Romney And Ryan Not Providing Details About Their Tax Plan

Mitt Romney and Paul Ryan are refusing to provide significant details about their tax plan. That's a mistake.

Mitt Romney says that his tax plan would actually end up increasing the tax burden on wealthy taxpayers because he would close loopholes and limit deductions that they’d be able to take advantage of. So far, though, his campaign isn’t being at all specific about what loopholes and deductions he’s talking about:

In separate interviews Sunday, Mitt Romney and Paul Ryan refused to identify which tax loopholes they would close in order to pay for their large tax cuts.

On NBC’s “Meet The Press,” Romney dodged multiple questions about which deductions or credits he’d target, saying only that he’ll get rid of “some of the loopholes and deductions at the high end” while seeking to “lower the burden on middle income people.”

Pressed for one specific example, Romney replied, “Well, the specifics are these which is those principles I described are the heart of my policy.”

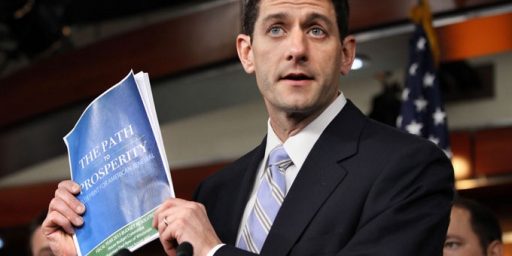

On ABC’s “This Week,” Ryan also fended off multiple questions about whether the Romney-Ryan tax plan should be taken seriously given its lack of details on which loopholes they would close.

“Mitt Romney and I, based on our experience, think the best way to do this is to show the framework, show the outlines of these plans, and then to work with Congress to do this. That’s how you get things done,” he said.

The Romney-Ryan plan would cut taxes beneath existing Bush-era levels, with benefits disproportionately for high earners, at a cost of roughly $5 trillion. They have vowed that the breaks would be revenue-neutral by way of closing tax credits and deductions but have persisted in their refusal to specify which ones, other than promising that the changes wouldn’t target middle class Americans.

As a matter of tax policy, there’s nothing wrong in principle with the idea that Romney and Ryan are putting forward here. Indeed, most serious discussions of comprehensive reform of the Tax Code, such as those contained in the plan put forward by the Simpson-Bowles Commission, include proposals that would lower tax rates while at the same time getting rid of tax deductions, credits, and loopholes. By almost all projections, the actual results of such changes would be increased tax revenues due in no small part to the fact that eliminating deductions often more than offsets any lost revenue from lower rates. Indeed, a large part of the last round of comprehensive tax reform, which is now 26 years in the past, included just these kinds of changes. Among the popular deductions that went away at that time were the deduction for interest on credit cards and car loans.

There are other benefits to eliminating deductions and loopholes, either across the board or on a more limited basis. All of these provisions of the tax code serve the primary purpose of making the tax code itself, and compliance with tax law, far more expensive and complicated than it needs to be. By some estimates, American individuals spend somewhere between $55 billion and $163 billion on tax compliance, with the difference largely being due to what one considers “tax compliance.” Even if one takes the lower figure as the accurate one, though, that’s still a heck of a lot of money being sucked out of the economy on an annual basis thanks to an overly complicated tax code. In addition to compliance costs, though, all of these deductions and loopholes end up distorting the economy by artificially encouraging investment in favored industries and methods of saving. The home mortgage interest deduction, for example, artificially lowers the cost of homeownership at the expense of renting. All of the tax credits, deductions, and favorable depreciation schedules allowed to private business, many of which are done at the behest of lobbyists rather than for any rational economic reason, distort the economy by favoring some forms of investment and business over others. As a general principle, then, eliminating these types of distortions in the Tax Code, is a good idea.

