Health Care Costs And The Third-Party Payer Problem

How insurance makes health care more expensive

The Cato Institute’s Daniel Mitchell makes this comment in a blog post on health care costs and Medicare reform:

I don’t pretend to be an expert on healthcare, but I am firmly convinced that third-party payer is one of the big reasons for rising costs and pervasive inefficiency in the healthcare sector. When we buy goods and services with our own money, we try to get maximum value, and producers respond by trying to be efficient as possible.

In the healthcare sector, by contrast, we shop with other people’s money. Or, to be more technical, we shop in an environment where government policies result in us bearing very little out-of-pocket cost for each additional increment of health care.

Mitchell does have a point. For most people with health insurance, a visit to the doctor typically ends up costing no more than a small co-payment. For other medical services, some people are responsible for a typically small deductible when using insurance to pay for tests, procedures, and prescriptions. Larger charges only tend to arise when, for some reason, an individual ends up receiving care from an institution or physician that isn’t part of the insurance network, although with most large insurance networks like Blue Cross/Blue Shield that seems to be much less of an issue than it used to be. For the typical person in a typical year, though, there’s almost no thought given to the cost of a medical procedure (why not go to the doctor for those sniffles when it only costs you a $10 co-pay?).

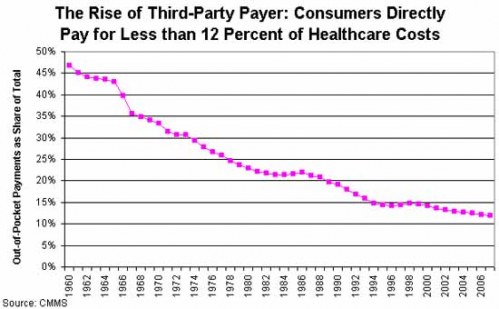

It didn’t always work this way. For a long time, health insurance, including insurance provided through employers, typically only covered major medical procedures and hospitalization (I remember terms like “major medical” and “hospitalization” being used to described health insurance as late as the 1970s). Over the years, though, insurance has come to cover more and more “routine” medical expenses, and consumers have become more and more unaware of the actual cost of their health care, to the point where now just 12% of health care costs are paid directly by consumers:

When consumers are insulated from the cost of a good or service, they aren’t going to take the price of that good or service into account when deciding whether or not to purchase it, which means that the normal supply-demand price mechanism isn’t going to work. In the long run, this means prices will go up. Of course, it’s true that health care itself is a good that isn’t necessarily subject to the same market prices as, say, groceries. We all want to live forever, and when we’re sick we want to feel better. Nonetheless, when someone else is paying the bill and, as the chart above shows right now someone else (the government and private insurance) is paying 88% of the bill on average, consumers have every incentive to use as much health care as they can. The consequences are inevitable:

When consumers share in the cost of their health care purchasing decisions, they are more likely to make those decisions based on price and value. Take just one example. If everyone were to receive a CT brain scan every year as part of their annual physical, we would undoubtedly discover a small number of brain cancers much earlier than we otherwise would, perhaps early enough to save the patient’s life.

But given the cost of such a scan, adding it to everyone’s annual physical would quickly bankrupt the nation. But, if they are spending their own money, consumers will make their own rationing decisions based on price and value. That CT scan that looked so desirable when someone else was paying, may not be so desirable if you have to pay for it yourself. The consumer himself becomes the one who says no.

Think of it this way. If every time you went to the grocery store, someone else paid 87 percent of your bill, not only would you eat a lot more steak and a lot less hamburger – but so would your dog. And food costs would go up for everyone.

(…)

The RAND Health Insurance Experiment, the largest study ever done of consumer health purchasing behavior, provides ample evidence that consumers can make informed cost-value decisions about their health care. Under the experiment, insurance deductibles were varied from zero to $1,000. Those with no out-of-pocket costs consumed substantially more health care than those who had to share in the cost of care. Yet, with a few exceptions, the effect on outcomes was minimal.

