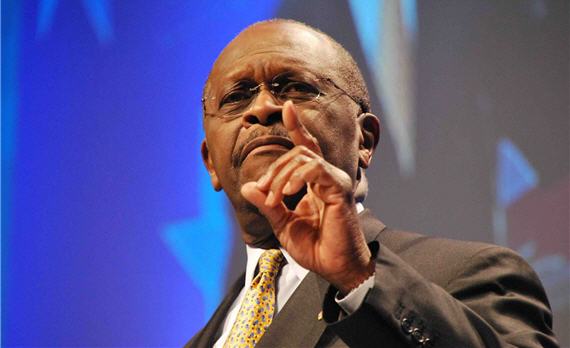

The Utter Folly Of Herman Cain’s “9-9-9” Plan

Now that he's a top tier candidate, it's hard to see how Herman Cain's tax plan can withstand serious scrutiny.

Not surprisingly, last night saw Herman Cain’s “9-9-9” plan came under the microscope in a way it hasn’t before:

Former Godfather’s Pizza CEO Herman Cain and his “9-9-9” plan stole the spotlight at a Tuesday night debate among Republican presidential candidates in New Hampshire.

The GOP candidates took their turns weighing in on Cain and their own plans to boost the economy and job creation at the debate, while frontrunner Mitt Romney, the former Massachustts governor, emerged relatively unscathed.

Cain, who’s surged to second place in recent national polling, talked up the plan — which calls for a nine percent tax on personal income, business income and sales — and responded to criticism from other GOP presidential hopefuls.

Minnesota Rep. Michele Bachmann said it’s “not a jobs plan; it’s a tax plan.”

“When you take the ‘9-9-9’ plan and turn it upside-down, the devil’s in the details,” she said, referencing the Satanic sequence of numbers, “6-6-6.”

“I don’t need ‘9-9-9,’ We don’t need any plan to pass Congress. We need to get a president of the United States that is committed to passing the types of regulations, pulling the regulations back, freeing this country to go develop the energy industry that we have in this country,” said Texas Gov. Rick Perry, whom Cain has overtaken in recent primary polls.

After the debate, the Bachmann campaign said that Cain’s plan would “wreck the economy,” and she wasn’t alone in piling on the new co-frontrunner. Rick Santorum denounced it as a “fantasy” that could never be passed by Congress. And, Jon Huntsam got off a good joke at Cain’s expense when he said that he thought 9-9-9 referred to the price of the pizza.

Joking aside, though, Cain is now a frontrunner and he’s starting to get scrutiny from the press and pundits like he hasn’t before, starting with his tax plan:

Cain’s so-called “9-9-9” plan has liberals and tax analysts worried that the plan would not take in enough revenue, and that it would cause lower- and middle-income families to pay more.

But conservatives have a different concern – that Cain’s plan to install a 9 percent national sales tax, paired with income and corporate taxes at that same rate, would give Democrats a brand new tax stream to try to squeeze out more revenue.

Cain’s rivals for the Republican nomination, like former Sen. Rick Santorum of Pennsylvania, are not the only ones expressing that concern. Even Grover Norquist’s Americans for Tax Reform (ATR), while saying there is a lot to like about the 9-9-9 plan, says the idea could give liberals a chance to expand the nation’s revenue base.

“All Mr. Cain’s plan does is establish a new tax on the American people and, while a 9 percent tax may pass the Congress, Harry Reid and Nancy Pelosi will waste no time making 9 percent into 19 percent,” Santorum told The Washington Post.

As for ATR, Ryan Ellis, the group’s tax policy director, said Cain’s plan to tax more on the consumption side was a positive step. But Ellis also worried that, if a new national sales tax was implemented, Democrats would try to use it to expand the scope of the federal government.

“The national sales tax in ‘9-9-9’ would be used by the left to be that new source of money if given the opportunity,” Ellis said.

Not just the left, I would submit, but the right as well. As the history of the income tax shows us, once the government has access to a new revenue stream it will inevitably act to enhance that stream as much as possible and, with a sales tax that is charged at the point of purchase and largely hidden from the taxpayer, the ability to enact stealth tax increases would be far too tempting for any Member of Congress to resist. Cain says he would prevent that from happening by making sure the plan included a required two-thirds supermajority vote to make changes to the plan. The problem with that, though, is that absent a Constitutional Amendment it’s hard to see how a supermajority rule enacted by one Congress could possibly bind a subsequent Congress, or even itself. All it would take, in theory, would be a majority vote to override the supermajority “rule.” Cain hasn’t explained how he’d deal with this problem, partly because nobody has asked him, and partly because I doubt he’s actually thought it through.

