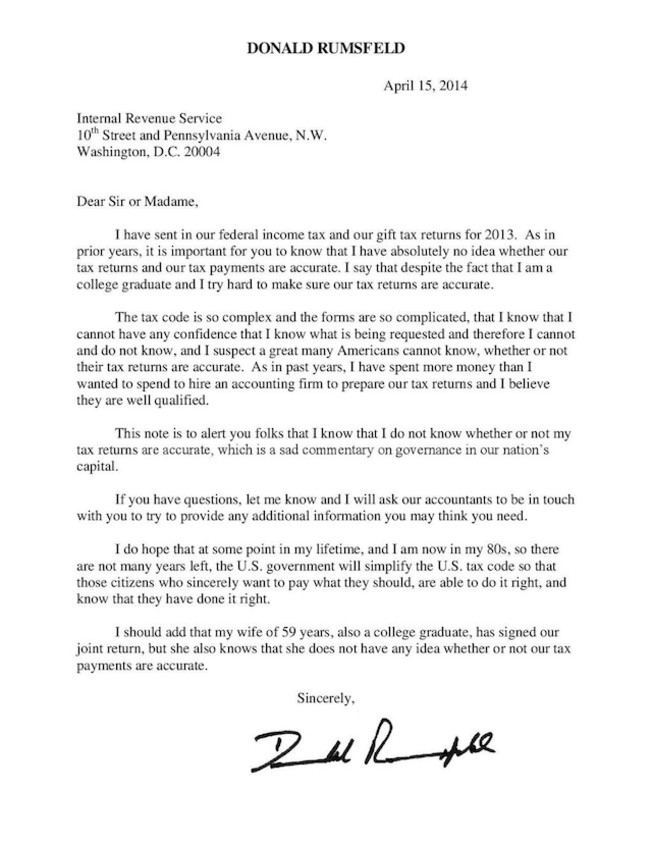

Donald Rumsfeld Has ‘Absolutely No Idea’ if His Tax Returns Are Accurate

Our tax system is so complicated that whether we're filing our returns correctly is a known unknown.

Donald Rumsfeld, Secretary of Defense under Presidents Gerald Ford and George W. Bush, tweets, “That I & most Americans have no idea whether our taxes are accurate tells us something. My annual letter to the #IRS.”

For those reading on mobile phones or otherwise unable to read the image, Rumsfeld notes that he and his wife, both college graduates, have signed their joint return in good faith but “The tax code is so complex and the forms so complicated, that I know that I cannot have any confidence that I know what is being requested and therefore I cannot and do not know” whether they are accurate despite “paying more money than I wanted to spend to hire an accounting firm to prepare our tax returns and I believe they are qualified.”

The letter is amusing and makes a reasonable point but is, of course, misdirected. The tax code is so complicated not because of the doings of the IRS but rather because Congress has riddled it with exemptions, boondoggles, and trickery to achieve innumerable public policy goals of debatable merit.

The result is a system so complicated that even people who do taxes for a living don’t get it right.

The Government Accountability Office sent people undercover to 19 randomly selected tax preparers, and all but two calculated the wrong refund amount. The errors ranged from calculating $52 less to $3,718 more than the right amount. (The GAO, unlike H&R Block in its ads, is careful to say that the sample can’t be generalized.) Some of these mistakes might be honest. But they don’t bode well for the accuracy of Americans’ tax returns.

Ezra Klein passes on a suggestion for how the IRS could help:

“It’s so frustrating,” says Austan Goolsbee. “Taxpayers have been turned into the Internal Revenue Service’s lowest-paid employees. They’re doing the IRS’s work for nothing.”

Goolsbee is an economist at the University of Chicago’s Booth School of Business. But from 2010 to 2011 he chaired President Obama’s Council of Economic Advisers. And like so many economists who’ve come to Washington before him he saw an obvious way to make tax day a whole lot simpler. But he couldn’t get it passed.

“If you’re a person with one job and one bank account and a reasonably simple tax situation,” Goolsbee says, “every piece of information that you’re sending to the IRS is information they already have!” And that makes it easy for them to fill out your tax return on your behalf.

It’s important to stop for a moment and clear something up: The IRS would just be filling out your tax form and sending it to you for approval — or modification. You could choose to sign off or you could scrap it and start anew. “It’s totally optional if you don’t want to use it or you don’t trust them,” Goolsbee says. “You can just crinkle it up and throw it away.”

