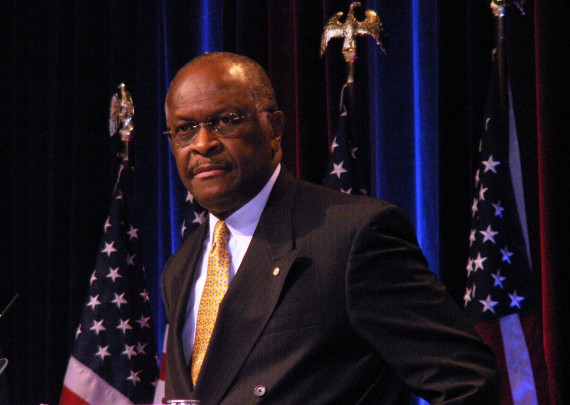

National Review Bashes Herman Cain’s 9-9-9 Plan

Perhaps not surprisingly since a few of their writers have already written critical pieces, National Review is out this afternoon with a rather blistering editorial against Herman Cain’s tax plan:

Herman Cain deserves credit for proposing a tax-reform plan that is specific, promotes economic growth, and has captured the imagination of conservatives nationwide. His 9-9-9 plan builds on the insight that one of the chief defects of the current tax code is its bias toward consumption over savings. But his plan’s peculiarities of design, substantive weaknesses, and political naïveté render it unworthy of conservative support.

(…)

Cain envisions his presidency as featuring a quick move to the 9-9-9 plan followed by an educational campaign about the virtues of the national sales tax. He will have to move fast, since he is counting on the massive economic boom he expects his plan to create to enable him to balance the budget in his first year. None of this sounds very achievable, but let’s indulge the candidate. Even if one believes, as we do, that the mortgage-interest deduction should be set on a path to extinction, does its immediate abolition in the midst of a weak housing market seem wise?

And while the plan promotes new savings, it attacks existing wealth. In particular, it is a plan likely to arouse the ire of retirees. They have paid income taxes their whole lives and would now have to pay additional sales taxes on their savings when they try to spend them. On balance, of course, retirees would continue to receive a large net transfer of funds from the federal government. But why fight them in a bad cause?

NR isn’t alone on the right in criticizing Cain’s tax plan, Grover Norquist has done so as well. If nothing else, I think they are making the kinds of arguments we can expect to see from Cain’s rivals now that he is, according to the polls at least, at the top of the field.

I’d suggest watching the comment thread there and what happens on the Corner over the next 24 hours.

If this had been written by an individual (versus the editors) we might have seen something similiar to the Manzi/Levin spat of a few years ago. Still given the number of Conservative Media “Cain” backers who are also contributors to the NRO, I have to wonder if this might lead to Buckley’s other child being branded a RINO.

Of course, the spin could also be: see, we critique our own, this shows we’re not brain dead libs.

The realities of this foolishness are starting to sink in. My basic protests against 9-9-9 are these:

It taxes the poor on 100 percent (or close) of their income – I refer to the “working poor,” people who are employed but whose income is so low that they have little or no savings. Yes, such people do exist and they are not welfare queens or kings. Meanwhile, the relatively well off are taxed on a much lower proportion of their income – until as NR points out, they spend it.

And that is the second rub: 9-9-9 taxes individual earned dollars twice -first when they are earned, since one 9 is an income tax, and the second time when they are spent, the sales tax. This means that on each spent dollar there is a federal tax of 18 percent. Here in Tennessee I now pay a state sales tax of 9.25 percent already.

So under 9-9-9, each dollar I earn will be diminished to 91 cents by the time I spend it, where to buy 91 cents of goods I will have to spend $1.076, which will be rounded up to $1.08 at the register. The tax rate on each earned-and-spent dollar is therefore 26 percent. But under present income tax law, I can deduct sales taxes from federal taxable income. If this is a feature of 9-9-9 I have not read that anywhere.

I would support a federal flat tax myself, but not the so-called “fair tax,” because there is nothing fair about it. Presently, the tax code disincentivizes people to make more money and, combined with welfare traps for low or no income people, almost completely removes the incentive to reach for even lower middle class.

I wrote a radical tax reform proposal as a thought experiment that incentivizes people to earn more money.

I wonder if the rather enormous crush that Kathryn Jean Lopez, NRO’s editor, has on Mitt Romney played a part in this…

An idea that will get about as far as Cain’s 9-9-9 Plan…

The main issue that I see with the Cain tax code is that it increases the cost of consumption. The reduction in many of the deductions that the Country may not be able to afford makes some sense. The elimination of tax credits for the lowest income brackets that end up netting families more that they paid in the first place is another form of welfare. If you wanted to create incentives for families to pull themselves out of poverty and move into the next income bracket, the greatest tax breaks should go to the brackets that low income Americans can actually work there way in to. The taxes for successive brackets should be incrementally higher and max out at a reasonable, across the board rate. I don’t want to penalize people who are already struggling to make ends meet but I also want to change a system that discourages upward mobility because getting a better paying full time job means that you lose substantial tax credits that are currently going to people who already pay the least. Back to the problem with the consumption tax. People will absolutely benefit from the simplified tax code and the reduction of many taxes that seem to pile upon each other. Having said that, consumption drives the economy. We are a society of consumers and the more we spend the more we must produce and the more services we must provide. That equals jobs. Making consumption more expensive will lead people to tighten up even further. That’s the absolute worst thing that can happen to us as we struggle to emerge from this recession.

Ok have any you thought about how the corporate tax at 9% instead of 35% ! This would bring corporation home and trillions of dollars back to u.s. soil. By lowing the corporate tax to 9% , it would lower the price of goods and get rind of all the embedded taxes. Yes, you will be paying more in taxes when you buy something but again the price of goods will be lower because of the corporate tax being lower. Imagine how many jobs will be created from Nike, under armour, and all the other HUGE corporation that would bring factories home! Lets quite supporting China and take care of our own. I read something last week that stated that corporation have over 2 trillion dollars sitting over sea because of how much they would be paying in taxes to bring it back home. Back to the 999 ….lets say a price a milk is $3+a 8% sales tax =$3.24 for the price of milk. Well, with the 999 take out the corp. tax out 35% which brings the price of milk down to $1.95 + new corporation tax $0.09= $2.13! Oh now we have to add the sales tax to the equation which will be $0.09 x $2.13 =$2.31! Now let’s add 5% for competitive market to it and the price of milk would be around $2.50! Who’s really winning here the wealth the poor …no EVERYONE! Pus you would bring home more on your check and everyone would have to pay taxes drug dealers, illegals, and people that avoid paying taxes. Only 40% of the population pay most of the taxes now. I wish Cain would explain it better….I WROTE THIS FROM MY PHONE SO ITS PROBABLY PRETTY BAD!