Under Herman Cain’s Tax Plan, Your Taxes Will Increase

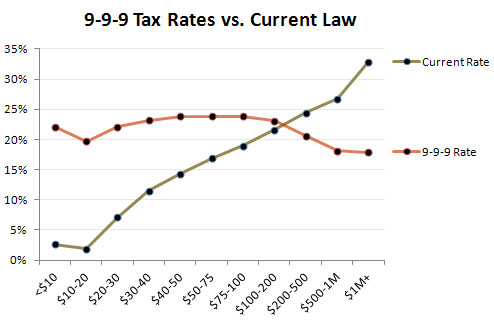

Just before last night’s debate, an analysis of Herman Cain’s 9-9-9 tax plan was released that was, in a word, devastating:

NEW YORK (CNNMoney) — Under Herman Cain’s 9-9-9 tax reform plan, 84% of U.S. households would pay more than they do under current tax policies, according to a report released Tuesday by a nonpartisan research group.

And the impact would be felt most heavily by the lowest income groups.

Those are some of the estimates from the Tax Policy Center’s analysis of Cain’s proposal, which has helped make him a leading contender for the Republican 2012 presidential nomination.

While some key questions about the 9-9-9 plan remain unanswered, the Tax Policy Center’s analysis is one of the first to take a comprehensive look at its potential impact.

(…)

According to the Tax Policy Center, households with incomes below $30,000 would have, on average, between 16% and 20% less in after-tax income than they do today.

By contrast, households making more than $200,000 would see their after-tax income grow by between 5% and 22% on average.

There are two reasons for that discrepancy between the poor and the rich.

First, while the Cain campaign has said it is working on ways to lessen the tax burden on low-income households, the Tax Policy Center said it didn’t have enough detail to assume what that change would be. One way to address regressivity is to offer a rebate to low-income households.

The second reason has to do with how Cain would restructure taxes.

Under the current system, most of the lowest income households end up owing no federal income tax. That’s because their incomes are so low that they’re exempt, or because their tax liability is canceled out by the standard deduction and tax breaks, such as the Earned Income Tax Credit.

The Cain plan doesn’t exempt very low incomes from taxation. And while it would eliminate the payroll tax, which is the heaviest tax for low-income families, that tax relief would be offset for many by the elimination of the EITC and other tax breaks they qualify for now.

But the majority of the highest income households would get a tax cut. For instance, 95% of those with more than $1 million in income would receive an average tax cut of $487,300.

Under Cain, capital gains — a notable source of income for the wealthiest Americans — would be tax-free. He would also preserve the charitable deduction. And taxing all non-capital gains income at 9% would amount to a considerable break from today’s top rate of 35%.

You can read the analysis here, and it’s worth noting that the Tax Policy Center is a left-wing organization, but the conclusions they reach match those that come from many on the right. To demonstrate just what kind of impact Cain’s plan would have, all you need to do is look at one chart:

We can have our debates about how progressive a tax system should be, but it strikes me that nobody would think that a regressive tax system is either good policy, or good politics. The reason that the poor don’t pay a lot in income taxes is because they don’t earn a lot of income and, as the saying goes, you can’t get blood from a stone. Cain’s plan would benefit a small group of people at the expense of the vast majority of Americans. That’s just insane no matter how catchy the name of your tax plan might be.

We can have our debates about how progressive a tax system should be, but it strikes me that nobody would think that a regressive tax system is either good policy, or good politics. The reason that the poor don’t pay a lot in income taxes is because they don’t earn a lot of income and, as the saying goes, you can’t get blood from a stone. Cain’s plan would benefit a small group of people at the expense of the vast majority of Americans. That’s just insane no matter how catchy the name of your tax plan might be.

shocked. shocked, i tell you.

What I notice is that it’s part of a pattern. People on the right (tax radicals, rather than true conservatives) will often “pick a number” and make that their tax plan.

It’s about what feels comfortable rather than the output of a budget/tax study.

We see proposals for flat taxes, VAT taxes, and corporate taxes that all arrive this way.

Notice how Perry and Romney are focusing mostly on each other? Even though Cain’s poll numbers are good at them moment, they both know he’s a joke.

A lot of analysis isn’t really necessary, it should be obvious that Cain’s plan would raise taxes on most people just from the name

I don’t want to appear to be defending 9-9-9 cuz I don’t actually like it… however, this chart’s green line appears to make the following assumption: that no one on that line drinks alcohol, uses tobacco, uses electricity, has a cell phone, uses gasoline, and is exempt from all commerce which involves freight.