And, in the real world, we have seen far smaller increases in the cost of those services, like Lasik eye surgery or dental care, that are not generally covered by insurance, than for those procedures that are insured.

In fact, a study by Amy Finklestein of MIT suggests that nearly half of the per capita increasing health care spending is due to increased health insurance coverage.

There are some alternatives available, but they are minimal and not generally favored by the law. A combination of high-deductible insurance, combined with a Medical Savings Account similar to an IRA, for example, would allow consumers to maintain coverage for major expenses like surgery and expensive diagnostic tests, which using the funds the MSA to cover more routine expenses live office visits, blood tests, and prescriptions. It might not be the answer for everyone, but it would go a long way toward removing the third-party payer problem and the upward pressure it has placed on health care costs over the years.

Yawn. Once again, the libertarians propose making people shop around for medical care (because, of course people with life-threatening conditions are going to go from doctor to doctor and hope the condition doesn’t get worse in the meantime). Proving once again how lost in their ivory tower they are.

If this is to be an actual solution, the HSA / high deductible plans are the second part of solution, not the first. The first is removing all pricing knowledge barriers from the patients, and I do mean all. Right now, providers generally do not provide any pricing information to patients, so even patients with an HSA / high deductible plan today don’t have the information to use the way this proposes.

For this to work, I’m pretty sure it would require a very intrusive federal pricing mandate, to make accurate, up front pricing readily available to patients regardless of insurance plan. There’s a reason this isn’t available now, the combination of providers and insurance companies have agreed they don’t want the information out there for patients.

(Oh yeah, and most importantly, this will only work for a very small portion of health care costs, won’t have a large effect on health care costs and will encourage people to delay seeking health care.)

Wait, it might not be the answer for everyone? In a country with, what, a nearly zero savings rate and massive unemployment and underemployment? You don’t say.

The people who have money to put into an HSA don’t need an HSA. And the problem has very little to do with sniffles, it has a lot more to do with an 80 year old Alzheimer’s patient who just might not be the most effective bargain shopper. And of course the car accident victim who may not have the presence of mind to check online to see which Level One Trauma Center would do the cheapest job of stuffing his brain back into his skull.

This libertarian drivel doesn’t pass the laugh test.

What government policies? The problems he raises are all features inherent to insurance in general – private insurance every bit as much as public.

…

This is when you know it’s time to stop reading.

I do think it would be nice to have access to pricing. Sadly lots of people struggle to pay a $20 deductible and if they could somehow make that $15 by comparative shopping many would.

Of course it would have dick-all effect on the overal cost of medical care which, again, is about cancer and heart disease and Alzheimers and diabetes etc… In fact, since the cheaper doctors would most often be the less qualified and the more “efficient” you’d be seeing doctors with no time to nag you about your unhealthy habits. Of course the cheaper doctors would also have more incentive to make up the loss leader by upselling meds and procedures.

If you want to cut the small stuff – doctor visits — you can do that tomorrow by making more meds OTC, by letting pharmacists write scrips for more meds, by using medical records keeping methods from this century, and of course by going to single payer so every doctor doesn’t have to employ a full-time staffer just to talk to insurance companies.

Actually, I think this article is exactly on the mark. The cost of healthcare is to often solely blamed on the medical field and the insurance companies, but rarely do people stop to realize how we have helped this system drive cost upwards. Medical care is out of control for a variety of reasons, but this is perhaps the most overlooked one.

The point of this article isn’t that everyone should be left to their own devices, and comparison shop for the cheapest doctor, or hospital, or even insurance plan. The point is rather that, because the costs are largely hidden from our view, we demand a lot more from the medical field than we otherwise would, and it would be about impossible to argue otherwise. You put someone on a high deductible plan and you’ll see them not run to the doctor for every case of the sniffles.

I try to explain it to people this way, we don’t expect our car insurance to pay for our oil changes, tire rotations, or the gas we put in, we expect it to be there if something bad happens, like an accident or theft. Same thing with home insurance. But with health insurance, we somehow collectively decided that since we pay a premium, we should have everything covered by insurance, and not just the bad stuff, but the routine stuff as well. Insurance companies were glad to take that on, and to drive up premiums to support. (And don’t forget to mention how most of us are completely shielded from how much our healthcare premiums really are in the first place.)

