Is The PPACA “The Biggest Tax Increase In History?” Not Even Close

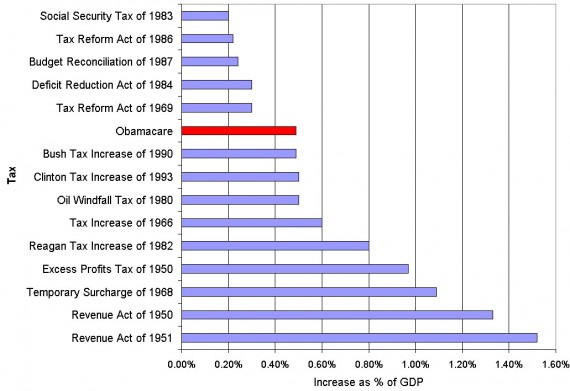

In the days since the Supreme Court’s decision in the ObamaCare cases, many Republicans have followed the lead of Rush Limbaugh to claim that, because of the Supreme Court’s decision that the PPACA’s mandate is authorized under Congress’s power to raise taxes for the “General Welfare,” the law is the biggest tax increase in history. As it turns out, and actually not quite surprisingly, that isn’t even close to being true. Politifact was the first organization to take on the claim, rating it “Pants On Fire” inaccurate and providing this list of the actual largest tax increases in history:

As a percent of GDP, here are the top five tax increases from 1940-2006, according to Tempalski:

1. Revenue Act of 1942: 5.04 percent of GDP;

2. Revenue Act of 1961: 2.2 percent of GDP;

3. Current Tax Payment Act of 1943: 1.13 percent of GDP;

4. Revenue and Expenditure Control Act of 1968: 1.09 percent of GDP;

5. Excess Profits Tax of 1950: .97 percent of GDP;

And here are the top five tax increases from the “modern” era of 1968-2006:

1. Revenue and Expenditure Control Act of 1968: 1.09 percent of GDP;

2. Tax Equity and Fiscal Responsibility Act of 1982: .8 percent of GDP;

3(t): Crude Oil Windfall Profit Tax Act of 1980: .5 percent of GDP

3(t): Omnibus Budget Reconciliation Act of 1993; .5 percent of GDP;

5: Omnibus Budget Reconciliation Act of 1990; .49 percent of GDP.

And the PPACA? Well, here are the numbers:

The list obviously does not include the health care law, which passed in 2010, and a spokeswoman for the Department of Treasury says it hasn’t been updated. So we calculated our own percent of GDP figure. We used 2019 as our baseline because that’s when all of the tax provisions of the law will be in effect. In 2019, the CBO estimates, the government will see increased revenues of $104 billion. We then divided that number into the projected GDP for 2019, which according to the CBO economic forecast is $21.164 trillion. That would mean the tax increase provisions of the health care law would amount to .49 percent of total GDP.

Depending on your rounding, that would mean the tax increases resulting from the health care law would be about the size of tax increases proposed and passed in 1980 by President Jimmy Carter, in 1990 by President George H.W. Bush and in 1993 by President Bill Clinton.

Economist Austin Frakt looked at data going back to 1950 and came up with this chart:

It’s understandable why the GOP would want to associate the PPACA with taxes in the mind of the public now that Chief Justice Roberts has opened the door to that argument. The PPACA itself has been unpopular for some time now, and taxes are even less popular, put the two together and you’ve got a brand new argument to rally the opponents of the law for the election in November. And, hey, everybody likes a politician who says they’ll repeal a tax, right? So, the political position makes sense. It’s too bad they can’t stick to the facts, though.

How rude it can be to stick to the facts.

I would say Roberts “reminded” people that the ACA bites on the tax form. Duh.

But you know what isn’t emphasized? That every single person arguing this for policy reasons, in congress, in a think tank, or in the media, is covered by health insurance, and their bill is zero.

It’s an argument about a tax which none of the arguers will pay.

We are talking about Republicans here.

Anyone want to place bets as to how many of the commentors at OTB will somehow “miss” this posting?

@mattb:

They will probably also miss this bit from the presentation:

I’m assuming Limbaugh meant in terms of dollars, because if he had specified as percentage of GDP then there would be explicit quotes showing such.

And let’s remember that ObamaCare passed with one single GOP vote from either House, which means the Democrats own this tax lock, stock, and barrel.

