Obama Threatens Veto If Deficit Plan Doesn’t Include Tax Increases

The second half of the President's political strategy is in place. Don't mistake it for a serious legislative effort.

In the Rose Garden speech this morning where he announced the deficit reduction/tax increase plan that James Joyner wrote about this morning, President Obama threw down a gauntlet to Congress and the “super Committee” created by this summer’s debt ceiling deal:

WASHINGTON — President Obama called on Monday for Congress to adopt his “balanced” plan combining entitlement cuts, tax increases and war savings to reduce the federal deficit by more than $3 trillion over the next 10 years, and said he would veto any approach that relied solely on spending reductions to address the fiscal shortfall.

“I will not support any plan that puts all the burden for closing our deficit on ordinary Americans,” he said. “And I will veto any bill that changes benefits for those who rely on Medicare but does not raise serious revenues by asking the wealthiest Americans and biggest corporations to pay their fair share.

“We are not going to have a one-sided deal that hurts the folks who are most vulnerable,” he continued.

His plan, presented in a speech in the Rose Garden of the White House, is the administration’s latest move in the long-running power struggle over deficit reduction. It comes as a joint House-Senate committee begins work in earnest to spell out, at the least, a more modest savings plan that Congress could approve by the end of the year in keeping with the debt deal reached this summer. If the committee’s proposal is not enacted by Dec. 23, draconian automatic cuts across government agencies could take effect a year later.

Mr. Obama is seeking $1.5 trillion in tax increases, primarily on the wealthy and corporations, through a combination of letting Bush-era income tax cuts expire on wealthier taxpayers, limiting the value of deductions taken by high earners and closing corporate loopholes. The proposal also includes $580 billion in adjustments to health and entitlement programs, including $248 billion to Medicare and $72 billion to Medicaid. In a briefing previewing the plan, administration officials said on Sunday that the Medicare savings would not come from an increase in the Medicare eligibility age.

Senior administration officials who briefed reporters on some of the details of Mr. Obama’s proposal said that the plan also counts a savings of $1.1 trillion from ending the American combat mission in Iraq and the withdrawal of American troops from Afghanistan.

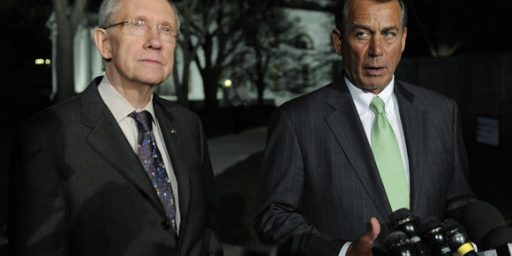

Mr. Obama’s threat to veto any legislation that seeks to cut the deficit through spending cuts alone without raising taxes puts him on a collision course with the House speaker, John A. Boehner, who said last week that he would not support any revenue increases in the form of higher taxes. But the White House has compromised several times over the last year after making stern demands of Congress that were not met.

Mr. Obama’s proposal is certain to receive sharp criticism from Congressional Republicans, who on Sunday were already taking apart one element of the proposal that the administration let out early: the so-called Buffett Rule. The rule — named for the billionaire investor Warren E. Buffett, who has complained that he is taxed at a lower rate than his employees — calls for a new minimum tax rate for individuals making more than $1 million a year to ensure that they pay at least the same percentage of their earnings as middle-income taxpayers.

That proposal, which was disclosed on Saturday, was met with derision Sunday by Republican lawmakers, who said it amounted to “class warfare” and was a political tactic intended to portray his opponents as indifferent to the hardships facing middle-class Americans.

But Mr. Obama spent much of his talk in the Rose Garden making an impassioned plea for what he called fairness in taxation, on the premise that “middle-class families shouldn’t pay higher taxes than millionaires and billionaires.”

“This is not class warfare,” he said. “It’s math.”

What it actually is, of course, is a campaign slogan. But I’ll get back to that in a little bit. Already, there’s indication that the President’s deficit plan, which technically I guess now gets put into the hopper for the Joint Select Committee (as the people on the Hill call the super-Committee), which it’s likely to die a quick death. Not surprisingly, Speaker John Boehner is already speaking out against the tax package part of the deal:

Boehner fired back in a statement, saying, “Pitting one group of Americans against another is not leadership.” He added, “This administration’s insistence on raising taxes on job creators, and its reluctance to take the steps necessary to strengthen our entitlement programs are the reasons the president and I were not able to reach an agreement previously, and it is evident today that these barriers remain.”