This makes total sense but it’s not going to happen.

In a paper for the Hamilton Project, Goolsbee estimates that a national system along these lines could save taxpayers about 225 million hours and $2 billion in tax preparation fees every single year.

Goolsbee wasn’t alone on this one. President Obama supports automatic tax filing, too. So, in fact, did President Reagan. But it never quite seems to pass Congress.

“The reason it doesn’t happen nationally is it creates a strange coalition of opponents,” Goolsbee says. First, it offends the anti-tax activists, like Grover Norquist, who want taxes to be a difficult as possible. Then it threatens the massive tax-preparation firms like Intuit, makers of TurboTax. Then there’s the IRS, which in the manner of so many government agencies, doesn’t want to take on a new, difficult task.

Of course, even if somehow implemented, it wouldn’t help Rumsfeld, whose tax situation is much more complicated than it is for the average American. Indeed, it wouldn’t help me, either. For I don’t know how many years in a row now, my accountant filed an extension for me yesterday and I’ll still be dealing with my past year taxes halfway through this year. Partly, that’s a function of procrastination on my part. But, running as I do a small business in addition to my day job, my tax situation is ridiculously complicated and the rules as to what deductions I can claim, how much I can contribute to my retirement accounts, and so forth not only change on an annual basis because Congress keeps tweaking the system but change depending on a variety of factors that I have no way of keeping up with.

It doesn’t help that the filing deadline is April 15 but companies are allowed to send me the forms required to comply with such deadline as late as the last week in March. Presumably, it’s complicated on their end, too, but that would seem to call for a later filing deadline.

While I complain as much as the next guy, if not more so, about the bloat and inefficiencies of government, I don’t mind paying my fair share. But I do mind the amount of time and resources it takes to do it.

Most developed countries send each taxpayer a pre-calculated bill, which they can either accept or file their own return. As usual the U. S. is several steps behind.

@Ben Wolf:

That wouldn’t work for people who are self employed, operate a Supchapter S Corporation (or LLC) that they pass through to personal taxes, or have significant investment income

@Ben Wolf: But would people accept the numbers from the IRS? A 1040EZ is ridiculously easy to file, yet millions of people go to paid preparers to have them done. I had one of my daughter’s dance instructors (college student, part time job only, no other tax issues) offer me $50 to do her taxes. Even after I told her about free sites to do them or suggested she spend $20 for the basic Turbotax, she still insisted they would be too hard for her to do.

Folks who are not inclined to trust the government and hate the IRS are not going to blindly pay whatever the IRS tells them to.

@Doug Mataconis: As I wrote, you can either accept the government bill or file on your own. Most Americans would need do no more than check the “agree” box.

Self-employment taxes and taxes on unearned incomes in countries like Australia are far easier to calculate than in the U. S. They pay higher rates but some governments think compulsory laws should be as easy to comply with as possible. Instead we have lobbyists for companies like Intuit, the owner of TurboTax, actively working to keep tax laws as complex as possible.

Donald Rumsfeld can take a giant leap off a tall building, along with Mitt Romney (yeah, like he does his own taxes and has to go to the post office to mail them) and all the other rabble rousers who spent yesterday in front of a camera or on Twitter or Facebook railing against the evil IRS as if it’s the second coming of Satan. They’ll have blood on their hands when some idiot who doesn’t understand how our tax system works decides to take matters in his own hands. The employees at the IRS are your friends and neighbors; they don’t deserve to be demonized.

2 things James, #1,

Every single one of those “exemptions, boondoggles, and trickery” were inserted at the behest of some lobbyist seeking a leg up on their competitors, whether their competitor was a for profit company or another not for profit fund. The gov’t is us, and we all have certain constitutional rights including that of petitioning the gov’t. so I don’t know how you end that.

#2: the IRS is funded so lowly right now that this is the best time in decades to cheat on one’s taxes. No way on Dog’s green earth is that going to change anytime soon.

@Doug Mataconis: True, but I’m willing to wager they’re not the majority of people filing taxes.

@OzarkHillbilly: Damn it! I shouldn’t have bothered telling the state of North Carolina that I bought items over Amazon! Then I wouldn’t have owed them that $13 of sales tax!

