Post Hoc Ergo Propter Hoc

Did World War II teach us anything about spending-as-stimulus? Not really.

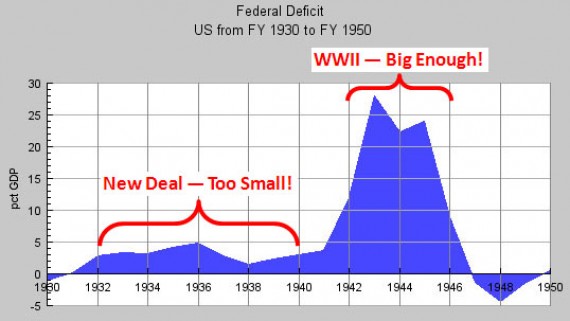

Responding to critics who point out that Franklin Roosevelt’s New Deal didn’t end the Great Depression and that the American economy didn’t fully recover until after World War II, Kevin Drum posts this chart:

And makes this point:

So why, then, isn’t that a good model for getting us out of our current slump? WWII featured five years with federal deficits above 10% of GDP, three of which were above 20% of GDP. And although WWII might have been a good thing for global freedom, all that spending was for war materiel that was completely useless to the U.S. economy. If we repeated this today, we could do better than that even if half the stimulus spending was meaningless makework.

So what’s the deal? Did WWII rescue the American economy or not? And if it did, what’s the argument for not trying it again, but without the war?

I’m not aware of anyone who makes the argument that Drum seems to be responding to. It’s true that the ramp up in war spending that began around 1940, and the switch to a near total war economy after December 7, 1941 and that this put a lot of people who had been previously unemployed to work, or put them in the armed forces and put a weapon in their hand. This wasn’t an economic recovery, though, so much as it was a near complete abandonment of the consumer economy and transition to a command-based economy that was devoted solely toward production that benefited the war effort. It wasn’t until after the war ended, the command economy largely abandoned, and millions of men came home that the economy recovery began, and it was made possible in large part because normal demand had been suppressed for so long in deference to the war effort. It wasn’t the spending on the war that created the recovery from the Great Depression, it was the end of that spending and the return to a normal economy, along with the fact that the United States stood alone as the only industrialized nation that had gone unscathed by the ravages and destruction of war.

Drum makes the mistake of looking at the post-war economic boom, looking at the war spending that took place between 1940 and 1945, and thinking that it was the spending that caused the post-war boom. It’s fairly clear, though, that this simply cannot be the case, and that Drum has gotten himself caught in a post hoc ergo propter hoc fallacy. Considering that most of the money that was spent during those years was spent on things that were either blown up, or used to blow things up, that’s a highly dubious conclusion to say the least.

Not surprisingly, history doesn’t really support Drum’s attempt to turn this into vindication for some program of Super-Keynesian pump priming:

Economically, however, World War II did not spark a recovery so much as it created a financial bubble—not in Internet stocks or housing but in munitions. Once the war was over, the bubble collapsed along with the demand for aircraft carriers and B-17 bombers.

(…)

World War II forced Roosevelt to concentrate on a single area of production: weapons. This focus was maintained for the duration of the war and resulted in a sustained economic bubble. Without a similar attention-focusing crisis, however, current government attempts at stimulus will simply result in economic effervescence—tiny bubbles inflating and bursting as the winds of politics shift lawmakers’ attention. Call it the Don Ho School of Economic Thought.

(…)

Contrary to popular belief, the “public works program” known as World War II did not end the Great Depression; it ended the New Deal. The end of the war brought federal spending and tax cuts and the repeal of the Smoot-Hawley tariffs. All these changes combined to pull the nation’s economy out of its long and painful slide, and all could have been made without the war. Similar changes made now could restore the world’s economy without the massive human suffering that, in their absence, is all but inevitable. Inevitable, yet so avoidable and so unnecessary.

Drum’s argument is essentially the same one that Paul Krugman makes in The Return of Depression Economics and the Crisis of 2008, in which he points to the argument that it was war spending that ended the Great Depression and prescribes the following remedy for the then-still-developing economic crisis:

“Let the government borrow money and use the funds to finance public investment projects—if possible to good purpose, but that is a secondary consideration—and thereby provide jobs, which will make people more willing to spend, which will generate still more jobs, and so on.”