Romney and Ryan, however, are simply not being honest in refusing to discuss at least some of the details of their tax plan. The only thing we know for sure is that they want to cut taxes, but they promise it will be revenue neutral because they’ll also be eliminating deductions and loopholes. Then, however, they refuse to talk about what deductions and loopholes they would propose eliminating. Discussing this matter on Twitter, some Republicans have raised the argument that it would be unwise for Romney to reveal his negotiating position beforehand. While there is some merit to that argument, it doesn’t strike me as sufficient justification for complete silence on the issue. If one of the central components of the economic plan that you are running on includes “tax reform,” then you owe it to the American public to explain what you mean. Ronald Reagan did it in 1980 when he made very clear that, if elected President, he would implement the Kemp-Roth plan that had been floating around Congress since 1978. In the end, what was enacted didn’t match Kemp-Roth in every single detail, such is the nature of the legislature process after all, but it was pretty darn close, and the people who had voted in 1980 knew from the start what Reagan was talking about when he talked about tax reform.

Governor Romney doesn’t have to reveal every single detail of what he is proposing, and we certainly don’t need the campaign to release a detailed piece of legislation. Indeed, such a detailed proposal would be mostly worthless because it completely ignores the role that the legislative drafting process, a function of Congress not the White House, plays in things such as this. Nonetheless, I do think that they are under some obligation to give voters at least a general idea of what kind of changes to the tax code they are contemplating, which deductions and loopholes they are talking about, and at least some basic analysis to support their assertion that the plan would be revenue neutral. If they don’t do it now, then Romney is clearly going to be put on the spot about issues like this, as will Paul Ryan, when the debates roll around. If they don’t have a good answer then, they will be open to an attack from the Obama campaign that their tax plan is nothing but smoke and mirrors.

But, but, but… Obama sucks. Vote for us. That is all.

Anyone who thinks Mitt Romney plans to close tax loopholes that benefit the rich is mentally deficient.

On the Sunday Talkies, he’s already conveniently walked away from his planed tax cut for top earners in the top bracket. Romney will probably backtrack on that backtracking soon. Also, he’s in no hurry to try to explain to the voters how he plans to eliminate those projected deficits by, for example, eliminating the mortgage tax interest deduction.

Romney reminds me in so many ways of Richard Nixon – no one liked Nixon much, and people are not thrilled about Romney. Both Nixon and Romney were dedicated to any position on any issue that would get them elected. Nixon said that he had a “secret plan” to get us out Vietnam – about 5 years and 20,000 lives later we got out. Romney has a budget plan that he doesn’t want to talk about – but trust him, happy days will be here again. Romney is Elmer Gantry without the charisma.

@al-Ameda:

No sane politician would campaign on eliminating the mortgage interest deduction. Nonetheless, I think the case for eliminating it is rather persuasive.

@Doug Mataconis:

It could be phased out over time, not obviously eliminated at a stroke.

Doug –

They CAN’T explain it. It doesn’t make mathematical sense. Anyone who can add and subtract knows the plan is absolute bull**it.

That’s why they won’t explain it.

You cannot increase the Military by 2 trillion…

…cut Taxes for everyone, including businesses, and captial gains…

…repeal Obamacare

…refuse to raise revenues via additional taxes

… and still cut the deficit and debt.

Can’t.

Be.

Done.

@Doug Mataconis:

I said that because, if you’re looking to find real money out of closing up loop holes, that is the primary place to go.

I agree with you, the case to eliminate is logical – however, as a practical matter, millions of people made their decision to buy homes based on both the mortgage amount and the beneficial tax treatment. It would be class warfare of the highest order to kill that deduction.

Beltway commentators:

“BUT THEY SAY THEY ARE FISCAL CONSERVATIVES AND WOULD LOWER THE DEFICIT!

SO THEY MUST BE FISCAL CONSERVATIVES AND DEFICIT HAWKS!”

