Olympic Medal Winners Face Hefty Tax Bills Back Home

One has to think that the prestige of winning a gold medal in the Olympics wears off a bit once you get a bill from the IRS:

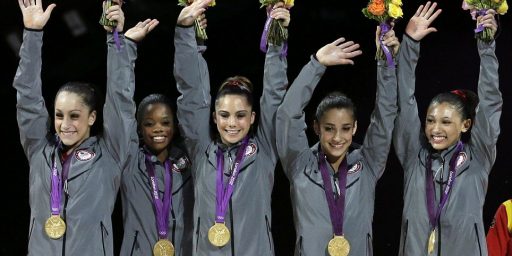

When the lucky (and good) Americans who medal at the London Games bow their head to receive the gold, silver or bronze, one can only hope the tax man is the last person on their mind.

They’d be unwise to forget him altogether, however. As with so much in life, Olympic glory comes at a price, and by price, we mean tax.

It’s not the hardware itself that’s likely to trigger a tax bill (though it could). It’s the cash that goes along with it.

Athletes who make the podium can look forward to a check from the U.S. Olympic Organizing Committee: $25,000 for gold, $15,000 for silver and $10,000 for bronze. Like lottery winners and Jeopardy champions, those winnings are taxable.

Individual sports including cycling and swimming have started to offer bonuses to their winners too. Wrestlers have a shot at $250,000 per gold metal this year as well.

Even sponsors are paying up for the big win. Yahoo! Sports recently reported that swimming star Ryan Lochte is expected to earn six-figure bonuses from Gatorade, Speedo and other major sponsors. Rival Michael Phelp’s 2008 $1 million windfall from Speedo was given to charity.

It’s all taxable, explains Alex Knight, a tax partner at Atlanta’s Habif, Arogeti & Wynne: “It’s no different from winning Wheel of Fortune or the lottery.”

Americans for Tax Reform seems to be asserting that the medals themselves would also be taxable, but that seems unlikely based on the Reuters report that they linked to:

Even the medals themselves could be seen as something of value, a gift of a commodity metal, and therefore taxable by the U.S. government, says Knight. He cites as precedent a 1969 tax case that required base-stealing baseball star Maury Wills to report as income the value of the Hickok Belt he received as 1962-s athlete of the year.

Still, Knight doesn’t expect to see the IRS chasing after athletes for a slice of their gold. “I have to imagine that would be a public relations nightmare,” says Knight.

Indeed, other than that 1962 case I’m not aware of any time where the value of a prize medal has been considered taxable, especially since there is no secondary market for Olympic medals. Moreover, as Reuters notes, if the IRS was really chasing down medal winners for the value of their prizes, we’d have heard about it by now. So, color me skeptical on the ATR post in that regard.

As for the rest of it, it’s certainly true that prize money, such as winning a lottery, or Wheel of Fortune, or prize money at a sporting event is taxable income under the Internal Revenue Code. However, as ATR pointed out, there’s one area where U.S. tax law differs from the rest of the world that brings this home to bear:

Not only do our Olympic athletes have to pay taxes on their medals and prizes – chances are their competitors on the field will face no such taxation when they get home. Because the U.S. is virtually the only developed nation that taxes “worldwide” income earned overseas by its taxpayers, our Olympic athletes face a competitive disadvantage that has nothing to do with sports.

The issue of the taxability of offshore income has been debated for several years now, with many suggesting that corporations would repatriate much of the cash they have overseas if they didn’t have to pay taxes on it. That’s something worth considering.

For someone to Michael Phelps, this amounts to $410,000 in taxable prize money over the course of his Olympic career. At a 35% tax rate that’s roughly $143,000 in taxes. Of course, that’s nothing compared to the millions he’s earned in endorsement deals.

For about five seconds, and then you see how that could be used to game US tax.

Consider this toy model: I buy raw wood for $1, use $1 of labor to make a birdhouse, and sell it for $25. My profit is $23 all taxable.

Then I get a bright idea. I make a foreign subsidiary to make birdhouses. I buy wood and labor over there, and then sell birdhouses for $24 to my US enterprise. US profit $1, foreign profit $22.

Repatriate the $22 for free and come out ahead, right? That’s the GOP plan?

