A (Partial) Solution To The Student Loan Problem?

A change to the Bankruptcy Code could go a long way toward alleviating the burden of student loan debt that seems to be motivating some in the "Occupy Wall Street" movement.

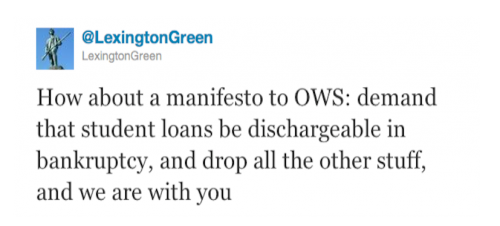

Chicago Boyz contributor Lexington Green offers this idea via Twitter:

This isn’t the first time that I’ve seen this suggested since the “Occupy Wall Street” protests, highlighted by the “We Are The 99%” stories, became a big part of the news cycle last week. Megan McArdle put forward the same idea just a few days ago:

This isn’t the first time that I’ve seen this suggested since the “Occupy Wall Street” protests, highlighted by the “We Are The 99%” stories, became a big part of the news cycle last week. Megan McArdle put forward the same idea just a few days ago:

Let me propose a modification that might at least alleviate some of the problems experienced by the 99%: allow students to discharge their student loans in bankruptcy (at least the ones guaranteed by the government, and private loans made before the rules were changed to make private loans un-bankruptable). There is really very little excuse for completely exempting student loan debt from bankruptcy. Bankruptcy is supposed to be the recognition that a person does not and will not have the resources to pay their debts–so why shouldn’t the government have to stand in line along with all the other creditors?

This is been a question that has puzzled me ever since I was doing bankruptcy work on a more regular basis back in the 1990s (the 2005 changes to the Bankruptcy Code have made it cost prohibitive for many solo practitioners to accept the dozen or so cases that they used to in the past, but that’s another issues).

The basic rationale is two-fold. For one thing, most student loan debt is either owed to, guaranteed by, or has been acquired by an agency of the Federal Government and, as a general rule, debts to government agencies are not dischargeable under a Chapter 7 Bankruptcy proceeding, and must be treated as a Priority Debt, and generally repaid in full, in a Chapter 13 Bankruptcy. The second rationale is that the high default rate for student loan debt requires that it be treated as non-dischargeable so as not to create a moral hazard problem. There are some provisions for relief from these rules, but the standards are incredibly hard to meet.

On their face, neither of these arguments make all that much sense to me. The only reason government debt is nondischargeable is because the government writes the Bankruptcy Code. There may be some forms of debt to government — tax debts and fines imposed by a court come to mind — that should never be dischargeable, but I don’t see any logical reason why this should be extended to student loans merely because of the government being involved in the transaction. In fact, with the government now having pretty well taken over the entire student loan industry by fiat, any student who takes out a loan to go to college is automatically agreeing that the debt can never be forgiven no matter how precarious their financial situation becomes.

Of course, there are some downside risks to a proposal like this, as McArdle points out:

I am fully aware of what this would mean: government lending costs would go up, the program might well become unaffordable, and if private loans were included (as they should be, at least for new loans), the private loan market might well disappear altogether for all but the most lucrative specialties. The reason that the bankruptcy exception was written in the first place was that the loans used to have an extraordinarily high default rate.

But I’m not sure this would be a bad thing. By allowing students to shift forward the additional income that their degree will earn them, student loans have allowed universities to capture a huge portion of that future income stream–which really hurts those for whom that stream doesn’t materialize. Moreover, it allows students to make the sort of stupid choices that most 19-year-olds will make if they’re allowed. I don’t have a lot of patience for university administrators claiming that they just can’t possibly charge less than $25,000 for 15 hours a week worth of classes, but they do have one point: they build expensive new facilities and load on the services because students demand them, and threaten to go elsewhere if they can’t get them. Colleges look ever-more like four year resorts with a sideline in academic research.

I tend to agree with Megan here that these aren’t necessarily bad costs. In fact, introducing some sanity into the student loan process might just cause prospective students to look more realistically at what kind of education can afford, or whether they’d be better off taking more than four years to get a degree because they had to work to pay tuition. It might also go a long way toward slowing down the insanely high growth in tuition rates, a topic that has been written about here at OTB several times in the past.

More importantly, though, could making these changes really make things any worse than they are now? I frankly don’t see how.