Haha, does it ever?

30% of medical costs is paperwork.

Seems like an area ripe for cost savings.

30-40% of medical expenditures are end of life care.

How about we get our cultural act together, admit to ourselves we will all die someday, and work out a better system to exit this vale of tears?

Because, of course, every single condition is life threatening, even a sprained ankle. And, you know, even some life threatening conditions aren’t so bad that you can’t do 30 minutes of web research or phone calls before seeking treatment.

Plus, as I sit here right now, I know that a case of Coca-Cola is going to cost less at Walmart than at 7-11. Walgreen’s is going to be someplace in between. It might even be as cheap as Walmart. You know why? Walmart!

That’s right, the mere presence of competition lowers all prices. Shocking. So while I may not get the cheapest price on Coca-Cola at Walgreen’s, it will still be cheaper than it would be if not for the existence of other retail outlets, or the existence of other soda brands. The same will happen with cancer treatment. The existence of competition will lower the prices of all medical care, such that even if I pick a more expensive one than average, it will still be a lot cheaper than it is now. This isn’t ivory tower stuff. It’s pretty basic economics.

Joe R:

So, if competition is the key, how is it that country’s with a national system are cheaper than we with our endless profusion of “for profit” hospitals?

countries. not “country’s.”

“The same will happen with cancer treatment. The existence of competition will lower the prices of all medical care, such that even if I pick a more expensive one than average, it will still be a lot cheaper than it is now. This isn’t ivory tower stuff. It’s pretty basic economics.”

While basic economics may say this, advanced economics has shown this is not so. Medical care (as pointed out above) does not have anything remotely like transparent pricing, in order to enable consumers to make decisions. Moreover, the quality of the service provided enables the suppliers to claim that their service is different than all others, vitiating the comparison.

A good example of why this won’t work comes from the world of legal advertising. Over the last few decades we have seen a plethora of lawyers’ ads. And yet the vast majority of consumers of legal services could not tell from them who is actually a good lawyer (hint — most lawyers who advertise are not). It has treated certain types of legal services as commodities, although the cost (especially in the form of percentage of amounts collected) has remained constant. And legal billing rates for non-contingency fee services have risen far faster than inflation.

Joe R: your Walmart example is way off base because they post prices on the items they sell. We already have many different medical providers to choose from, but no way of knowing how they differ on price.

The people making this push are claiming that shopping at multiple stores that don’t post prices will save money. It’s the most ridiculous idea ever.

Most people already have a deductible pay their coinsurance as a percentage for anything beyond doctors office visits and prescriptions, but this skin in the game doesn’t seem to make much of a difference if any.

The whole insurance game is a scam. My contribution to my employer provided health insurance is $85 month, plus $80 month into my HSA, so $1980 a yr. My firm contributes another $4500 yr (not including disability or life insurance). (I have no idea what part of that the government subsidizes.) $2400 yr for car insurance plus another $800 for homeowners. That’s over $10,000 a year for insurance alone. That’s quite a bit more than I pay in taxes, and I get a sh**-load more in services from the government than I do from insurance companies. So why aren’t the silly people with tea bags dangling from their hats screaming about this travesty? Right – the Insurance companies aren’t run by a Kenyan socialist.

And the reason so much routine medical care is covered is that we had the push to HMOs, which operate under the belief that easy access to preventive or early treatment results in cheaper health care costs for the insurer overall.

So, if they were right about that, a shift to high deductable plans would just raise costs.

IMO, the current system has also led to a lot of price distortions. I recently had some rather routine tests done. According to my statement of benefits, the “billed rate” for all those tests was in the neighborhood of around $1,800. My insurer’s negotiated rate knocked this down to around $250, of which I was responsible for fifty bucks.

Something’s really off there.

Meanwhile, some more unexpected results from Obamacare Lite: Visits to ER rise despite health law.