That Cain doesn’t have a lot of specifics to back up the slogans shouldn’t be all that surprising. While he loves to mention the plan during his media appearances, he is far less willing to share any of the details behind the plan, such as the backup for his assertion that the plan is revenue neutral, or the even who has helped him come up with the plan. That’s not surprising, though, once you realize that the plan’s chief architect, Rich Lowrie, isn’t an economist at all and is in fact a Wells Fargo Branch employee working outside of Cleveland, Ohio whose highest educational degree is a apparently a B.S. in Accounting from Case Western Reserve University. Outside of his banking experience, Lowrie appears to have distinguished himself primarily as a volunteer adviser to Americans for Prosperity and the American Conservative Union. Considering that Cain has said repeatedly in other contexts that he intends to surround himself with “experts,” his reliance on such an unqualified person to draft the central plank of his campaign is strange indeed.

The other detail about 9-9-9 that Herman Cain never mentions is the fact that it’s really just step one of his tax reform plan. Step Two would be to transition the nation to something resembling the so-called FAIR Tax, a national sales tax that has been advocated for several years by people like Cain, Mike Huckabee, and talk show host Neil Boortz. Leaving aside the problems with the Fair Tax, of which there are many, Cain has never quite explained how he would be able to implement two fundamental transformations of the tax system in four or eight years in the White House. He clearly has no understanding of how Washington really works, or why he would need to worth with Congress, not merely dictate to them as he did when he was CEO at Godfather’s Pizza.

National Review’s Kevin Williamson did a fairly devastating takedown of the plan two weeks ago:

Mr. Cain says the proposal would be revenue-neutral. I have my doubts. The federal government took in about $2.2 trillion last year. Based on personal-income and business-income figures from the IRS, and consumer-spending figures from the Gallup survey, my English-major math suggests that a 9 percent tax on all of the above produces about $1.7 trillion in revenue, meaning that 2010’s $1.7 trillion deficit would have been more like a $2.2 trillion deficit — from calamity to catastrophe. If Mr. Cain’s team is building in some growth assumptions into the fiscal forecasts, they must be sunny indeed.

In any event, Mr. Cain has not spelled out in any detail a spending proposal that would allow the federal government to get by on $2.2 trillion, much less on $1.7 trillion. If the Tea Party stands for anything, it stands for smaller government, meaning lower spending. And yet the allure of magical thinking on taxes is so powerful that the tea-party favorite has given a great deal more detail about his tax proposals, with actual figures and everything, than he has about his spending proposals, which remain remarkably vague: Spending must be “reviewed with a keen eye and a red pen,” he says. Well, gee willikers, why didn’t I think of that? (Other than his pie-in-the-sky growth assumptions, my least favorite thing about Herman Cain is that his response to every challenge is to appoint a committee of smart guys to do the right thing. He seems incapable of appreciating the fact that moral failing is not the only reason Washington fails to do the right thing.) As I have argued before, the real danger of tax-cuts-and-growth utopianism is that it draws attention away from spending cuts, which is where the real action is needed. Mr. Cain is nibbling at that bait.

The 9-9-9 proposal also creates some perverse incentives. With business income taxed at 9.0 percent while dividends and capital gains are taxed at 0.0 percent, there is an excellent reason to pay out something approaching 100 percent of business income as dividends, or to hide it by “reinvesting” it in the business. I like dividends and am sympathetic to the case for giving them preferential tax treatment — a company that concentrates on paying a high dividend rather than on raising its share price probably is a better-behaved company, in most cases — but it is always and everywhere true that if government creates a tax shelter it will be exploited to maximum effect.

Former Reagan Administration official Bruce Bartlett, meanwhile, points out the perverse policy impact that Cain’s plan would have:

It’s important to understand that the 9 percent rates on personal and business income would apply to very different tax bases than now exist. For individuals, the tax would apply to gross income less only the deduction for charitable contributions. No mention is made of a personal exemption.

This means that the 47 percent of tax filers who now pay no federal income taxes will pay 9 percent on their total income. And elimination of the payroll tax won’t even help half of them because the earned income tax credit, which Mr. Cain would abolish, offsets both their income tax liability and their payroll tax payment as well.