Perhaps. But for all his faults, Nixon was a brilliant man with impressive political skills. Don’t think you can say the same for Romney. The private Nixon was also reputed to have a droll wit that could be quite funny. I am having a hard time imagining Mitt providing any laughs (at least intentionally)

I don’t blame Romney for not giving out details about which interest groups he wants to p*ss off before a close election. The big tax loopholes are there for a reason — they are popular with voters or influential special interest groups (or both, in the case of things like the mortage interest deduction). Plus, the Democrats would make hay out of any such proposals that would be unpopular with voters — they were quick to jump on McCain for wanting to tax health care insurance benefits, for example.

In practice, any “revenue neutral” tax reform is going to have winners and losers, and there’ll be a political and lobbying battle royale to hash out the details. My prediction is that, in practice, there would be a bunch of tax cuts on things like capital gains, followed by a convenient congressional deadlock when it comes to most loophole closing.

@anjin-san:

The very fact that Nixon, a guy with real personality flaws and drawbacks, could be a major political player for nearly 3 decades, and be elected president twice, is testament to his great political skills.

It is a mistake to underestimate Romney, he is very ambitious. But I have to admit that until this campaign season I had no idea that Romney was so inauthentic and tone deaf. It shows you just how threadbare the Republican Party is – when it is very clear that Romney was the ONLY acceptable candidate of those who stayed in to the end. Who else even belonged up there? Santorum? Bachmann? Cain? West? Perry? Gingrich? That group should be turned into Soylent Green.

Did Romney really say this?

“Well, the specifics are these which is those principles I described are the heart of my policy.”

Is Yogi Berra prepping him for the debates?

Romney and Ryan just flat out lie about everything else so why not just make up some stuff they have no intention of doing.

Bill Clinton, explainer-in-chief, on why we need a ValueAddedTax to restructure. (Ans: ManuJobs) Video: http://youtu.be/sDW_cRIcybE

Which led one person to wonder if Yogi Bera was helping him.

Digby:

@ratufa: Well, he had better come up with something specific, otherwise it’s the political equivalent of vaporware.

Romney doesn’t want to give specifics. As he’s said, if he tells you what he’s going to do, some people won’t like it & will use it against him.

OK.

This is the political equivalent of “taking the Fifth”.

Meh.

If they gave the precise details then the liberal media would spend the next several weeks nitpicking them, quoting them out of context, misstating them, etc. Heads they win, tails you lose, when you’re a Republican. Besides, Zombieland doesn’t do details. Hell, Zombieland wouldn’t know itemized deductions on Schedule A from a menu of items at KFC.

That aside, if Romney wins and if McConnell becomes Senate Majority Leader then the most likely result is a muckety muck “reform” package that doesn’t really do all that much. Democrats will fight tooth and nail against truly fundamental tax reforms. The deduction for mortgage interest is too popular with adult voters realistically to be jettisoned. You can’t realistically get rid of the EIC or the child tax credit, because then the media-Democrat complex would scream racism at the tops of their lungs. Too many thumpers are too fond of the charitable donation deduction realistically to cast that one into the dustbin of history. So on, so forth. Mostly the status quo is the most likely result. Sad but true.

Romney and his campaign sees what happened with Obama after 2008. Obama was specific enough that when he didn’t follow through 110% on his campaign “promises”, it was held against him.

Romney has shown that he is even more of a “Against it, before he was for it” and “Before it, before he was against it” than John Kerry ever was. So much so that even John Kerry himself was able to use it against Romney at the convention.

I do not expect anything Romney says or does in this campaign for president to ever stick for long. As it has been said before, again and again, Romney is a well oiled weather vane.

While Obama may have “evolved” on issues, Romney has taken it to a level I have never seen or heard before.

It seems Romney and his campaign are more than willing to take the hits over and over again over changing positions constantly, than have to worry about having principled stances held against Mitt later. Which definitely adds to the stigma that Romney is not likable or trustworthy.

If there wasn’t such a large portion of the electorate that was in the anyone but Obama crowd(willing to accept pretty much anyone without the last name Obama), Mitt’s obvious lacking of principles and his exorbitant amount of flip-flops would have done him in long ago.