You can expect the reaction from Senate Republicans to be the same, but it really doesn’t matter anyway. Obama’s veto threat is little more than empty rhetoric. For one thing, he’s made these threats before and never followed through on them. Most recently, he was insisting that any deal to raise the debt ceiling must include both spending cuts and tax increases, and yet he ended up agreeing to a deal that included no tax increases at all. There was something else in that deal, though. If the “Super Committee” isn’t able to come up with a deal that can make its way through Congress and be accepted by the President, then there are $1.2 Trillion in automatic cuts that will take place starting in December of this year. The only way those cuts could be prevented would be by another act of Congress, which clearly isn’t going to happen under current circumstances. Therefore, if the GOP wants a “budget cuts without tax increases” deal on the deficit, then they really don’t have to do anything, because they’re going to get that by the end of the year. What incentive do they have to agree to anything additional that the President is offering? Moreover, if you buy the Democratic argument that cuts in government spending are bad for the economy, wouldn’t the additional cuts that the President is proposing by a bad idea?

Jonathan Bernstein seems to think that the existence of the automatic cuts gives the President more leverage over the GOP this time around. That’s only true, however, if you believe that the GOP as a whole is really worried about those cuts. Yes, there’s been some grousing from conservatives about the level of the defense cuts, but when you really look at it, its clear that the Defense Budget under the automatic cuts actually makes out better than it would have under previous budget projections. If Obama is really making this gamble on the theory that he GOP would rather make a deal that includes tax increases but doesn’t touch entitlements in any significant respects than to let the automatic cuts take place, then I think he’s misreading his opponents yet again.

This deficit plan also lays bare the true purpose of what the President has been doing since the beginning of the month. He started out with a jobs speech that was tough on rhetoric and light on substance, and as I noted at the time, clearly more aimed at laying the ground for 2012 than actually passing legislation that could help the unemployed in this country. Even the President’s own party hasn’t been very impressed with that plan. Harry Reid has said there’s no rush for a vote in the Senate, and his colleague Dick Durbin has said that he doesn’t expect a vote on the plan until at least October. Senators seen as vulnerable in 2012 are backing away from the plan as well. Now, he comes out with a plan for tax increases that is reminiscent of his 2008 campaign rhetoric, despite the fact that he walked away from that rhetoric in 2010 when he unilaterally caved on the extension of the Bush Tax Cuts.

What this is all about then, from the jobs deal to the speeches in selective locations to today’s Rose Garden speech, is laying the ground work for 2012. I don’t really think the President’s are so afraid of the automatic cuts that they’ll have a “come to Jesus” moment on tax increases. I also don’t think that he’d be willing to agree to a deal that includes significant entitlement reform before the election. This is all about laying the ground work for 2012. So, let’s get on with it already.

Photo via The New York Times

And here, Doug, your argument falls flat on it’s face. There is absolutely nothing Obama could propose that has a snowball’s chance in hell of passing either chamber of congress. Laying the groundwork for 2012 is all he has left.

Looks like this will be President Downgrade ObamAA+’s campaign speech right up to the election.

He NEVER expected his failure of a plan to pass. Many Dems do not even like it.

This plan is no different than his budget that got voted down in the Senate 98-0.

8-2009, in Elkhart Indiana.

““First of all, he’s right. Normally, you don’t raise taxes in a recession, which is why we haven’t and why we’ve instead cut taxes. So I guess what I’d say to Scott is – his economics are right. You don’t raise taxes in a recession. We haven’t raised taxes in a recession.”

Barack Hussein Obama

That’s definitely going on the record as being pro tax increase.

Here is a list of all the taxes President Downgrade ObamAA+ has instituted.