It’s already fun watching them run from the “tax” label.

@Jenos Idanian #13:

Idiot. And I say that in the kindest possible way.

None of your comment made sense. Limbaugh meant it in terms of BS. Fixed that for you.

Second, why do you wingnuts think that Obama is surprised that the law he wrote, with a spot on the tax form to put down whether you have insurance, is a tax?

Third, do you have health insurance? If not, honestly why not?

@this:

I think idiot down-voters should answer this:

From a pure dollars perspective, where does this tax increase fall? I read the Politifact review and it only uses percentages.

@Jenos Idanian #13:

I’m assuming Limbaugh meant in terms of dollars, because if he had specified as percentage of GDP then there would be explicit quotes showing such.

Why do you assume that? Is it because you think Limbaugh is either an idiot or a liar like yourself? Because comparing tax increases from many decades ago or longer in dollars would make no sense because of these little things called inflation and population growth, and even with those, it is nowhere near true that the PPACA is “the biggest tax increase in history.”

Looking at taxes over time as a percentage of GDP makes sense. Looking at them in terms of dollars is stupid. So which is it? Stupid or dishonest?

@Dean:

Another way to do it would be to look at each administration and its tax changes (Reagan gets two increases that way), and then inflation adjust them to current dollars. I bet though that you’d come out pretty close to the percentage of GDP ranking.

The thing you really don’t want to do is look at unadjusted nominal dollars. That’s just dishonest.

@Jenos Idanian #13:

And let’s also remember that insurance mandates were initially a conservative Republican idea, which means that Republicans ran from their own idea, which is what they do when a Democratic politician decides to use these conservative ideas in legislation.

I can’t wait for Romney to explain how his health insurance mandate in Massachusetts ruined that state.

@Jenos Idanian #13:

Geez. Since he said on his radio show, how would he pronounce quotation marks? He’s not within a gazillion parsecs of being the genius Victor Borge was.

@john personna:

“Second, why do you wingnuts think that Obama is surprised that the law he wrote, with a spot on the tax form to put down whether you have insurance, is a tax?”

Um, because the administration is still insisting it’s NOT a tax? Like Jacob Lew and Nancy Pelosi?

“And let’s also remember that insurance mandates were initially a conservative Republican idea, which means that Republicans ran from their own idea, which is what they do when a Democratic politician decides to use these conservative ideas in legislation.”

I realize lefties have trouble changing their minds (most haven’t had an original thought since the 60’s), but why do they assume that everyone suffers from this problem?

The only consolation re: Obamacare is that all of you supporters will get the same lousy care as the rest of us. Not a big consolation, but that’s what we got.

@john personna:

Well, all of the bills around the country to outlaw abortion and limit contraception are being introduced & championed by men who’ll never partake of either, so it’s kind of a running theme…

@al-Ameda: And let’s also remember that insurance mandates were initially a conservative Republican idea, which means that Republicans ran from their own idea, which is what they do when a Democratic politician decides to use these conservative ideas in legislation.

So, what’s the statute of limitations on how long bad ideas from one part of one side can continue to be used as representative of the whole side? I can think of a whole passel of bad ideas from Democrats that I’d like to see defended…

Also, please, enlighten us. Just which conservatives or groups came up with it, and how much support did it have?

@alanstorm:

Well, first of all, Romneycare was actually a _good_ thing for the people of Massachusetts, but it’s Romney & the GOP Chorus that are now saying such things are EEEEEVVIL and will destroy any society they are set upon. It’s not that they changed their mind – it’s that they’re actively lying about what Romney did and what effect it had.

And this is the part where you’re actively lying. The consolation is that a whole lot of people who don’t have medical coverage – for whom any health issue more advanced than a head cold can literally bankrupt them – will have any coverage at all.

@Jenos Idanian #13: Wow. You might just be the dumbest person on the whole Internet. Congratulations.

@alanstorm:

I think a lot of the time they are arguing it is not a “tax increase,” and if you have insurance it is not.

Seriously, what is this thread about? “The biggest tax increase …”

Only if you don’t have insurance. Do you?

@legion: How generous of you to offer up your crown, but I must decline it.

@Jenos Idanian #13:

Why was / is the insurance mandate a “bad idea”? If you’re not going to do the most rational thing and go to a single payer health insurance system, then an insurance mandate is a sensible approach.