Darn the luck, darn…

The entire premise is bull. Filling out the tax forms is certainly tedious, but it’s a completely straight forward process, unless you start trying to do something weird to game the system. Now if you want to make your finances unnecessarily complex in order to wring out a slightly lower tax rate, that’s your prerogative, but then don’t blame other people for a mess you deliberately created yourself.

Also, it takes a lot of chutzpah for someone who became a multi-millionaire entirely off a lifetime spent sucking at the public teat to complain about government costing too much.

Thirdly: when you file you taxes, you sign an affidavit that all the information contain within is, to the best of your knowledge, complete and accurate. So isn’t this letter a confession of perjury?

@Stormy Dragon:

@Doug Mataconis: You’re a lawyer. Having signed his return, does this BS letter buy Rumsfeld any protection if he’s audited and found in violation?

The list of what Donald Rumsfeld doesn’t know is a lot longer than just his taxes.

The guy has the blood of 4000 troops on his hands.

And he helped waste over 2 trillion taxpayer dollars.

Who gives a flying f’ about this dimwits taxes?

Rumsfeld doesn’t do his own taxes. As he said, contact his accountants (plural) (but don’t talk to me). He’s just being a d-bag. What else is new.

Yes the problem is the tax code not the IRS. But our politicians like to pretend they have nothing to do with the code and, worse, encourage the idea that tax cheating is somehow patriotic and being audited is akin to government oppression. Makes me want to barf.

Using Turbo tax, I find taxes pretty easy. Granted, I don’t have too many complications like rental property or small business issues. What I like about the software is that I can enter documents as I receive them so I’m spending 5 minutes here, 5 minutes there over a couple of months. Makes the chore a lot easier.

@beth:

This is an excellent point and I fear it gets lost when we talk about entities in terms of giant, faceless megalith populated with nothing but obedient mindless slaves. They are human beings with limited power and authority in the position they hold, be it IRS, BP, Bank of America or the BLM. Many of them are just doing their job and don’t have any more ability to make a significant policy change then your average employee does (less if they are government and Congress sets the rules). People who scream about the government forget that it is made out of flesh and blood who are beholden to the system, same as them.

As former customer service, please don’t take your hate out on the face you see. They most likely hate what they are doing even more then you hate having to do it. Smile at your waitress, be kind to your teller, and don’t cuss out your taxman. It’s not their fault.

I’ve provided amusement to my tax firm for years. Especially when they get my Japanese salary and tax statements, with the translations scribbled in on the margins.

@Stormy Dragon: Well, no. If you’ve got a job and get a paycheck and have nothing more complicated than an IRA and a home mortgage deduction then, yes, it’s pretty easy. And that describes the vast bulk of taxpayers. Even then, though, they could well be missing out on an obscure deduction they don’t know about. Or be within the ambit of the Alternative Minimum Tax or the Earned Income Tax Credit.

In my case, I earn substantial additional revenues through my blogs and other outside writing. I declare every nickel of earnings, which some years has included large sums that weren’t 1099’d or otherwise reported by the payer to the IRS. But that revenue is substantially offset by legitimate business expenses related to the enterprise. Documenting that is a giant pain in the ass that takes hundreds of hours of my time that I could spend more productively–including earning more money that would go to the public treasury.

@C. Clavin: And the blood of a hundred thousand Iraqis minimum. In these threads I’ve quoted Krugman pointing out that there are monsters in our public life.

In my case, I earn substantial additional revenues through my blogs and other outside writing. … But that revenue is substantially offset by legitimate business expenses related to the enterprise. Documenting that is a giant pain in the ass …

This is an inevitable consequence of an income-based tax and has nothing to do with the details of our particular tax code: if you’re going to tax income, you have to force people to document expenses.

@James Joyner:

Which is, as I said, tedious. But that’s not what Rumsfeld is actually complaining about. Are you in any way unsure whether any of that income your were documenting was actually income? Are you in any way unsure whether any of those business expenses you were documenting were actually business expenses?

Rumsfeld isn’t complaining about how much time it took to document his income and expenses; he’s saying it’s impossible to know what his income and expenses actually were. The only time I ever see that happen is when people are trying to fudge things to avoid declaring income they ought to be declaring or to claim expenses they ought not be claiming.