A 156 percent increase in the federal excise tax on tobacco:

Obamacare Individual Mandate Excise Tax

Obamacare Employer Mandate Tax

Obamacare Surtax on Investment Income

Obamacare Excise Tax on Comprehensive Health Insurance Plans

Obamacare Hike in Medicare Payroll Tax

Obamacare Medicine Cabinet Tax

Obamacare HSA Withdrawal Tax Hike

Obamacare Flexible Spending Account Cap – aka “Special Needs Kids Tax”

Obamacare Tax on Medical Device Manufacturers

Obamacare “Haircut” for Medical Itemized Deduction from 7.5% to 10% of AGI

Obamacare Tax on Indoor Tanning Services

Obamacare elimination of tax deduction for employer-provided retirement Rx drug coverage in coordination with Medicare Part D

Obamacare Blue Cross/Blue Shield Tax Hike

Obamacare Excise Tax on Charitable Hospitals

Obamacare Tax on Innovator Drug Companies

Obamacare Tax on Health Insurers

Obamacare $500,000 Annual Executive Compensation Limit for Health Insurance Executives

Obamacare Employer Reporting of Insurance on W-2

Obamacare “Black liquor” tax

Obamacare Codification of the “economic substance doctrine”

http://www.atr.org/comprehensive-list-obama-tax-hikes-a6433

Liberals vow to challenge Obama in Democratic primaries

“President Obama’s smooth path to the Democratic nomination may have gotten rockier Monday, after a group of liberal leaders, including former presidential candidate Ralph Nader, announced plans to challenge the incumbent in primaries next year.

The group said the goal is to offer up a handful of candidates from various fields and areas where the president either has failed to stake out a “progressive” position or where he has “drifted toward the corporatist right.””

OH NO!!!!! The libprogs are turning into RAAAAACISTS!!!!! If they don;t like him that MUST be the only reason……

And the libprog raaaaaaacists are all over.

“If [former President] Bill Clinton had been in the White House and had failed to address this problem, we probably would be marching on the White House,” Cleaver told “The Miami Herald” in comments published Sunday. ”

So, if there was a white man you would march but since there is a black man no so much?

Racism in the bright light of day and they have no compunction about it.

Shorter Doug:

If the crazy Republican’s hold America’s economy hostage to get their way again, Obama will cave.

I wouldn’t count on it next time…a huge majority of Americans are on Obama’s side.

Way to take over the thread Sam.

Need a ride to CVS to refill your meds?

@Hey Norm:

Hey norm, get a brick, shove it up your ass if you can remove your head from the same spot.

@ponce:

HUGE numbers are in his camp. HUGE!!!! Yea, go with that that’s the ticket!

@Hey Norm:

Sam’s argument style has always been “If I shout long and I shout loud, I win.”

Well, yes Sam, there is.

Poll after poll show 60-70% of Americans favor increasing taxes on the rich as step towards balancing the federal budget.

What Doug seems to be arguing is that the rich have a disproportionate amount of political power that they will use to destroy any politician who does what a large majority of Americans want them to do.

Which is rather creepy.

@Neil Hudelson:

Find a brick, shove it up your ass if you can remove your head first.

@ponce:

Polls at one time favored slavery I suppose as well.

“For one thing, he’s made these threats before and never followed through on them.”

When did the President promise to veto a bill and then sign it? When did he specifically say he would not sign a debt ceiling deal that did not increase taxes?

Mike

Plenty of posts Sam, but I’m not even sure what you’re trying to say. Maybe try to pull together something a little more focused?

The President is running for re-election? Really? I find that shocking.

Meanwhile

is treated by Doug as an immutable fact that bears no discussion, much less journalistic cynicism. Go figure.

What the President is proposing…more stimulus now, austerity later…is sensible…is structural reform…cannot be argued against without resorting to blinkered ideology…and has the support of a large majority of Americans.

Take a look at the responses from the so-called republican candidates. No alternatives. No answers. No proposals. Just abstract criticisms, and vague references to the same voodoo economics that have been failing us for decades and got us to where we are.

In a rational world conservatives would embrace this reasonable proposal…it would work it’s way through the legislative process…and we could all get on with it.

This is not a rational world.

Let’s assume for a moment that the super committee was going to include “tax increases.” I think that’s reasonable, given budgetary realities.

So, basically Obama has positioned himself for what is coming, and perhaps tempted opponents into positions which will be at odds with the committee.

Shrug. You say that while being even lighter. You are playing the GOP strategy, which is to complain about all plans while doing nothing.

Do you have an alternative, a real honest deficit reduction plan to show us, as contrast?

