G.D.P. Growth In Third Quarter Was Healthy, But Many Caveats Remain

The economy appears to have grown strongly in the third quarter, but concerns about long-term growth remain.

The Bureau of Economic Analysis reported that the U.S. economy grew slightly faster than expected in the 3rd quarter of the year, but the numbers indicate that we’re not seeing the kind of growth in business investment that would be needed to push the economy forward:

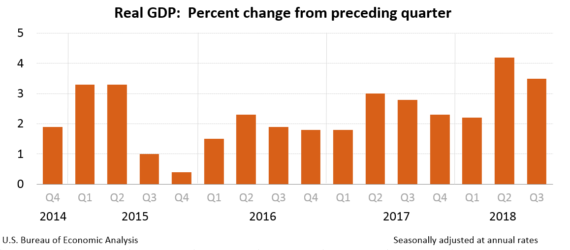

Real gross domestic product (GDP) increased at an annual rate of 3.5 percent in the third quarter of 2018 (table 1), according to the “advance” estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.2 percent.

The Bureau emphasized that the third-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see “Source Data for the Advance Estimate” on page 2). The “second” estimate for the third quarter, based on more complete data, will be released on November 28, 2018.

The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, state and local government spending, federal government spending, and nonresidential fixed investment that were partly offset by negative contributions from exports and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased (table 2).

The deceleration in real GDP growth in the third quarter reflected a downturn in exports and a deceleration in nonresidential fixed investment. Imports increased in the third quarter after decreasing in the second. These movements were partly offset by an upturn in private inventory investment.

Current dollar GDP increased 4.9 percent, or $247.1 billion, in the third quarter to a level of $20.66 trillion. In the second quarter, current-dollar GDP increased 7.6 percent, or $370.9 billion (table 1 and table 3).

The price index for gross domestic purchases increased 1.7 percent in the third quarter, compared with an increase of 2.4 percent in the second quarter (table 4). The PCE price index increased 1.6 percent, compared with an increase of 2.0 percent. Excluding food and energy prices, the PCE price index increased 1.6 percent, compared with an increase of 2.1 percent.

The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, state and local government spending, federal government spending, and nonresidential fixed investment that were partly offset by negative contributions from exports and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased (table 2).

The deceleration in real GDP growth in the third quarter reflected a downturn in exports and a deceleration in nonresidential fixed investment. Imports increased in the third quarter after decreasing in the second. These movements were partly offset by an upturn in private inventory investment.

Current dollar GDP increased 4.9 percent, or $247.1 billion, in the third quarter to a level of $20.66 trillion. In the second quarter, current-dollar GDP increased 7.6 percent, or $370.9 billion (table 1 and table 3).

The price index for gross domestic purchases increased 1.7 percent in the third quarter, compared with an increase of 2.4 percent in the second quarter (table 4). The PCE price index increased 1.6 percent, compared with an increase of 2.0 percent. Excluding food and energy prices, the PCE price index increased 1.6 percent, compared with an increase of 2.1 percent.

As this chart shows, the rate of growth in the third quarter stands slightly below where it was for the second quarter of the year, and better than what we have seen for previous years: (click to enlarge)

The New York Times notes that the rate of growth, which comes in the first of three reports regarding Gross Domestic Product Growth in the third quarter of the year, was slightly above the expected growth rate of 3.4% and also takes note of the potential political impact of the numbers:

Analysts had expected the economy to slow somewhat after a blockbuster second quarter, and the economy remains on track to grow 3 percent or more this year, the first time it has achieved that pace since 2005.

On the surface, the numbers appear very strong, but the underlying picture is more mixed.

“Clearly a strong headline but the details are a little less robust,” said Michelle Meyer, who leads United States economics at Bank of America Merrill Lynch. “There was very little increase in equipment investment and a decline in residential investment. And there was a particularly large increase in inventories, which is not sustainable.”

Ms. Meyer said the jump in inventories could pose some downside risk to her estimate of 3 percent growth in the fourth quarter.

For now, consumers remain the bedrock of the economy. “What’s most notable is the strength in consumer spending,” Ms. Meyer said. “The consumer had momentum coming into the year and the tax cuts further fueled that.”

Business investment barely increased in the third quarter. Since surging in the first three months of the year after a big cut in corporate tax rates, businesses appear to have scaled back their spending.