The entire purpose of Bankruptcy is to give people a fresh start. As much as some of my friends on the right might object to the idea, it’s worth noting that creating a Bankruptcy Code was one of the powers granted to Congress in the Constitution because, even then, the Founders realized that it was necessary and beneficial. Have the bankruptcy laws been abused in the past? Perhaps they have, although quite frankly I didn’t see very much of the kind of abuse that the credit card industry was complaining about when it spend the better part of the late 90s and 2000s when I was spending my time in the Bankruptcy Courts. More often than not, you’re talking about people who got incredibly down on their luck and were saddled with debts that they were never going to be able to repay. That seems to be the situation that some of the young 99ers are dealing with right now. Wouldn’t it be a good idea to change the law and help them out a little?

So here’s what I’m suggesting. Make student loan debt fully dischargeable in bankruptcy, and allow it to be treated the same as any other unsecured debt in a Chapter 13 repayment plan, meaning that the debtor would not be obligated to repay the entire debt in full if the plan doesn’t allow for it. Sound like a deal?

The real reason is that, as a student graduates from college, they generally have few assets nor a considerable credit history, so there is little loss from declaring a bankruptcy at that point. If student loans were dischargable, declaring bankruptcy right after graduation would likely become nearly routine, which would turn result in student loans largely becoming unavailable.

I think the problem is that a higher education degree constitutes an intangible asset that has potentially appreciating value. If you allow people to file bankruptcy on their student loans shortly after getting their degrees, the lender may be unfairly denied the real value of the education that may not come to fruition for a dozen years.

Two alternatives come to mind: (1) bar discharge of student loan debt until passage of a term certain (which is what I think the deal used to be), or (2) monetarize the value of the degree and only permit partial discharges (greater dischargeability for a fine arts degree than a medical degree).

@Stormy Dragon:

Well then the answer, perhaps, could be a sliding scale in the law that makes it difficult to obtain full discharges right after a student graduates absent extraordinary financial situations.

@Stormy Dragon: I’m too slow today.

I can see no useful purpose in choosing the bankruptcy option over a simple blanket forgiving of the debt. It costs us nothing to do so as the money repatriared to the government through the loans is destroyed anyway. It would also have the benefit of spurring significant consumer spending.

@Ben Wolf:

It limits the cancellation of the debt to people facing legitimate financial hardship, rather than people who can pay and just don’t want to.

Let’s see…education has gotten too expensive for the average student…so the solution is not to address costs…but to open up the bankruptcy courts.

Someone is missing the forest for the trees.

There are some parallels here to the health care problem. We can go argue forever about how to finance a college education, what the role of public assistance should be, who should get help, etc, but the “real” question is why on earth it costs so much to begin with. Just as with health care, the only solution that’s not just kicking the can down the road is looking at bending the cost curve.

I’d propose a Medicare-type solution. Greatly expand the Pell program by converting student loans to the highest-risk (poorest) kids into grants, on a sliding scale so that many, many kids have at least some grant money. Set the price of a “full ride” grant at something like 75% of the current price of a state school education. Tell schools that if they want to accept *any* students in the Pell program- kids who accept even a little Pell money- they’re not allowed to charge any more than the Pell full-ride rate. Voila. The price of all but the pickiest and most exclusive schools drops instantly.

The bargaining power of the federal government is considerable. Why we’re not using it to 1) help poor kids, 2) invest in the intellectual capital of the nation, and 3) give a generation of young adults a shot at getting out from under debt, is beyond me.

FWIW, I was picking schools in the 90’s, when soaring college costs were getting on everyone’s radar. I remember getting the straightforward advice from more than one counselor that anticipating bankruptcy was the “smart” plan for financing your college. Take out as many loans as you could, graduate, declare bankruptcy, move on. You probably won’t want a mortgage until you’re nearly 30 anyway and by then your credit history is good to go.

It’s the sort of behavior that a bankster would call “playing hard” but strikes nearly everyone else as unethical. So I’m more sympathetic than most bleeding-hearts to the idea that student borrowers need to be accountable to some extent, and we shouldn’t just be waving bankruptcies around as a cure-all. But instead of figuring out who’s going to get stuck holding the bag the question *has* to be why the bag is so dang big.

@Stormy Dragon: Why is that relevant? Again, the government does not need the money that comes from student loan repayment and what it does receive is destroyed when the debt is retired. If an educated populace is a national requirement then there’s no reason not to switch to a grant program with government negotiating tuition with universities.

@Andyman:

It’s basic supply and demand. If the market clearing price for a college education is $10k and the government decides to spend $8k to subsidize it, the price will end up being $18k, not $2k.