Krugman, like Drum, thinks that all we need to do is spending a ton of money and we’ll be fine. It doesn’t even have to be on anything productive, although I guess that could be a side benefit. Spending money unproductively somehow creates economic growth in his universe. It’s an attitude that completely explains Krugman’s obsession with Broken Window Fallacy defying arguments, and Drum’s failure to comprehend that spending billions of dollars on munitions, ships, and planes does not create economic growth, it merely creates the implements of destruction. In both cases, though, I’m beginning to notice a fixation on war and disaster on the part of Keynesians, because apparently creating something useful doesn’t really occur to people who live in Ivory Towers.

Krugman believes that there is a multiplier for economic growth with public spending, so that $1.00 in spending creates $1.00 + X in GDP growth. Holding that belief, it really doesn’t matter what you spend the money on, as long as it creates employment and stimulates consumer spending.

But neither does the Post Hoc fallacy mean that all theories of the past are, automatically, wrong.

The theory that WWII provided economic stimulus is very old, and was for a long time rarely questiooned.

Don’t you think it is suspicious that it is suddenly en vogue to doubt it? When current stimulus becomes a question, THEN it’s important to re-factor WWII as stimulus and etc.

@john personna: The theory that WWII provided economic stimulus is very old, and was for a long time rarely questioned.

I know Doug seems pretty reasonable compared to other conservatives out there, but he is a guy who implied a few days ago that the U.S. has been on the wrong road for the last 75 years.

Mike

Stick to law and politics. You are way out of your depth when discussing economics.

It doesn’t seem to matter how often “conservative” ideas like tax cuts create jobs are shown to be utter nonsense, you plow on every day with the same tired rhetoric.

The economy was a complete disaster after the Bush years, yet Republicans just want more of the same failed policies (and Obama is giving it to them).

In this case: seconded.

The fact that we already had two threads in which your misunderstanding of stimulus spending has been explained in lawyer-compatible language, combined with the fact that in neither case you deemed it necessary to defend our view or offer a rebuttal makes it unceasingly obvious that these topics have nothing to do with analysis and all with party propaganda.

Simply repeating the same claim time after time, ignoring critique, won’t do much for your credibility.

Government stimulus spending over the long-term is a zero sum game.

That’s not to say, however, there isn’t a place for some large quanities of federal spending in connection with the current economic crisis.

Hell, I’m to the right of Attila the Hun but even I can get in touch with my inner Keynes from time to time. For example, I would have no problem with some serious federal spending on all of the following:

– Loan guarantees for construction of several score nuclear power plants.

– Direct spending on more dams, thereby to ramp up hydroelectric power supplies.

– More submarines and guided missile cruisers to help keep China in line vis-a-vis Taiwan.

– More Global Hawks and Predator drones to help whack Jihadi vermin.

– Expansion and acceleration of the F-35 program, to ensure our air forces retain superiority over the next few decades.

– Better fences and related hardware along the southern border.

The foregoing costs can and should be offset with cuts to misguided, useless and insolvent programs and useless agencies, such as Medicaid, Social Security, federal education spending, AFDC, the EPA, the NEA, Sallie Mae, green energy, Fannie Mae and Freddie Mac, etc.

Problems solved.

To be even less kind, let’s step back to what the biggest news of the day is: zero job growth.

Blast from the past, September 21, 2010:

That is what Doug (and OTB in general) should be facing up to, but instead he does the craven meme dance, and indirectly attacks stimulus in general.

Stimulus is not what got us to zero jobs growth in mid-2011, austerity did that.

@Tsar Nicholas:

It is probably bad strategy to lead with nukes in a post-Fukushima world.

(Desert solar-thermal never killed anybody (arguably some tortoises) and is massively cheaper to implement.)

In these cases I would be for digging and re-filling holes. At least filled-in holes have no ongoing maintenance and operating costs.

The only reason to respond to a post like this is to shout down nonsense. Doug actually engaging commenters and defending his work is never going to happen, which is a shame as it’s an opportunity for everyone involved to learn.

@Ebenezer Arvigenius: Yes, but he’s going to pay for all these new toys that kill people by slashing programs that keep people alive. He’s really the perfect Republican — he hates humans so much that the only thing he considers worthy of tax money is new ways to kill them. Health care? Social security? Let them all die.

@Doug

Could you please droo the broken window fallacy? The argument within it is itself a fallacy, an inverse of Fallacy of Composition. Krugman knows this because he understands macroeconomics, and that the rules which apply to individual transactions often do not translate to the aggregate.