“You really lean back in your chair and wonder whether this enormous tax cut that was given to corporations only lasted three months,” said Torsten Slok, chief international economist at Deutsche Bank.

Looking ahead, Michael Gapen of Barclays said he was not expecting a big rebound in business spending and that “if you’re banking on strong G.D.P. growth, you need business investment.”

President Trump has not been shy about claiming credit for the strong economy, even though many trends, like falling unemployment, were firmly in place under his predecessor, President Barack Obama. Still, with less than two weeks to go before the midterm congressional elections, the Republicans will probably use the strong growth of recent months to argue that they have been good stewards of the economy.

“There will come a day of reckoning for the economy after the tax cuts monies are all gone,” Chris Rupkey, chief financial economist at MUFG Union Bank, said, “but for today Washington really has something to crow about.”

For now, government largess is helping to lift the economy. Federal spending rose 3.3 percent in the third quarter.

Another wild card is the effect from one of Mr. Trump’s leading economic moves, increasing tariffs on $250 billion in Chinese imports. The president has also raised tariffs on imports from elsewhere, including on products like steel, aluminum and solar panels. So far, there is little evidence that the administration’s trade policies have reduced growth much.

A surge in soybean purchases by buyers seeking to act before retaliatory Chinese tariffs kicked in helped lift growth by about half a percentage point in the second quarter, economists say. But that uptick reversed itself in the third quarter as overall exports dropped and imports increased.

“One interpretation of the data is that the trade war is not having the intended effect of boosting exports and lowering imports,” Mr. Slok said. “Another interpretation is that the trade war can’t do much about that. If the consumer spends more, you will have more imports.”

The Washington Post takes a similar tack, but also notes that the third quarter does seem to have cooled off the economic growth we saw earlier this year:

The U.S. economy slowed in the third quarter to a still-strong 3.5 percent annual growth rate, as free spending from consumers and the federal government carried the load.

Growth dipped from the second quarter’s 4.2 percent rate, but the economy still posted its best back-to-back quarters in four years and is within reach of the Trump administration’s 3 percent annual growth target.

“Despite all the hand-wringing about the (stock) market, the economy is looking pretty good,” said Ethan Harris, head of global economics for Bank of America Merrill Lynch. “The story here is a double dose of caffeine from tax cuts and spending increases.”

Strong consumer and government spending boosted growth in the July-September period. A buildup in goods inventories also helped, suggesting potential weakness ahead if companies lower production while selling off any backlog

“That’s probably telling us that growth in Q4 will be a bit slower paced,” said Ben Ayers, senior economist for Nationwide Insurance.

Business investment was surprisingly weak, growing by just 0.8 percent in the quarter after an 8.7 percent gain in the previous three months. The administration advertised last year’s corporate tax cut as a spur to business spending on new machines, computers and factories. Yet any gains seem to be fading fast, the report showed.

Spending on new structures fell by 7.9 percent after increasing by 14.5 percent during the prior period.

Another major negative: Trade sapped the $20.7 trillion economy’s strength as imports outpaced exports by a rising margin, the report said. The president has made shrinking the trade deficit a key goal but has yet to see any progress after 21 months in office.

Instead, his threats of additional tariffs on Chinese products may have encouraged U.S. companies to ramp up imports to beat rising prices, economists said.

“The details for growth were not as impressive as the 3.5% headline,” said Jim O’Sullivan, chief U.S. economist for High-Frequency Economics.

The third-quarter results fell short of expectations set by the president, who had promised in July that the third quarter figure would be “a lot higher” than the second quarter’s 4.2 percent.

Shortly after taking office in 2017, the president promised a “return to 4 percent annual economic growth,” a mark the U.S. hasn’t achieved since 2000. But administration officials such as Treasury Secretary Steven Mnuchin more recently have described years of 3 percent annual growth as the objective.

“The economy is still growing significantly above its potential, which is pretty remarkable,” said economist Michael Strain of the American Enterprise Institute, citing an expansion that has not experienced a recession since 2009.

The Commerce report comes as Trump this week again attacked Federal Reserve Board Chair Jerome H. Powell for raising interest rates, calling the nation’s central bank the “biggest risk” to continued growth.

