Marco Rubio’s Olympian Tax Policy Pander

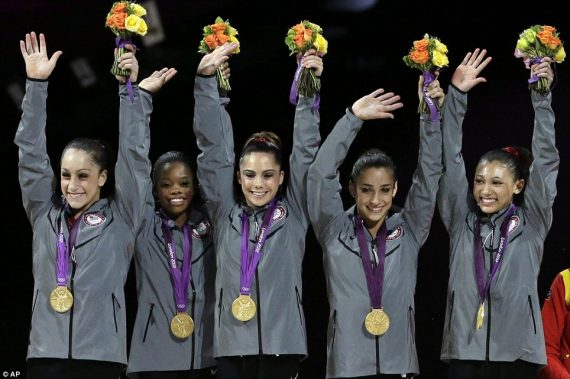

Marco Rubio wants to prevent these young women, and other Olympic medal winners, from paying taxes. It's a dumb idea.

Reacting to the news that Olympic medalists are taxed on the cash prizes they receive as part of their Gold, Silver, or Bronze Medals, Florida Senator Marco Rubio is proposing that those winnings be exempted from taxation altogether:

In a move timed to coincide with the huge interest in the Olympic Games in London (and the upcoming election in November), Sen. Marco Rubio, R-Fla., has introduced a bill to waive taxes for the honorariums winning athletes get along with their gold, silver or bronze medals.

Besides a medal, winning athletes also get an honorarium: $25,000 for gold, $15,000 for silver and $10,000 for bronze. So for the Fab Five gymnasts who won Tuesday in London — McKayla Maroney, Kyla Ross, Aly Raisman, Gabby Douglas and Jordyn Wieber — that’s a total honorarium of $125,000.

Americans for Tax Reform, a group that opposes tax increases, has calculated that an athlete’s tax bill for winning a gold medal totals $8,936, including $8,750 based on a 35 percent tax on the honorarium, and $236 for the value of the medal. Based on that, the Fab Five would owe Uncle Sam $44,680 collectively.

(…)

Rubio, who’s considered a possible running mate for GOP presidential candidate Mitt Romney, thinks the athletes should get an exemption, though.

“We need a fundamental overhaul of our tax code, but we shouldn’t wait any time we have a chance to aggressively fix ridiculous tax laws like this tax on Olympians’ medals and prize money,” Rubio said in a statement to introduce the The Olympic Tax Elimination Act, or TEAM Act. “We can all agree that these Olympians who dedicate their lives to athletic excellence should not be punished when they achieve it.”

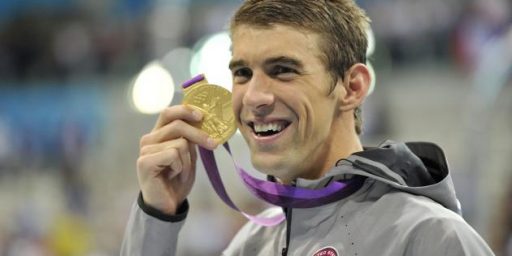

As a preliminary matter, we have to get one thing out of the way. The Americans For Tax Reform article I linked to in my post yesterday claimed that athletes would be liable for nearly $9,000 in taxes for a Gold, about $5,400 for a Silver, and just over $3,500 for a Bronze. This analysis is flawed, however, because it is based upon assuming that all Olympic medal winners would be subjected to the highest tax rate possible, currently 35%. As Politifact points out, that’s most likely the case only for the top-tier athletes like Michael Phelps, the members of the 2012 Dream Team, and perhaps the female gymnasts due to endorsement deals they are likely to garner from their wins in London. The reasons are two-fold. First of all, the tax rates apply to taxable income, not gross income, so it’s likely that many medal winners will find their taxable income pushed down to a tax rate that’s lower than 35% after business expenses on Schedule C, deductions, and other applicable credits are taken into account. Secondly, as Politifact, points out, outside of the top tier athletes I mentioned above, Olympic medal winners don’t necessary earn a lot of money. One member of the USA Track Team in the 2008 Olympics reported that his income was only about $25,000 a year, meaning that his tax rate on a medal prize would only be 15%. Additionally when you’re talking about the athletes with multi-million dollar endorsement deals, an additional tax of a few thousand dollars is hardly going to be noticed on their return. So, using the 35% rate to determine the tax rate on Olympic winnings does not give an accurate picture at all of what the potential tax liability will be for an Olympic medal, which is one reason I didn’t quote that portion of ATR’s article in my post yesterday.

