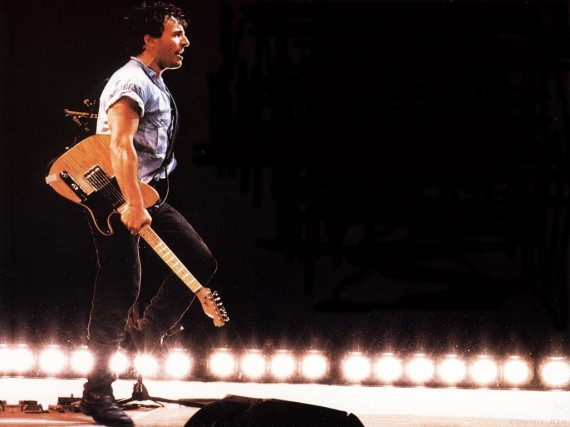

Who Knew Bruce Springsteen Was A Farmer? (He’s Not, But He Gets Farm Subsidies)

A new report from the General Accounting Office reveals that a number of very wealthy people who have next to nothing to do with farming as a profession are nonetheless receiving farm subsidies:

Wealthy celebrities including Bruce Springsteen, Jon Bon Jovi, Quincy Jones and Ted Turner have received federal subsidies, according to “Subsidies of the Rich and Famous,” a new report from the office of Oklahoma Republican Senator Tom Coburn.

The Government Accountability Office (GAO) identified several individuals receiving farm payments “whose professions had nothing to do with farming or agricultur[e],” says the report. These individuals include real-estate developer Maurice Wilder, a “part-owner of a professional sports franchise [who] received total of more than $200,000 in farm program payments in 2003, 2004, 2005, and 2006.”

The report also says millionaires Jon Bon Jovi, Bruce Springsteen and Ted Turner have collected farm subsidies.

“These individuals include Scottie Pippen and Ted Turner, respectively. Millionaires also receive state tax breaks on farm land. For example, Jon Bon Jovi paid property taxes of only $100 last year on his extensive real estate holdings in New Jersey that he uses to raise bees. At the same time, Bruce Springsteen received farm subsidies because he leases his property to an organic farmer,” the report explains.

I certainly don’t deny The Boss the right to make a little money off his property, and I can’t say he’s wrong for taking advantage of a program that exists. The problem is that the programs exist to begin with. Farm subsidies are a huge problem to begin with, as has been documented numerous times, but farm subsidies to people who aren’t really farmers is just silly beyond words.

H/T: United Liberty

Ah yes, I remember one of my more conservative law school friends (also my predecessor as Federalist Society president) telling the Bon Jovi story. I heard that Bon Jovi only paid $500 in taxes, not $100. One dollar for each dollar of honey sold.

And yet I just read somewhere that there is a farm bill being passed right now to help ensure these subsidies continue for the foreseeable future (2017 I believe). While some subsidies may be in order (I am not an expert in the industry and cannot speak intelligently) when reports like this pop up, something tells me there is something wrong.

They say “don’t make the perfect the enemy of the good.”

I’d be with an end to ag subsidies as perfect, but surely effective means testing (on total family income) would be good. Surely whatever testing we have in place is broken when a guy making $70M a year “needs a little help.”

We respond to stories like this about individuals more readily than to analyses of the much more financially significant corporate subsidies. These subsidies amount to corporate welfare payments, to the tune billions of dollars, based on their gigantic land holdings. Their campaign contributions/bribes ensure that the farm subsidy bill passes every time with bi-partisan support. The huge subsidies to the near monopoly corporations actually harm small farmers. And I’m sure we’re getting more public benefit from the thousands of small farmers who get a subsidy. Springsteen and Bon Jovi, who I know something about, clearly are using their land to promote local small farming they believe in, and quite possibly passing the subsidy on to those leasing the land and actually doing the farm work. Both have histories of major public, and even more private, generosity. They endorse policies and candidates that will result in their paying more taxes. I’m sure they’d very enthusiatically endorse means testing for the subsidy but the corporations and congress will make sure that never happens. It would eliminate the main beneficiaries and proponents of the bill: mega-farm corporations and politicians.

@KyleWilliam:

And to connect my comment to the concern about “wealthy” people getting subsidies: the shareholders in the agricultural corporations are predominantly “non-farming wealthy” individuals, institutions and corporations, are they not? I haven’t read the report, but I doubt that these shareholders are named, while it probably singles out a few prominent individuals who support the Democratic party. Effective propoganda, but we surely shouldn’t endorse such a superficial, partisan analysis.

Those who are not hurting for money shouldn’t receive subsidies in the first place; aren’t subsidies in place for those who really need them?

Some of those listed have been performers in Farm Aid concerts as well-is that how you get in on the subsidy racket?