Ezra Klein has an interesting chart of various proposals and it shows the revenue side of this proposal to the left (more revenues) of Obama’s attempted deal with Boehner…but still to the right (less revenues) of Simpson/Bowles. All these proposals are in the $1-2T range. A far site better (if you are a fiscal fraud like Ryan and Cantor) than letting the Bush cuts expire at $3.7T.

http://www.washingtonpost.com/blogs/ezra-klein/post/does-obamas-plan-raise-taxes-yes-does-it-cut-taxes-yes/2011/08/25/gIQAmlncfK_blog.html

@ JP…

The Libertarian position is that we should have let the auto industry and the major banks fail and not undertaken the stimulus.

Basically…it’s an absurd position to take.

Try to imagine our situation today had we followed that course.

Abstract ideology almost always fails the real world test.

@Hey Norm:

That seems kind of a non sequitur to me … but to answer it, I think there were actually two flavors of libertarians at the time. The least interventionist were “let chips fall where they may” types, but there were also “with safety net for individuals” types.

We were a long way from trying any of these things, but it’s possible that letting companies fail, but catching workers, might not have been a bad way to re-order the economy.

It would have been ugly with the “let chips fall” path.

We were a long way from trying any of these things, but it’s possible that letting companies fail, but catching workers, might not have been a bad way to re-order the economy.

This appeals to me, but the devil, as usual, is in the details.

And again, I post the only rational response to Sam’s posts (and await my “bricking”)

Sam, what you’ve written is some of the most insanely idiotic things I have ever read. At no point in your rambling, incoherent posts were you even close to anything that could be considered a rational thought. Everyone in this room is now dumber for having read your contributions. I award you no points, and may God have mercy on your soul.

Ah yes…there are good rich people with Ds behind their names and bad rich people with Rs behind their names. Same old crap.

@john personna:

sounds about right to me. cynical for sure, but should we expect anything else anymore? this is the era of the 4 year campaign, after all.

@mattb:

that was a thing of beauty.

The capitol S Sam is a pimp…..!

@CB: Really, Adam Sandler (or his writers) deserve all the praise. I guess its from “Billy Madison.” I heard it years ago and it’s become a “go to” line of sorts for me.

mattb, we live in the age of YouTube and copy a link:) http://www.youtube.com/watch?v=fEkWH8DB7b0

Thomas Sowell compared current times with 1921. Back then high earners were taxed in the 73% bracket because then, as now, the cry was to “tax the rich!” However, when you compare the number of people with taxable incomes of $300,000 in 1916, greater than a 1000 people, to those fitting that bracket in 1921, less than 300 people, there was an enormous drop of income in 5 years.

Sowell then asks the question, “Where did all these high earners go?”

Sowell goes on to talk about the behavior of the rich, attaching it to their actions when they are overly-taxed. As Newton’s Laws of Motion proved, To every action there is always an equal and opposite reaction… And, it’s no different when relating this law of physics to the law of a steep and progressive tax raise. Unfortunately, even good intentions behind such capricious acts tend to go awry as well, by hurting the very people these acts are meant to help.

Ironically Jeffrey Immelt, GE’s CEO and member of Obama’s Economic Recovery Advisory Board is a classic example of big business going overseas, pulling jobs out of the country with them. And, in Mr. Immelt’s case, he strangely escapes paying any taxes, while working for a president who wants to raise taxes on every other rich person(????)

With all this mind, I tend to agree with Doug and others, that it appears the primary reason for Obama’s latest tax speeches is for fluffing up his constituencies for re election purposes, rather than doing something calming but productive for the economy.

I’m so tired of the taxing the job creators meme. The so called job creators have had two large tax cuts in the last 10 years and how many jobs have they created (here in the US)? Zip – Zero. Instead they used their tax cuts to play at the Wall Street Casino and buy bizarre financial instruments which eventually resulted in the bursting bubble and the financial crisis.

And as for that class warfare. We have been in class warfare since Reagan became president and the middle class has been losing. Supply side economics is not economics but is class warfare.

I am sure it has nothing to do with the fact that a sr. java developer makes about 110k a year here, and about 12k a year in easter europe or russia.

no, its probably all Obama’s fault.

Immelt has been moving jobs at GE out of the US since 2000 when he took over, so he is not fleeing the scary liberals. And since at least some of those jobs have been moved to Germany, it is not really fear of high taxes and strict regulation.

So, in short, Obama is holding the country hostage to his desire for more taxes.

Hey, if the charge works for Republicans….