As a preliminary matter, it’s worth emphasizing that this is an advance estimate of the state of the economy in the third quarter. We’ll get a better idea of what the economy is doing when the second and final revisions come out at the end of November and December respectively. It’s also worth noting that this is a quarterly number and that the actual annual rate for the year is likely to be significantly different. At the same, though, there’s no denying that these numbers are better than what we’ve seen in recent years and that the economy is growing at a healthy enough pace that a downturn seems to be unlikely in the future. In fact, rather than a downturn, the immediate concern that is likely to influence the Federal Reserve Board going forward is the concern that the economy could end up growing too fast, thus triggering fears of a rise in inflation which would have its own detrimental impact on economic well being. In that regard, though, it’s worth noting that these GDP numbers come at the end of a week of mixed economic news. Yesterday, for example, it was reported that durable goods orders grew at a slightly better rate than expected and that new claims for unemployment are still at record lows unseen in the past fifty years. At the same time, though, home sales were off their estimated mark and other figures showed that the economy may not be quite as strong as the rate of GDP growth implies.

These numbers also contain some areas of potential concern that could negatively impact growth in the future. For example, business investment remains low notwithstanding the measurable benefits that corporations and businesses have received from the tax cuts enacted in December. This runs counter to what many advocates of those cuts expected, namely that the cut in corporate taxes would lead to increases in business investment and hiring that would help to sustain a strong economy not just in 2018, but for several more years to come. That does not appear to be manifesting itself, which is not surprising given the fact that many corporations have been using their tax savings for things such as stock buybacks rather than for investment. Additionally, it’s probable that much of the tax savings that is being invested in an expansion is being used to help increase automation rather than the type of spending that would require additional spending. This, of course, is a reflection of the fact that, for many manufacturers, automation is generally less expensive than increased hiring due to the costs of labor, which include not only salary itself but also things such as health care benefits, training, and other related costs. Finally, as we’ve seen in connection with several recent jobs reports, some employers have reported that hiring has proven to be more difficult than anticipated due to a lack of properly trained or qualified applicants. Because of this, the actual benefit of what business investment there has not led to massive increases in hiring such as what we’ve seen in the past.

Another factor worth noting is that the tariffs do appear to be having a noticeable impact on American exports, thus harming American agriculture and manufacturing. This could be one factor in the decline in business investment, but it’s difficult to assign just one reason to a decision that is likely to be influenced by a number of factors. Interestingly enough, though, they don’t seem to be having much of an impact on imports Part of this could be due to the fact that imports during the third quarter were already “locked in” orders placed prior to the imposition of tariffs, as well as needed increases in inventory as retailers prepare for the upcoming holiday season. This suggests that Trump’s tariffs are not having their desired impact of helping American industry

With less than two weeks to go until Election Day, the biggest short-term question is what impact all of this will have on the economy. These positive numbers, as well as what seems to be a generally optimistic view that seems to exist regarding the state of the economy, is likely to enure to the benefit of Republicans in the upcoming election and could prove decisive in close races. Ordinarily, the state of the economy and the individual economic security of voters is among the strongest motivators when it comes to determining who they will vote for. This could help Republicans stave off a blue wave even if it doesn’t completely prevent Democrats from taking control of one or both Houses of Congress. This is partly reflected in the fact that while the President’s overall job approval remains very negative, his job approval on the economy is essentially the exact opposite, with 51,4% approving of the President’s performance in this area and 42.8% disapproving. With numbers like this, the economy could be the thing that helps to save the GOP to some extent in November.

The US economy has grown at a rate of 3.1 % since 1947. Obviously, it was much better in some years and worse in others. When we had the sharp downturns of ten-twelve years ago, i.e. the Great Recession, the Obama administration responded with some economic stimuli. Some people thought the interventions were overdone and represented improper government interference in the economy. Others thought that Obama’s stimulation was too feeble and pointed to the lack of a big rebound that usually follows downturns. I am not qualified to pick a side here. I hope smart people are studying the problem because there will always be downturns and preventing downturns from becoming recessions or even depressions will always be important.

1. Reliance on inventory investment is undeniable. It would have been helpful if the commentators would have at least estimated how much was replenishment and how much build in advance.

2. The Fed effect is underestimated. Those discounted cash flow models are very sensitive over time to the discount rate. The effect on housing is already being felt.

3. Lots of flapping of lips by the economists. Their (poor) track record speaks for itself.

4. The trade issues are really unknowable right now. For everyone buying more expensive goods there is someone employed. Anyone who tells you how it’s shaking out net net is lying.

5. Maybe fewer cheap immigrant laborers would spur investment.