Romney Losing Tax Debate To Obama, Polls Say

The Wall Street Journal takes a look at a series of recent polls, and finds that the Romney campaign has fallen behind President Obama on one of the central issues of its economic message:

Mitt Romney, who has proposed new cuts to individual and corporate taxes, has lost his recent lead over President Barack Obama on the question of which presidential candidate would best handle taxation, a reversal that turns up in several polls and presents a worrisome trend for the GOP nominee.

Republicans who favor tax cuts as a way to boost the economy, and who believe the issue should be a political winner for the GOP, are wondering why Mr. Romney hasn’t gained traction with his tax-cut plan. Some say he simply isn’t promoting it well or arguing forcefully that it would bring economic benefits.

(…)

At least four polls in recent weeks have found Mr. Obama holding an edge over Mr. Romney on who would best handle the issue of taxes. An ABC/Washington Post poll last week found Mr. Obama with a seven-point advantage on taxes among registered voters, after Mr. Romney had led in that survey in August. A Gallup poll in late August found Mr. Obama holding a nine-point lead on the issue of taxes, after Mr. Romney led in July.

Some conservatives suggest the Romney campaign hasn’t done enough to convince voters that his plan would boost economic growth.

“I think there’s an educational effort that needs to be made with the public,” said Douglas Holtz-Eakin, a former economic adviser to GOP Sen. John McCain’s 2008 campaign. “I don’t think sufficient effort has been made on that front” by the Romney campaign.

Grover Norquist, president of Americans for Tax Reform, a group that pushes for lower taxes, said the Romney campaign “would be better off focusing more on taxes. It’s a clear winner.” Mr. Norquist said taxes and federal spending issues brought many voters to the polls for the big GOP wave of 2010 and could help the party again. “I find it hard to believe you can overplay them,” he said.

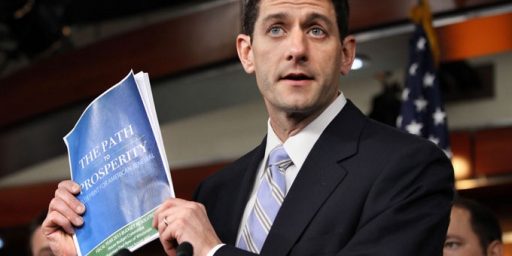

To a large degree, this seems to be occurring because the Obama campaign has effectively used negative ads to portray Romney’s tax plan would lead to big tax cuts on high income earners, while increasing them for the middle-class due to Romney’s promise to make his plan revenue neutral by balancing it out with the elimination of certain deductions and loopholes. The Romney campaign has compounded the problem by refusing to be at all specific about what deductions they are looking at. The campaign’s defense to this was stated quite clearly by Paul Ryan in an interview this weekend with conservative journalist David Brody:

David Brody: There are some conservatives that have spoken out saying they want to see some more specifics from the Romney/Ryan team and one thing that comes up, at least from the liberals is tax loopholes. Is there a reason you guys aren’t naming specific tax loopholes?

Paul Ryan: Yes because we want to get it done. Look, I’ve been on the Ways and Means Committee for 12 years. I’m very familiar with how to make successful tax reforms take place. Ronald Reagan and Tip O’Neil did it in 1986 but we haven’t done it since 1986 for lots of reasons, which is we don’t want to presume to say, ‘Here’s exactly our way or the highway take it or leave it Congress.’ We want to say this is our vision, lower tax rates across the board for families and small businesses and work on the loopholes that are enjoyed by the higher income earners, take away their tax shelters so more of their income is subject to taxation.

That lowers everybody’s tax rates. And we have to be able to work with Congress on those details, on how to fill it in and, more to the point, we don’t want to cut some backroom deal that they did with Obamacare where we hatched some plan behind the scenes and they spring it on the country.

We want to do this in front, in the public, through congressional hearings with Congress so that we can get to the best conclusion with a public participation. That’s the process that works the best to ultimate success gets this done. That’s why we’re doing it this way.

(Video available here)

In can understand the desire not to give away your entire game plan before beginning Congressional negotiations, but that strikes me as a bit of a weak excuse for a lack of any specificity. For one thing, before you get to the point where you’re negotiating with Congress you have to win the election and I don’t see how the Romney campaign can do that by playing “hide the ball” with their economic plan. For another, it wouldn’t be necessary for the campaign to give away their entire game plan before the election, all they would need to do is lay out a general framework of the kind of deductions and loopholes they’re thinking about here. Are they talking about the plethora of business tax credits that amount to little more than under the table subsidies? Are they talking about re-jiggering the depreciation schedules for business equipment? Or, are they looking at something far more substantial such as the home mortgage interest deduction, even in a limited way? (One suggestion I’ve heard is that the home mortgage deduction would be limited or eliminated for high income earners, and even more severely limited for second homes.) These are the kind of questions people are asking, and the kind o questions Romney and Ryan will face at their respective debates. They need to have an answer ready.

It’s been explained quite a few times that the Romney budget math is impossible, so a coy game that “they should just explain their plan” is kind of ridiculous. It is past its sell-by date.

On taxes, when the question is polled aren’t most Americans ready to accept some increases?