What about Rubio’s proposal to make all Olympic winnings tax exempt, though? Should we do that, and if so why? Rubio’s argument seems to be purely emotional, which makes sense because that’s all there is to support his idea. There’s no economic argument in favor of treating any one kind of income (and pursuant to 26 U.S.C. 74, those medal winnings are as much taxable income as any other prize or award) different from another, for example. So Rubio’s entire argument seems to be that it’s unfair, or un-American, to make Olympic athletes pay taxes on medal winnings. As Conor Friedersdorf points out, though, what Rubio is proposing here is exactly the reason that the Internal Revenue Code has become the utter mess that it is:

[T]his is a perfect example of why the tax code is a complicated and burdensome mess. Guys like Rubio stumble upon a category of earning that they regard as being “different,” whether because there are campaign contributions in it for them, or because it advances a larger ideological agenda or, as in this case, because the category of people being taxed are popular. This particular loophole accords with a widespread intuition that the prize money and medals from an Olympic victory are unlike “regular income” that is subject to routine taxes. It also plays on general antipathy toward the IRS. Many can probably imagine what it would feel like to win an Olympic medal, and feel that they’d be resentful if presented with a tax bill.

But these are bad reasons to create a special exemption. The fact is that prize money from athletic victories is income, and there is no good reason for the government to treat that income differently than the income of all the non-Olympic athletes who earn analogous types of income. Why should Olympic athletes be exempted from paying taxes on their prize money, but not professional golfers, or poker players, or winners of literary prizes, or folks who win the lottery?

(…)

[T]reating Olympic winnings as if they are singular and morally superior to other income, and even other prize income, cannot be justified, and least of all by someone who advocates tax code simplicity and objects to government picking winners and losers

Friedersdorf is precisely right here. There is no sound policy reason to treat Olympic winnings any differently than the money someone wins from the lottery or at the poker table. Under the law, they are both taxable income. Unless you want to exempt all awards and prizes from taxation, there’s no reason to treat this situation any differently. More importantly, Conor’s first point is really what matters here. It’s been 25 years since we’ve really had a major round of “clean out the code” tax reform. Since then tax law has been manipulated by both Republicans and Democrats, with both sides adding and taxing away credits, exemptions, deductions and the like, all aimed at pandering to one political group or another. In Rubio’s case, he’s mostly just pandering to general anti-tax sentiment as well as the excitement of the Olympics to propose something that makes no sense whatsoever and which completely contradicts his previous statements about how we need comprehensive tax reform rather than just tinkering with the mechanics of the code. It’s really quite pathetic.

Life and politics would be so much easier if we didn’t have a federal income tax. Sigh.

In any event, concerning Rubio, lately he’s been pandering quite a bit and on some hot button kitchen table issues to boot. Maybe then he’s still actually in the running for veep? Otherwise why bother?

@Tsar Nicholas:

Now that’s just stupid. I know; unhelpful comment.

Hmmm…. Shocking…. Marco Rubio doesn’t want to tax income.

Next up, birds fly, the sky is blue, and it rains in Seattle.

ANOTHER tax break for the horse? It already loses $77K a year. “Neigh” to that.

Surely if the medal is business income then all the training and transportation expenses can be claimed as cost, nulling out the tax bill. No net profit.

(The “tax bill” story was one of the stupidest things to ever catch fire, even before the stupid bill to “fix” it.)

I think the real question whether or not the expenses associated with training and travel can be used to offset the deemed income.

If not, THAT’S pathetic.

If so, how much you want to bet the taxable income becomes I’d minimus.

Heh..I see JP beat me to the keystrokes.

I would tend to agree with Doug, except that I’ve heard from the highest levels of the leadership in Congress than none of the women on the gymnastics team paid any income tax for the last twenty years.

And the money they get paid to endorse stuff and grin at us from cereal boxes – presumeably that should be tax free as well?

The think about Rubio is – he just isn’t very bright.

How about a bill proposing that horses that has competed at the Olympics can’t be turned into glue?

Yes, Rubio is being ridiculous here. He needs to wake up and let this one fade away.

Well, there were those stories about the weak Olympic security. Now we see 5 gymnasts being held up by the US government man. But no worries, they won’t take more than 35% of what

they earnedthe government earned for them.Rubio is nearly as air headed as Sarah Palin, although he does seem less intemperate.

I am sure that a deficit hawk like Rubio proposed offsetting tax increases or spending cuts, right?

@JKB:

Well, there were those stories about the weak Olympic security. Now we see 5 gymnasts being held up by the US government man. But no worries, they won’t take more than 35% of what they earned the government earned for them.

Go somewhere where there are no taxes so you can avoid being “held up by the US government man.” Try Somalia. Please hurry.

@JKB:

Just so I know, you’re saying that income should not be taxed?

Interesting question. I guess they could claim the expenses as hobby losses, and could deduct them to the extent they exceed 2% of AGI. To be business expenses, they’d have to enter the activity w/ a subjective, but good faith, expectation of profit. Tough to see how that would be the case given the de minimis prize amounts.

@al-Ameda:

I’m not saying they shouldn’t be taxed. I simply described what happened. They won, the US government man takes his cut.

Now, here’s an interesting question, do they own money to the Crown for earning this income in Her Majesty’s dominion?

@jpe:

Easy to claim profit motive, “I’m in it for the endorsements!”

