Cost Of Raising A Child: $235,000

The Department of Agriculture released a report late last week that purports to calculate the cost of raising a child:

WASHINGTON – For $235,000, you could indulge in a shiny new Ferrari – or raise a child for 17 years.

A government report released Thursday found that a middle-income family with a child born last year will spend about that much in child-related expenses from birth through age 17. That’s a 3.5 percent increase from 2010.

The report from the Agriculture Department’s Center for Nutrition Policy and Promotion said housing is the single largest expense, averaging about $70,500, or 30 percent of the total cost.

Families living in the urban Northeast tend to have the highest child-rearing expenses, followed by those in the urban West and the urban Midwest. Those living in the urban South and rural areas face the lowest costs.

The estimate includes the cost of transportation, child care, education, food, clothing, health care, and miscellaneous expenses.

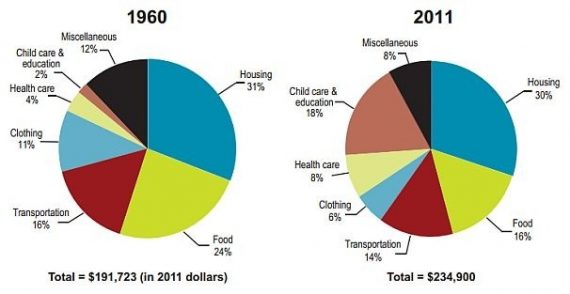

The US Department of Agriculture has issued the report every year since 1960, when it estimated the cost of raising a child was just over $25,000 for middle-income families. That would be $191,720 today when adjusted for inflation.

So, the cost of raising a child for 17 years has increased roughly $43,280 in today’s dollars over the course of 52 years, that’s an increase of about 22.57% over that period, or less than 1% per year over half a century. Does that make sense?

Via Suzy Khimm, here’s a chart showing how the Dept. of Agriculture breaks down the expenses now, and in 1960:

Some of these expenses, most especially housing, would be incurred whether or not one has a child, of course so I’m not sure exactly how you calculate the additional housing costs for a single child. The other interesting question is the impact of multiple children. Is that another quarter million over 17 years or are there some economies of scale built in there?

Well, here’s one way to save costs: The $100 Masters Degree From Udacity

Figure out average home price per square foot, then figure out the difference between the size of the average home owned by people without children and the average home owned by people with children.

I think I’ve looked into the housing aspect of this before. As I recall, DOA argues with some support that people make different housing choices with or without children. For one thing, in many parts of the country, where you live is how you “pay” for public education. For myself, I think my wife and I might have been tempted to keep renting if we had not been expecting.

@Stormy Dragon:

Or go straight for average housing costs of people with/without children, yes.

So, having children increases spending, which in turn increases aggregate demand, and creates economic growth.

Finally, I understand why Republicans oppose contraception.

Crap, I knew I was missing $705,000 somewhere.

*looks at bank account*

Estimate seems low to me…

@ Doug — my wife and I were quite happy to live in a large 1 bedroom apartment before we got married and/or even seriously thought that it was time to have a kid.

We bought a decent size 3 BR house in a mediocre school district when we got married. We now have 1 kid and another in the next six weeks. We’ll stay in this house until the oldest hits either middle school (for my district, I think that is the 1st day of 6th grade) or there are consistent bloody noses from sibling conflicts because they are sharing space. In either case, we’ll look to significantly upgrade the school district that we are in as it is either several thousand dollars more a year in mortgage payments or the same/more in tuition payments for middle school and high school.

Kids do drive housing decisions, especially since education is so differentiated at the municipal boundary level, and housing prices reflect the differentiation.

While it was certainly a choice voluntarily undertaken, the tuition paid for my son’s excellent eduction ran three, if not four times that figure.

@Dave Anderson:

I forget where I read it, but someone remarked that the US already has a voucher system in education, we just force people to buy a house to get the voucher.

@Dave Anderson:

Indeed all around. More kids means you need more bedrooms and living space and schools are a prime concern in these choices.

@Doug:

I think that the economies of scale are likely limited. I saved some money on hand-me-down clothes and toys, but ultimately that only goes so far. Each kid has their own health care, educational, and recreations costs. They all need their own food and whatnot. So, on balance, my guess is that it is per child with little overlap creating savings.

Children are horrible little money pits. 235 grand? Hah! I wish I was getting off that easy. My daughter’s private special needs (dyslexia) school costs close to 50 a year. My son’s at camp for a month: $6,500. Plus they eat — even when we go out to restaurants.

And it doesn’t end with needing a bigger house. If I didn’t have kids I wouldn’t need a back seat in my car. I could drive a convertible instead of a family sedan with good crash safety numbers. Granted that’s not so much an expense issue, but still, the point is I could be driving a Mustang or a Viper, something cool.

@EazieCheeze: Looks low? They do say it only includes the first 17 years.

The DOA is reporting what people spend, not what it costs.

Again, as I recall, this analysis provides breakdowns based upon family income. The more income the family has the more they spend on their kids and vice versa. This is what medium income families spend.

The analysis does breakdown the spending for a second, third . . . etc. child. People do spend less on additional children, but not much less. Most of those items up there are consumables, and clothing is not as expensive as it probably was a generation or two ago.

The analysis does not include saving for college.

@PD Shaw: Also as Michael Reynolds pointed out, special situations such as his daughter, makes the mean value higher than the typical cost per child. (unless those data cases are other wise excluded for the typical situation)

Michael, I’m so glad we spent all that money on a school for dyslexics. Without it we would not have been able to spend money on an education at Virginia Tech. In the end we have a fine son who is doing great work – but it was expensive.

@michael reynolds: I traded in my 350Z convertible for a 328i convertible. Backseat and hardtop when in roof-up mode, which I’m generally in with kids in the car.

Even that compromise only goes so far, in that I can’t haul a lot of gear. Then again, I also own a Sienna minivan.

@PD Shaw:

The problem with looking for a baseline is that a baseline is going to be a neglected child. Every cost above that is “what people spend.”

@James Joyner:

Yeah, but your kids are still. My daughter might just barely make it but Jake just hit 6′.

Um. . . still little.

@michael reynolds: If James wore them out with a long afternoon at the playground, they may be still.

My primary parenting strategy is still playful exhaustion.