In 1929, personal debt was about 130%the of GDP. By the end of WWII it stood at about 65% of GDP. How did it drop? People must have had jobs to pay it down. Where did they come from? The fastest rate of growth in the 20thend century occurred in what years? It certainly looked like it worked. Does that mean it will work now? Probably not since we started out with a much larger debt load due to increasing debt starting in 1980the when we stopped being fiscally conservative.

Steve

Just to spare the fringe right amateur economists further embarrassment, here’s the pre-WWII GDP growth numbers under FDR

1933 -1.3%

1934 10.9%

1935 8.9%

1936 13.0%

1937 5.1%

1938 -3.4%

1939 8.1%

1940 8.8%

1941 17.1%

Needless to say, the economy grew even faster during WWII.

Bringing up the broken window fallacy over and over and over is an example of the broken record fallacy. For you younger readers, a record was a black plastic thing that… oh never mind.

@Doug:

This strikes me as a wholly unfair characterization, as the point is not the destruction (especially not, as I noted at the time, the alien invasion scenario). One can dislike the policy prescription, but what Krugman is arguing for is massive stimulus (and, indeed, he has been arguing for such for two years or so).

Further, regardless of whether one think Krugman is right or not, the Broken Window Fallacy is simply not a counter-argument to what he is proposing. It simply isn’t.

(I hit “post” too quickly”).

Krugman, Drum, et al. are not arguing that destruction is good or that breaking things creates wealth, but that they pointing out that fixing broken things, especially via deficit financing, can infuse money into an economy. It is a stimulus argument. Again: one may reject it all one wants, but the BWF does not refute it.

I read this Forbes article, No Paul Krugman, WWII did not end the Great Depression,that dismisses the Keynesian theory application, something which Krugman continually espouses in claiming a greater stimulus would escalate our recovery.

Instead of paraphrasing, I am going to include a rather long and convincingly written excerpt.

The emboldened part is my doing. It so simulates the whole debt ceiling crisis — the urgency for more money because the last sum was used up and probably wasted. And, the closing remark, about common sense is such a common denominator when enumerating differences from progressive thinking versus conservative. Progressives are primarily engaged in theoretical acrobatic musings, while conservatives confine much of their debate to ‘what works and what doesn’t,” — pragmatic approaches involving personal experience. This is the chasm that unfortunately separates these two mind sets from mutual collaboration.

Jan,

All you’ve done is regurgitate some fringe right talking points, using bold doesn’t make them less crazy.

I admit it is bad taste to create an article ad hominem, but the guy Jen linked is (expectedly) just too precious. His bio is condensed tea-party boilerplate at it’s absolute best (I hope I will come to content later):

@jan:

PBS just showed a documentary on the 1929 stock market crash. And while they had the roaring 20’s, many indicators were showing that the underlying economy was not doing as good as reported. And I liken the Bush era the same. During Bush’s term, he borrowed for his tax cuts, borrowed for war, and neglected our infrastructure. The housing industry was falsely targeted by both parties for growth and we closed some 57,000 factories and sent some 6 million jobs overseas. All the stimulus of tax cuts was used up and even during that time the fed printed money.

Now that we lost all the stimulus and that there is no private economy, at least where I live, the question is, with 2 billion cheap laborers who are part of our free market system and who want jobs at lower wages than ours, just what is going to make up all those lost jobs? What widgets can be made here and not some other country? If we had the tax cuts all these years-a trillion dollars, borrowed and spent, what will stimulate our economy and what product or service will it be?

Bush had his roaring 20’s, a fake economy, and with his laissez-faire in not solving problems has got us here. So now, after spending a trillion dollars on tax cuts and seeing its failure, the right now says it is corporate tax rates that will create jobs. What perturbs me, is that they did the great trickle down and it did not trickle down, all that money is spent and now the pundits say it is corporate tax rates. So, we go from one theory after another while the middle class lost.

My anger is that when Bush came to my state and said “free trade is good” that we saw the factories close. Now, no matter what you do, whether you spend or have tax cuts, you want results. If those results do not work, then why keep persisting on it and keep destroying the middle class? I could see the problems in 2004, of deficits and debt, factory closings, our money going to Iraq, and the neglect of our infrastructure. I waited and waited for something to get done, and all we got was “stay the course.” And with that our country and two wars were run into the ground. While Obama seems to be lost, it is most difficult to get out of a situation that has been provoked and ignored for so many years.

