Contemplating the “Four Years” Question

If we are going to assess the "Reagan Question" then methinks some data would be helpful.

In many ways, I do not like the “Reagan Question” because it ascribes too much power to the office of the President (and, worse, to the person who occupies that office). Still, it does have a certain short-hand political validity to it. It certainly is a useful question for candidates to deploy.

In many ways, I do not like the “Reagan Question” because it ascribes too much power to the office of the President (and, worse, to the person who occupies that office). Still, it does have a certain short-hand political validity to it. It certainly is a useful question for candidates to deploy.

However, one thing that is striking to me about this question in the current context is the degree to which there are some issues of data that seem not to be taken into account in the conversation (although, as was noted earlier today, this can be a subject, feelings-based question as much as anything else).

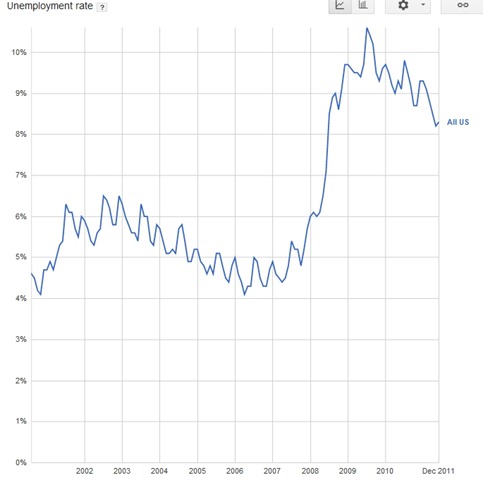

Now, I am not trying to make an argument here about policy outcomes, but rather am focused on the empirical. One of the things that can drive me nuts is people talking about reality whilst ignoring it. A recent example was a meme I saw on Facebook touting the Bush economy and citing a pre-financial collapse unemployment figure for 2008 and then citing the unemployment numbers not long after Obama’s inauguration. This was a blatant mischaracterization about the facts, as the chart below indicates (via Google charts):

Look, one can think that Obama’s policies were wrong and that other policies would have created more jobs, etc. And if one thinks that, then one should do one’s best to make that case. (Indeed, one of my criticisms of the Romney campaign is that they infer that something better could have been done without actually laying out an argument for what that might have looked like). However, what one cannot do is assert that the job situation is worse now than it was at the end of the Bush administration. Further, one cannot pretend (though many try anyway) that the trends were made worse by Obama policies.

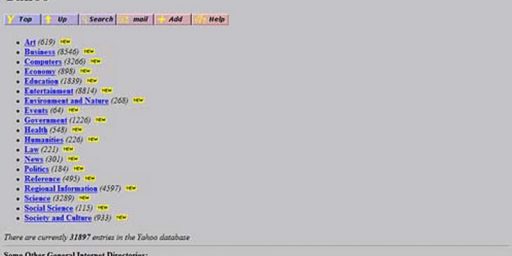

Another metric that comes to mind is the Dow Jones Industrial Average (source: Yahoo):

The red trend line is mine. I should have also put one from early 2007 to the trough in early 2009. Again: one can argue whatever one likes about what might have been, or what might be, but what one cannot argue is that the stock market was better off at the end of Bush’s term versus now. Likewise one cannot argue, as a commenter did in a thread over the weekend, that one under the current administration business aren’t allowed to make money.

Indeed, on that count, corporate profits are doing quite well (also better than at the end of the Bush admin):

Of course, this also shows one way in which we are not better off: compensation (Source: Taegan Goddard’s WonkWire).

By the way: I am not trying to take a comprehensive approach to this question. And, further, there are certainly areas that have gotten worse (inequality, for example). However, we seem to have a short memory as to how bad certain key indicators were not that long ago.

As I said this morning, I think this is about more than just a matter of citing raw economics statistics. It’s also about the relative economic security that people are feeling, and what they think about the future direct of the country. Polls indicate that voters are rather pessimistic in that regard at the moment.