@Tsar Nicholas:

Just for the record, you’re against the free market when it comes to news media?

Bill Clinton already told us Mitt’s tax policy……so we really don’t have to hear it from him.

Romney and Ryan won’t talk about their tax plans because it will become clear that the middle class will get screwed while the one percent will make out, once again, like bandits. From what I’ve read, the average one percenter will pay about $250,000 less, while the average middle class voter will pay $2500 more. Plus, the deficit will still climb.

As Bill Clinton said, arithmetic. And, as it was with Bush II, arithmetic is not Romney’s friend.

@Mr. Replica:

Nice try, but you give Rmoney way too much credit. Do you really think he’s smart and disciplined enough to run his campaign with an eye towards re-election? What’s really happening is that he plans to avoid specifics because he’s not sure what his policy is going to be until Paul Ryan, Grover Norquist, the Christian leadership, and the NRA tell him what it’s going to be. The strategy here is to run a policy-free, “I’m not Obama” campaign, while hoping for bad news between now and November.

Truly an empty suit.

@Tsar Nicholas:

And you accept this incredibly lame excuse without laughing your head off?

@EddieInCA:

I never really liked the “stupid” slogans. Too unkind. Just the same, in this case:

As I understand it, when Romney handed his budget to graders he did three things. He asked them to accept unnamed spending cuts, unnamed revenue increases, and he gave them a specific GDP surge that would result.

That last part is the biggest cheat ever. Economics may be half bullshit, but naming GDP changes years in the future, which are supposed to result from policy changes you have not named, is the most bullshitty imaginable.

@Herb:

I presume that they came up with a “sekret budget” so that people like Tsar could believe in it.

What was supposed to happen at the same time was that rational swing voters would ignore it, and just get swept along in the “no-bama” tidal wave.

We’re seeing how that worked out.

Romney doesn’t have a plan. He has wealthy supporters who don’t want to pay taxes. That’s all he’s got.

@Ed in NJ:

Considering Mitt isn’t smart enough to run his current campaign well enough to beat Obama…no, I do not think he has any clue how to run a re-election campaign. It’s not like he has any prior experience in running a re-election campaign anyway.

I think that even IF Romney won one term as the POTUS, his re-election bid would consist of blaming Obama for everything that went/will go wrong, while trying to weasel out of any stance he took while president.

Seeing that most republicans are more than willing to forget everything from the years between 2001 and 2007(plus the years that their conservative god Ronald Reagan raised his fair share of taxes AND compromised with the enemy), I wouldn’t be surprised if their whole outrage over Obama never taking responsibility would be thrown out the window when their guy does the same. Or maybe saying that Obama is still wrong for not leading as a president should, but for Romney it is more than acceptable to do so. Or maybe falling back to the idiotic stance of “Both sides do it!”.

Either way, I do think Romney and his campaign is smart, smart enough to know their base is a few sandwiches short of a picnic and are more than willing to accept the exact same things that they hold against Obama as reasons why Romney is better. But, having said that, I do not think Romney nor his campaign of yes men are smart enough to play politics in the long term.

@ Tsar

When I was 20, I was with a group of friends & was being a little whiny about something that had happend to me (don’t really recall what). An older friend cut me off, saying “You’re not a kid anymore. Men should not whine.”

It was really good advice, and I took it to heart. It’s too bad no one ever had that conversation with you.

@gVOR08:

One presumes that the billionaires are not backing Romney so that they can pay the same tax.

That should read…

Either way, I do think Romney and his campaign ARE smart enough.

I just switched from firefox to google chrome and for some reason the edit functions do not show up anymore.

That sentence could have been written by Sarah Palin.

Eliminating the mortgage interest deduction and lowering marginal rates is a tax increase on the middle class. That’s why you don’t talk about it. The big three he can eliminate to raise any revenue is the interest deduction, the employer non taxed health portion ( which they may be looking at changing that whole market altogether) or accelerated depreciation.