The repetition is precious. The federal spending cuts did NOT create private jobs, so let’s all talk about 1940 instead.

@jan: Gosh, Jan, you still have no idea that there’s a difference between an article, which is meant to state facts, and an opinion piece, which this is.

But even more hilarious is the source you’re quoting. If you follow your link and read his other “articles,” you’ll find the one where he says that poor people should not be allowed to vote, that people who don’t own property should not be allowed to vote, that public employees should not be allowed to vote, and that presumptive voters should be made to pass literacy tests. In other words, you are cheering on a man who is fighting to bring back Jim Crow as a way to “save” America.

Well, now we know who you are.

@Ebenezer Arvigenius: Apparently the vision of the founders he wants to bring back is restricting voting to property-owning white males. Hooray for the Tea Party!

@Gerry W.:

Gary, first off I always read and ponder your posts, as they are legitimately laid out and ask relevant questions, that unfortunately, for the most part, can only be answered more by conjecture than anything else.

In the excerpt above, you talk about “spending” a trillion dollars on tax cuts. This is where I see it differently than you do. Taxes are not earned by the government, but are rather the earnings of others that are taken by the government. The government’s only loss was that they had less money of the peoples’ to spend the way they saw fit. And, as it has been proven, over and over again, the government is oftentimes a poor bookkeeper and distributor of others’ monies.

In the often referenced Great Depression, FDR did everything he could to tax “rich” people, tripling taxes, pushing legislation through that would financially punish those who even withheld investment savings by enacting repetitive legislation such as the Wealth Tax Act of ’35, etc. However, the best UE rate he could ever achieve with his policies of redistributing the wealth of others was 14%. I would call that a failure. And, much of his New Deal legislation was eventually struck down as unconstitutional by the courts

These attacks on the rich, though, was validated by the New Dealers’ entire premise and legislative push as being that the Great Depression was caused by people who controlled too much wealth,casting this class as the instant villains, and the one who should bear the brunt of recovery, at all cost.

However, later analysis of this era paints a different picture showing that major factors bringing on the Great Depression were the severe monetary contraction that the Federal Reserve presided over, unit-banking laws that made it impossible for small town banks to diversify, high wage policies making it more expensive for employers to hire people, the Smoot-Hawley tariff that adversely effected trade, and the 1932 tax hikes. Also, the main reason investors lost so much money between ’29-’33 wasn’t because of stock market fraud or abuse, as much as simply that the stock market went down. Just like our sub-prime mortgage debacle, where people bought homes they couldn’t afford, so did people over-invest in risky stocks.

But, the blame game often looks around for the usual suspects to attach “cause and effect” to, those being those who have more than others. That is what is currently happening too. We are experiencing a re-make of the Great Depression, including a push for all the social progressive New Deal remedies that didn’t work then, extending a depression into a Great Depression. And, they’re not working now, as we are seeing ourselves going south, economically, with more and more people holding on to their monies, or going elsewhere to more favorable economies. Overtaxing the rich, giving Unions more power, pandering to more constituencies and increasing our deficit by redistributing the wealth of some to aid others will not stabilize our economy or create more private sector jobs. All it will accomplish is to nourish a bigger centralized government who will have to become more rigid and dogmatic as time passes to please all the people it is beholding to.

I think the way out is to loosen regulations (like Obama started to do yesterday), give business more assurances and stop the finger-pointing, unemployment insurance should have some work attached in receiving it, tax reform where loopholes are tightened (achieving more revenues) while margins are reduced (giving incentives to expand)…..small business and big business should be brought in as consultants on how to bring business confidence back in a non-punitive way, including business that has gone overseas.

Whether you like business or not, they are the engines of a country’s economy. If one marginalizes them, if the government makes them the enemy of the people, only an economic stalemate will follow, along with the creation of an indefinite nanny state totally dependent on the government’s good graces to survive.

@jan:

Your second paragraph. You can go by ideology all you want as we heard it over and over again that it is our money and not the governments, but ideology only goes so far. Whatever is done, you still have to make capitalism work. It does not work by itself. Now that may be tax cuts, low interest rates, cutting spending, or government spending to keep its infrastructure working. But if you abuse any situation, then it is just a waste of time and the people in the middle are worse off.

