definitely done about the medicare.