Cashing Out?

Americans have largely stopped using checks and are rapidly doing the same with cash.

WaPo data columnist Andrew Van Dam: “Paper checks are dead. Cash is dying. Who still uses them?“

Oddly, the other is true for me: I use checks regularly but specifically, whereas I essentially never use cash.

In a few years, comically oversized foam-board novelty checks will be the last remaining evidence of a 20th-century icon, as the paper check goes the way of the landline phone and the floppy disk. Even the most dubious cliché of the past century — the promise that the check’s in the mail — has fallen from common usage.

So where — if anywhere — are paper checks making their last stand? That’s what astute reader Bill O’Donnell from Chicago wants to know. “How many Americans still use paper checks?” he asks. “Who are they and where do they live? What are the trend lines?”

Let’s start with the trend lines, Bill! They, uh, point down. At the turn of the millennium, back when recording each transaction on paper might still have seemed like a good way to outfox the Y2K bug, they were the default for anyone not handing over cash.

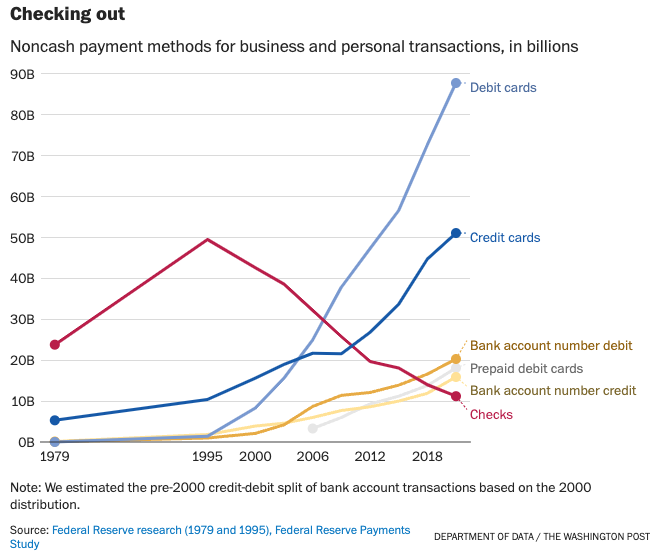

Back then, 6 out of every 10 noncash purchases, gifts and paid bills were handled with checks. A mere two decades later, just 1 in 20 are. The paper check’s fall from grace has been meteoric, in the plummeting-so-fast-it-immolates-in-the-mesosphere sense.

Here’s the requisite graphic:

Again, I’m an outlier. The only times I use my debit card are at a particular gas station that gives me a substantial discount for using it rather than a traditional credit card and—exceedingly rarely—to withdraw cash from an ATM. I use credit cards, both physically and virtually (either for online payment or via ApplePay) almost exclusively otherwise unless there’s a fee, in which case I use a virtual check.

As recently as 2003, the Federal Reserve ran 45 check-processing locations in whichbrigades of workers routed each check. A decade later, it was operating just one, in Atlanta, as check usage fell and the Fed executed a long-planned transition to a largely electronic system. The checks were also processed faster, meaning even fewer of them were, as the cliché went, in the mail.

I can’t honestly remember the last time I sent a real check via mail.

There are a handful of times, usually dealing with government agencies, where I need to pay via virtual check (i.e., by putting in my routing and account numbers to initiate an electronic transfer). Otherwise, I write checks for dealing with personal services (our cleaning lady and lawn service) who seem only to take payments that way. (I suppose I should try to convert them to Venmo or Zelle.)

