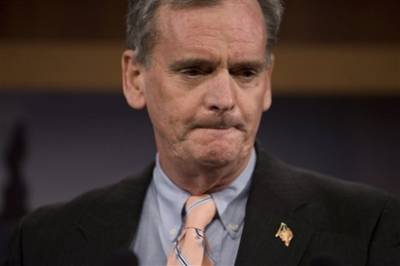

Judd Gregg: House GOP Won’t Make A Deal Until After A Shutdown And Default

Former New Hampshire Senator Judd Gregg doesn’t think his fellow Republicans over in the lower house of Congress will make a deal until they see proof of how much pain not raising the debt ceiling will cause:

Former Senator Judd Gregg (R-NH) says Social Security checks will need to be halted before House Republicans will agree to a deal to raise the debt limit.

A deficit hawk and former Chairman of the Senate Budget Committee, Gregg turned down an offer from President Barack Obama to be his Secretary of Commerce.

Now an analyst with Goldman Sacks, Gregg said on a conference call this morning that there is a better than 50 percent chance that Congress will not reach an agreement before August 2nd.

Gregg said that if that were to happen, it “would put the blame on the Republicans,” saying House GOP’ers are the biggest obstacle to a deal.

“In the Senate, you’ve got a center of 40 members who are willing to sign on to something dramatic AND you have the President endorsing it — that’s good news. We have agreement on the problem and a resolution,” he said.

“BUT the House is nowhere near an agreement. The Gang of Six plan will not come to fruition in the next few weeks — maybe not even until the next election. The best thing that could happen is that a special committee might be set up to continue to work on the Gang of Six agreement. Ultimately, it won’t affect the debt ceiling debate in the short-term.”

Gregg added that he wasn’t any more optimistic about the “last-ditch” plan put forward by Senate Minority Leader Mitch McConnell (R-KY) and Senate Majority Leader Harry Reid (D-NV).

“The McConnell-Reid is too political; people say it’s a fallback, I think that’s wishful thinking.”

As I mentioned in another thread, I think Obama’s mistake was holding off the default as long as possible and then letting all the consequences happen at once. When we first hit the ceiling in May, he should have started cutting stuff then, gradually ratcheting up the bad consequences over two months to knock some sense into the non-believers out there.

The thing is, if they do not agree and there is not a deal…then Obama is off the hook. This might make them think twice. I hope.

@Stormy Dragon: Does the president have the authority not to fund the programs congress has mandated while the money exists to fund them?

Uuuuuuuhhhhhhh……. For the good of the country?

HAHAHAHAHAHaaaahhaahaahahahhaaaheeheheheheeheheeeeheheheee!!!!!!!

Sometimes I just crack me up.

@Stormy Dragon:

Questions about political authority aside, I don’t think your “gradual cuts” proposal would have the consequences you want.

I have a hard time believing that many people who 1) Don’t already want the debt ceiling raised and 2) Don’t understand the consequences of not raising it would change their mind on the basis of voluntary cuts made for political reasons. Any such cuts to programs voters care about would rebound totally on Obama and would “knock sense” into pretty much no one.

Because it would be good for the country?

The irony is every day that goes by, with headline after headline saying “GOP intransigence is causing the crisis”, makes Obama stronger. Additionally, it lessens the possibility that he, Obama, will be blamed for the crisis.

So by being so steadfast, the House GOP is strengthening Obama.

Go figure….

I couldn’t think much less of the House GOP, and I still can’t believe they would let Aug 2nd come and go without raising the debt ceiling. I honestly don’t see the upside to default, even for them. Even the cynical view where they only care about their re-election and not being primaried, why gamble they would be the ones to survive? Unless they’ve fallen for their own spin that not raising the debt ceiling won’t have any negative effects.

Gregg also said what’s needed is “artificial drama.” Great. What we have had so far is farce.

Former Senator Gregg reads it aright. The GOPers in the house . Megan McArdle (no liberal ) pointed out in this article

http://www.theatlantic.com/business/archive/2011/07/getting-specific-on-spending/242240/

That the federal government really would have to shut down in large part if the debt ceiling was not raised. She is being shouted down by the tea party folk, who are certain that there is some huge unknown government program out there that can be shut down without pain to anyone. Funnily enough, they just can’t get around to identifying it.

The US defaulted on it’s debt the moment when demand for debt exceeded supply. The US printed money to make up the difference rather than raising the interest rate until supply met demand. Printing money instead of paying higher rates diminished the value of all US debt and betrayed those who purchased it. Major creditors, including China, have already stated that printing money is, in fact, a default on the US debt.

The default has already occurred. The question is: Will the US stop defaulting? The way to stop defaulting is to stop raising the debt ceiling and instead buy back the trillions printed when demand exceeded supply. The US must respect Free Market Principles, including the law of supply and demand.

These people obviously learned nothing from the showdown between Newt Gingrich and Bill Clinton…but they will if they keep this nonsense up…

@Graham

there has not been enough money existing to fund all of Congresses’ mandated programs since May. Since then the treasury has been shifting money around and borrowing from programs with surpluses (SS) to keep the government functioning. On or about Aug. 2nd they run out of the ability to shift around any more money

Don’t want to answer for Stormy Dragon, but I would start with defunding the things closest to the Republicans heart and work my way up to the SS checks.

Well, I’ve got some money sitting in money markets, waiting should crazy-high bond rates come out of this mess.

Do you know that in 1981 the 30-year treasury paid 14%? Best buy evar!

So, fix the budget guys, but failing that give me high rates.

david m:

We need to be in touch with reality. That means grasping just how out of touch with reality the GOP base is. Remember, these are the people who still think invading Iraq was a great idea, because Saddam was behind 9/11, and that someday we will find Saddam’s WMD buried in the desert. These are the people who never stopped approving of GWB. These are the people who think Palin will make a great president. These are the people who think Obama is a Muslim from Kenya. These are the people who believe in the Laffer curve. Thse are the people who have big issues with global warming and evolution. It’s helpful to notice that many different forms of ignorance get concentrated in the same group.

In particular, let’s notice that people are ignorant about the federal budget. For example, about a third of all Americans (pdf) believe that foreign aid is more than 20% of the federal budget (correct answer: 1%). In the same poll you can see other big misunderstandings about such things as public radio and food stamps.

So I think there are lots of people (that is, the tea party) who think that slashing the federal budget by 40% overnight is a great idea, something they’ve wanted for a long time, and something that will only hurt people they don’t like.

Or at least you do now. You better hope whoever it was loaned to didn’t use it to buy treasury securities and defaults on their debt to you come August 2nd.

Well, at least you’re covered by the FDIC.

Oh, wait…

The Laffer curve is pretty standard economics. Even Keynes had a variation of the idea. The debate is over which side of the peak we’re on.

Yes, good point. Thanks for clarifying that. It would be better if I said that they treat the Laffer curve as if it was a straight line.

@Stormy Dragon:

Yes. At the very worst they’ll print me some.