@Doug Mataconis: Raw economic statistics are actual facts vs feelings which are not.

@Brianne Villano:

Human beings are not robots or iPads. Anyone who dismisses the emotion element in issues like this doesn’t understand what motivates people to vote.

@Doug Mataconis: Still sounds like an excuse to ignore the data and use it to our advantage.

@Brianne Villano:

Obama’s people can use the data whoever they wish (for the record I do not wish to be considered part of that “our).

FYI, you can’t compare the unemployment rate in ’08 to the unemployment rate in ’12. One of the reasons why today’s reported unemployment rate is less catastrophic than it otherwise would be is because so many people simply have stopped even looking for work, due to disastrous job prospects, they’re no longer counted. Literally, they’re no longer counted. They’re not part of the measured workforce, upon which the reported unemployment rate is predicated. This is one of the paradoxes of labor market stats.

The reality is that the employment population ratio (the % of the population gainfully employed)and the labor force participation rate (the % of the population that’s either gainfully employed or actively searching for gainful employment) are both far lower today than they were in ’08. Those two metrics are the ones that professional economists most often use to really understand the health of the labor markets. At least those who don’t have a clear and present political agenda.

Another useful metric is long-term unemployment. Those without jobs for more than 27 consecutive weeks but who’ve continued to search. That figure is downright horrific and is far worse than four years ago.

The Dow is not the economy nor the job markets and vice-versa. The Dow currently is inflated becuase the Federal Reserve has inflated it. Read Bernanke’s WaPo op-ed right before QE 1 was initiated. Understand that Wall Street is Lemmingville. Connect the dots.

Corporate profits are a red herring and are one of the most ignorant items being thrown about. Those stats are reported earnings by publicly traded (i.e., large) companies. Everywhere else profits are scarce or in the toilet. Not everyone gets to sell iPads or military hardware. For every Apple there are a thousand small, private rotten apples.

Not every item necessarily falls under the “worse” category. We don’t need fancy stats to tell us the banking sector today is not in complete meltdown mode, as it was four years ago. On the other hand, without the bailouts and especially if FASB had not cynically eliminated mark-to-market accounting we’d know the true health of today’s banking sector, and that might be a cause for some real panic.

That all said, ultimately this whole topic in large part is six or half a dozen. Partisans will ignore the stats they don’t like and will play up the stats they do like. Obviously the media has taken sides. The public either gets it or they don’t. That’ll break down right about 50/50. Nature of the beast.

@Tsar Nicholas:

Are you channeling your inner Joe Biden?

If someone isn’t looking for work, there is no way they could be included in that statistics unless you’ve got some reliable way to suss who out why they aren’t. Did they retire? Go back to school full time? Decide to let their spouse be the sole bread-winner?

People like you want to blow this up into some kind of conspiracy, when the simple truth is trying to account for all these variables would result in nothing but bad data.

The analogy is when people like you also want extremely volatile items like energy and food included into the core inflation calculations.

What is percentage of our population is of working age compared to four years ago?

The problem is that it is a personal question-it is asking if ‘you” are better off, not what the data says or doesn’t say.

People and their personal experience aren’t seeing data, but their experience.

If I were answering this question I can say absolutely we aren’t better off, I lost my job due to downsizing about 15 months ago. I have a job now that is for fewer hours and less pay, so my family while making ends meet has lost a large chunk of income.

At the same time gas is very high compared to 4 years ago which affect my budget, and food is higher as well-especially meat and produce, so my grocery bill is higher.

My stocks have been stagnant for years (started in the Bush admin, but was growing, and then fell apart during the latest recession and still is pretty stagnant with little growth).

My kid’s college funds have been equally stagnant and now that they are starting to hit college age (oldest is a sophomore and my next kid hits college next fall) it is pretty clear that those savings won’t even pay for a year of college tuition.

What I don’t know, and nobody can say for sure if these would be the same or different had Obama lost.