After a few paragraphs of history, Van Dam continues,

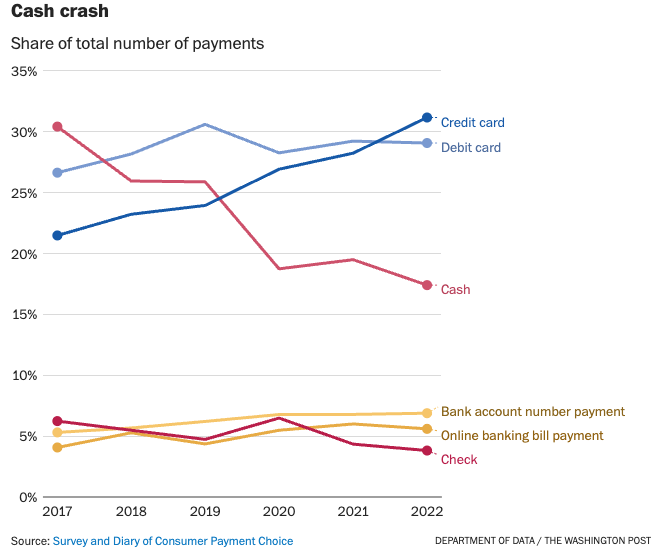

As recently as 2017, cash was still king. The following year, it was usurped by the debit card. And then covid-19 hit and made us all a little more reluctant to meet in person and pass objects back and forth. Now cash is used far less frequently than it was just five years ago.

The rise of the credit card, which is used in almost a third of all U.S. transactions and took over the top spot from debit cards in 2022, has further sidelined paper bills. And payment apps such as Venmo and Zelle, while still a minor part of our financial lives, expanded rapidly during the pandemic and remain elevated.

Again, the requisite graphic:

That is stunning, indeed. Aside from the exceptions already noted, I haven’t used a debit card on a regular basis in at least 30 years. The same is true of cash, as well. There used to be a time when I was sheepish about making very small transactions via credit card—but that was decades ago. Now, it’s my default unless I’m charged a fee for the privilege.

As for the debit card’s analog cousin, the paper check? It starred in just 4 percent of our transactions. These days, most Americans (57 percent in 2020 and 2021) have not written a check in the past month, and even those who write them do so rarely. They’re most common in high-dollar transactions of $500 or more, but even then we write checks only 14 percent of the time.

Again, unless the merchant discourages my writing a check, I much prefer to use a credit card for transactions large and small. Indeed, especially large ones, since I get a modest amount of “cash back” for doing so.

As a rule, age predicts check usage: Three-quarters of retirement-age Americans still use checks, compared with fewer than a tenth of their college-age comrades. It’s also higher among those with more education and higher earnings, regardless of age.

I’ve got two in college and one who’s graduated and doubt they even have checking accounts. But, while I’m in my mid-50s, I’m pretty current in adoption of modern financial tech. My use of checks and even cash is pretty esoteric. Indeed, the only time I can think of that I still use cash is for tipping valets, bellmen, and the like. (This is actually awkward, in that I have to remember to have small bills available for those encounters, which are relatively rare.)

Bill also asked about geography. We don’t have great data on that, but it looks as though check usage is most common in the great Pacific coast and the Midwest, and lowest in the East and the South.

I won’t reproduce the graphic, but must say I’m surprised. I’d have bet good money that the South was a laggard here.

There’s another way to look at where people still use checks: by merchant type. Even in 2022, there are still a handful of businesses where checks are the most common form of payment. In particular, we still reach for the old checkbook when dealing with contractors, charities, taxes and landlords. But you may encounter some furrowed brows if you hold up the line in Safeway or Taco Bell to painstakingly spell out “sixteen dollars and forty-four cents” — data shows that almost nobody uses checks for groceries, fast food or transportation anymore.

Because I tend to do grocery shopping in late afternoons, I still encounter elderly customers in front of me writing checks. I can’t remember the last time I wrote a check in a grocery store but it has to be at least three decades ago. But otherwise, yes, we tend to pay folks in the way they make it easiest to pay.

One factor transcends age, income, education and geography in terms of check usage: race. White people still love writing checks. Most White people (51 percent) have written a check in the past month, while fewer than a quarter of their Black friends have done the same. Hispanic (31 percent) and Asian (37 percent) Americans are in the middle, though further analysis hints that their numbers tend to be closer to Black people than to White ones.

I guessed race is serving as a proxy for socioeconomic status here. The non-government entities to whom I’ve written paper checks in the past year have been exclusively Hispanic. I was right, but not for quite the right reasons.