This would actually feed the increasing cost of education, as the colleges would have little incentive to keep their costs down if increases in tuition are eventually covered as a loss not realized bye the college

@Ben Wolf:

Well, like in my case, I’m perfectly capable of paying off my loan on an engineer’s salary (and indeed, I’m paying it off ahead of schedule). It’s silly to say that either the bank or the government should have to take money from someone else for my benefit.

@Ben Wolf:” It costs us nothing to do so as the money repatriared to the government through the loans is destroyed anyway.”

It would constitute a transfer of public wealth to the lending banks.

While I won’t argue against the value of an education. The Universities themselves are in the business of harvesting the future potential earnings of those attending.

@Andyman: A university education is so expensive because our federal government says we’ll fund student loans and you higher education institutions can charge whatever you want. There’s absolutely no excuse for the Feds not negotiating tuition prices and any serious reforms must include it.

@Stormy Dragon: Back in the day, a common practice was for newly minted doctors and (ahem) lawyers to open private practices that they couldn’t afford to operate, declare bankruptcy, discharge several tens of thousands of dollars (at a time when a year’s tuition at a private university was about $5-6 thousand) of student loans and then go to work for the hospital or big law firm that they should have gone to work for in the first place.

In other words, they acted like Republican Objectivists. Ayn Rand would be proud.

@SD,

I’m on board with what you’re saying. That’s why I suggested the Medicare model… if a college wants access to the 20% (30%? 50%? 80%?) of the student market that accepts government aid, it has to set a price below clearing price. There’ll be a large enough market to accomodate colleges that don’t want to play ball just like there are doctors who don’t accept Medicare patients. But enough schools will be on board that the clearing price becomes irrelevant for many, many meritorious students.

@Hey Norm:

Tell the academics that they need to take pay cuts so we can reduce tuition. No, really, try it,.

@PD Shaw: @PD Shaw:

Only the interest; the deposit on federal student loans has to be paid back to the Federal Reserve. To be honest I’m fine with interest on outstanding loans going to the banks, otherwise we’d have dollars being pulled out of the private sector during a recession.

Keep in mind federal loans no longer go through private banks, so the issue of who gets the interest will eventually become moot.

@Doug Mataconis: Universities are already cutting teaching costs to the bone, that’s why so many instructors are now adjunct wage-slaves. The biggest reasons for soaring costs are that schools are:

A) trying to turn themselves into luxury resorts for their students

B) allowing administration costs and salaries to grow way beyond what’s reasonable.

@Stormy Dragon: Look, that federal loan comes from the Federal Reserve, which is literally limitless. I can assure you that no one is being taxed to pay for it. The way it worked before student loan reform last year was:

1) a bank makes a loan to a student and credits the proper accounts.

2) The bank then goes to the Federal Reserve to obtain the deposit.

3) The student (hopefully) repays the loan. The bank pockets the interest and the deposit is repaid, disappearing into the ether from whence it came. The illusion of an actual budget is just that. This is, incidentally how every bank loan works.

With the student loan bill, the process has changed from the above to:

1) The Department of Education makes a loan and credits the proper accounts.

2) The deposit for the loan comes from the government ether which is formless and limitless

3) The student (hopefully) pays the loan back and the deposit returns to the ether.

@Ben Wolf:

My student loan wasn’t federally subsidized, so I’m not sure any of that applies in my case.

@ Ben…

As someone who provides professional services to private Universities I can tell you this…the reason an Education is so much more expensive is…get ready for it….free market competition. In the late 70’s when I attended undergrad the food sucked, the dorms were bunkers, facilities were limited (doing more with less has been a strength of mine across two careers) and the instructors were not exactly getting rich. Today, in order to attract students, the dining halls are 5 star eateries, the dorms are much nicer than most local apartment builldings, and the facilities are top notch. (You’ll have to ask James about salary growth since then.) This race to attract revenue units (students) drives up cost. The cost is then passed on to the revenue units themselves. It’s a funny sort of feedback loop.

My graduate degree is from UCLA…a school subsidized by the state. I still cannot believe how inexpensive that degree was…outside of paying for housing in LA that is. But I imagine those schools are a primary factor in California’s economic condition.

There are no easy answers…but declaring that hell (bankruptcy court) is open for sinners strikes me as a band-aid on a much bigger problem.

@ Doug…

What Ben Wolf said. The cost of an education is not in the instructors salaries.

@Stormy Dragon: I don’t see any reason why you shouldn’t be given the same consideration: it’s almost certain the deposit for your loan also came through the Federal Reserve system. The Fed can simply cancel the issuing bank’s liability and call it a day, no one loses.