Take the Bush tax cuts. He could have had a recovery just by having two or three years of tax cuts, and the economy would have recovered. There are many aspects of what Bush did and did not do. He was at a pivotal point on many fronts. We had an economic recovery for some 25 years and unemployment was lower than 5% on his watch. But this is when you should have more concerns and not having concerns after the fact when we see the high unemployment for today, because Bush was solely relying on his tax cuts for a recovery on borrowed money. At the same time, Bush borrowed for his wars and that added to the deficits and debt, hence, a “guns and butter” economics. And talking about arrogance, Cheney said “deficits don’t matter.” You cannot have two for the price of one. Something has to give.

http://www.washingtonpost.com/wp-dyn/content/article/2005/09/21/AR2005092102504.html

And all throughout, Bush “stayed the course.” In other words, he stayed the course, no matter what any results were. It was an ideology and failed ideology. On top of this, we have globalization and everyone including Obama are globalists. And we are years, even two or three decades behind in preparing for globalization. We lost our jobs, and it was really upsetting when Bush kept going with “stay the course” when we saw our factories shut down. Most people did not see this in 2004, but I did. I did not see the housing bubble as that was in other parts of the country. But to give up some 6 million jobs over a decade, makes no sense at all. And this was all covered up with a “good” economy with tax cuts on borrowed money and housing still being built. But in the end, all I saw, was our jobs going overseas, our money going to Iraq, and then the neglect of our infrastructure. It made no sense to me.

That trillion dollars of tax cuts is spent money, it was borrowed money, and it has little effect for today. We lost that stimulus, we lost our jobs, the fed has been printing money. We have nothing to offer to have a recovery when it was already done under Bush. We ran out of ammo. Well, so much for that ideology, it only lasted for so long.

The government is a poor housekeeper, but there are many factors with this. There are political payoffs, the politicians target the wrong areas, perhaps based on their ideology, and we elect leaders which has a view that misses what we are seeing in middle America.

Your third paragraph. When you don’t see a private economy, what can one do? We can see what Roosevelt was up against, and the same is happening today. All the stimulus has been spent and we have no jobs. We gave up millions of jobs and the housing industry which represents millions of jobs are gone also. But we cannot dream up jobs. Yes, there are entrepreneurs, but they take time and there is no quick fix. So government steps in and tries to do something because we ignored so many problems of the past.

Your fourth paragraph. If you look over the Bush years, that tax money was supposed to trickle down, but we lost the jobs. There is a growing inequality of wages to what CEO’s get. The factories are closed for cheap labor. You may call it an attack on the rich, but the rich took the money and took the jobs with them. Now, the rich are our bread and butter, we need them, but the trick is to have that upward movement for everyone. If during all those Bush years, they got the money, then we should have gotten the benefit, and all the middle class got was being screwed. I am all for the rich, but it has to trickle down for jobs also and it did not happen. And as I have said before, we have 2 billion cheap laborers who want jobs, automation and losing more jobs, lean principles and losing more jobs, and mergers and consolidation and losing more jobs. So, this is the area that is creating problems for jobs. But we sat on this as we had the Bush tax cuts and all of these problems were ignored.

Your fifth paragraph. There was major fraud and abuse in the stock market. On the PBS special, many of the rich could control the stock price and drive it up. There were problems piling up, but they were ignored. So, I liken this situation with the Bush era. And when you play all your cards, there is nothing left.

Your sixth paragraph. You see the depression today, and yes I see it too, but I saw it back in 2004. Like I said before, you cannot borrow for tax cuts, borrow for war, and neglect the infrastructure and the problems without something bad happening. We are only acting today what was done for the past decade. The democrats are spending to create jobs, the republicans say more tax cuts for more jobs, the fed is printing money for low interest rates and a low dollar to export more with 1/3 less manufacturing. So, we are seeing this desperate attempt to get the economy going, but we lost any ammo we had.

Since we lost a lot of our private economy to Mexico, China, and other countries (the private sector) you may see a more centralized government. If there is a void, then something has to fill that void. You talk about union power, but that power is really diminished. It is the middle class that lost. The middle class is losing on wages and jobs as jobs leave the country. You talk of pandering to constituencies but the right does it all the time while we lost the jobs. The right will talk about gun rights, religion, free markets, and God and country and we sit with no jobs. Nothing new here, just more ignorance.