White America’s preference for paper checks can’t be explained by any demographic characteristic we considered. At every age, income tier and education level, a White person is much more likely to write checks than friends of other races, with Black Americans standing out almost as much on the other end. It seems likely the real rift lies not in demography, then, but in history.

Black Americans, once marginalized by the formal banking system, were five times less likely to have a bank account than their White peers in 2021, according to the Federal Deposit Insurance Corporation. With more than 1 in 10 Black households remaining unbanked, it’s no surprise that Black Americans are consistently the biggest cash users.

Black Americans may also turn to cash because they’re much more likely to be denied credit. Almost half (46 percent) of Black people who applied for credit in 2021 were either denied or approved for less than they requested, dwarfing the 22 percent of White people who met the same fate, according to a Federal Reserve survey.

Hispanic Americans also tilt toward debit cards and cash, while Whites match the overall trend in which debit cards replaced cash, only to be overtaken by credit cards. Asian Americans have the most lopsided financial group of any we looked at. On average, they use credit cards in about 60 percent of their transactions, up from a bit over 40 percenta few years earlier.

I’m not sure I can explain this but it’s interesting.

I write checks for one thing only, and it’s commission checks to my agent. That’s it. Everything else is CCs (I like the points) or Apple Pay. I do carry $200 emergency cash at all times, just in case, but the two C notes in my wallet might come apart from being folded in there so long without being used.

I write about 1 check per month, mostly for some local school activity (PTA, band, athletics). The last time I used cash was over the summer at a beach carnival where they charged extra if you used a credit card. Otherwise, the same $20 has been sitting in my phone case (I don’t use wallets anymore either) forever. Don’t use a debit card; I want the cash back. Most everyone has a credit card swiper even at the farmer’s markets or anywhere there is cell phone service. Yes, venmo is used a lot between friends. I have about 175 checks left. Figure that will last me the rest of my life.

We’ve had to write a couple checks in the last few years to buy cars outright – it’s the only way to transfer that much money. Our other check use is, strangely, for the guy who plows our VT driveway, who sends us a pen-and-paper accounting of his work and we have the bank cut and mail a check in response.

About 5 years ago we realized we didn’t know where our checkbook was. We bought “new” checks, but because we knew that we almost never wrote them, I insisted on the cheapest checks possible. Those turned out to be “old person checks”: physically oversized with writing that’s hilariously large. They were, IIRC, $12 for the box, which was as close to free as our bank offered. We have since written something like 4 checks using these, so the fee-per-use is approaching a bad ATM.

I use my bank’s on line checks to schedule payments on when-due basis. I write a few personal checks, either when a charity is picking it up from the front desk at my office or for a major purchase (e.g., piece of furniture) to an in-town vendor who knows me and we can save the credit card fee.

The next generation is my cellphone company giving me a discount to ACH the payment straight from my bank to skip the CC company.

I recently heard from a friend about a situation where her father needed to pay $20,000 actual cash for an antique car he wanted to rebuild. Rather than travel with that much money, the father transferred the funds to his daughter’s account and at the appropriate time she went to withdraw it. The teller looked at her and said, “I’m not sure we have $20,000 in cash at this branch.”

Ditto on the debit card – rarely if ever use it because my credit card points pay me for each transaction. And we can’t get out of the habit of carrying cash, even though we never use it.

Checks – only to the plumber or other single-owner-type business tradesperson. And, these days, I have to remember how to write numbers out again in word form.

We are cheap – never ever pay service fees or interest charges – so we pay property taxes and DMV registration via “electronic check” to avoid fees.

When COVID hit we pulled out a few hundred bucks in cash, thinking that would be our safety net if electronic transactions were impacted. That seems silly in retrospect.

The kids use Apple Pay, but I won’t go there – yet.

@EddieInCA: I got a couple hundred in cash before we went on a vacation trip in the spring. Old habit. A week or so ago our favorite local German restaurant had their bill and credit card system go down, so I was finally able to get rid of some of it.