It almost sounds like it was drafted by the kind of capitalist who can set up foreign operations.

On the Olympians, you make money, that’s good news. That you pay tax kind of goes with the territory.

So what? As the Obama has explained, they didn’t win that. They should show the proper respect as demonstrated by the North Korean wrestler.

Now to make amends each US Olympic winner should consult the Obama campaign for advice on how to donate their winnings to Obama

@john personna:

Well the idea is that bringing that money home would be a boost to the economy to some extent even if it was just sitting in the bank

Also, there are Democrats who have talked about changing the territoriality rules in the tax code, FWIW.

This strikes me as a case of manipulative headlining.

What? Olympic athletes are being hounded by the IRS? For what? Sounds like I should be getting outraged!

Oh. They are being given $25,000. Well then , of course….

@Doug Mataconis:

There is some money parked out there that was authentically fully made by foreign operations selling to foreign buyers, but the problem is that there is absolutely no way to distinguish that from the accounting tricks.

Given this opportunity thousands of accountants would find ways to “book” more profit overseas when the markets are buyers are here in the US.

(I have no doubt that some Democrats would be in the bag on something like this.)

@JKB:

No gaffes by that guy!

@Doug Mataconis:

Also, if the tax on manufacturing a thing overseas was $0, who exactly would want to manufacture in the US?

Death and taxes. Sad but true.

In any event, I stopped dead in my tracks when I got to this part of the post:

Substitute “Republicans and business leaders” for “many” and then substitute “pointing to the 2004 repatriation tax holiday as irrefutable proof” for “suggesting.” Then substitute “doing” for “considering.”

No, NK is further along that Obama. That guy knows if he messes up, not only his but his entire families food stamps will be cut off.

Wait, let me get this straight – tt’s income, therefore it’s subject to Income Taxes? No way!

@JKB:

I was willing to ignore the Obama stuff, for the basic humor of the weightlifter’s quote. Heck, he might have been laying it on thick enough that it was funny at home.

But I gotta worn ya, that “as the Obama has explained, they didn’t win that.” stuff just makes you look stupid.

I mean there actual video of Romney telling Olympians they didn’t do it alone, right?

“worn”?

I took that Ambien and went to sleep … don’t remember posting in the last 24h at all!

@this:

Dear idiot downvoter, video is here.

@john personna: And then there’s your last sentence in the same post. Perhaps “there’s”?

@john personna:

Funny thing, for all the people Romney listed as helping the Olympians, no one thought he implied that the Olympians didn’t deserve the full credit for their success. Obama on the other hand, being the great orator, implied that not only did the business owners not own their success, but that they should pay more to the parasitic State for their success. Perhaps someone should tell Obama that it isn’t just what you say, but how you say it.

Here’s a nice Olympic ad that implies Olympian success had some help. Think of Ann Romney and how she never worked a day in her life while you watch the ad.

One other thing that’s misleading in this story is the notion that this is truly “overseas income” in the first place, and that athletes from other countries don’t face the same obstacles as American athletes. The cash prizes that are at issue are, so far as I can tell, awarded by the United States Olympic Committee, which of course is a purely American entity, rather than by the IOC or the British organizing committee. Athletes from other countries may or may not even get the cash prizes.

Regardless, it’s not quite right to call this overseas income – it’s more analogous to income earned from your US employer while on a business trip for that employer than it is to an offshore bank account. An even closer analogue would be a situation where your US employer gives you a nice bonus or commission check for closing a deal for them on a business trip to London. I doubt that there are many countries, if any, that would view this as anything but taxable income. Don’t get me wrong – it may be that some countries have created special tax exemptions for cash prizes awarded by their national Olympic Committee, but that’s obviously a different animal from what is being claimed here.

Bottomline, I feel especially sorry for guys like Michael Phelps, who has to pay income taxes on the millions of dollars he earns in endorsement deals.

It’s hard to believe, but If it’s income, it will probably be taxed.

@JKB:

Me? I think of the $77,000 tax deduction for equestrian horses, and the installation of that new car elevator in the La Jolla house that those horses will never see and never use. It is profoundly sad.