Just let the tax cuts expire. The rates were about as fair as you will get. Go back to them and quit complaining. Tax rates do not dictate economic growth. Bush II proved that, Clinton proved that and Reagan proved that. The economy is more complicated than they would like you to believe.

Remember the term “stonewalling”. That’s what Romney reminds of with respect to his income taxes and to his tax plan.

What’s sad is that it is working because Romney/Ryan has the backing of the Conservative media which sets the talking points agenda for all media.

Were Romney a Democrat, his refusal to release his income tax returns for the past decade would still be an hourly mantra on every Conservative, and therefore Liberal, media outlet. But he is a Republican. Conservatives support him. So the attention directed at his refusal to be more open has dropped precipitously.

I expect the same will be true of the Romney/Ryan tax plan. When faced with a granite cliff, the MSM collapse. If only Democrats had similar backbones.

More whining from the chief spokesman for Conservative Victims United…

Except, of course, it was Republicans who came up with the EIC and the child tax credit…I guess some people probably wouldn’t grasp the irony of claiming that the “media-Democrat complex” would be upset with cutting programs created by Republicans…

What about those of us who bought a house about five years ago, banking on this tax deduction existing? We’re just ****ed? If your answer is then “tough ****, if you can’t afford it sell your house”, what about the fact that with the market having collapsed enough in that meantime, we would financially cripple ourselves by selling now, losing our entire down payment?

Eliminating the home mortgage deduction would be an absolutely decimating tax increase on the middle class, while the wealthy would barely even feel it.

@Ben:

So fade it out over 10 years. Housing price increases would compensate.

For what it’s worth though, I think Doug phrases it wrongly. The housing dediction is 100% an extra tax on renters.

Think back to the beginning. Most (esp. young) house buyers buy just as much house as they can afford at a point in time. They count on time going forward to reduce their burden and increase their return. What happens if you knock $1000 off the tax for a home buyer? Well, if sellers are rational, they’ll raise the price of the house by $1000 to even things out. The buyer can now afford “more.” To do anything else would be to leave money on the table.

Once the housing deduction was in place for a few years, the tax saving was baked into every home price and the benefit was gone. The only ones hung out in the cold were the renters who were still paying the old tax.

@Ben:

BTW, home ownership reduces labor mobility and arguably holds down GDP.

You’ve got to be kidding me. This man is running for President of the United States. The tax code, whether simple or complex, is profoundly important for every individual, business, city and state. Politically, everyone I’ve ever read – left and right – is in favor of tax code simplification. But “simplify” is a mighty malleable term.

If Romney wants tax cuts for the wealthy, it is his duty to outline how he would pay for it.

(Addendum: Romney doesn’t want to show his tax returns because he would be criticized. He doesn’t want to reveal how he would pay for his tax cuts because he would be criticized. This is a rather troublesome pattern, no?)

@al-Ameda: It’s class warfare of the highest order to have a mortgage deduction but not a renter’s deduction.

But it would be a violation of Grover Norquist’s tax pledge.

I have yet to have a Republican explain to me why he supports Romney without using the word “Obama.”

How do you support someone when you have no idea who they are, or what they believe in, or what they will do?

The man just flip-flopped on healthcare reform, for God’s sake, after swearing he’d end it on Day #1. He’s flip-flopped on abortion and on gun control. He used to describe himself as a progressive and now says he was severely conservative. Here’s a man who tapped Ryan and then denounced his budget and defense decisions ten seconds later. He hides his tax returns, despite the fact that his own father showed his. He can’t tell us what he’ll do. . . because we’re not cool enough to know. He can’t be bothered to talk about the war we are actually in.

I mean, what are you Republican idiots out there even supporting? Can one of you make the case? What is a Romney? What does it plan to do?