A bit of historical trivia. Saw an article decades ago about the Federal Reserve’s airline. IIRC they had a fleet that would have been like the world’s third largest air force. The night sky was crisscrossed with their even then old twin engine prop Convairs, twin Beeches, and even DC3s flying bags of cancelled checks around the country. The pilots were young guys building hours to get into the major unionized airlines. The fees they charged banks for the service were a major source of income for the Fed. Every now and again a plane would crash, leaving a huge paperwork mess.

In the last year or so, local gas stations have been offering 10-15 cents/gallon discount for paying in cash. I know there is a cost to the seller for taking credit but does that discount make up for the expense of handling cash (receiving, counting, closing out, depositing, etc.)? Or is it to get people to come into the convenience store to buy something?

BTW, getting 4% rebate on my Costco card for gas is about breakeven for that choice offered.

In Scotland in the 1970s, checking accounts were being advertised as a brand-new time-saving convenience.

Last time I read about how to get a marker at a casino, the advice was to send a photo the check one was to deposit at the cage*. It must have been some years ago.

I think I know where my checks are. I don’t recall when I last got any. I’m sure I closed that account in 2021 anyway. So, in effect, I’ve no checks at all.

*that was the updated advice. In the original, one sent a fax of the check.

The fee thing is why I default to cash on occasion. Our town, for example, allows us to pay online for fees, such as dog licensing. However, the fee associated with doing so is around $5. The annual fee is $6.50 for an adult, spayed/neutered dog. I am not paying a fee equal to 75% of the license, so I go in to the town offices and pay cash. There was a recent uproar in town when the town dump wanted to go to cashless for disposal of large goods/anything with a fee associated, because of the surcharge.

I frequently have cash on me because of all of the honor system farm stands around here.

Writing checks–that’s pretty rare, and really I only do so when it’s a one-off that would be more hassle to set up in the online bill pay, rather than just writing it.

My 16-year-old stepdaughter is taking the state-mandated personal finance course this year. The state putting this in place is a welcome development. She has some learning differences so the class is very focused on practical life skills related to finance. Also a welcome development.

She had an assignment where she had to practice writing checks. Probably not the most useful skill but also not an entirely useless one yet; I still have to write a paper check for my monthly rent. But then they had her practice balancing her checkbook with a mocked up paper register. Huh? Why? It’s like their curriculum is stuck in a time period during which the class didn’t exist. Oy.

Cash, which is asynchronous, is king in areas where the power and communications lines have gone out. You know, hurricanes, snow storms, tornados, even flooding to an extent. And when it is gone, well, then you are totally dependent on the government handouts for your survival. And increasingly, that aid is driven by partisan discrimination of the government or charity employees.

In any case, no one wants to live in a world where you have to give a stripper your bankcard number. So, if cash is removed, a blackmarket currency will arise.

@JKB:

As evidenced by Trump vis a vis aid to Puerto Rico.

Assume that is based on personal experience?

@Kazzy: When I was teaching middle school I used a mock check register in math class. Even then the register and checks were outmoded but the exercise was good practice for basic arithmetic with decimals.

@JKB: It used to be the case that cash was preferred in a power outage. However, with almost all point of sale systems now electronic and internet-connected, even if one has cash, you can’t complete a purchase.

@Jen:

In Canada a 24 hour outage by our largest cell phone provider last summer took down basically all debit/credit/ATM capabilities but store and restaurant POS systems still worked fine. People like my wife who still carry cash were just fine.

@Pete S: Yep, it will depend heavily on the outage type. A cell phone outage is different than a power outage, which is different than an internet outage, all of which are different than a widespread disaster that takes out all three.

Mobile carriers now set up response systems with mobile towers just outside of the area that might be impacted by a hurricane, so it’s possible to get cell service up and running as quickly as possible after one hits. JKB was making a blanket statement that cash is “king in areas where power and communications lines have gone out.” It’s more complex than that, as we’ve seen when people try and fill up their tanks at gas stations where the pumps aren’t operational because they rely on electricity. In New England, we had a multi-day power outage that affected grocery stores–no one could purchase anything because the power was out and that knocked out the terminals.