@Ben Wolf:

The government would not even be able to calculate a tax for the categories of people I’m talking about in most cases, though

@gVOR08:

No, of course it doesn’t.. The letter is pure political theater

@Stormy Dragon: As @Doug Mataconis notes, the letter is “pure political theater.” He’s right that the complexity of the code is such that people like himself—and me—utlimately never can be sure that we’re paying exactly what we owe. If I gave the same documentation to 100 different competent accountants, I’m guessing I’d get 100 different returns because they’d interpret some expenses differently or make different judgment calls about fuzzy aspects of the code. So, we’re basically signing saying it’s our best shot at the truth.

The tax code is our entire government writ small (or rather large). It has accumulated so much cruft over the years it is becoming essentially unworkable. Reagan reformed the system in ’86 (while raising taxes). Since then, it’s just accumulated more and more garbage. Everyone knows it needs to be overhauled or completely trashed but no one is willing to give up their special perk.

No it isn’t. If you have any business income at all or run a business, it can become *immensely* complicated. There are different kinds of depreciation schedules, different deductions and credits and special rates on this that or the other not to mention to AMT. We have an overseas rental property and it takes my accountant hours to figure out how everything works out. Last year, we had immense uninsured medical expenses but we had to keep track of prescriptions vs. hospital fees vs. doctor fees to deduct them. This isn’t “gaming the system”. This is trying to comply with the law.

I would submit that the proof is in the pudding. As James noted, 19 tax experts looked at the same return and got 19 different answers. That didn’t happen because they were stupid or ideological. It happened because the tax code is too damned complicated.

For many people, it is.

Par for the course. Rumsfeld’s predictions about how quickly and efficiently we would wage war in Iraq showed that he had no idea about that stuff either.

@Stormy Dragon: Nowhere in the letter did he complain about government costing too much.

Oh, hell… who DOES know about the accuracy of their tax returns?

Average folks at best are usually guessing.

Better off folks have their taxes done for them. Either way, the amount of personal involvement/understanding is minimal.

My husband runs a very small side business.

Our taxes are tedious and so what comicated.

Keeping up with the income isn’t the hard part it’s figuring out just which things are and aren’t deductible. It isn’t so complicated he hires an accountant but it’s complicated enough that filling out tax forms is a long process and much like Rumsfeld while we are pretty confident all was filled out correctly and the right taxes paid it’s hard to be certain that it is correct.

Since he gets the joy of taxes, I get the joys of filling out the FAFSA which isn’t complicated but it very tedious. At least now if we get taxes done soon enough I can auto fill from the tax return.

I would love to see taxes made less tedious and a part of me often thinks something like a VAT in place of the income tax would be ideal.

At least our state doesn’t require income taxes so we only have to fill out one tedious set of forms.

@James Joyner: “In my case, I earn substantial additional revenues through my blogs and other outside writing. I declare every nickel of earnings, which some years has included large sums that weren’t 1099′d or otherwise reported by the payer to the IRS. But that revenue is substantially offset by legitimate business expenses related to the enterprise. Documenting that is a giant pain in the ass that takes hundreds of hours of my time that I could spend more productively–including earning more money that would go to the public treasury. ”

Either you’re overestimating, or you’re really bad at documenting things. Hundreds of hours means that you spend some multiple of two hours/week.

Anybody remember that study they did a few years back where they called up the IRS help line and checked the accuracy of the advice? They were wrong something like 25% of the time, and then were instructed to improve. Now they’re wrong “only” 11% of the time.

… and somebody wants them to do your taxes for you?

First, Rumsfeld is a liar, who urged us into a war on false pretense and then botched it; there should be no mention of his name without this added.

Second, the guy would be filling out a 1040EZ if it weren’t for his pulling down vast sums of money from government connections.

Third, the complexity of the tax code comes directly from people like him, trying to find inconspicuous ways of not paying taxes (while calling their Senator up and getting ‘favors’ done).

Fourth, Rumsfeld didn’t seem to be bothered by not knowing what’s going on during an actual f-ing war.

Fifth, of course when your affairs become highly complicated, you don’t know everything for sure. IANAL, but there’s undoubtedly both black letter law and case law on this.

It’s not like getting a minor detail wrong would result in him getting blown up 🙂

@Just Me:

As an IDEA I believe that a majority of Americans would support a VAT – one that would supplant the federal income tax.

However, the problem, as we know well, is how to get there – end the mortgage interest and local property tax deductions? Those two alone – the biggest middle class tax benefits there are – make it extremely hard to get serious consideration of a VAT. I’ve read articles suggesting that a VAT of at least 20% would be necessary to replace the income tax. Then there are the Social Security and Medicare taxes – are they to be included in a VAT too?