Additionally, everyone would now pay a 9 percent sales tax on all purchases. No mention is made of any exemptions from this tax, so we may assume that it will apply to food, medical care, rent, home and auto purchases and a wide variety of other expenditures now exempt from state sales taxes. This would increase their cost of living by 9 percent while, at the same time, the poor would pay income taxes.

The business tax in the Cain plan bears no resemblance to the present corporate income tax. The tax would apply to gross sales less dividends paid and all purchases from other companies, including investment goods. Thus, there would be no deduction for wages.

How benefits would be treated is unclear, because purchases of things like health insurance might constitute a purchase from another company and remain deductible. If so, what is to stop a company from paying its employees by leasing their cars and homes for them and even buying their food and clothing? That would reduce their taxable revenue.

The abolition of any deduction for wages is likely to raise the cost of employing workers, even with abolition of the employers’ share of the payroll tax. And since the dividend deduction doesn’t appear to be related to profitability, companies could borrow to pay dividends and still get the deduction. Even a novice tax lawyer could easily make a tax shelter out of that.

Both Bartlett and Williamson make excellent points. As The Cato Institute’s Dan Mitchell has noted, imposing a national sales tax on top of an income tax would be an invitation to disaster on the part of Congress, and Congress is always wiling to accept those kinds of invitations. On the other side of the argument, a plan like Cain’s would have the perverse effect of raising taxes on those least able to pay them, while providing those in upper income brackets with an entirely new, and nearly foolproof, method of sheltering their income from any taxation at all. Yes, they’d have to pay the sales tax like the rest of us do, but that’s going to be a far smaller share of their income than it is for somebody making $35,000 per year, or less.

Cain’s tax plan is getting attention because it sounds simple and easy. As Mitt Romney pointed out last night, though, the solutions to our problems aren’t going to be simple and easy, and hiding behind a slogan that is, as Hunstman put it, more appropriate for a pizza place than a Presidential candidate is a sign of just how unserious Herman Cain really is. The floodgates have been opened, though, and I think we’re about to see people start to realize that there’s far less to Herman Cain and 9-9-9 than meets the eye.

The only way to get Cain’s plan to work would be to do it as a Constitutional amendment that specified the percentages. As you say, once a tax starts, it doesn’t go away and only creeps upward (with very few exceptions — I think it took over a century to get rid of a Spanish-American War “temporary” tax).

And I still hold it up to the only standard that matters — would it be better or worse than the current system, plus four more years of Obama? On that scale, I’ll go with Cain. He might not get his plan through, but I like his spirit.

Plus, when was the last time one of these plans actually got implemented as promised? Look at all the promises Obama made about ObamaCare that didn’t make it into the final plan.

J.

Seems Bruce Bartlett is lying. It says on Cain’s website that food and gas are exempt from the national sales tax as well as purchases on used goods. In addition, you are all leaving out that lower-income Americans would pay 0% on payroll taxes. That is something that will directly benefit the lower class!!!

Doug, why are you dragging out the old class warfare crap? What right do you have to say that a rich person should pay a higher rate of his income than a poorer person? This fairness crap drives me crazy. Life ain’t fair and when some busybody tries to take something from me in the name of fairness to give it to someone else who is perceived to have experienced less success, then I say the American spirit is lost.

It’s not the job of government even the field of results; only to protect the field of opportunity.

Well, any tax scheme that claims to be “revenue neutral” while also reducing the tax burden on the wealthier classes must, by definition, _increase_ the tax burden on the middle & lower classes. If you want a regressive tax structure, just say so. But bear in mind – such things aren’t built to make things better for _anyone_ who is reading this blog.

A federal 9% sales tax on top of the 9.75% we’re already paying here in Chicago would drive legitimate businesses out and either drive sales to jurisdictions with lower local sales taxes or create an enormous black market. Frankly, I think that compliance would be so low that the federal government wouldn’t realize enough revenues to pay its tab (it’s not paying its tab now but that’s a different subject).

@Thomas:

Please tell me where those exemptions are mentioned because I don’t see it and Cain has never said anything about exemptions from the sales tax in his numerous appearances on the subject.

And your Payroll Tax question brings up another question — how exactly is Cain going to fund Social Security and Medicare?

@Dave Schuler:

This morning when someone brought up the issue of imposing a national sales tax on top of state and local sales taxes, Cain said, in effect, that that was a problem for the states.

The entire Republican party combined has zero good ideas about the economy.

Why single out Cain?