But what I can say is, whether the data looks rosy and great or not, that question isn’t answered from an “Oh let me see the data before I answer that question” but from personal experience and at that level the data doesn’t really matter.

I think what’s going on is the complete upending of the lives of people who thought that they were forever insulated from the logic of the system. For certain people, this experience and not the data have been why the last four years have been horrible. It’s the anxiety and stress of suddenly being exposed as being no different than the classes of people you once despised. And it is, I’m guessing, the people who were most happy to be on the winning side who have fallen the hardest.

Thanks for the outline…whish leaves us with the question; Who has the best plan for going forward? Somehow I doubt it is the one that has been called “mathematically impossible”.

And in my gut I believe that anyone that is forced to lie as much as the Romney/Ryan campaign is lying…can’t have a very good argument going for them. I mean…marathon results even? C’mon.

As I’ve said previously, in the depths of the Great Depression, if in 1936 voters had been asked are you better off now than in 1932, many might have said “no.” That would not have meant that the voters were in the mood to vote for the party that was in charge when the economy crashed.

By the way, those charts in the body of your column do make a case that we are better off now than we were when the economy crashed in 2008 and spiraled into a deep recession into 2009.

Well in a market that has gone from 7,000 to 13,000 that sure the hell isn’t Obama’s fault.

Gas is the same price it has been…and actually was down for most of the summer before the big refinery fire. August 4th, 2008 gas was 3.82. August 4th, 2012 gas was 3.84. Gas prices did drop in the last quarter of ’08 before starting to rebound…because there was a major f’ing financial crisis…maybe you read about it?

@Doug Mataconis:

Well, of course it is, and I am not arguing otherwise. I certainly understand why the polling on this question is what it is. However, surely it behooves us, as analysts and observers, to look at the data and go beyond just the subjective, yes?

@Modulo Myself:

Indeed. And, without a doubt, a lot of people are worse off now.

That the matter is subjective is told by the DOW chart above. The market panicked then has slowly returned. Nothing dramatic changed in that time, just people in the market got used to the new paradigm. That doesn’t mean that they pick the low point to do their subjective calculations from. I’d say they probably pick that 2007 peak and then look at how much of that they’ve reclaimed since the crash.

Add in, regardless of the improvements, people have lived or are living off their savings. Thus, even if they are working they feel diminished. And how secure dot hey feel in their job?

Now the crash isn’t on Obama but the slow recovery is. You can argue that presidents can’t really drive the economy but that isn’t what they sell to get elected. If the crash was Bushes fault, then the slow/no recovery is Obama’s. Now the question people will be answering is whether they feel Obama is on the right track and just needs more time, or do they need to hire a new CEO for a fresh perspective.

As for compensation, what does that include. We should look at the cost of labor divided up into direct compensation, employer provided benefits, employer paid taxes and government imposed labor expenses, e.g., paychecks, employer portion of health insurance, employer portion of social security and Medicare, worker’s comp and unemployment insurance. Then we can tell where the missing compensation is going, i.e., is it going to profits or is it going to the government directly or their other designated third party

@Steven L. Taylor:

Why do that when you can decry “political dysfunction” one day, then revel in it the next?

@JKB:

This makes no sense. If one had signficant stock holdings in 2008 forward, the status of the DJIA was no subjective matter, it was quite real. This was especially true if one’s retirement funds were invested in the stock market.

@JKB: I really don’t understand where the tax cutters think that the money to run the government will come from, especially if they keep insisting on More And More for Defense.

Do they realize that their numbers don’t add up? Or are they going to yell “Laffer curve!” and giggle about how Somehow It Will All Work Out?

@Steven L. Taylor:

If you bought at the bottom things are great.

If you owned the stock in 2007, you are still down. The question may say 4 years ago but people tend to go back to when they were doing good. It would be a tough sell to try to break this tendency. And what about the people who freaked out and sold at the bottom, their loss is a loss even as the market has recovered.