@JKB:

No JKB, that is a total lie. The Right hammered Obama’s words into a pattern of their own making.

Maybe that pattern was paranoia inspired rather than conscious misdirection for some .. but that’s kind of the choice. Either the Right is crazy or dishonest.

@john personna: Standard aspect to international tax planning; look up “transfer costs”.

Anyone who wants to get his brain truly fried should read the rules on international taxation for US companies.

@john personna:

You keep telling yourself that. Obama said what he said whether you pull the sentences or show the two paragraphs. Even if you play the whole speech. Not wanting them to mean what he said, doesn’t mean they don’t mean what he said.

On the other hand, you pulled Romney’s remarks out of context. The context that led to a call for applause for all those who helped the Olympians make it to the games, after calling for applause for the athletes themselves.

This is the only reason I haven’t been kicking Phelps’s arse for the last 12 years. 19 Medals & 15 Gold? Pathetic. I could have more than that in swimming alone, and then a few dozen extra in Gymnastics, Shooting, and Judo and other sports. And thats just counting the summer Olympics. Of course, I didn’t do it because I’m too smart to give my hard earned $ to the IRS. I’m getting sick of living in a society where losers like Phelps get to break records because all the smart guys like me refuse to compete in a corrupt system, but I’m seriously thinking about competing for a Gold in “Going Galt”.

By the way, Doug–paying standard income tax rates on a windfall isn’t something that’s considered “hefty”. They would be paying the same rates had they acquired the same amount of $ by winning a lottery or stumbling over a chest of unclaimed cash.

“Hefty” is when you pay higher rates on something due to its source.

(And by the way you critters who invested in gold–no, you don’t get to pay the standard 15% capital gains tax on changes in its price. You pay the tax on appreciation in commodities, which is much higher. Don’t complain–you were the idiots who chose to sink your money into it without checking on the tax implications.)

There must be a market for Olympic medals because Wladimir Klitschko sold his gold medal for $1 million: http://edition.cnn.com/2012/07/26/sport/olympics-boxing-klitschko-gold/index.html

What happens if you come across something that is worth a half a million dollars, like catching Barry Bonds 756th home run ball. Do you have to pay taxes on its worth, or only if you actually sell it?

This just in: income is taxable.

Quick, someone stop the presses!

Merely catching the ball was a taxable event. There was a big kerfuffle when one of Bonds’s homer balls was caught over this issue.

@jpe:

I’m not sure that’s true. Some people were saying that, others disagreed. The guy who caught the Bonds ball sold it which is certainly a taxable gain. He was apparently told by someone that he would owe taxes if he kept the ball. Since he didn’t we don’t know what the IRS would have decided. I’m not an accountant but my guess is that it wouldn’t be taxable till it’s sold.

Here’s an article from 1998 about possible tax consequences for the person that catches Mark McGwire’s 62nd home run ball.

“tax experts lay out several options:

*If the fan keeps the ball, the fan owes no tax now. But the ball would become part of the fan’s estate, taxable after death.

*The only way to avoid tax entirely is to give the ball to a charity. Any charity could then sell the ball for a profit, which would not be taxed.

*If the fan sells the ball, the fan owes tax on the profit, just as the seller of any property would. The transaction would put the fan in the highest tax bracket, with 39.6 percent due. The tax on a million-dollar ball would be $396,000.”

In that case the guy that caught the ball gave it back to McGwire.

Err… No Doug. His Olympic career has spanned 16 years.

I’m sure you’re a great attorney but a CPA you are not. Forget that you’ve vastly inflated the tax bracket he would fall in to just from his Olympic earnings directly. What deductions might be applied to an athlete who trains for over 3 years prior to an Olympic appearance.

Trust me, hire a pro.

Thanks for the correction, Scott O.

When did they start paying these Olympic athletes? How about not paying the athletes and return the sport to its amateur status. The other solution would be to do away with a lot of taxes.

I see now that most purchases done on the internet are now taxed. Outrageous!

@JKB:

Perhaps someone should tell Obama that it isn’t just what you say, but how

you say it.Fox News decides to edit what you said.FTFY.

My neighbor develops anti-cancer drugs. My other neighbor is an intensive care nurse. Should they pay taxes on their income?