@john personna:

I think you’re missing something. A few years will not be long enough to undo the damage done by eliminating the deduction. You can’t sell your house for less than you owe without your bank approving a short sale (which is almost never approved, especially if you’re current on your payments, trying to not annihilate your credit history).

Just as a house is only worth what someone is willing to buy for, the converse is true: houses are only available for prices sellers are willing to list for. It will take a heck of a lot longer than a few years for people to pay down enough equity to get back in the black and build up a decent down payment for a new, cheaper, smaller place to live

As for your link about home ownership limiting labor mobility and bringing down GDP, regardless of the validity of that argument, it means nothing to the people who are already locked into a house and can’t sell.

@Timothy Watson:

I didn’t really catch that one. “By almost all projections” … I’d like to see them. Any study I’ve seen that actually tries to do the math, to find deductions and credits and remove them, comes up short. Sure, you can do an “insert number here ‘study'” that runs on promises, but that’s not the same thing.

There are not enough deductions and credits in the tax code that removing them would actually raise revenue.

That’s why it’s ok with Norquist.

@M. Bouffant:

Except that renters aren’t locked into anything, they can always change their situation. Homebuyers who bought in because the deduction existed are pretty much locked in at this point. To take it away would cause an unprecedented wave of foreclosures, bankruptcy and ruined credit.

3 things…

The lyingest campaign in history is asking us to trust them. Sure…why not.

Rand Paul is unaware that we have been shedding government jobs…how can a Senator not know that?

Did you see Faith Hills dress???

@Ben:

There you’re just mixing problems.

The mortgage tax deduction was not invented to save underwater home owners.

For what it’s worth, about 30% of home owners have no mortgage at all, 70% have mortgages, and about 30% of the 70% (or about 20% overall) are underwater.

(If ten years of appreciation, until 2022, will not get you out from underwater, you bought way too much house.)

No it wasn’t invented to save underwater mortgages. However, millions of people took out mortgages based on it, and millions of them are underwater due to market forces that were not their doing.

If a ten year grace period were really the proposal, than I would have much less problem with it. Most people don’t include anything like that, and have a “f*** ’em” attitude about everyone that would be affected.

Meanwhile, people who rent or people who don’t have children get penalized…I guess those people are just f***ed…the tax code isn’t just used to pick winners and losers just among the wealthy…

@An Interested Party:

I agree it’s not fair to renters. However, since the mortgage deduction has existed for generations, and people have taken out mortgages based on the expectation that the deduction would continue to be there, eliminating it immediately would cause an insane amount of destruction and ruined lives. That needs to be taken into account.

@john personna:

The problem with this is that if housing prices increase, who will be able to afford to buy them with a mortgage? Granted, people of means will still be able to purchase properties by just buying them.

But financing a property is an entirely different ball of wax. Financing a property pretty much guarantees you’re paying two to three times what the property is worth, and since the interest is all front-loaded, you could literally pay a mortgage for ten years and make very little movement towards paying down your principal.

Removing the mortgage interest reduction would make financing a home prohibitively expensive for everyone who cannot buy a property outright. It’s not a good idea.

@Tsar Nicholas: A couple of the points that you make have some merit. It’s too bad that they are surrounded by so much mouth-breathing crap.

No, it´s simple. Tax loopholes exists for a single reason: both voters and politicians love them. As I pointed out here the Brazilian Income Tax is something simple compared to the American Income Tax(I swore: you just have to download a software, fill in your income, your deductions(All of them related to expenses related to education and health care) and voilá,.That´s because Brazilian politicians have a very complex system of Federal Sales Taxes, and they insert loopholes there. American politicians don´t have the same tool.

Most analists agree that it would be politically impossible to deal with the biggest deductions, like the Mortgage Income Deduction, the deduction for companies with expenses with health care and things like that. And I really don´t like any of these deductions.