There are a couple of types of debt that are non-dischargable including student loan debt. Expand this proposal to allow all debts to be dischargable under a certain matrix, including 1st mortgage debts for primary residences and voila, we might actually have some price discovery in the housing market instead of a morality play that sorts the deserving from the undeserving poor.

I think Stormy Dragon pretty much hit the nail on the head in the very first comment. But perhaps that’s not a bad thing.

The consumer was removed from the costs/obligations of their purchase decision by the third party payer system in health care: costs skyrocketed.

The consumer was removed from the costs/obligations of their purchase decision as the govt granted unwarranted housing credit and created a secondary market “dump” for bad loans: home prices skyrocketed.

The consumer was separated from the costs/obligations of financing college education by the government: the cost of education skyrocketed.

Wasn’t it Einstein who said a definition of insanity is doing something over and over and expecting a different result?

Stormy is correct in that if there were consequences to those who extend credit they would extend it more carefully (unless its the government) and therefore college loans would be more scarce. I don’t know that that is bad. As someone else noted, college campuses have turned into party resorts, sort of like those Carribean singles places. And the money is going to college staff and profs. Hence skyrocketing tuition.

The Rube Goldberg cultists – Democrats – offer price controls, and I’m sure eventually no shortage of ridiculous rules and regulations. Anyone surprised? Needless and bizarre.

So in the end, I’m with Doug, as long as the government isn’t just the bottomless source of bad credit. And given the evidence of the housing mess, I’m not sure that can be accomplished.

@Ben Wolf:

Only by adding to the size of the money supply (The college already got the $20k when I was a student, which was offset by the $20k liability at the bank; your proposal wipes out one but not the other). And while creating $20k to cover my loan won’t affect much, do that millions of times over and you’re likely to have a measurable effect on the value of the dollar. Which means you’re essentially proposing that instead of me paying it back, we’re going to go around and transparently extract a tiny bit of the debt from everyone’s savings.

Which may not have a big long term effect, but in general I don’t see why everyone else should be paying for a loan I’m perfectly capable of paying for myself.

Greetings:

When I bought my first car, the State of New York had a mandatory automobile insurance requirement. When my father subsequently looked over my car insurance invoice, he thought that I had bought way too much insurance coverage. His take was that insurance was to protect one’s assets and being an 18 year old, I had no assets to protect. In his mind, the amount of damage I might cause to others was not a determining factor. The absolute minimal coverage was what both fulfilled my legal responsibility and made business sense.

It seems to me that most students are similarly situated. Having no assets, bankruptcy basically allows them to receive unearned benefits and then suffer very little if they decide to walk away.

The problem I have with this is the impact on personal honor. Even if the government decides that it is in society’s interest to allow bankruptcy, does personal honor not require the beneficiary of the loan to pay back the money? I think it does. To allow otherwise is to teach a very poor lesson.

Back in the mid-’70s, I worked with a student from Yale University. If I remember correctly, he told me that back then Yale had a system in which students could opt to pay several percent of their annual income during their lifetime in lieu of paying tuition. That seems like an interesting alternative to putting another band-aid on a system that seems to need a great deal of ongoing fine tuning. Let the universities assume some of the risk and a bit of delayed gratification. Education is a contract between the student and the institution. Why do they both have dibs on my “third party” income?

Social justice and wealth redistribution are not the answers. They are but signposts along the Road to Serfdom.

You know something else that would make a difference? For them not to borrow the money in the first damn place. Tuition might not be so high if they were not so willing to go in hock to pay for it.

These kids don’t just want cheaper college, they want free college..just like they want free health care and free everything else.

@SD:

Typically, when a student loan is referred to as “federally subsidized” it means that interest does not begin accruing until after you graduate. The feds are paying that interest for you while you’re in school, or whatever the arcane bookkeeping equivalent of that is, hence the subsidy. I think unsubsidized student loans are backstopped by the gov’t the same way subsidized loans are- thus the similar interest rates.

@Terrye,

It’s hard to get through an entire news cycle without hearing someone say that there’s no future for someone without skills anymore. And your suggestion is that people just forego education altogether?

Only on the Internet and in the academe would people argue with straight faces that engendering a massive slate of bankruptcies with its concomitant destruction of taxpayer dollars is the way to deal with the student loan fiasco. Unreal.

The real way to deal with this problem is to engage in the comprehensive regulatory reforms necessary to spur job creation for these kids (and for adults too). The first step would be to eliminate or at least radically to reduce the federal minimum wage. By itself that would help a lot of these kids obtain employment. The next step would be to abrogate all local “living wage” ordinances. Then to repeal Obamacare. Then to engage in fundamental tort reform. Then to engage in fundamental labor and employment law reform.