Defining how much anyone pays in taxes is nearly impossible. This uses the what comes out of the check and 1040 method. And it is accurately pointing out that there are indeed problems with 999. I just don’t think it tells an accurate picture of what we’re currently paying in hidden taxes.

And that is your current frontrunner.

The Republicans really, really don’t want Mitt Romney, do they? Sure, they’ll eventually settle after every other candidate flames out at least once, but they won’t be happy about it.

“We can have our debates about how progressive a tax system should be, but it strikes me that nobody would think that a regressive tax system is either good policy, or good politics.”

Proving how out of touch Doug is with the Republican electoral base. Hurting the poor remains a feature, not a bug.

We really didn’t need that TPC analysis to tell us this. A national sales tax without a total abrogation of the federal income tax by definition will amount to a tax hike on the overwhelming majority of Americans. That this farce of a plan also includes a de facto VAT takes it from the absurd to the staggeringly absurd.

@NickNot: Cain is only proposing to replace the federal income tax and FICA taxes, so the comparison is valid. There’s no reason to think hidden taxes would go away under his plan.

“Under the current system, most of the lowest income households end up owing no federal income tax. That’s because their incomes are so low that they’re exempt, or because their tax liability is canceled out by the standard deduction and tax breaks, such as the Earned Income Tax Credit.”

Why do you assume this is a desirable situation? The graph shows a nearly flat rate (don’t quibble with the exact shape, children – graphs like this show general trends, not details), which means everyone has some skin in the game, as was said by some guy or other when he was running for office. It’s not possible to get any fairer than a flat tax. Anything else is identity politics between different income groups.

One could always make the adjustment that the tax doesn’t apply to food or clothing, as some states do now.

Instead of criticizing the idea as it is right now, why not use some of that legendary liberal genius and use it as a basis for discussion? At least he’s proposing to do something about the idiotic, lobbyist-written system we have now.

@NickNot:

I don’t want to appear to be defending 9-9-9 cuz I don’t actually like it… however, this chart’s green line appears to make the following assumption: that no one on that line drinks alcohol, uses tobacco, uses electricity, has a cell phone, uses gasoline, and is exempt from all commerce which involves freight.

The federal taxes on those things, with the exception of hard liquor and cigarettes, are below 9%. Cain’s plan is a tax increase on those sales.

I just don’t think it tells an accurate picture of what we’re currently paying in hidden taxes.

Indeed. And the answer, in most cases, is less than what Cain wants us to pay.

At least he’s proposing to do something about the idiotic, lobbyist-written system we have now.

Yes. Something terrible.

@alanstorm:

If you tax the very poor, will you have to give back with public housing and transportation?

That might actually be OK, but I don’t think you can just tax them, and then leave them with the same housing and transpiration requirements.

I don’t want to appear to be defending 9-9-9 cuz I don’t actually like it… however, this chart’s green line appears to make the following assumption: that no one on that line drinks alcohol, uses tobacco, uses electricity, has a cell phone, uses gasoline, and is exempt from all commerce which involves freight.

Just realized that Cain’s plan doesn’t actually eliminate federal excise taxes. His plan is an enormous tax increase on all but the rich. Always lookin’ out for the 1%!

@David M:

I read it differently: But I know I need to know more about 999 (though I have little interest in doing so):

From HC website: It replaces taxes that are already embedded in selling prices.

@mantis:

Good points. It gets a little shaky in VAT part. Especially if there is a vendor/not to mention manufacturer purchase. Then it gets a little like figuring tax on a loaf of bread currently.

Safe to say 9-9-9 is a bad plan. I developed an interest in it about 3 weeks ago, and the more I read, the more it got out of hand and proved to be a bad plan.

I sure would like to see a simple tax code one day. One that takes the bullets out of politicians pens.

The Tax Policy Center doesn’t factor in a “poverty grant” that Cain says would correspond (as I understand it) to an EITC because of insuficient details from Cain.

So, the Tax Policy Center analysis is probably wrong,

and Cain needs to go out buy another napkin to work this thing out.

@Moosebreath:

Yup. It’s just too bad that the vast majority of the GOP’s base are such undereducated, gullible tools that they don’t realize _they’re_ the poor the GOP is dumping on.

@alanstorm:

1. We must do something

2. This is something

3. Therefore we must do this

is a fallacious argument. Regardless, the Federal tax code is difficult because there are so many deductions/credits/exemptions. You could have a progressive tax system with hundreds of marginal rates and it would still be a 30 second tax return.

Even assuming that a flat tax or a 9-9-9 tax could pass, it would maybe survive 1 year before exemption after exemption after exemption was added back into it. Most likely, it wouldn’t make it to a vote before just about every major lobby got to carve out their exemptions.