Pew: Raising Taxes on Rich Seen as Good for Economy, Fairness

We’re back to the Republican idea of compromise, IMO, that everyone else should just fold. That the minority should prevail.

(I mean, I know you are reporting the story, but it does ring a bit like “let’s back up and pretend again that the budget is real.”)

What’s interesting about Obama’s attacks and Romney/Ryan’s answer is the inversion of the stereotypical relationship between Democratic and Republican talking points:

In recent years, the Republican side has been very good at boiling a topic down to a powerful soundbite attack (“Death Panels” is a great example). The Democratic response to that talking point is usually anything but a soundbite.

Here we see Obama’s campaign creating excellent quick attack videos and the Republicans struggling with compact responses (either saying that its too complex to tell you our plans or Ryan’s three paragraph response in the interview with Brody).

I have to say, I am just loving the utter imbecility of conservatives. Mr. Romney hasn’t explained well enough why he needs a tax cut? The man who won’t release his returns? The man who hides money in offshore accounts just needs to ‘splain it better to us simpletons? The man pushing the very same policies that drove us into the ditch to begin with?

You just can’t make up that level of stupid. If I wrote a story with these characters saying these things it would be shelved under satire.

He hasn’t released specifics because there are no specifics — the “plan” is a half-baked fraud. Just like the Ryan budget.

@michael reynolds: Exactly……they don’t seem realize that the country has rejected Republicanism.

It is funny, Romney actually looks like the smart one in the party for realizing these and deciding to be vague.

Hell, this is nothing. By late-October the media polling will be telling us that Romney is losing every issue to Obama. No, seriously, literally, every issue. Taxes. Jobs. Healthcare. Education. Energy policy. Foreign policy. The Middle East. The Far East. The Wicked Witches of the East and West. Everything.

Whether or not that translates into Obama actually winning the election remains to be seen. Certainly it might. But then again it might not.

Is it only me who loves the irony in Paul Ryan stating

when the way he first came into the public eye was by grilling Obama during the nationally televised Healthcare summit?

http://www.youtube.com/watch?v=e-lxg7XrF6I

@Tsar Nicholas:

Insightful analysis. I feel I’ve learned something reading it: something might happen, or it might not. There’s really no arguing with how you’ve managed to boil this situation down to its essentials.

Shorter Paul Ryan: “We don’t want to give our opponents anything to attack us with.”

Vote Romney/Ryan because lying gutless weasels make the best leaders

@Tsar Nicholas: “Certainly it might. But then again it might not.”

Another keen political analysis from the Tsar. With this kind of insight and wisdom, it seems a shame to confine your thoughts to blog comments. You should write a book. Or run for office.

@Rafer Janders: Beat me to it. Sorry for the duplication.

@Tsar Nicholas: P + Not P = Total Set.

Gee, I think I can distill this even further: stuff happens.

I think it’s more that “working” high earners are starting to notice the extent that there is a parasite class that is receving highly favorable tax treatment despite providing very little to the economy in terms of producing goods and services. When the republicans talk of reducing taxes, it increasingly seems to mean only their taxes. When a Doctor or Lawyer notices that Mitt Romney is paying a much lower tax rate then they are, arguing that their taxes should go up so that his can go down even more turns what otherwise have been a Republican ally into an enemy.

@Lynda: Further irony from the small man of obstructionism…

Ryan:

If Ryan has been on Ways & Means for just 12 years (and in Congress only a little while longer)…

…and the last time there was a successful attempt to enact tax reform was in 1986, and it hasn’t happend since…

…then how exactly is Ryan “very familiar with how to make successful tax reforms take place”? He hasn’t been a part of any such effort, and he hasn’t even been around when it happened…so what on earth is he talking about?

(In reality, given the paucity of his legislative record, Ryan doesn’t seem particularly familiar with how to make any kind of successful attempt to pass a bill.)

Also, too? Always heartwarming* to see them recycle the old lie about Obamacare being done entirely behind the scenes.

*By “heartwarming”, of course, I mean supremely annoying.

@wr:

Great minds, etc. I think we’re both agreed: we are intrigued by his ideas and interested in subscribing to his newsletter.

OWS has something to do with the success of Obama’s message on tax fairness, me thinks.

The major problem for the Republicans is they just don’t seem to grasp that the public has seem their program work for eight years and have seen it fail, utterly. Trotting out the same snake oil simply doesn’t work after the public has seen it fail, painfully and spectacularly.

Nothin Ryan said changes the Bayesian conclusion that they are keeping the loopholes secret because they are the loopholes that primarily benefit the middle class.

@Tsar Nicholas:

Is there an issue for which you think Romney is polling better than the President?

stormy:

This is a key point, especially in light of the shell game Mitt is playing with the Feldstein analysis. Feldstein essentially admits that Mitt is planning to raise taxes on the $100-200K group.

Details here.

ryan:

It’s quite Orwellian for Ryan to say he can’t tell us his plan because “we want to do this in front, in the public.”

Like Michael said, these people sound like satire. Poe’s Law in action.

@b.tom.darga:

I can’t wait until Paul and Mitt explain to the voters that the deficits go away with elimination of the Mortgage Interest Tax Deduction.