I’d love to see a real debate and discussion on this, but we’re kind of incapable of real debates and discussions these days.

@Barry: A little of both. I probably spend dozens of hours, not hundreds. But the problem is that I have to compile most of the information post hoc, from PayPal, bank account, credit card, and other venues. It’s an enormous bookkeeping burden and I’m not an accountant by either training or temperament.

@Just Me: I’m not sure a VAT would make it easier. You’d be trading one expense ledger for another because his business expenses are an element of a VAT tax scheme as it is the income tax scheme where you get to offset business expenses against business income.

I counsel strict separation between personal and business accounts and activities along with a 3-4 hour session with a friendly bookkeeper who knows your bookkeeping software and business and can set up a chart of accounts suitable for his day to day use can make the whole thing less taxing.

Compare with Rumsfeld’s situation where even though a more thoughtful approach was called for ole Donald went a letter writing with the mindlessness he already had, not the one he would have preferred or wished to have had.

Since my mother passed away last year I had to file returns for 2 trusts that involved the sale of a house. I knew it was beyond my ability so I took the over 100 pages of documentation to an accountant who had to consult with a tax attorney. It cost me over $1200 for this service which produced a return for each that was over 30 pages. I spent almost an hour last week at the accountant’s office signing forms. I received a call late on the 14th that there were 2 forms that had failed to have me sign so I had to go down to the office again on the morning of the 18th. In the end there were no taxes owed.

@al-Ameda: Many of the people supporting a VAT or a flat tax don’t realize they’d end up paying more in taxes. If you’re middle class with a mortgage and kids you probably pay from 10 to 18% in federal tax. Both VAT and flat tax would probably be higher. I’m always surprised by how many people don’t know how much they really pay in taxes (I hear a lot of “Oh I got a refund”) but they can tell you to the penny what they paid last year for a new tv or rsfrigerator or jst ski.

Interesting enough, filling income taxes here in Brazil it´s extremely easy. You simply go to the official Website(There is nothing like Turbotax), fill in all your income, deductions(Generally simple things like education, healthcare and Private Pensions expenses) and you are ready.

On the other hand, corporate taxes(Specially payroll and sales taxes) in Brazil are a REAL hell, because that´s where the tax revenue is concentrated. That´s where politicians likes to create deductions, like tax deductions for some industries to stimulate the economy. On the other hand, Income Taxes in the United States are complicated because that´s where politicians likes to create deductions and incentives.

Brazil has it´s own version of the VAT. It´s regressive, and it creates red tape for the industry. It also creates incentives for the informal market. VAT can be a good idea, but they can´t substitute Property and Income taxes in it´s entirety.

P.s: Yes, Brazil also has it´s own version of the Red Tape Industrial Complex: since there are all kinds of companies and businesses that PROFITS from Red tape, there little incentive to deal with that.

If Donald Rumsfeld had a conscience he would be doing his best to stay out of the spotlight, hoping we all forget he exists.

@James Joyner:

So basically, you’re running a business without a proper bookkeeping system and then want to complain at the end of the year because it’s hard to audit.

Seriously, how specifically could the tax code be simplified in a way that helps you? Should they eliminate all your business deductions and tax your business income on gross instead of net?

@Stormy Dragon:

I suspect you have never had to deal with the Alternative Minimum Tax.

While I generally agree with James that it isn’t the IRS’s fault, there are a couple of places (like the AMT) where the instructions are inadequate to the point of nonexistence. For example, it seems like a bad idea to ask people whether they have any exceptions or adjustments to report, without telling them what would count as an exception or why you might need to adjust.

@beth:

You’re exactly right. Without the mortgage interest and property tax deductions I would be paying an effective rate of 19% instead of the 13% that I reported on my return.

1. Donald Rumsfeld is a f*cking liar. We knew this before today, of course, but he apparently cannot resist reminding us.

2. The complications in our tax code are 99% to do with deductions (i.e., what is your taxable income, as opposed to your gross income). Complexity increases with greater income and multiple income streams. In other words, it’s basically a problem for the affluent only. And affluent people can afford to pay an accountant (this is, of course, wasteful and I’d prefer changes be made, but that’s not the point of Rummy’s dishonest show here).

In conclusion, f*ck Donald Rumseld with a rusty spork.