These debates grow wearisome because there is so much bad faith imputed to anyone who asks questions. As we look at how health care costs increase I wish more people would understand that it isn’t just a question of inflation for the same services. While I firmly agree that the use of third party payers increases costs when the recipients of services see it more and more as free, or at least greatly discounted, I believe there is a lot of evidence that middlemen do serve a useful , important, adn dare I say it, efficient role in free market economies. When health care insurance served primarily for catastrophic coverage, more akin to most care and property insurance, I think this was probably true. Now, not so much.

But how is it that going to a single payer system (which is the ultimate third party payer) is going to fix this? Not to mention that Obamacare’s purported savings are dependent on tax increases, rationing, and cuts to Medicare reimbursements on 1/1/12 that I am wiling to bet anyone here aren’t going to happen.

Sigh.

“…how is it that going to a single payer system (which is the ultimate third party payer) is going to fix this?”

I suggest you ask any one of 14 comparable OECD nations – all of whom spend less money.

http://www.kff.org/insurance/snapshot/OECD042111.cfm

We spend 16% of GDP on health care. no one else spends more than 12%.

of course you won’t accept the facts because they go against your ideology. clearly there’s nothing that will ever change that. blinkers are blinkers.

it’s not that there is “…bad faith imputed to anyone who asks questions…” it’s that you are just full of – to be kind – bad faith. “…savings are dependent on tax increases, rationing, and cuts to Medicare reimbursements on 1/1/12 that I am wiling to bet anyone here aren’t going to happen…”

sigh

I am firmly convinced that empirical evidence plays no role in the thinking of people like Doug Mataconis. If you’re interested in lowering the total bill for medical care in the United States and if this beats every other consideration, your first choice is government run health care, as in the VA or the British National Health Plan, your second is a single payer system, like our Medicare or the systems used in Canada and France, and your third is a system like the one used in Germany or what the Affordable Care Act would be if it gave the government the power to control medical prices. You would not pick our present system if cost is your main consideration. Bad as it is, though, it’s still better than Doug’s loony idea that if individuals ” share in the cost of their health care purchasing decisions, they are more likely to make those decisions based on price and value.” How are they going to know about value without medical training, and how are they going to know about price when it’s so difficult to find out what hospitals charge for procedures? Doesn’t real world experience play any role in libertarian thought?

1) Every other OECD country has third party payments. Only ours has grown so fast. If you want to do away with insurance, you need to find a way to pay for expensive care.

2) 50% of people account for 3% of spending. The spending of these people has been shown to be responsive to market incentives. Most spending comes with chronic illness or acute major illness. This is quality sensitive, but does not appear to be price sensitive. This makes sense as these people know they are going over their HSA or deductible limit.

3) Most patients of Medicare age do not understand their care well enough to ask for another procedure or to shop around. The huge majority of patients just say, “Do whatever you want Doc.” Those who advocate for these kinds of market based changes presuppose a major cultural change.

Steve

Actually, Doug’s essay is spot on. But, heh, I would say so, seeing as I have been making the same points for three years over at Schuler’s place.

And I see we have the usual BS springing up about how health care services are “different,” which is a red herring, because what we are really talking about is pricing health care insurance, not services.

As I have pointed out numerous times, we don’t have homeowners insurance for mowing the lawn, painting the house every few years, or if the toilet plugs up. We on’t have car insurance for changing the oil. That’s out of pocket. Else, homeowners and car insurance premiums would be skyrocketing just like health care insurance premiums. And plumbers, lawn mowers and oil changers would be making more money.

The fact of the matter is that the third party payer system has resulted in an all inclusive health maintenance program shielded from the throttling effect of price. It needn’t be that way.

The result is that we are headed toward a single payer fiat health care service rationing scheme. People won’t be any more happy with that than if they were informed their lawn would be mowed twice a year, and the leaky toilet will just have to wait.