If more of these kids gainfully were employed more of them could pay back their student loans, which thereby would go a long way towards reducing the loan costs for future generations. That’s how the markets for lending at spread work in the real world. Lower risk, less cost. Duh.

We also need to create a strong disincentive for these kids to obtain useless degrees. Taxpayer funds only should subsidize the hard sciences (medicine, finance, engineering, business, computer science, MIS, information technology) and vocational programs. Otherwise taxpayers are being forced simply to piss away money on these kids. If Johnny von Space Cadet wants to study philosophy or sociology he should do so on his parents’ dime.

Tsar…

you seem to be ignoring the fact that a lot of these kids are already working for minimum wage. Lowering their wages even more is no solution. For that matter neither are any of the other extreme right wing talking points you rattled off. My only other point would be that all those talking points are loosely based on the work of…yes…philosophers. You can’t make it up.

Well, actually isn’t that more or less what was advocated by Wall Street with respect to the banks during the 2008 collapse? Though I guess your point might well be that Wall Street used the Internet as well …

Bankruptcy/government bailout seems to be a normal way of doing business. Is it any surprise that quite a few students think it should apply to them as well?

And in terms of engineering/tech degrees, many of those jobs are now going to China and India, where the same quality of engineer/programmer can be found to work for considerably less, simply because their cost of living is considerably less. To a large degree, the problem is that a lot of professional work is now becoming global, which means wages will tend towards the global medium. And eventually so will costs of living, though that’ll take some time, time which many students don’t have.

@Terrye:

Pricey institutions of higher learning lull students into their programs by encouraging them to take out student loans. Like debit cards, it’s painless in the beginning. Only when the debt hangs over their head for years does it become similar to a financial ‘hang-over.’

There are definitely less expensive options out there, albeit they may lack the exotic frills of more well-known, popular universities. Community colleges, on-line college courses, even extension courses, though, can take you a fair distance, academically, that is affordable. In the meantime, if more students refused to enroll in institutions that were outrageously expensive it just might promote some pricing recalculations elsewhere.

@Tsar Nicholas: So your proposal is to keep on doing what you have been wanting to do for at least the past thirty one years, and only do more of it….

@Terryre — when confronted wtih the data that shows a HS grad with no college has massively lower standards of lifetime living and earnings compared to a college graduate, the decision to take on debt, on average, is a good decision. However that analysis assumes that there are decent jobs available for recent college graduates, but those jobs are not available right now.

When I’m fully employed like now, the debt service to pay for my master’s degree is a manageable expense. When I was out of work/massively underemployed, that debt service was a near dehibilitating expense.

@Stormy Dragon: Actually I agree with you: the best solution would simply have the Fed buy all outstanding student loan debt, as it did with toxic assets or bank debt. It would be a direct swap of liquid (cash) for illiquid (loans) assets which together would net to zero with no increase in financial assets. Think of it as a Quantitative Easing directed at mainstreet rather than the financial sector.

This is a problem that might already be solved. Government student loan debt is fairly manageable. It’s low interest (with deferred interest while you’re in school) and you actually have to be doing good in school to get it.

But there’s private loans out there that a lot of people were able to qualify for regardless of how they were doing, whose interest piles up while you’re in school, and whose servicers typically engage in all the annoying behavior of any non-government creditor. The reduction of the latter i think will go a long way towards making student loan debt less insane. The problem is the changes that pushed private banks out of the student loan game are really recent and don’t affect a lot of people that are seeking jobs now.

This is a little obtuse. “These kids” as you call them have been told from day one they were expected to go to university, that if they did that and made good grades jobs would be waiting for them. They were told this by corporate America, by schools, by their parents and pretty much every one in between. They did what they were told they were supposed to do and then found out they were lied to and the game was rigged. They bought into the existing system and got kicked in the teeth for it, so don’t tell me they should have known better.

@Ben Wolf:

This reminds me of an older dentist friend of ours. He was a gentle decent guy, who ate healthily, exercised everyday, was honest, actually had no faults that I knew of, but was hospitalized with an abdominal aneurysm. Before he died, he asked me, “I did everything right, why did this happen to me?”

Moral of story —-> there are no guarantees.

@jan,

There are no guarantees. I don’t think anyone is arguing that society owes college graduates (or anyone else) a certain life that they thought they were buying into.