The only solution would be to raise taxes. To me, a good solution would be to eliminate the Corporate Tax and to increase capital gains(Yes, a nonstarter among Republicans). But I don´t know how you can cut the deficit to reasonable rates, control Medicare and keep taxes at a acceptable rate without any pain.

@Herb:

I’m pretty sure many nations have successful mortgage markets without having mortgage deductions in their tax system.

Country data here.

Romney wants to keep all the best parts of Obamacare and get rid of all those pesky bits that actually pay for them, like the mandate.

Typical Romney, promise the world with no explanation on how it would be paid for.

Considering the pasting the housing market has taken in the last five years, I have a really hard time seeing this.

But then again….if someone wants to pass a law capping the interest charge at a fraction of a percentage, I say kill the deduction.

If someone wants to pass a law saying that a monthly interest payment cannot exceed one’s principal payment, I say kill the deduction.

But as long as the bank is tripling my costs and taking their cut upfront…..I have no problem with the government giving me a deduction. Sad that it has to come from them, rather than the bank…..but I’ll take it.

@john personna:

Do those nations have such a usurious system?

You know, financing charges tripling the price, front-loading the interest, etc?

@anjin-san:

Here’s the real problem. It unwinds like this:

– housing is a typical family’s principal investment

– they over-invested because the tax code encouraged it

– they over-leveraged because easy credit allowed it

– housing is down because that very bubble cycle burst

Despite all the good reasons not to subsize re-inflation of that bubble, people like the game?

Too bad more people did not choose smaller houses and diversified savings. Macmansion nation.

@Herb:

That “nations” link has good arguments pro and con.

As it notes, cheap loans just make expensive homes. Kind of pay me now or pay me later, but also a punish the young or punish the old thing.

It strikes me as odd that the political faction that constantly hammers away at the idea that government is not to be trusted refuses to say what they would do if they hold the reigns of government.

@michael reynolds: I wrote the above 21:49 post before seeing your better written 20:18 post. Maybe repetition is beneficial.

@john personna:

Sorry, JP, but I don’t really buy this. Cheap loans do not make expensive homes. Homes are expensive because they are homes.

Cheap loans make expensive homes affordable.

Also, it should be said that there’s a major difference between “expensive” and “prohibitively expensive.”

Removing the mortgage interest reduction would make financing a home, an expensive proposition already, prohibitively expensive.

Translation: upper middle class wage earners will pay more because they’re continue to pay current tax rates while losing all their deductions. Multi-millionaires that make all their income off capital gains will see massive tax cuts. People like me (engineer) who are already paying a higher tax rate than Mitt Romney will see their taxes go up so that his can come down even more.

@Herb: In fact, interest rates for the consumers are very low in the United States when compared to other countries. The United States also have protections for the indebted(Like personal bankruptcy) that most countries does not have.

That´s one of the reasons that the United States has a very low level of personal savings. Brazil is not the most frugal country in the world(far from that), but most people that I know either do not have or do not use frequently credit cards. Germany has a very high level of personal savings, and people see no problem with rent. Or living in small houses.

Note that from a rational perspective the idea that prices of houses are falling should be a good, not a bad news.

@Doug Mataconis:

It’s persusive if it’s replace in a corresponding drop in the middle tax brackets so the people getting it don’t see their tax liability jump thousands of dollars a year. Eliminating it to further reduce Romney’s alread ridiculously low capital gains rate does not, which is what Ryan’s plan is actually proposing.

@Herb:

You do realize this is basically a ban on long term loans? Any long term loan will result in interest making up the majority of the payment at the beginning due to amortization.

@Andre Kenji:

Brazil has favelas, and Germany is the size of Montana and has 220 million fewer people. Lifestyle-wise, we can learn a lot. Policy-wise….not so sure.

@Stormy Dragon:

Yes, and that’s why I support the mortgage interest deduction. It’s not perfect, but it works.