Your seventh paragraph. The code word today is less regulation, just like a decade ago on tax cuts. Yes, there are some dumb regulations, but others are out there for a reason. And that reason is for the abuse of past experiences. You are talking about “after the fact.” Our problems were piling up under Bush and I heard no one complaining. And that is why we are seeing what we are seeing today. Now you can talk about less regulation “to create jobs,” but we still gave away millions of jobs to globalization.

And I will continue to ask. What widgets can we make in our country and not some other country? And how do you support small business in a community where factories have closed?

But as I repeatedly said before, the private sector cannot do it all. If we wait on the private sector to create jobs, it will be years of even decades. You cannot makeup for those lost jobs in the private sector. And I have said, you need to invest in your country, in your people, and in the future. Too bad that we ran on a failed ideology for so long. And now, we are paying the price.

@Gerry W.:

Gary you were thorough in addressing each and every paragraph of mine. But, as I started off initially, answers, as to why so many jobs have been lost, can be responded to mainly via conjecture and guesswork. We can reconstruct historical models, plugging in different solutions, in trying to derive different outcomes. But, you’re right, that ‘ideology’ or one’s own personal perspective plays into how we might gauge the success or failures of said outcomes.

However, a common thread throughout most of your posts is a frustration with the loss of jobs that you are witnessing in your own area — towns withering due to business going elsewhere, and/or hiring people at lower wages etc. A general response is that business models change with the times. Jobs are being replaced by electronics, robots, a workforce that doesn’t require benefits or collective bargaining hassles.

I don’t like calling businesses that have impersonal menus and computerized voices to handle problems. But, that is called ‘progress,’ in this civilization. It has always been the public mantra to get something for the least amount of money. That’s why people shop at the big box stores, like Costco, Walmart, both of whom cater to globalization in getting the cheapest products to sell for the cheapest price to the shrewd shopper trying to save a buck.

You might say that the average business man is forced into incorporating this type of competition into his own business plan in order to stay alive. Because, if business attempts to hire locally, play by the rules, follow regulations, have union shops call the shots requiring him to pay higher wages/benefits, and also create a ‘widget’ that is competitive with overseas markets that don’t place all these liabilities on the backs of their businesses….how can this be realistically accomplished? That’s the main reason why Obama’s green solar company, went bankrupt, because China proved to make a less costly solar panel causing Solyndra to shutter it’s doors, despite having a huge government investment handed to it in it’s start-up .

Yes, we can isolate our markets, creating a tariff like Smoot-Hawley in order to protect our country from being flooded by low-cost products. But the unintended consequences would be even more dire for our economy than what we are already experiencing. Whenever, government meddles it seems to do so at the peril of making a bad situation only worse, IMO.

You commented about Bush that:

Business does not function well or flourish within the confines of small blocks of time. If you promise a tax cut for 2-3 years, expecting someone to then invest big bucks into a venture that may take that amount of time to finance, get it off the ground, let alone have any profitability, it isn’t going to happen. That’s one of the reasons why the current 2-year extension hasn’t done too much to encourage investment, as most people are seat-belted in for taxes to be jacked up after the expiration of these tax cuts. Obama has even said as much, that he is not going to extend them. That’s where the “lack of confidence” comes in to today’s business climate.

Also, Bush had a mixed bag of job creation on his watch. It slipped initially, which may have been due to the financial shock and uncertainty caused by the 911 attacks. People on the left, though, don’t give much credence to what Bush ‘inherited’ after a mere 8 months in office. The world stopped in it’s tracks after that day, and Bush had to somehow inject hope, civility, political cohesion, and a financial stimulus (tax cuts) into his presidency to go forward. And, he did go forward, did create jobs, and didn’t have high unemployment as a by-product of his policies.

As discussed in this article, Substantial job losses in 2008: weakness broadens and deepens across industries, under Bush’s policies there was job expansion for three years.

As far as Chaney’s comment about deficits don’t matter, technically he was right. Deficits don’t matter as long as they are below a certain percentage of GDP. Under Bush/Chaney deficits were mainly between 2-3%. Now they are 10% or above.

And, while you said:

My husband and I were very aware of how ludicrous pushing sub-prime mortgages were, ultimately raising housing prices into unreal and unsustainable territory — very much like the people who over-invested in the stock market in the late 20’s. What goes up unrealistically, usually comes down, and then there is a crash in one or more sectors, as those sectors decline and shrink.