@beth:

Yup, and I’d add that that 10-18% of your AGI, not your gross income. For my family at least, the difference between gross and AGI is significant (mainly our 401(k) contributions).

IIRC, my family’s federal income tax rate was right around 17% of AGI this year.

Like Rummy and many others, I pay somebody to take care of our taxes for us. We actually probably don’t “need” that service, as our taxes aren’t too complicated (and we have yet to trigger the AMT), but it’s one of those things I’m ok with paying for even though I could probably save a few hundred bucks by doing it myself.

@Stormy Dragon: The only reason that I need to do book keeping at all is to file my taxes. I’m a sole proprietor with no employees. I’m not claiming a home office or depreciating any capital.

@Rob in CT: I don’t understand the notion that Rumsfeld is lying here. Grandstanding, sure. But nobody with a complicated return honestly knows that they’ve paid exactly the amount of taxes that they should, even with a team of accountants handling the filing.

@James Joyner:

So again, how should the tax could be simplified to help you? Or by “simplify the tax code”, do you really mean being allowed to run an off the books revenue generating business and pay no tax on it whatsoever?

@Stormy Dragon: The simpliest way would be to end the taxation of income entirely and substitute taxation of consumption. That opens a whole different can of worms, of course, but it would greatly simplify the system, save taxpayers enormous amounts of time, and end the deadweight loss of the tax filing racket.

Barring that, elimination of the AMT and changing of some other rules would provide some transparency to the system. But so long as we tax income and thus force tracking debits and credits, there’s going to be a huge burden on the taxpayer.

@James Joyner: I agree, as I said above @Ron Beasley: I paid an accountant and a tax attorney $1200 to do the tax returns for the 2 trusts and I have no idea if they got it right and I doubt they do either.

@James Joyner: James, that can of worms is the fact that any consumption based tax is going to be very regressive which would probably help me but I would oppose it anyway.

@Ron Beasley: No doubt. I suppose there are ways around that—maybe exempting basic groceries, medicine, and other essentials from the tax?—but it would certainly have a different outcome than the present system.

I don’t think a consumption tax would really reduce your bookeeping that much. You still have to report how much revue you’re getting from website and speaking to pay said consumption tax on it. And if it’s a VAT, you still have to track all your expenses so you can determine what your “added value” was.

@James Joyner: The problem I see with that is if you exempt most of the stuff people buy the tax on everything else is going to have to be very high. The lobbyists will come swooping down trying to get the sectors they represent exempted.

The state to the north of me, Washington, has no state income tax but they do have a sales tax which exempts most but not all groceries plus you buy other things at the grocery store. Until everything became computerized this was a huge nightmare, now it’s just a nightmare.

@Eric Florack:

Speak for yourself…based on your comments…there are 6 other people in this country as dumb as you.

@Ron Beasley: Your story leads me to believe that we do as bad a job of estate planning as we do planning for end of life health care. If we weren’t so freaked out about death and actually considered these things rationally and well before we need them a lot of this could be avoided.

@KansasMom:

On that..I just recently went through this.

My mom had prepared a living will over 20 years ago…that was very clear in her desire to not be resuscitated. DNR.

Earlier this year she had a heart attack and flat-lined on the table during the installation of a couple stents.

When we learned of this later we wondered WTF???

It turns out Doctors believe they know more than the prepared documents.

Meanwhile my Mom has been bedridden in Hospice for a couple months now.

There are currently 20 something lawsuits across the country regarding similar situations.

For the record, my wife and I went through a similar situation. Her father crashed in the hospital and was revived despite a DNR. He spent about two weeks in ICU before we were able to get them to honor his wishes and take him off the machines. The hospital fought us every step of the way — including our attempt to follow his documented wishes not to have a feeding tube implanted.

I cannot express the mental/emotional stress of being treated as if you are trying to kill a beloved relative, when all you are attempting to do is execute the orders he had put in place.

@Matt Bernius:

Hey, just because your relative is done living doesn’t mean the hospital is done using him as a revenue source. Thanks to you that poor cardiologist is going to have to settle for a BMW 3 Series instead of that 7 Series they had their hearts sets on.

You monster.

@Stormy Dragon: Yes, a VAT is problematic in its own way. I was thinking more of a straight-up sales tax. That has disadvantages, too, in that things that are now deductible expenses would instead be taxed and have to be built into one’s fee structure.