It’s interesting reading all the conservatives jumping in about how unfair it would be to eliminate the mortgage deduction. I’m not agreeing or disagreeing with them. But it gives me a chance to trot out my reply whenever a so-called conservative makes the crack “A Conservative is just a Liberal that has been mugged”: I reply “Yeah, and a Liberal is just a Conservative talking about their own problems.”

Mittens is Sarah Palin without the balls.

I find it hilarious that conservatives are whining about stopping a subsidy to the banks.

@Herb:

I´m not talking about favelas. I´m talking that most people outside the United States does not have the same low interest rates that Americans have and the same protections for the indebted and that Americans uses that to have the lowest level of personal savings in the whole industrialized world. That´s why a middle class family can be living in a trailer if the breadwinner is unemployed for some months.

In most countries people do use credit cards to do everything and taking debt for discretionary expenses is considered lack of personal responsibility.

I didn’t realize that even AEI is admitting that Mitt’s numbers don’t add up:

AEI can usually be counted on to say anything the GOP needs them to say, so this is a surprise.

Of course they won’t talk about the details. The plan is that the rich, particularly the rentier rich, pay less, others pay more, and we still rack up the debt.

re: mortgage interest deduction. I do think it should be phased out. Just junking it overnight would be terrible policy. Cap it, and then slowly reduce the cap.

The mortgage interest rate deduction not only skews things toward ownership and away from renting, but also incentivizes taking out the biggest mortgage you can afford, no? This doesn’t seem wise.

In the medium term, taxes on the middle class, particuarly the upper middle, will have to rise (if we’re going to get back to ~18-19% of GDP in tax revenue, the middle class has to pay more too). I would rather it be done by phasing out deductions rather than raising rates. Of course, I also favor higher taxes on the richest, including changes to capital gains taxation and the estate tax. And pigs shall fly…

@Rob in CT:

All the hybrid/electric car credits are also special aid to the rich, or at least upper-middle.

The median income of hybrid buyers has been very high. They didn’t need credits.

I’ve been listening to audio broadcasts of the Sunday TV shows. It’s clear that the more Romney and Ryan explain their tax and budget plans, the worse they look. That’s why they don’t provide details of their plans. It’s not a mistake- it’s a defense tactic.

@Stonetools:

The same tactic used when Romney is asked to release tax returns. Oh, someone might attack what’s in them, so I won’t release them.

Not a great argument.

@Herb:

Brazil has favelas…and the US has slums. And in the last ten years, Brazil has moved millions of the poor into the middle class, while the US has been moving in the opposite direction.

And who cares what physical size Germany is? That’s a completely irrelevant details. Germany has 80 million people, has the largest economy in Europe, the world’s fourth largest economy and is the world’s third largest exporter. It has more social and class mobility than the US and less income inequality, offers universal health care, and is is many ways ahead of the US in quality of life, economic security, and financial health. The idea that the US has nothing to learn from Germany policy-wise is just bizarre Know-Nothingism.

You know…the argument for not getting specific about the loopholes and deductions would make some sense…if they weren’t so damn specific about the tax cuts they intend to make.

You have to be

an idiota Republican to buy this malarkey.@Ben:

What’s really sad about the mortgage interest tax deduction is that it was part of Reagan’s grand tax reform package which ended tax deductions for credit card interest. This, of course, with the help of those wonderful new financial instruments, eventually turned a person’s home into an ATM machine with the consequences we all know.

How would you feel, OTOH, if as part of true tax reform (I know, totally unrealistic, but treat this as a thought experiment) the deduction was retained for all existing home owners but not for home buyers after a date certain?

@Rafer Janders:

There is not a single US slum that resembles even the most advanced Brazilian favela.

Um….I was much more cagey than that, bud. Allow me to quote myself:

I can see how you’d get “nothing to learn from Germany” from that…..

@Herb:

*Everyone* that lives in the worst Brazilian favela has healthcare. And even without considering PPP there dozens of favelas in São Paulo and Rio that have a higher GDP per capita that many counties in the US.