@Jenos Idanian #13: Then stop saying things like

when every single article about the ACA decision mention the fact that Republicans were pushing this idea back in the 80s and Romney himself instituted in when he was Governor of MA. And that the GOP never considered such things to be “bad ideas” until Obama tried to build a similar program at a national level.

In other words, don’t try to derail a discussion that’s not going where you want it to by such a pathetic, transparent tactic as “forgetting” the entire thread up to this point in time and demanding the other side re-iterate every single argument they’ve already thrown at you.

@alanstorm:

The problem here is that this year Republicans, and their presidential candidate, are changing their minds regularly depending upon which Democratic president has decided to use their policy ideas. In fact, they don’t need to reject the ideas that Democrats have borrowed, they repudiate their professed ideals all the time. Deficits are bad? Not really, Paul Ryan’s budget proposal proved that the GOP does not care one bit about the deficit – cut taxes from 34% to 25%, begin to privatize Medicare, increase defense spending, resulting in no deficit reduction.

I’m not surprised to see the OTB drones pick up this line of bullshit (straight out of How to Lie With Statistics) and run with it.

Good luck in your desperate efforts to convince people that the largest tax increase in history is not actually the largest tax increase in history.

Who knows, maybe a few of them will even believe you instead of their own lying eyes!

@Buzz Buzz:

Buy a book.

I’m not entirely sure that Rush Limbaugh would know the differences between a GDP-adjusted tax increase and a titty bar. I’m not merely being glib. Limbaugh is pretty f’n far away from being the brightest bulb in the display case.

In any event, Obamacare is a huge tax hike, albeit not close to the largest in history, but that’s not even the worst component of the law. The worst aspect of this turkey is that it already has and will continue to result in massive increases in premium costs for employers. The inevitable result is that many employers will rein in their health insurance benefits packages. Leading to the absurd irony of many gainfully employed people having less coverage post-Obamacare than they had pre-Obamacare.

Speaking of irony, Obamacare also will act as a de facto cap on net hiring in various segments of the labor markets. Let me put it this way: If you’re running a company with 45 employees and business is booming and you easily could expand your workforce by a half-dozen or so the chances of you actually doing that are between zero and nada. Nobody outside of Obamacare’s orbit voluntarily will enter it. Business managers are not that dumb.

@Buzz Buzz:

Shorter Buzz Buzz: Yes it is the largest tax increase in history, because shut up, that’s why.

@legion: when every single article about the ACA decision mention the fact that Republicans were pushing this idea back in the 80s and Romney himself instituted in when he was Governor of MA. And that the GOP never considered such things to be “bad ideas” until Obama tried to build a similar program at a national level.

In other words, you just mouth the talking points, you don’t try to understand them. Got it.

Let’s just take on one part of that spiel that I actually understand — the Massachusetts plan was created and passed by an overwhelmingly Democratic (over 85%) legislature. Romney’s input was largely limited to shooting down some of the worst aspects of the plan. Romney didn’t originate the plan, and had he vetoed it the Democratic legislature (over 85% Democratic) would have overridden his veto without working up a sweat. Romney had to choose between riding the tiger and being eaten by the tiger.

But my point was not to challenge the facts, but to challenge you. Can you actually back up your own talking points? Do you actually understand what the hell you’re saying? Can you put names and dates to what you keep spouting?

Apparently not.

@Tsar Nicholas:

A tax increase for whom, exactly? I’ve asked a number of times in this thread if anyone here is uninsured, and why. If they are insured, there is no increase.

If they are uninsured, I think we feel for them, and would want them to be safer and more protected.

On this:

Is that what happened in Mass? Why do they have low unemployment? Whatever the reason, it obviously isn’t their mandate … unless you think the mandate increases jobs?

On using percentage of GDP, here is a good page explaining it all.

@Jenos Idanian #13:

I’m sure you’ll enjoy the coming video, the ads in which Romney says how proud he was of that bill.

Here’s an early sample.

(Man, Mitt just gave the best defense of the individual mandate we’ve heard!)

@Jenos Idanian #13: That is some sweet, sweet historical revisionism there. For everyone else that cares, in 2008 Romney was proud of the Mass health care reforms and they were a positive achievement, not something he was forced to do. And not only did Romney tout the reforms, plenty of other GOP officials including Jim DeMint listed the Massachusetts health care reforms as a reason to support Romney.