You want to spend 3.6 trillion each year then you better start taxing everybody. There is a complete disconnect between what people want and what they want to pay for. Everybody wants to go to heaven and nobody wants to die. Tax the gold tax the silver tax the bronze . Tax the rich and tax the poor and tax everyone in between because if you don’t we will go dead ass broke. OF COURSE WE COULD SPEND LESS but that is apparently out of the question.

Awesome Guardian headline from today:

Ann Romney’s horse fails to win dressage but avoids offending British

@Jim:

I agree with your main point, that expectations for spending and tax are out of whack.

But in terms of “taxing everyone” I’d say we should look at it as life-cycle analysis. We don’t tax kids in school (re. PD’s “no tax for the last 20 years” joke), and we may not have to tax all seniors. We may not have to tax the unemployed, etc.

Ideally though, when people are making money, especially when they are making big money, we’ll tax them to catch up.

@Jim:

Right now, Americans just do not want to pay for what we’ve ordered. Our federal income tax rates are at post WW2 historical lows and half the voters will not entertain restoring the top tax bracket to the pre-Bush rate of 39% – we’re spending $4T and we’ve offered $3T to settle the bill. We’re locked in to a Zero Sum game of chicken.

Maybe one solution would be to look at the tax code and just drop, eliminate many of the taxes that we pay on just about everything.

Connor is right. I noted that when I saw how easy is to fill income taxes in Brazil, a country widely know for it´s red tape. You just dowload a software, fill in your annual income, deductions with medical and education expenses and voilá.

That´s because Brazilian politicians uses sales taxes instead of income taxes to pander to votes.The Sales Taxes system in the country on the other hand is a mess. Everything that is sold in the country has a different tax rate.

How has no one yet pointed out the biggest problem with this? The TEAM Act? Where is that last M coming from? The only way you can get there is by

ThE olympic tAx eliMination act,

which I think even the Department of Defense would be ashamed of.

@Tsar Nicholas: You don’t want to pay income taxes. Well, I want a pony that farts diamonds.

If you really believe that paying income tax is all that onerous, please put your money where your mouth is and move to a country that doesn’t have any.

I think you’ll discover that countries that don’t have income taxes don’t have that much in the way of an economy, either.

(I also notice that most self-proclaimed Libertarians also fail to put their money where their mouths are when it comes to location within the US. They chose to live in the blue states or urban areas, and then bitch incessantly about the taxes they have to pay. Wankers.)

@Delmar:

LOL

We have a whole political movement devoted to that, the Tea Party.

The tax on the actual medal itself is what’s so offensive. The assumption by our entire county that these athletes get PAID to compete is complete and utter fallacy. Most live below the poverty level. When the U.S. Team marches out during the opening ceremonies, they do so not really as TEAM USA, but as individuals who got there by there own merit – AND- at their expense. They represent us by THEIR generous and good graces, not ours. Unlike most other country’s we compete against, the U.S. doesn’t do sh*t for it’s athletes. Zip. Zero. Nada. Their are HUNDREDS of corporations, and entities: The IOC, the USOC, NBC, NGB’s who make beaucoup dinero off the athletes, most of whom will come away from the games with nothing to show for it other than the honor of participating. For those lucky few who earned a medal, you want to now levy a TAX on that medal? With that, the athletes will need to sell those medals just to pay the taxes and keep a meal on the table and a roof over their heads. Well hey, why stop there? Why not TAX the Congressional Medal of Honor or The Purple Heart? We ask these young people to represent us at the games, we do NOTHING at all to help support them, and then we tax and P!ss on their accomplishment- which they did completely without our help. We are an ungracious and unappreciative country indeed. We don’t deserve our Olympic athletes. Luckily for us they continue to represent us despite that. Proudly and Well.

And if you want to educate yourselves on the reality of how MOST of our Olympic athletes live, I suggest you read Eva Rodansky’s book ‘Winter of Discontent’. Armchair athletes spouting off on how spiffy these athletes have it don’t have a clue on what the reality is.

@PD Shaw:

Well it might be because these ‘women’ aren’t even that old. Are we taxing kids now just for drawing breath? These athletes don’t pay taxes because they don’t get paid for what they do. They don’t make money, they only spend it.

Michael Phelps supposedly sold his condo over 1.4 million. He has tons of sponsors and is and my perception is he is not dirt poor. Gee, how much money does he make for those Subway commercials? And what do other athletes make for their commercials, etc. The economy is awful and most poor saps are lucky to have a job let alone get a measly bonus and are feeding families, etc. If they even get a bonus of $250, $500, $1,000 they have to pay taxes. So, are we to call all these Americans losers and tax them and not tax those Olympic Winners. Those Olympians trained and worked hard but so do those of us in the work force. Why should they be tax free?

Many cogent points here, both pro and con. Thus far, haven’t seen mention of the Team USA basketball players — all pro athletes, most of whom earn multi-million dollar salaries each season. Does Rubio propose an exemption for them as well? Perhaps he’s thinking LeBron will grant him courtside seats in Miami.