Not really. My mother invested her profits from the sale of a house in ’89 in the market. She is far, far, ahead. She might be down from a paper peak in 2007, but in reality she is way ahead. Paper profits are just that. If you did not sell at a peak, you never really had the money.

You invoking pretzel logic to try and minimize the raging comeback in the market under Obama. Sorry, but it’s a fail

@anjin-san:

I was simply pointing out why although the market has made a comeback, some would still feel they weren’t better off. Paper profits are ethereal but people get attached to that number.

(my emphasis)

If deceiving is your goal.

Look, I am definitely worse off now than I was 4 yrs ago. So What? 4 years ago the world was crashing all around us but I was working better than 2080 hrs per year. Now I am lucky to get 400 hrs. It took 2 yrs for the crash to catch up with me, but I always knew it would. (When you work construction, the crashes always do) I also knew it would be a lot worse if McCain got in. Did Obama work as hard on his jobs agenda as he could have? No. Would it have made any difference if he had? No. The GOP had already adopted their scorched earth strategy and Obama decided not to fight battles he could not win. Do I blame him? No.

Ironic that he could lose this election for not fighting battles he could not win. Doubly ironic that I, one of the losers, am among the few who can see this.

Somebody is buying cars…

Car Makers Post Strong U.S. Sales

Auto makers posted strong U.S. sales in August, with Chrysler, General Motors and Ford reporting double-digit growth from a year earlier

http://online.wsj.com/home-page

@ JKB

No, you were quite specific, and it was not about perception.

Nice attempt at walking back your bogus argument though.

@JKB: @JKB:

Indeed. A lot of friends of mine were heavily invested as day traders just before the dot.com bust, and boy, were they depressed when they found out all that paper was…. paper.

But JKB, if one did not sell at the bottom, as my little bro did not with my alzheimered fathers portfolio, one was bound to come out ok (according to the inverse of Newton’s Law of gravity)(what goes down, must come up).

In other words, if you can hang on long enuf, it’ll all be OK. If not? You are fw(k3d.

@JKB:

Is “owned” in 2007 the best metric?

Normally we use cost basis, and older workers with long investments have a much lower cost.

Younger workers should be time averaging their cost over the next 20 or 30 years.

Anyone curious how having people’s social security benefits tied up in the stock market would have affected the recession? I’m not sure I see the upside to that at all, I’m pretty much sold on not changing it now.

(FWIW though, paper profits are real, and can be rebalanced if you feel them at threat. People who maintained any equity/bond ratio through the stock cycles did better than a stocks only, or bonds only, investor. See also “your age in bonds.”)

@Doug Mataconis: It’s also about the relative economic security that people are feeling, and what they think about the future direct of the country. Polls indicate that voters are rather pessimistic in that regard at the moment.

Relative. How secure and optimistic did everyone feel at the end of 2008? People are unhappy with the rate of economic growth now. Then, they were still trying to figure how bad it was, and if the bleeding would stop any time soon. The only optimism was that under Obama it would get better.

@Steven L. Taylor:

Trends in Family Income: 1947-2010

That helps visualize it, with each quintile shown. The real bad news hit back in 2000. The 2008 crash erased the weak peak preceding it and a bit more. It’s worth remembering though that that 2000-2007 gain wasn’t much.

@JKB: If you owned the stock in 2007, you are still down. The question may say 4 years ago but people tend to go back to when they were doing good.

This is a great illustration of the problem with the question. If everyone were being honest about what the question is supposed to mean (now compared to when Obama policies went into effect) it would be very difficult to say we are not better off. But that is not what people want to talk about. What they want to talk about is whether the recovery has been what they expected, or, as JKB says, are they better off than they were before everything went bad.

