Not Exactly A Honeymoon In Vegas

It was a Las Vegas slugfest last night, but once again Mitt Romney walked away unscathed.

Last night’s Republican debate in Las Vegas was certainly the most energetic of the recent encounters we’ve seen. Herman Cain came under a withering assault from all sides for his 9-9-9 tax plan. Mitt Romney got hit on health care reform, again. And, perhaps most surprisingly of all, Rick Perry actually decided to show up this time and remain relatively conscious throughout the entire event. What the debate had in energy, though, it seemed to lack in substance. With the exception of the opening questions about Cain’s tax plan and a later question about foreclosures, we went for nearly the entire two hours without a single question about jobs or the economy. Instead, thanks to audience member participation, we got questions about the role of religion in politics and the candidate’s position on the storage of nuclear waste at the Yucca Mountain facility in Nevada. I blame this mostly on Anderson Cooper, who certainly could have asked economic questions if he’d wanted to, but the format itself wasn’t all that helpful either. Perhaps it would’ve been improved had Wayne Newton, who was in the audience, had opened the show was Danke Scheon.

More than anything else, though, what the night was about was an an all-out effort by his rivals to get under Mitt Romney’s skin:

LAS VEGAS — Mitt Romney came under intensive attack from his rivals for the Republican presidential nomination at a debate here Tuesday night, with a newly assertive Rick Perry leading a sometimes personal barrage against him on conservative consistency, health care policy and even the immigration status of yard workers at his home.

It was the most acrimonious debate so far this year. Marked by raised voices, accusations of lying and acerbic and personal asides, it signaled the start of a tough new phase of the primary campaign a little more than two months before the first votes are cast.

Mr. Romney responded aggressively to the attacks and sometimes testily. Once, after Mr. Perry spoke over him, he turned to the debate moderator, Anderson Cooper of CNN, to plead, “Anderson?”

President Obama came in for some criticism, but it was almost entirely overshadowed as the seven Republicans on stage spent most of their time challenging one another. Most of the candidates faced questions on some of their biggest vulnerabilities, including Herman Cain, who spent the debate’s opening moments defending his 9-9-9 tax plan against nearly unanimous criticism from his fellow candidates.

But more than any other debate, this one was about Mr. Romney, a former Massachusetts governor. Previously, he had managed to parry attacks relatively easily. But he had yet to face a barrage like the one he walked into on Tuesday.

It came at a time when the Romney campaign was seeking to present an air of inevitability that he will be the nominee, while his rivals were seeking to exploit the sense that his support is soft and that Republican primary voters continue to seek an alternative.

The most striking difference from the last several debates was the performance of Mr. Perry, the governor of Texas, whose candidacy has floundered after a series of unsteady debate appearances. He displayed a much more combative style, if at times appearing too heated and occasionally drawing jeers from some in the Republican audience.

Striding onto the stage with an air of confidence, Mr. Perry seemed to relish challenging Mr. Romney from his opening statement. He called himself “an authentic conservative — not a conservative of convenience,” a swipe at Mr. Romney, who has been criticized by some conservatives for changing positions on issues like abortion.

For all of his confidence and energy, most of Perry’s attacks on Romney came up short, though. The most bizarre one came when, in the middle of an exchange between the panel about health care, Perry attacked Romney for hiring illegal aliens:

This was obviously a planned and rehearsed attack on Perry. Apparently, the story had come out at some point during the 2008 cycle but never went anywhere, and it’s easy to see why. The landscaping company that Romney had hired to maintain his home had apparently hired illegal immigrants. Romney didn’t hire them directly, and there’s no way that he can possibly be expected to know what their hiring practices are. Romney completely had the better of Perry in that exchange, and for the first time that I can remember there was a pro-Romney (or was it anti-Perry?) crowd in the audience. I’m not sure what it was that the Perry campaign thought they were going to accomplish with that exchange, but it ended up being a massive swing and miss on the candidate’s part. At the end of this exchanges, I’m guessing most viewers were left wondering what the heck it was the Rick Perry was talking about.