But… going to school is an expensive investment that we want as many people as possible (who are capable intellectually) to make. We hear all the time that this tax rate or that tax rate should be lower because lowering the financial burden encourages the behavior. Well, going to school is an investment we should be encouraging, and thus it’s a financial burden we should be seriously looking at reducing.

A college education is a valuable thing. There should be costs associated with it. There should not be student loans. Those who can’t afford to pay for their education themselves can work and save or they can enlist in the US armed forces to get $ for college.

No one is owed a college education. Now if all of America decides to start giving away $ for people to go to college then so be it. But this idea of low-interest loans that students can borrow and then easily discharge in bankruptcy is just ridiculous. The loan process is serious it creates an obligation which borrowers should be prepared to meet and not just abandon when it’s inconvenient.

The occupiers are owed nothing. They do, though, deserve our contempt. They already have mine.

@Drew:

This is actually correct, except for the word “government” stuck in there.

Liar loans were sold by private agents, packaged by private banks, and placed as marketable bonds by Wall Street Firms.

The excesses, the NINJA loans, the interest only loans, the zero down loans, never touched a governmental institution in their creation.

Now it’s true that in the aftermath of the crash the government acquired those crap bonds all kinds of ways … to prop up Wall Street, and to create profits that Wall Street titans could claim were theirs fair and square. That they did it all on their own, and the dirty hippies should pipe down.

C’mon, jp. See: Fannie and Freddie.

@john personna:

This is exactly right. Deregulation made it possible for investment banks to borrow unlimited quantities in the form of deposits from the Fed and create vast quantities of debt that should never have existed.

Freddie and Fannie lost market share to the newer looser loans, but sadly they were brought in post-pop to buy then known-bad loan bundles. That was government socializing Wall Street loses.

The basic problem I see with this whole debate is the notion of a free lunch. Many commenters leap from the valid notion that education is good to……..therefore market considerations must be eliminated and the government should subsidize education. Oh, wait! That’s what actually happened. And now we have skyrocketing tuition costs, and a debt overhang that is debilitating.

Who knew? (snicker)

Drinking beer, smoking pot, banging chicks, going to football games ……….and getting a smidge of an education……is all fine. But if you major in sociology, French Lit or philosophy etc – all worthy pursuits – but pile up debts that you cannot even hope to pay off, don’t look to the taxpayer, look in the mirror. It was your choice.

@Drew: You don’t really “get” what money is, do you? You just don’t understand that money is flows, not stocks. It explains your incoherent postings.

@Andyman:

I agree about reducing this loan burden. However, some of this can be done voluntarily by choosing less expensive academic venues, especially when doing one’s under graduate studies. So much of the first couple years of college are comprised of pretty mundane classes, mandated to simply satisfy prerequisites for one’s major/minor.

Like I said in an earlier post, many of these can be taken in 2-year colleges, on-line etc. Currently there are more and more college alternatives available, geared to people who have to work while going to school. I know when I did some graduate work at Loyola, some of the professors admitted that much of the Bachelor’s program there seemed to be nothing more than an extended finishing school for ‘rich’ kids.

I don’t think I’ve ever agreed this much with one of Doug’s posts before, I’m really not seeing much of a downside to this at all. It wouldn’t be very hard to add a couple conditions that would prevent people from simultaneously graduating and declaring bankruptcy, so that seems to be a manageable concern. Besides, not very many people actually want a bankruptcy showing up on their credit report.

I am very confused by the comments advocating policies that would result in fewer people attending college. Exactly how would that help the USA compete economically? What would we gain by having a less educated work force?

So much of the discussion here involves a continuum starting from a choice someone makes, to the conclusion or outcome of that choice. Whether it was to buy a home, with nothing down (seemingly a good deal at the time), or getting into a prestigious school which parents could ill afford, but nevertheless swung with student loans dangled in front of them. These unsecured choices enabled people to buy homes/education on a shoe-string, never having to go down that other path of deferring immediate gratification for what they wanted.

Now, we are in the part of the timeline called ‘consequences’ for those decisions. Many are unintended, and that’s what people are lamenting. With home purchases they want their loan reconfigurated with smaller payments, or some kind of forgiveness from the government in being responsible for paying back the full amount of the loan. School borrowing is viewed the same way. Many of these students enjoyed a satisfying time in school. But, now that they are in the real world and opportunity is not banging on their door they have grivances towards society, the ‘system,’ lenders, and so on.

@David M:

I don’t see people advocating not attending college. What is being said is to attend a college or academic medium you can afford without a 5-6 digit loan amount on your back. Even going into the military is an option that others have voiced, which, for the right person would be a good alternative.

Sorry, jp, your crap just doesn’t fly.