@JKB:

You mean like Trump telling Gavin Newsom in advance that he had better pucker up if he wanted federal disaster aid for parts of California affected by firestorms?

Or DeSantis voting against disaster aid for New York, supposedly because he was worried about federal spending, then going after federal aid for Florida?

Can you provide a few examples of Democrats using aid this way?

@Jen:

One can, in theory, take cash and make a handwritten record of sales and money taken in.

I’ve just never seen an emergency quill and ink well kept behind thin glass.

For the record, I reduced the amount of cash I carry since the mid-90s, when crime was a real issue here. One could cancel one’s bank cards, but not one’s paper notes. I carry some “just in case.” Also a number of small bills when I go shopping. The people who bag groceries don’t take debit cards.

@Mr. Prosser: I’d be on board with that if they didn’t let them use calculators for it. There is still value in even THAT but… when discussing it with her we kept saying, “This is something you’ll primarily due via your bank app. What’s a bank app? They didn’t talk to you about bank apps?” Like, I get that the class probably can’t actually have them log into their banking apps (provided they have them) but why not mock up what it might look like and help them work through that? We’re still just two weeks in so lots of time for more to emerge but… I was more than a little shocked when she pulled out the fake paper register.

@JKB: I don’t have personal experience, but I wonder if the strippers don’t take crypto now.

Like twenty years ago I walked into the bank and told them I’d balanced my check book and there was a $0.36 or something error in their statement. I got the pitying look when I said it and a dumbfounded look when I showed her I was right, they had made a data entry error. I naively thought they’d want to know, but I imagine they have a tolerance on their own balance.

Just for the record, ten cents (the rate here) on ~$5/gal (price here, again) is NOT a “substantial discount.”

I always keep several $5 bills in my pocket for the homeless hard luck stories standing on the corners. I always will. While I have never felt the need to beg, I have stood on the side of a road and felt that hopeless thought of what comes next and how I am going to deal with it. Soon enough they will be $10 bills I suppose, but what happens after that?

Oh yeah, as far as checks go, I wrote one for the first time in… a long time a few months ago. Still haven’t ordered new checks.

Tell you one thing, the move away from cash screw your average burglar or stick-up artist or bank robber. You need a college degree if you want to make money in the crime biz nowadays. One more way the educated elites are crushing the little guy.

My first felony score back, waaaal, lemme see now. I ‘reckon we’d be talking 19 and 78, was 7,ooo, the second (and last) was 10,000. I just threw away the paper credit card receipts, they were pocket change. Also they’d have been evidence. Which you want to avoid.

@Kazzy: I didn’t allow calculators in my 6th grade classes until late in the year. The point was to nail down basic arithmetic with paper and pencil and yes, the dreaded memorization of basic multiplication and division. Calculators came out mid-way through second semester to prep the kids for 7th grade pre-algebra. As for using apps and cell phones, they were showing me how to use them.

@JKB: Just want to say, as much as it pains me, JKB has a point. Not at all sure that cash can is the answer, but when communications collapse, what fills the void?

@just nutha:

True in just about any other context. But 10 cents a gallon on gas is pretty substantial, in that it’s a commodity product and local variation tends to fall within that band. If one station is charging $3.89 and the one next door charges $3.79, I’ll almost always choose the latter unless there’s another serious differentiator (name brand vs off brand, better pumps, much shorter lines, etc.).

Joining the conversation late, but here goes:

The management of our financial system is antiquated and costly on end users.

When I was living in Brazil a lifetime ago (20+ years ago), they redid their financial system to ensure the easy flow of money.

They made it possible for anyone to electronically transfer money to another person via bank routing number (yes, that same number on your check that you used to hand out all the time). Transfers IN were not limited.

That means that they have no need for paypal, venmo, or all those other apps that cost consumers billions per year. (PayPal Holdings net income for the twelve months ending June 30, 2023 was $4.075B)

We are still remarkably behind the times. Because companies are very good at lobbying.