“And after the 2012 elections the GOP will be led from the House majority and the incoming Senate GOP majority. They have already tipped their hand: They will pass the Ryan Plan, which includes spending restraint, broad welfare/Medicaid block grants, entitlement reform, and tax reform, beginning with top rates dropping to 25 percent.The debate about 9-9-9 or Huntsman’s plan or Romney’s plan or Perry’s upcoming plan helps pass the time if Netflix hasn’t arrived. But the only real question is whether each candidate has a working thumb and forefinger and can sign the legislation Boehner and McConnell pass. We are not looking for a fearless leader. We are looking for signer in chief.” — Grover Norquist

It would seem to me any oath taken ahead of the Oath of Office qualifies as an impeachable offense on the face of it.

This fairness crap drives me crazy.

No. You were already crazy, which is why you see “this fairness crap” as so terrible.

…

Cain’s “plan” is nonsensical and obviously unworkable. It’s just a slogan.

A plan that is fiscally irresponsible and primarily burdens the poor is probably a net positive dying the GOP primaries.

I have to echo ponce. Is Cain’s plan any more ridiculous that anything else in today’s conservative economics?

Mike

And your Payroll Tax question brings up another question — how exactly is Cain going to fund Social Security and Medicare?

It seems he thinks they shouldn’t exist. From his website:

No more Social Security or Medicare, but don’t worry, maybe your church will help you!

@Rob in CT: Hey Rob, I had an off year in my business. Would you send me 10% of your income so I can buy pork chops instead of pork and beans? If you don’t, then I will lobby my rep to pass a bill forcing you to do so.

Hey Pete, if you weren’t successful this year, you’re a loser and should just stop whining about it. Ask Herman Cain.

Another thing to point out: the average federal tax rate is currently 16%. 9% income tax + 9% sales tax means that for each dollar you spend, the federal government is getting 18%. So Cain is actually proposing to increase taxes on the vast majority of americans.

You deserve to keep more of what you earn, but only if you’re in the top 20% apparently.

@Pete: 3 things on why a rich person should pay a higher proportion of their income in taxes than a poor person.

1) We as a society have decided that we should not heavily tax basic subsistence. The combo of a personal exemption and a single person standard deduction basically covers the federal poverty line.

2) Declining marginal utility of income — if the point of a tax code is to raise X amount of revenue with the fewest distortions, then taxing low marginal utility dollars instead of high marginal utility dollars makes a whole lot of sense.

3) The wealthy benefit much more from a stable society than the poor.

@Dave Schuler: As long as there is a national 9% sales tax, I don’t think Chicago’s retail mixture would flee the city at any higher rate than it has already. The community that is 10 miles outside of city limits which already has a 2% or 3% price advantage due to lower taxes will still have a 2% or 3% price advantage due to lower taxes. If anything, the slightly higher cost of gasoline, all else being equal, may concentrate retail slightly.

Stormy Dragon,

“Another thing to point out: the average federal tax rate is currently 16%. 9% income tax + 9% sales tax means that for each dollar you spend, the federal government is getting 18%. So Cain is actually proposing to increase taxes on the vast majority of americans.”

On the other hand, upper income Americans tend to spend a much smaller percentage of their income. So they are getting a tax cut.

As I said in another thread, for Republican primary voters, hurting the poor is a feature, not a bug.

Herman Cain??

In any event, a national sales tax without a corresponding elimination of the income tax ultimately would be tantamount to economic suicide. That fact plus the complete regressive nature of this putative plan by themselves make it a non-starter.

In an ideal world we’d permanently repeal the federal income tax system in its entirety and substitute in its place a national sales tax which exempts food, water, prescription drugs and medical devices.

In reality the best way to reform the tax code is to move towards a lower flat tax on a broader base of income (no deductions or exemptions). Something along the lines of what Huntsman proposed, but with a few tweaks here and there.

@mantis:

@Pete:

Or Doug Mataconis. He can tell you to “Suck it, Loser”, but he’ll use flowery language to do so.

It seems like every discussion of taxes includes at least a couple of bloggers/commenters making the point that “once a tax is created it inevitably creeps up over time.”

In fact, taxes on the wealthy have been creeping down for 30 years, from a top rate of 70 percent when Reagan took office, to 39.6 percent during the socialist horror that was the 90s, to 35 percent.

Similarly, capital gains taxes have gone from being taxed equally to income during Reagan to 15 percent now.

And, every GOP tax proposal includes large further tax cuts for top tiers, whether it’s Paul Ryan’s magical dream to balance the budget with a 30 percent tax cut on the top rate (35 percent to 25), or Cain’s consumption tax + elimination of capital gains, or the “flat” or “fair” tax proposals which always include a cut in upper rates.