Right there with you, brother. My accountant doesn’t even bother to ask anymore.

Well, he also has no idea where the WMD are, despite assurances to the contrary.

@James Joyner:

That´s why the Brazilian tax system is so complicated, each item has it´s own VAT.

@Barry: it comes down to what a “reasonable person” would believe.

Unless there’s something that looks like a tax scheme involved or deliberate fraud, the IRS takes you at your word. They’re not asking for perfection; they’re asking for “a good enough attempt.”

There are certainly enough arguments, opinions, and personal experiences just on this blog to justify some tax reform proposals, such as a flat tax or sales tax. And they need to get more people into the system instead of so many loopholes. Everyone over 18 should pay something, with very few exceptions.

@James Joyner: “A little of both. I probably spend dozens of hours, not hundreds. But the problem is that I have to compile most of the information post hoc, from PayPal, bank account, credit card, and other venues. It’s an enormous bookkeeping burden and I’m not an accountant by either training or temperament. ”

IOW, you are running a complicated small business.

I would ask your network about financial management software.

@James Joyner: ” I don’t understand the notion that Rumsfeld is lying here. Grandstanding, sure. But nobody with a complicated return honestly knows that they’ve paid exactly the amount of taxes that they should, even with a team of accountants handling the filing. ”

He’s not lying, just extremely dishonest.

First, his complexity comes from the fact that he’s trying to minimize his taxes – he feels that it’s worth the price.

Second, the complexity comes from the fact that the rich have put a lot of complexity into the tax code, so that they’ll pay lower rates.

Third, so he doesn’t know perfectly what’s what – didn’t bother him in a f-ing war, it shouldn’t bother him now.

@Barry: But the business is only complicated because of taxation of income and the resultant need to document expenses so that I’m not taxed on income I didn’t get to spend. I really should get into a real software system but, again, that’s turning me into an amateur unpaid accountant for the IRS.

@Barry:

Not necessarily. You’ve got to fill out the forms whether you’re angling for a refund or not. If you’ve got multiple sources of income, including retirement income, plus any speaking fees or book revenues, you’re looking at more than an afternoon with a pen and a pocket calculator.

You pay your taxes with the 1040 forms you have, not the ones want or wish to have at a future time.

@Tyrell: Yes Tyrell. Even people who make nothing should pay something. Maybe they should give their first born, as long as it’s healthy and still infant-like, to a nice prosperous family who can care for it.

@ KansasMom

Maybe the poor folks who can’t afford to pay taxes could become indentured servants to work off their debt to society. Ann Romney’s barn probably needs cleaning, and I am sure keeping the toilets clean at the Cheney home would provide some honest work.

@Pinky:

Yes, but I’m willing to bet that Mr. Rumsfeld didn’t take the Standard Deduction…

@James Joyner: When we had a home business, ultimately, I decided to route almost all our payments/expenses through Paypal, transferring bank balances as needed to fund PP. Except for a few major purchases, I didn’t worry much if I got the functional categorization of expense correct when filling out the tax return, since all these cash expenses were deductible, in any event. For inventory, I used a simplified method, tracking how many shelves were filled with stock and what the average number of items was per shelf. Revenues, cash expenses, and items like deductible mileage, I just took a few minutes to write down, every day, and stick the notes in a drawer. Then doing the SE taxes was a four to eight hour ordeal instead of something much greater. When it was all said or done, everything I did was honest, reasonable and above board and would withstand review by a reasonable IRS agent. The question, of course, is how many are reasonable. Sadly, most the agents that I have known, presume taxpayers are sneaky cheats and are not the brightest lights. I don’t know how things would have worked out if we had been audited.

the answer is something nobody in congress will do- go to a flat tax, and it wouldn’t really matter anyway as the states would pick it up from there.a flat tax would virtually eliminate and entire industry, and not too many elected officials would want their names on such a bill. most Americans don’t have to worry about that industry as they don’t have enough income/investments/etc. to worry about- it’s the ones with the money that gripe about it the most.

Good thing Rummy wasn’t tasked with anything difficult or complicated in the past….

@bill:

Wrong. Dead wrong. A flat tax just means there is one % rate. You can have a flat tax system that is choc full of deductions. And deductions are what cause compexity, not the rates.