But, people tend to view only present benefits, and not what may come down the pike. In housing, people don’t look beyond their equity increasing, never giving it a thought that there might be a downturn and their equities going south. Consequently they refinance with impunity. The same with employment. People

expect certain employment niches will stay constant, along with benefits, guaranteeing them a safe passage throughout their life. And, yet, there is nothing more predictable than change. When the horse and buggy gave way to the automobile, people lost jobs. And, so it goes with most industries. It’s not fair. But, it has happened throughout the ages. However, I personally don’t think throwing in the towel, blaming those who are financially staying afloat, and tapping government on the shoulder to supply all the answers, jobs, monies is the most satisfying or sustainable solution.

There isn’t an arbitrary figure which the deficit should be above or below. Deficits depend entirely on the greater economic context, otherwise government policy can end up working against the private sector. For now the private sector wants to save. Government policy should therefore be to spend; if both save at the same time the result is deflation as the two sectors effectively begin to compete for financial assets (dollars).

@Ben Wolf:

I don’t know where an ‘arbitrary figure’ should be set for where the deficit should or should not be. However, in various articles dealing with European debt, red flags were being raised for deficit/GDP percentages that were approaching 8-9%.

Furthermore, in this Washington Times article, a year ago, citing a CBO report, it went on to say:

Then we have this:

As far as the public saving, my husband heard this on network news a month ago, that 64% of the public have saved less than a $1000. I find this an amazing statistic, if accurate.

@jan: Cheney didn’t say “deficits don’t matter up to a certain point.” He said “deficits don’t matter” period.

Maybe you could find another quote from a “scholar” who wants to bring back Jim Crow to back you up on this one.

@jan:

This has been real simple. One is that the housing market hit a bubble and is responsible for creating millions of jobs in related industries. Two, is globalization. It is 2 billion cheap laborers, lean principles, automation, and mergers and consolidation-all happening at the same time. Simply put, there is not enough jobs to go around. We simply gave away millions of jobs and closed thousands of factories. The gurus have been wrong about globalization and its effects on the middle class. If you are going to give up millions of jobs, then what is going to replace them? While everyone is singing their own tune, they are doing more harm with spending, with more tax cuts, with more printing of money and not recognizing the problem. You cannot fill a bucket with water if it has a hole in it. And likewise, you cannot create jobs if you are sending jobs overseas.

I can quote you Veronique De Rugy, economists from George Mason Univ., on C-span saying to a caller, that it was alright to give up our jobs and that Wal Mart was hiring. We were told years ago that we did not need manufacturing and that we were going to be an information and service society. Now, these are the people who are calling the shots. These are educated people, telling the American public that we can do without jobs or have less. And yet, everyone is scrambling around and saying we need jobs. So there is no conjecture or guesswork. It is simple math of 2 billion cheap laborers and what that will do to the middle class on wages and jobs. But of course, if you are in a delusional ideological world, then you may never get that. After all, a simple trickle down should work? Am I right or wrong.? At least that is what Bush felt as he “stayed the course.”

Yes, the business environment changes. And that is the frustration that I talk about. It is not about the changing environment, but it is about doing nothing except have tax cuts and laissez-faire. We gave away millions of jobs and there is nothing to replace them. All we did during those years was rely on a failed ideology. It was wasted time and money and it made condition worse for today. Again, you cannot do a “guns and butter” economics. You cannot borrow for tax cuts, borrow for war, and neglect the problems.

So is that better than jobs? We are living on cheap wages, cheap dollar, cheap interest rates, cheap products. But how has that going to create jobs in our country? I guess, that is the one ingredient that the economists left out.

I do not agree with the democrats in creating dreamed up jobs. However, we could have invested in our country, in our people, and in the future as other countries do, instead of a failed ideology.

The unintended consequences so far in doing nothing has been lost jobs and wages for the middle class.

To get out of a recession it is normal to have tax cuts and/or the fed accommodating for two or three years. Given that 9/11 happened, a good three years or maybe four would have been enough. It was predicted at the time that the Clinton/Gingrich deal was going to create huge surpluses and that tax cuts were in order as the government was having too much money. But even Greenspan noted that he could see the surplus was drying up and he was against more tax cuts.

There was no new jobs created under Bush. Larry Kudlow said the following:

Any job creation under Bush was under the guise of his borrowing for “tax cuts.” A fake economy.