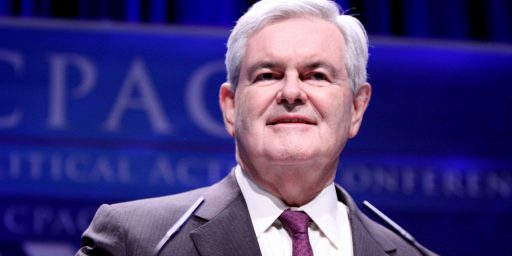

Romney also came under attack, again, on health care. The candidates arguments are familiar at this point, and they haven’t really done much to damage or fluster the former Massachusetts Governor to date. Last night was no different. Taking a tack that he had not before, Romney actually defended the program more than he had in the past, and none of the candidates bothered to take the bait. The one interesting moment came when Newt Gingrich said that likening the Massachusetts health care plan to the Affordable Care Act was not a fair charge, but then proceeded to attack Romney for putting in place a “big government, bureaucratic” program. Romney shot back by noting that the idea of an individual mandate had come from plans put forward in the 90s by Gingrich himself, and the Heritage Foundation. That pretty much ended the health care exchange, and, once again, Romney had walked away with very little damage and having made no real mistakes.

The other target for the night was, of course, Herman Cain. Right at the beginning, his tax plan came under attack from all sides, with the candidates repeating most of the criticisms I’ve detailed here over the past week or so, as well as a new study from the Tax Policy Center that says that Cain’s plain would result in higher taxes for 84% of Americans, with most of those not paying higher taxes being in the upper income brackets. Everyone from Rick Santorum to Michele Bachmann criticized Cain for putting forward a plan that was entirely regressive, and Mitt Romney pointed out that Cain’s argument that you can’t include state sales taxes in an analysis of his plan was pure nonsense. The entire exchange is worth watching:

Cain, and his tax plan, certainly came out of this worse for wear and it’s hard to believe that its not going to have some impact on his standing in the polls. When his own tax advisers are telling him he needs to change the plan because part of it is so unpopular that it could never become law, it’s fairly clear that 9-9-9, which has really been the only thing most people know about Cain’s campaign, is not being taken seriously.

It’s hard to tell what impact this debate, the last one until November 9th when we’ll be inside of 60 days until the Iowa Caucuses, will have on the race. Nate Silver suggests that it won’t have much of an impact at all that the debate was mostly a draw, and he may be right. However, there were two candidates who walked onto that stage last night with a clear goal they had to achieve. Herman Cain needed to prove that he deserved to be among the top tier of the candidates for the Republican nomination. Rick Perry needed to prove that he still deserved to be in that top tier. Based on what I saw, only one of those two men succeeded.

Rick Perry came into this race as the great hope for conservatives and, thanks largely to his disastrous debate performance, he fell out of the good graces of conservatives, most of whom turned to Herman Cain. One debate performance is not going to turn things around for Perry, obviously. However, last night we saw the Rick Perry that conservatives thought they were getting when he entered the race in August and, if he keeps it up and supplements it with the kind of retail campaigning that he’s well known for in Texas, it’s likely that he’ll start turning around slowly but surely. Perry could have put a nail in the coffin of his campaign last night if he’d made the mistakes he did in September, instead he’s given himself a second chance.

Herman Cain, on the other hand, struck me as the same novelty act we’ve been seeing from the beginning. His defenses to the argument against the 9-9-9 plan essentially boiled down to “go ready my analysis.” He refuses to see how a national sales tax on top of state and local sales taxes would harm lower income earners and small businesses. And, as demonstrated by his odd comments before the debate about possibly releasing prisoners at Gitmo if an American soldier were kidnapped, he displays a studied ignorance on foreign policy that I think voters are going to find disturbing once the charm wears off. Last night was Herman Cain’s chance to prove himself. He failed. And people are going to start noticing.

High point for me was when Mittens stuck the individual mandate up Newt’s fundament and broke it off at the hilt.

As for Pizza Man’s 999 plan, even he doesn’t understand it.

As ridiculous as Perry is, I did feel a sort of empathy for the guy as Romney took him apart. Romney is such an obvious asshole that I can’t see how it won’t become an enormous comic liability. I.e., the career of Al Gore, cool to some, awkward robot to the majority.

Perry’s only shot is one of the mysterious redemption plans set up by television, in which a piece of nonsense transforms him from oaf into competitor. This is what happened to Bush, late in the 2000 election, when he went on Oprah, and did a pointless well-telegraphed something which shot him up in the polls and removed all questions about his competence.

Cain is just a statistical anomaly. For every one Herman Cain, rich and running for President, there are 999,999 other Herman Cains, insolvent and with crackpot schemes that go nowhere.

@Modulo Myself:

I had the exact opposite reaction: for the first time I felt some sympathy for Romney. Perry, trying to talk over everyone to keep them responding to his BS charges, was the one being an asshole.

Even though Cain was very inarticulate at trying to defend his plan, the one part I did not get was how everyone was acting like the continuation of existing sales taxes counts as some sort of new tax under Cain’s plan. There’s plenty of other reasons to be against 9-9-9, but that particular exchange left me wondering if they other candidates are all so stupid they can’t grasp that or if they were being deliberately disengenious because they think the audience was too stupid to get it.