Where’s the upward creep? Seems more like a downward creep, that at the same time somehow manages to be ever more unfair to wealthy taxpayers, and ever more likely to incent them to stop working.

The GOPs new hangup is the 47 percent who “don’t pay taxes” [sic]. To me, the problem is that 47 percent of our country doesn’t make enough money to outpace the standard deductions, not that 47 percent are getting away with something.

The auto companies are going to love that “used” is not taxed status.

The Free Republic did a detailed analysis of Cain’s 999 plan, and the results were fascinating if you wanted a glimpse of the far-right mind.

The authors found that, taking today’s economic conditions, Cain’s plan would only raise $1.7 trillion in revenue.

Their hypothetical analysis, however, takes the cake:

“One of the difficulties in estimating tax revenue is that both people and corporations change their behavior in order to take advantage of tax policy. Obviously, this plan is proposed encourage economic activity, and create an environment where economic growth can occur. It would not be unreasonable for the 999 plan to result in a 10% growth rate. Ok, that’s a bit aggressive, but not unreasonable. Remember, the Federal Budget Baseline assumes an 8% annual growth in Government outlays, and that after 4 years of no growth – there may be significant “pent up demand” making this possible. And honestly, if we don’t get some economic growth out of a dramatic policy change, why bother anyway. So, lets scale back a bit, and for the sake of rhetorical simplicity, assume 9% growth….”

Only by propping the economic growth rate up to the fantastic 9% figure does Cain’s plan become “revenue neutral”. This would only get us to the $2.2 trillion in tax receipts we already are collecting in a possible double dip recession. The kicker is the conclusion on how to balance the budget under Cain’s plan:

“As bold and dramatic as the 999 plan is, it addresses only the revenue side of the Federal Financial issue. As Cain often says, “First you’ve got to identify the problem.” The revenue “problem” is how to most equitably, and efficiently extract about 20% of GDP from the nations producers? 999 is an elegant and effective answer to that question.

The more pressing question remains, “How do we run the Federal Government on less than 20% of GDP?” This will require actual budget “cuts” – not the faux “cuts against the baseline” that are the Washington norm. The answer is this:

Combined with the 999 Revenue Plan, the Congressional Super Committee must establish a “Prosperity Baseline Budget” of $2.2 Trillion. (That’s approximately 2004 level spending) and re-establish the “growth baseline” to be limited to 1% per year. Sparing everyone the laborious calcs after the first year of implementation the resulting outcome would be:

999 Revenue Plan + Prosperity Budget Baseline =

9% annual economic and revenue Growth, and the virtual elimination of all Federal debt – in 9 years.”

They immediately cut 40% out of the federal budget to balance it (without adjusting how this might affect the same 9% growth rate in the economy). They then only allow a 1% increase in federal spending for a period of a decade in order to attempt to pay down the national debt…

Such a wonder it must be to live in a vacuum. The problem is of course that mandatory spending (entitlements, interest on debt, etc) is projected to take up around $2.3 trillion by the end of 2020. This includes no other discretionary spending…So not only do we have the ignored economic impact of cutting 40% of the federal budget, we also have the pesky fact that conservatives would also have to dramatically cut entitlement spending on those currently receiving Medicare/Medicaid/SS. (and ration the healthcare to boot!)

999 is a dream world policy…

@Dave Anderson:

The operative word in my comment was “legitimate”. An aggregate sales tax approaching 20% would be certain to create a black market.

Generally, to make a dent with a national sales tax you have to charge it on food and rent. That might make it revenue neutral … but people would hate it pretty bad.

The 999 plan seems to be a solution in search of a problem. I’m not sure how anyone would settle on this plan if they weren’t sitting around thinking how to best hide the fact they were raising taxes on the poor and middle class while lowering them again for the wealthiest.

Maybe it’s a plan to make a VAT look like a good idea?

The Utter Folly Of

Herman Cain’s “9-9-9″ PlanRight-Wing Economic Theories and PoliciesThere…fixed that for you.

Germany has a 19% sales tax and progressive income taxes. So far they still seem to be alive.

@Dave Schuler: Plenty of areas have high 15% to 20% sales tax/VAT regimes with reasonable levels of compliance (Ontario is the one I most recently visited),

@Dave Anderson:

Hmm. You might want to check your info. To the best of my knowledge under the HST Ontario’s combined retail tax is 13%. Find any place where the combined tax is 18% or above without a substantial level of black marketism?