You’ve fallen for a common lie: that complexity is about having multiple marginal rates. It just isn’t true. They’re lying to you, Bill. The goal of the flat tax crowd is to lower the effective tax rate on rich people (and either raise it on middle class folks or hold that constant and cut aid to the poor/middle class).

One could easily devise a much simpler tax code that maintains or increases progressivity. I could cook one up in a few minutes. But this idea will never, ever, EVER be pushed by the people who carp about the complexity of the tax code, because simplicity is not their primary goal. Paying less in taxes is.

And James, look: I’m tired of pretending that someone who mixes up a cocktail of disingenuous nonsense is doing anything but lying. In conclusion, f*ck Rummy with a rusty spork.

@bill: A flat tax is EXTREMELY regressive, to start off with. And in order to raise the amount of money required, it would need to be quite high (up around 25%–don’t believe the so-called 18% quoted–they got there by dubious math.)

And why shouldn’t we have progressive taxes? It’s more in line with economic reality: a dollar increase in income is worth more to a poor person than a rich person.

@grumpy realist:

Marginal Utility is apparently something that wingnuts either don’t understand or don’t care about.

Shit, I missed that James is in favor of using sales taxes instead of income taxes. Oy.

There’s no way to make such a system fully progressive. You can exempt basic necessities and throw in tax credits to make sure the poor don’t completely get the shaft, yes. This means that the system would be progressive at the low end. But not at the top. Under such a system, middle class people will pay significantly higher % of their incomes in taxes than rich people. And, unlike today, it won’t be a relatively rare thing (e.g., Romney paying a lower tax rate than I do). Today, high-income people (wage earners, that is) do pay higher effective tax rates than middle-income people. Not so much higher that it justifies all the whining and crying about it, but the system is, in fact, progressive. Under a sales tax system, that will reverse. What is now relatively rare will be common and what is now common will be relatively rare.

It’s a terrible idea (unless you believe that it’s morally wrong to set up a progressive tax system. In that case, it’s great!).

@Rob in CT:

Don’t stop there; there are 27 other reasons why replacing income tax with sales tax is a terrible idea. Just off the top of my head…

1. Wealthy people already spend far less of their income than poor people do. If you make ‘purchases’ the tax base (rather than the current ‘transfers’), you remove much of the income of the wealthy from the tax base, but almost none of the income of the poor. Which makes it even more regressive.

2. The market will react to a new universal sales tax the same way it always reacts to an increase in real prices — by buying less. So you have to set the sales tax even higher, to offset the lost tax revenue from corporate profits. Which further depresses sales and profits, leading to cuts in jobs and benefits — mostly at the low end of the wage scale. Which makes this even more regressive.

3. But wait! you say, even if real prices went up, so did wages because you’re not paying income tax any more. Except, the market knows how to respond to a universal wage increase, too — it’s called ‘inflation’. If the sales tax is to collect enough revenue to eliminate the need for income tax, it’s going to be a net wage loss for the poor (because Regressive, remember?) and a net wage gain for the rich, who don’t spend as much per dollar of income. So you get inflation and unemployment and recession and an increase in wealth disparity, all at once.

Need we go on…?

@James Joyner: “But the problem is that I have to compile most of the information post hoc, from PayPal, bank account, credit card, and other venues.”

BTW, I’ve been there, reading long lists of transactions from bank records and guessing. And having dished put extra money for pulling the records.

James, if you haven’t done so already, get one checking account strictly for business, with a check card. Then get one credit card which will only be used for business. If you have a club membership with an airline, call them and find put how miles, upgrades, etc. are handled when you are sometimes on business and sometimes traveling for personal reasons.

If you can get a tablet/phone/laptop app for finance, get in the habit of using dead time at airports to enter records. That way you’ll rarely have to spend big chunks of good time on this.

Especially, ask colleagues what they use.

@Pinky: “Not necessarily. You’ve got to fill out the forms whether you’re angling for a refund or not. If you’ve got multiple sources of income, including retirement income, plus any speaking fees or book revenues, you’re looking at more than an afternoon with a pen and a pocket calculator.”

The man has a sh*tload of income (CEO of at least two companies, government service/pension/benefits, probably on boards of directors). He can afford an accountant.

Of course he doesn’t know every last detail, of course things are pretty much right rather than 100% right. That’s the way life works when it gets complicated.

And as I and others have said, the m—-er-f—er didn’t give a rat’s ass about getting it right in the slightest when lives were at stake. He can d-mn well shut his lying mouth now.