@Stormy Dragon:

I’m not sure I follow. To me, Cain could not seem to understand that if you have a 6% state sales tax and a 9% federal sales tax, you, the customer, are paying a 15% sales tax (and we’ve not even got to city sales taxes yet…). He kept talking about apples and oranges, and Romney was right: In the end, the customer is hefting a big basket of apples and oranges –but it’s the weight that really matters not what’s in the basket. As I said, Cain didn’t seem to get the point.

@sam:

Yes, but Romney is acting like he’s going from 6% state sales and nothing to 6% state sales + 9% federal. Cain is proposing going from 6% state sales + X% federal income to 6% state sales + 9% federal income + 9% federal sales. Now depending what your X is, you may or may not benefit, but the fact the state sales tax is the same in both cases has no bearing on what your total tax burden is.

Romney seems to think state sales tax only counts if there’s also a federal sales tax, when it’s the same burden either way.

No, I don’t think I agree with that. Romney was, unless I myself really didn’t get it, talking about the sales tax, period. And pointing out that you’d be paying, in the example, a 15% sales tax on new items (used food wouldn’t be taxed…). As I said, though, I could be confused.

But anyway, doesn’t this just point up the foolishness in saying 999 is a “simple” plan? Moreover, I do think that Bachmann was right, it is a kind of VAT (I said “kind of”) on manufactured items. If Acme Widgets has to pay 9% on each and every piece of materiale that goes into the manufacture of Widgets, Acme will surely pass that onto the consumer, as it does all its costs. That could add up, right? The consumer could end up be taxed a lot more than 9% in a way.

Now depending what your X is, you may or may not benefit, but the fact the state sales tax is the same in both cases has no bearing on what your total tax burden is.

No, but it makes the cost of goods and services go way up. That’s the point they were trying to make, I believe. They just have to dance around it because such a tax structure hits the poor hardest of all, and Republicans couldn’t care less about the poor, so it’s not a great argument for the forum.

When is one of the other candidates going to point out that Romney was once pro-choice? That seems like such an obvious winner in a Republican debate, I’m amazed no one has used it yet. Paging Santorum…

The high point for me in this debate was when Cain was asked if he was joking about putting up electric fences on the Mexican border or not. The audience laughed hysterically, and continued to laugh as Cain gave his non-response. Later, Romney reminded the audience that Republicans are allegedly pro-legal-immigrant. it’s only illegal immigrant’s deaths they find funny.

Favorite moment:

Michele Bachmann: “He put us in Libya. He is now putting us in Africa.”

When is one of the other candidates going to point out that Romney was once pro-choice?

Perry tried with his embarrassing attack in one of the other debates. “He was before he was for Roe v. Wade before he was before….against for before.”

Or whatever the hell he said. It was an attempt! It is surprising that Santorum hasn’t hit harder on this point.

Las Vegas has an 8.1% sales tax. The effect of 9-9-9 is probably going to be absorbed differently in places with high sales tax as opposed to low sales tax.

@sam:

As I said, there’s plenty of other reasons to criticize the 9-9-9 plan. I’m not in favor of it. But just because X is wrong, doesn’t make every argument against X valid. And in particular, Romney’s suggestion that existing sales taxes are more of a burden under Cain’s plan than they are now is not a valid argument. State taxes will be exactly the same burden as they’ve always been.

The debate made me glad that I’m not a Republican tasked with picking among that cast of clowns to vote for the one who’d do the least harm. Since Huntsman isn’t going to move above single digits, I’d have to go for Romney. Perry looked like a petulant child in his attacks. His refusal to STFU when it was Romney’s turn to speak came off as incredibly unstatesman-like, as if he thought that he who yelled the loudest would win the debate. Yeah, he was awake this go round but I’m not sure he did himself any favors.

I’d also agree that Cain’s time in the frontrunner spotlight is likely to end after last night’s performance. People are beginning to figure out that 9-9-9 might be a catchy campaign slogan but a it’s horrible and horribly unfair tax plan. Combine that with his complete lack of knowledge about foreign policy and even Cain’s likeability can’t make him electable.

Biggest moment of candor: Ron Paul taking on St. Reagan for trading arms for hostages during Iran-Contra. I think that’s enough to get him drummed from the cult.

Comic moment of the night–Rick Santorum’s claim to being the only candidate to have won a swing state. Um dude–you got handed your ass in the 2006 election. I wish somebody on stage had pointed that out to Rick, so he could go whimpering back to his corner.