What happens when people are on high deductible, high out-of-pocket health plans? Same thing they do when they have no insurance at all. They don’t go to the doctor, EVER, unless their friggin arm is falling off or they are so sick that they need to be hospitalized. They end up having no preventative care, no checkups or physicals, and they let symptoms fester until they are life-threatening.

There’s a problem with an early statement that helps serve as the basis of this argument:

I’ve emphasized “we” because there’s an important mistake going on there…

Provided one has health care insurance, the moment one chooses a primary care physician, the supposed “we” is a BS move. By and large, it’s our Doctors who are shopping with other people’s money — not the patients. And this is a system that goes back generations within the US.

Outside of elective surgery, by and large medical decisions, tests, etc. are ordered by GPs and Specialists (who, remembering the movie “Malice” and Alec Baldwin’s famous rant) have historically seen their authority to order and authorize just short of Godhood.

Americans have not been historically trained (for better or worse) to make their own health care decisions… so to pretend that most people are the “we” who is making spending issues (beyond should I go or not go to a GP/Specialist appointment) is already positing a world that ISN’T the current US medical system.

Hey Norm, so you think that British subjects on average have better health care that the US even though they spend less? Really?

“The result is that we are headed toward a single payer fiat health care service rationing scheme. People won’t be any more happy with that than if they were informed their lawn would be mowed twice a year, and the leaky toilet will just have to wait.”

Right, Drew, that’s why the French hate their health care system so much. And why the Canadians are dying to have ours. They want a system like ours, but they can’t get it because they’re socialist dictatorships.

“The fact of the matter is that the third party payer system has resulted in an all inclusive health maintenance program shielded from the throttling effect of price. It needn’t be that way.”

Get out. See the world. Third party payments are the norm in countries with quality care. Only in the US does it result in such high costs.

“Hey Norm, so you think that British subjects on average have better health care that the US even though they spend less? Really?”

Our best is probably better than our best, but since we have so many people not covered, on average, they might be better. Depends upon how you rate things.

Steve

Michael Reynolds,

What Doug is describing is quite similar to the Swiss system.

steve,

Good job missing the obvious:

1. Every country (except Singapore and maybe the Netherlands) has issues with their health care systems from a sustainability perspective.

2. The U.S. is in the worst shape, and look we have “Only ours has grown so fast.” with regards to third party payments.

So obvious question: is there a link?

Hey Norm,

It is a good thing you don’t get to use your insurance, not a bad thing. Duh.

As for the life threatening procedure non-argument please read the OP:

Let me translate for everyone:

Life threatening procedure needed? Covered by insurance. The limited plan with a high deductible means it costs less.

The routine care treatment would be paid more out of pocket….like in Switzerland. You wouldn’t pay all of it, just more than you are now.

So, just to clear, if you are in a horrible car accident and need serious emergency care you would not need to shop around. Where Doug is saying that shopping around might help at least somewhat, is in routine non-urgent/non-emergency care. If you need a blood test, or a TB test, or such. If you are having a heart attack, no shopping around nearest emergency room.

BTW Ben,

Let us know how well it works the next time you want to have your cake and eat it too. The idea that we can make all health care free of charge to people is a great idea, just simply isn’t going to happen.

Cost control is only going to occur with a reduction in the quantity of care provided.

In the end it is pretty simple, what are the two areas of the economy in the US where we suffer from constant, year after year inflation and upward pressure on costs, healthcare and education, Hmm… those are the two areas of the economy where the government is most involved, you lame liberals think there is a connection! The Left’s solution to problems caused by government intrusion into the marketplace is always more government intrusion. Like giving enormous power over to vast sections of the US economy over to the judgement of clowns like Anthony Weiner is a solution to anything. Liberals like to sit up on what they think is the moral high ground because they have good intentions, however they are responsible for the bad outcomes despite their good intentions. Chairman Mao had good intentions with the Great Leap Forward, however he ended up killing between 30 and 50 million of his own people, oops, never mind lets try something else like the cultural Revolution, kill a few million more. This is at base no different in character than the constant tinkering with the economy done by liberals and some Independents and Republicans that side with them to pass the monstrous bills like FINREG and ObamaCare.