Really amazing. And so hypocritical to make that remark. It is justified because it was a lower number. Just like having a little cancer. I argued this years ago as republicans said we can have deficits, and now we see where we are.

Yes, but there was always the next industry to go to. We had an upward movement, at least after WW2. We gave away millions of jobs. We lost the jobs classifications. And like cutting off your right arm, you cannot get your arm back again. But as you say, the horse and buggy gave way to the automobile. So people went from one job to another. In the case today, we do not have that.

Again, you have to invest in the country, in the people, and in the future, to fill in those lost jobs that were given away in the private sector.

@WR:

…that would probably be you then, WR, as you’re the one who brought it up.

@Gerry W.:

I don’t understand your reasoning on how the housing bubble is responsible for creating jobs in related industries?????

In my POV the housing bubble put a strain on the housing market, and caused people in related industries, such as construction, lenders, to lose jobs. The viability of one industry feeds another. And, the opposite is true as well, where the failure of one will negatively effect others offering neighboring services or skills.

Yes, we don’t have enough jobs to go around. But, I don’t think that miring us down in government obstacle courses of regulations, higher taxation, pending health care costs, and what not is going to help the problem as to encouraging business to participate in expanding their business and hiring more people. This is a very hostile business climate. And, even if you legislatively force people into the market, it’s not the same as having a voluntary and excited business climate.

I stand by my Chaney statement too. Relating to your little cancer analogy, catching cancer early is very treatable. Having it go to a stage 4 is where you have higher mortality rates. The same is true about deficits. Having manageable ones does not leech enough out of the economy to effect sustainability. But, when you get to the stage where we are at today, then we are entering economic morbidity.

Also, I think Kudlow was doing averages on job gains over a 10-year period, as there was a 3-year span of time where 5.4 million jobs were added during Bush presidency. I’m only mentioning this as a technicality, though, because, over-all we have been on a downward spiral dealing with employment in this country. This can be attributed to many administrations including Clinton, Bush, and now Obama. However, I think in Bush’s case he did more during his 8 years to slow down job losses than Obama is currently doing. In fact, Kudlow, tonight is saying that the loss of jobs is because we have moved away from the free market capitalistic policies that were in place under Reagan.

I may have phrased that wrong. A good housing market creates millions of jobs. We have temporarily lost that. That is one reason you cannot have a recovery. I agree regulations need to be looked at, but let us not fall into an ideology that it is just that. It is globalization and many other factors.

Okay, let us add up the Cheney statement: “Deficits don’t matter.”

So Bush borrowed for his tax cuts, he borrowed for his wars, he neglected our infrastructure, and our jobs went overseas. Bush “stayed the course” and Cheney said “deficits don’t matter.” We have just witnessed the most disastrous presidency of all time. Bush and Cheney are a joke.

Your last paragraph is all bunk. We have globalization and that is taking away our jobs. I have said globalization a hundred times and everyone on the right wants to ignore it. The Bush era created no net new jobs. Bush spent and borrowed a trillion dollars on his trickle down and we still lost the jobs. If you want to talk about free market capitalistic policies, then you have to include 2 billion cheap laborers who want jobs. And for some reason, the right wing wants to ignore that. They still keep going with their failed ideology. The one thing they can’t beat with less regulation and less taxes is dealing with 2 billion cheap laborers. And with that ignorance, they ignore the middle class. The only way we can create jobs in a free market climate is by lowering wages to a dollar an hour. And when Reagan or Kennedy was president, they did not have to deal with globalization. You still sit in the dark ages and sit with your ideology. Globalization is the major factor that is crimping us in jobs and wages.

No, all we are seeing is the progression of cheap labor countries taking our jobs. It is cheap labor. And along with that the destruction of unions and the middle class. And we did nothing to replace those jobs. All the money has been spent on tax cuts and on war. And we still lost the jobs.

http://www.washingtonpost.com/wp-dyn/content/article/2010/01/01/AR2010010101196.html?wprss=rss_print

http://www.progressiveliving.org/editorial_offshoring_American_jobs.htm

@john personna:

Not when it took 60 years to even begin to question the myth that FDR was a great president, by virtue of the press the education system and politics all being dominated by the left, no.

@Eric Florack:

lol. Are you self-aware about your examples? Do you think FDR is now universally disliked, or are you aware that is a flag-wave to a certain slice of the political spectrum?