The truth be told, when activist Jim Johnson took over Fannie Mae in the early 90’s, the die was cast. Supported by the Black and Hispanic Congressional Caucuses, the Clinton Administration, and so-called National People Action group, it was open season on promoting uncreditworthy home loans, to be offered and/or purchased by GSE’s. With prodding from Team Clinton, the eventual equity requirement declined to 3%. Its a fact. Sound reasonable? No. But its a fact. And so the bad loans flowed, and flowed, and flowed.

As usual, being the completely intellectually dishonest person you are, you want to attempt to ignore what set this all in motion, and take a factiod about down the road share gain by other enterprises and attribute the cause to another set of players, while ignoring root causes. “Analysis” (snicker) of this quality would get you summarily fired as an incompetant in our firm.

For those who feel the need to look down the road for villians I have pointed out many times that there are available CSPAN tapes of Maxine Walters, Barney Frank etc absolutely denying any problem in the housing markets and rebuffing any attempts at regulation. On tape, in their own words. And dead wrong.

“I want to roll the dice a little bit more in this situation towards subsidized housing.”

Barney Frank – 2003.

But, I know, I know, its just so much cleaner and neater to blame “Wall Street Greed.” Who gives a damn about real causes and preventing another problem, right?

@Ben Wolf: How would this spur consumer spending? Here is a better solution, one that I did: work 2-3 jobs until you get your loans paid off. These people knew before they went to a high price grad school that graduate degrees are expensive and only certain degrees have a chance of getting a good job that will pay these bills off in a reasonable amount of time. If they didn’t, they were spending too much time playing their playstations. So now, they want the taxpayers to pay it. Fine, then the government can pay off my mortgage, which they could have easily done for every homeowner with the stimulus money instead of it going to pork barrel projects and the “green” industry scandal.

@Drew: You don’t really “get” what money is, do you? You just don’t understand that money is flows, not stocks. It explains your incoherent postings.

You are absolutely correct, Ben. That’s why am a partner in a private equity firm and have made 10’s of millions of dollars. I don’t have the unique insights you do on money……………and that whole, tremendously insightful, flowey/stocky thingy……..whatever

@Drew:

I don’t really like Freddie and Fannie, and know that they’ve done a lot of dumb, crooked, things over the years. But that isn’t excuse to blame them …. like a cop picking up “the usual suspects” for a new crime.

Lots and lots of people have documented their relation to the real estate bubble and crash.

Here’s a serous one:

Fannie / Freddie Acquitted

Actually the intro to that piece talks about the same thing I did. People wanted to blame Freddie and Fannie because they already hated them. Not because this crime in particular was theirs.

@Drew: You’ve posted some comical nonsense regarding the housing market, so it makes sense you’re in the financial sector. If anything, you somehow managed to reduce your credibility.

Remember, Fannie and Freddie didn’t cause the housing bubble, they were victims of it.

@jan,

Maybe this is a generational thing– I wouldn’t want to guess your age, but I’m 30– but it bears repeating that a college education is definitively transitioning away from “rich kids’ networking club” and into Grades 13-16 for people who’d like to be middle class.

Of course nobody should get loans they don’t expect to be able to pay for. And junior college, correspondence school, etc are all options that should be encouraged. But imagine you’re graduating high school now; on one hand, you can roll the dice, rack up some loans, and maybe you’ll get the job you need to pay them off (and want to have to get your career going); on the other hand, you can wait until you’ve saved up money working… where? Wal-Mart?

There’s a crappy Catch-22 in place for many members of the current student generation. You can’t afford college without a good, middle-class job, and it’s next to impossible to land one of those without a bachelors degree (at least). I’m sure there are heroic stories of the guys who worked 23 hours a day with two kids and don’t have any student loans, but let’s talk about the median experience here. The only way to avoid working a non-union assembly line for 40 years is to go ahead and get the loan while you’re young, get out of school as quickly as possible, and pray that whatever you land in is lucrative enough to bail you out.

What I’m saying is that we should be treating unemployed grads less like homeowners who bought the 5-bedroom colonial they could never afford and more like people who made the best investment available and it still didn’t pan out. Frankly, it’s the sort of self-betterment initiative that society do with more of.

Perhaps the problem is that since Wall Street was able to avoid its consequences because of a gov’t bailout, the precedent has been set for every other aspect to gain the same. If we can afford to bail out rich financiers, why not students? Or home owners? Or any other group. This is just another reason why fiscal conservatives were against the Wall Street bailout – it sets the precedent for every other goup, many of which arguably have a much stronger claim for such a bailout than Wall Street did.