@Jenos Idanian #13: What John Personna said. You just can’t grasp that Romney, et al have already admitted every single point you’re arguing against.

@Jenos Idanian #13:

Romney introduced the original proposal for Massachusett’s health care reform, dumbass. Why do you think they call it Romneycare?

But my point was not to challenge the facts, but to challenge you.

So says the person the facts have shown to be an idiot.

For those who care about the history of the Massachusetts plan, let me suggest starting with the Wikipedia page:

http://en.wikipedia.org/wiki/Massachusetts_health_care_reform

Here are a couple key bits of history from the article (all, btw, are sourced) which tie into a number of points currently being discussed:

@al-Ameda:

If you support the Obama administration, which first said “It’s not a tax!” to get this monstrosity passed, then said “It’s a tax!” before the supremes, and are now saying “It’s not a tax!” again, you have no standing to argue that Repubs are changing their minds.

Not quite as fun as watching the Romney camp run away from the “tax” label…

Oh, no one needs to worry about Republicans except for the GOP presidential candidate himself…are Republicans sure they want to stick with him?

@alanstorm: Obama said it wasn’t a tax. The Supreme Court says it is. The Republicans say it’s SOSHALIZUM and will destroy the healthcare industry & good ‘ol Amurrican entrepreneurialism, despite the evidence they themselves supplied by implementing it years ago.

So yes, we will continue to mock the GOP – not for changing their minds, but for blatantly lying and/or being idiots.

Republicans lied?

Next you wil tell me Anderson Cooper is gay.

Well, it does seem like Obama has changed his mind on whether its a tax, just as Romney changed his mind on whether its a good idea.

For my part, I guess its better than nothing, but its a far cry from a private/public system like they have in many parts of Europe, and which seems to work the best.

@Buzz Buzz: So aside from asserting it loudly, how exactly is this the largest tax increase in history?

@Jenos Idanian #13: @alanstorm: @Jenos Idanian #13: @Buzz Buzz: @Tsar Nicholas: @Jenos Idanian #13:

Heh heh…. Heeehee…. Bwhaa HAA hAAHAAHHAAAAHAAAHAAA HAAAA HHHAAAAHAAAAHAAAHAAAAAAAAAAAAAAAAAAAAAAHAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA

Gaaaassssp… wheeeeeeeeeeeeeeeeeeeeezzzzzzzzzzzzzz (2 many cigs over the yrs)

You guys need to take this show on the road. I’ll bet you could make as much as the ACA raises in taxes.

And before any of you complain that I have added nothing to this conversation, I have 2 replies:

#1, neither have you.

#2, I, at least, have added the absolute, complete ridicule each of your fact free, revisionist comments so richly deserve.

ps: for the record, as a union carpenter I am blessed to have some of the best insurance coverage in the country. My oldest son, by virtue of his turning 26 in 9 days, will lose it. Under the ACA, he will have choices. Under the GOP plan…. Oh, I’m sorry, the GOP doesn’t have a plan…. He will get left to twist in the winds of misfortune.

@Tsar Nicholas: You are wrong here Tsar – Limbaugh is brilliant – he’s telling a bunch of dim bulbs what they want to hear and making millions.

@john personna: Your mastery of the English language is amazing. My young children argue more eloquently than you.

First, what is the track record of the CBO in accurately predicting the cost of anything? In case you need an assist, the answer is “not very good.” The prediction cited in this post will likely prove to be just another example. In order for 2019 GDP to be ~$21 trillion, the economy will need to grow at a rate exceeding 5% for the next 7 years. As I’m sure you know, the rate of GDP growth from 1947 to 2012 has averaged 3.25%. Real GDP growth in the first quarter of 2012 was at a 1.9% annual rate.

Second, the original CBO estimate almost certainly understates the cost since it counts 10 years of tax revenue and only 6 years of costs. In fact, the recently revised CBO estimate puts the cost of ACA at $1.76 trillion compared to the 2009 estimate of $940 billion. The chief reason for the increase is that the new estimate includes 3 years during which the coverage provisions of the law will be in effect that were not included in the original.

Whether or not this proves to be the largest tax increase in history remains to be seen. However, the argument that it is not, as set forth in this article, is suspect.