We are starting to see careful studies of 9-9-9. These show (contra the promise) increases for low to middle class workers, and lower taxes for the rich. Perhaps that’s accidental?

Citizens for Tax Justice:

@Stormy Dragon:

I’ll guess we’ll have to agree to disagree. BTW, here’s an analysis of the 999 plan and its impact on weuns.

CHARTS OF THE DAY: 9-9-9 Plan Means Tax Cuts For Everybody! (Who Makes Over $200,0000)

@sam:

What part of “there’s plenty of other reasons to criticize the 9-9-9 plan” are you not getting through your thick skull? That analysis has nothing to do with state sales taxes.

@Stormy Dragon:

Why the hostility? I didn’t say the analysis had anything to do with state sales taxes per se. I just offered up the analysis for review by folks who might not be aware of it.

I thought Romney came off as a pompous fool. Trying to pretend that we don’t pay any federal taxes on things produce is either him lying or shows his incompetence.

@Manis Re”No, but it makes the cost of goods and services go way up”

No it doesn’t. It replaces the hidden federal taxes that are paid for goods now with an upfront federal sales tax. It simply replaces a multitude of complex taxes that require a great deal of overhead to manage with a “simpler” (not the same as simple) tax plan. When it is simpler it tends to have a good deal less overhead cost. So in the end a bigger tax burden is replaced by a smaller one. Therefore cost would go down.

Many politicians don’t like it because it doesn’t hide the taxes. They are afraid that when people become aware of how much in taxes they actually pay that there will be a backlash.

Bachman came off as a fool. She had nothing but buzz phrases and platitudes. Newt did well once again. Cain instead of spending so much time explaining that they are talking about apple and oranges, should have ask the others “are you saying we pay no federal taxes on loaf of bread now?” and then kept to “I’m just replacing the inefficient federal taxes we pay no with a more efficient sales tax”. Smart detail explanations don’t work for this type of debate. Candidates need concise easy to remember phrases.

@sam:

The hostility is because when I say “X is a bad idea, but not for the reason Romney gave” and your response is “We’ll have to disagree, because X is a bad idea”, you’re misrepresenting what I said.

It replaces the hidden federal taxes that are paid for goods now with an upfront federal sales tax.

What taxes are you referring to, exactly?

Oh I thought Cooper came off as a frustrated liberal hack. His questions were lame and was trying to play liberal gotcha games. He differently was giving Romney a leg up. How many times did Romney go over 30\20 second replies while others were not allowed to? Cain was given a chance to reply on some of the 999 tax comments level at him but Romney was given a chance over and over again when he came under attack.

Higher marginal rates in the production process to name one.

@Stormy

whatever

Higher marginal rates in the production process to name one.

You didn’t actually name one. What tax are you referring to?

Then there are the excise taxes like what the federal government collects on fuel that increase cost of production. I can’t believe anyone believes that there are not federal taxes that get incorporated into production cost.

@mantis

The taxes a company pays get incorporated into the production price. The money that that companies pay was collected from their consumers. If we simplify the tax code we will reduce the overhead to comply with the tax code.

Then there are the excise taxes like what the federal government collects on fuel that increase cost of production.

The current federal excise tax on gasoline is $0.183 per gallon. Gas is running at about $3.40 per gallon on average right now. Even assuming a lower price of $3 per gallon, the excise tax is only 6%. Cain’s plan is a federal tax increase on gasoline.

I can’t believe anyone believes that there are not federal taxes that get incorporated into production cost.

Strawman, and a funny one coming from someone who clearly has no clue about current tax rates.

The taxes a company pays get incorporated into the production price.

What taxes are you referring to? Most excise taxes are below 9%. Cain’s plan is a tax increase on goods and services, and a big one at that.

@Wayne:

If they get incorporated into cost, they are not hidden.

Is Cain actually proposing to end the excise and fuel taxes? I didn’t think he was.

Is Cain actually proposing to end the excise and fuel taxes?

I took some wingnuts’ word for it that he was. That was a mistake. He’s not, apparently, proposing we do away with those taxes. In light of this info, it is clear that Cain’s plan is a truly enormous tax increase for all but the rich.

@sam: “I do think that Bachmann was right, it is a kind of VAT (I said “kind of”) on manufactured items.”

I’ve been trying to get my head around this issue (CNN says not enough information to know one way or the other), but Josh Barro helped me understand it:

Oh yeah, the kicker:

@PD Shaw:

And that means Cain’s plan rewards businesses with high material costs but low wages and punishes with low material costs but high wages. So it discourages both the creation of high paying jobs and discourages more efficient use of resources, restraining GDP growth.