And actually it’d be a lot cheaper to bail out students than it cost to bail out Wall Street.

@george:

Actually, it would be about as expensive. Student debt just passed credit card debt and is above $800 billion. With a ‘b.”

This one is where the government did engineer it. It is mind boggling that we got ourselves in this position.

($825B divided by 318M population means $2,644 for every man, woman, and child? Surely that is wrong …)

jp –

There’s so many exculpatory items that have been published. If you’d ever like to deal with reality, let me know. Same for you, David M.

Andyman actualy wrote something useful, attempting to differentiate between some guy who got overbooked buying a big house, and a guy buying an education. This goes to motive, which is useful. However, he craters in a straw man dichotomy, school vs Wal-Mart greeter. Andyman – at 30 yrs old, sorry to disrupt your worldview, but a college education is not a publicly funded “right.” There are so many, older than you, who paid their own way, looked to “angels” or earned a real scholarship.

I know that sounds cold. But its a fact.

I’ve never bought the “moral hazard” argument here. Declaring bankruptcy isn’t like eating an ice-cream cone. Few graduates are really going to want to go there.

Will some people game the system? Sure. But (1) those people were probably going to default anyway, and (2) someone ALWAYS games EVERY system. Right now, the ones gaming the system are the lenders. Let’s put the benefit of the doubt where it belongs.

@Drew:

Sometimes ‘exculpatory’ wins the case. That isn’t bad, not when it’s the truth.

@Coogan: Working two to three minimum wage jobs will not pay off one’s debt. Ever. The days of working one’s self through college are long over. Furthermore money not saved to pay down debts is money free to circulate through the economy. Excessive private debt is exactly why we’re in the Great Recession.

@Drew,

I actually did a little bit of all four when I was in undergrad. My “real” scholarship got me started, I chipped in what I could (as an eighteen-year-old, not a lot), my parents helped me out, and loans covered the rest. So I’ve got a little experience in many areas.

Since you’re confused about my worldview, let me lay it out. I agree that there’s no right to a college education. I also think that we, as a society, want to minimize the number of kids who are smart enough to get a college degree but can’t because of money. We already encourage all sorts of behaviors, from saving for retirement to having health insurance to buying a house, with “expenditures in the tax code”. College is just as important as most of those, so it behooves us, as a society, to spend money on that as well.

In other words, this isn’t about what’s a fundamental right or what’s owed to whom by whomever else. But sometimes it’s smart to give people helping hands even when they’re not “entitled” to them by some Jeffersonian principle. And in this case it’s smart to reform a broken system that traps people outside the middle class unless they take on a mountain of debt that they have to gamble they can pay back later.

Another aspect of my worldview is that it’s absurd to act like relying on an “angel” for college is upstanding behavior but relying on a Pell grant is mooching.

In other words, the good schools are for the children of the 1%. Peons, you need not apply. Send your kids to the JC. Maybe they can read about the American Dream in a history book.

@anjin-san: Indeed, that’s the point. The Jans and Drews of the world envision a perfect society — for themselves. The drones can work away for minimum wage (or less) to do all the things our wonderful masters of the universe can’t dirty their hands doing. Of course, if you let these morlocks get decent educations, they’ll start asking questions — like, why can’t they be eloi, too? Hence their terror of OWS, expressed as contempt for hippies…

@WR:

Dumb. And you are a university prof?

@lhfree:

I’m sure they feel the same way about you.

Many of the comments here end up going back to “no guarantees”. What do you think would happen if everyone – or rather 99% of the people – just quit paying their bills? Do you really think ANY industry has the power to take everyone to court? Since debt exists in an ether, imagine the financial chaos that would cause across all industries.

If the vitriol of the individual I quoted doesn’t chill that may be what we all get. Now – would you prefer that, or would you like to extend the same help to the people that are actually the job creators when they demand goods and services with the money they no longer need to pay to the banksters that made poor investment decisions.

You say there’s a moral obligation that these debtors pay their bills? I say there are no guarantees (ring any bells?) and that a moral obligation to eat outweighs any obligation to debt owed to some bank. The reason interest is charged is to generate a return on the risk – if the risk doesn’t pay off then it sucks to be you. Kinda like that education, huh? Sure nobody FORCED “these kids” to get the degrees they chose to get – but I don’t recall anyone FORCING Wall Street to pull the crap they did with their shifty investments tricks either.

My point? -In the end it works both ways whether you like it or not. You can’t sue everyone at the same time and forces them to pay their debt with the jobs and money they don’t have.