The question is basically meaningless in the current context because Obama took over in the middle of a free fall. At some point we were bound to hit bottom and recover. So the question is unfair to Obama if you compare now to before the collapse, but it also unfair to compare now to right after the greatest damage as well because it almost had to be better now. The relevant question is whether the policies that Obama pursued and plans to continue were better or worse than the plans that Republicans have put forward. That, however, is much more difficult to address in a sound byte or bumper sticker.

all in all it doesn’t look good- but i doubt if these stats will change anyone in here’s vote!

@Tsar Nicholas: You blathered on for 5 or 6 paragraphs to get to “both sides do it?” WTF!

Oh please, that’s nothing…there are whole posts here devoted to “both sides do it”…

@Doug Mataconis: “As I said this morning, I think this is about more than just a matter of citing raw economics statistics. It’s also about the relative economic security that people are feeling, and what they think about the future direct of the country.”

Yup, that’s Doug.

We should also take into account that a lot of the pre-crash prosperity people remember was smoke and mirrors. People borrowing against their homes to buy boats and take trips to Tuscany is not prosperity.

@anjin-san: and they should suffer for their gambles? i do! roll the dice, deal with the downside. they could have bailed early and reaped profits, that’s America. not much press on the bubble riders who got out early, and there never will be.

@Doug Mataconis: And Mr Mataconis is the human being MOST far from data processing equipment such as i-pads and the like. But prolific.

Mr Taylor, thank you for this corrective. I would also recommend Dr Krugman’s and Dr Dean Baker’s columns on this topic. Specifically:

“Suppose your house was on fire and the firefighters race to the scene….After the fire is out the courageous news reporter on the scene asks the chief firefighter, ‘Is the house in better shape than when you got here?’

Yes, that would be a really ridicuous question.”

@Tsar Nicholas: Mr Romanof, you are correct in several ways. The percentage of the total population considered as “work force” dropped from approx 63% prior to the Financial Disaster to about 58% after. You confuse the entire issue though by introducing a separate discussion regarding “structural unemployment” versus demand-related lack of hiring & training. But confused thinking permeates your entire dynasty.

Thank you for mentioning that the supply-side argument has been totally demolished these last few years though. Thus: “Corporate profits are a red herring…reported earnings by publicly traded (i.e. large) companies.” (Which of course would be non-gov’t entities most capable of solving our economic woes by investing.) “Everywhere else profits are scarce or in the toilet.” By which you of course mean, because of lack of customers.

Wonderful argumentation against your own viewpoint, sir! You are a Judo master.

You can reframe the question:

Would you prefer to return to four years ago? To 700,000 job losses a month, the Dow at 7,000, a frozen credit market, home values tanking, the Auto Industry and Financial Institutions on the brink, a second Depression threatening, and OBL and Ghaddafi still out there?

Yeah….that’s what I thought.

The people I know who have finally found jobs are returning to work at a lower wage and usually with few or no benefits.

All of this while numbers of people on food stamps are increasing.

Four years of this is enough.

@Dexter:

A real problem.

This has probably peaked.

It would be nice if we could vote “Recession, yes or no?” wouldn’t it?

Don’t be fooled that this Presidential election is a proxy for that choice. The big economic cycles are running and and responses to them matter, not the the head at the top of the totem pole.

Hey…my response to Dexter went to the spam filter for some reason.

Set my comment free!!!!

(Please?)

@Doug Mataconis:

Spot on. People aren’t perfectly rational actors and their expectations play the primary role in their decision-making.

More good data, going beyond four years, here:

Labor Day, Income & The Middle Class

In particular that page has a chart of “share of income going to the middle 60% of households” going back to the 60’s. It shows a “steep” decline since that time, but with a chart scaled from 44% to 54%. The actual decline looks to be about 53% to 47%. Not terrible.

On the other hand, the same page shows certain costs significantly higher. As with credit.

So it looks like costs rose faster than income and credit filled the gap.

The Obama administration has sat around four years and blamed everything on Bush. Of course, the biggest problem they faced was that two nutcases, Reid and Pelosi, ran everything.

“No more years”