Off-hand, I’d also guess that Toronto is a lot more law-abiding than Chicago. Pretty sure that an aggregate retail sales tax that high here would make it very difficult for apparel, electronics, auto, and general merchandise sales here.

I think its fine that Cain now come under scrutiny. One only wishes that Obama had come under scrutiny, rather than have to take frequent showers what with all the media slobbering.

Cain isn’t a serious candidate and it’s pointless to give him the attention he is getting. He’s a vanity candidate who is only interested in promoting himself as a brand, setting up the inevitable Fox News gig for 2012.

999 looks good on a bumper sticker and that is precisely the problem. Too many republican voters are easily swayed by simple slogans and once the hood is lifted up and looked at by a qualified mechanic, then they will sour on him because things like tax reform are not simple problems.

Plus he seems like an arrogant callous jerk. He dismisses anyone who calls out his 999 as ‘misinformed’ but that will only get him so far. Telling people who lost their jobs to shut up and quit whining? Wow. And then saying that all black people are brainwashed? More proof he’s just a big mouth with a bigger ego who thinks he knows better. I’d love to hear him say that at Howard.

And mocking the names of countries like Uzbekistan? That’s cut right from Palin and her anti-intellectualism and it’s not that surprising that Republicans gravitate towards candidates who proudly proclaim their ignorance as if that’s a hallmark.

He’s a joke and it’s only a matter of time before he’s the Steve Forbes of this election cycle; a one trick pony with not much else in the bag.

I know the DC media is looking for a new champion now that Christie isn’t running so that’s the reason Herman is getting the spotlight.

Perhaps the reason that people in places like Germany and Canada can live with a progressive income tax and relatively high sales taxes is that they have a much more generous social welfare system to help cushion them from those taxes…

@Doug

We’ve been cutting income taxes for sixty years and yet you can write this drivel? Jesus Christ.

@Ben Wolf: That ties in nicely with this foolish nonsense…despite the reality, so many conservatives and libertarians continue to scream and whine about issues that do not exist…

Herman’s problem with his 9-9-9 plan is simple math. He wants to promise current and near term retiree’s full promised benefits while at the same time eliminating all FICA taxes. Problem is that the SS program is pay as you go. And the current FICA revenue stream is barely keeping up with the benefit commitments. If the revenue stream is reduced then there is no way to keep current benefits coming in. It really is math 101.

Changes in taxes result in changes in income generating behaviour. That is why when Kennedy, Reagan and Bush #2 lowered the tax rates, revenues shot up by signifigant amounts.

Obama has previously stated that his goal in raising the tax rates “on the rich” aren’t about raising revenue but about making the tax system “fair”. Of course, as evidenced by the “Occupy Wall Street” crowd, one mans idea of fair largely depends on who one backs politically. i.e. Why are the Koch bothers a problem and George Soros is not?!?

Regarding the “Congress wil raise the rate – new tax stream” argument, two points. 1) the 9-9-9 plan REPLACES the current rate system of fluctuating and favoritism based on politics. So it’s a single “personal tax” stream instead of the multiple disparate streams that exist currently. 2) True, congress may raise the rate, they may lower the rate, they may all get religion. So does that mean we don’t try and change anything because we have unreliable and corrupt officials in Washington?

I like 9-9-9 because it follows the KISS formula. (not the band.. Keep It Simple Stupid – KISS).

Last point. Why is an accountant and business man not an expert? What makes an expert econmicst? Real world experience and results or a piece of paper from a college? Personally, I’d rather have a mathematician and accoutant,(Cain and Lowrie), both of whom have well established successes in private enterprise over a bunch of “college intellectuals” who lack real world experience in growing economic institutions, (Geithner, Larry Summers, etc.)

Cut the fed gov by 40%. I like it.

Go back to 2004 levels when people were dying in the streets and we had so much less liberty than we do now. Let’s see, in 2004, unemployment was much higher than it is now and nobody could afford health insurance.

Oh yea, everything I just stated in the above paragraph. The OPPOSITE is true. Let’s go BACK TO THE FUTURE. (always liked that movie..)

Remember when democrats said that welfare reform would devastate the poor? Sorry, that was wrong, the actual number of poor went down (thanks Bill).

I think it was Reagan who said. “If you want more of something, subsidize it. If you want less of something, tax it”. Want more poor, subsidize them!!! WORKS EVERY TIME! Want less business growth? Tax and Regulate them!! WORKS EVERY TIME!!