Poor Pay High Taxes, If We Redefine ‘Taxes’

The American tax code contains perverse incentives and barriers to getting out of poverty.

Edward McCaffery, a professor of law, economics, and political science at USC argues that some Americans pay a 90% tax rate.

The intro is intriguing:

In a recent opinion column on Phil Mickelson’s tax comments, I pointed out that some of the working poor face marginal tax rates “approaching 90% as they lose benefits attempting to better themselves.”

Readers were incredulous, asking how it could be that in a nation with a top federal income tax rate of 39.6% on individuals making more than $400,000 a year, anyone could face a 90% rate.

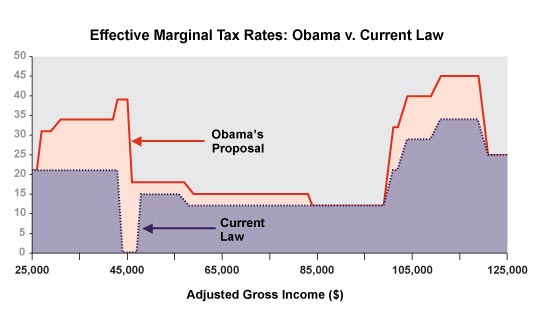

It is true. Marginal tax rates, especially for those below the top rate brackets, are chaotic, confusing, and all over the map.

That’s true! But they’re not 90%.

As a result, some of the working poor face extremely high rates on their next dollar earned. Tax scholars and economists have long known this. Dan Shaviro of NYU published a study in 1999 showing marginal tax rates above 100% on the working poor; specifically, he illustrated that a single parent earning $10,000 would lose over $2,500, after taxes, by earning another $15,000, pushing her income to $25,000.

Last year, a study from the Congressional Budget Office shows how a single parent making $18,000 now faces a marginal tax rate of 88% in 2013, down from 95% in 2012. The CBO report is 45 pages long, with complex details. Adding in all the taxes along with a host of other things that have strange acronyms like SNAP and TANF, and the result is that it is possible to face marginal tax rates approaching 90%.

What does this mean? It means that, like Mickelson, these individuals will not gain all that much from working additional hours.

Now, this is an interesting argument. And yet completely misleading.

While Mickelson’s tantrum over the prospect of tax hikes at the federal level and in his native California was unseemly–as he’s since acknowledged–he’s actually facing a tax hike. What happens to the working poor is quite different: They lose federal subsidies, potentially making work self-defeating. This is a very important thing to understand and McCaffery does a good job of illustrating the issue:

How can this be? The effect comes about because governments at various levels give aid to the very poor, such that the extremely low earners face negative tax rates. In short, we pay some poor to work — this is the “welfare to workfare” move of Bill Clinton’s legacy. But then the law takes these benefits back from the near-poor via high marginal tax rates in a “phaseout” range. The most important of these provisions is the earned income tax credit (EITC) located in the federal income tax. This provision pays the working poor up to 40 cents on the dollar up to approximately $10,000 of earnings.

If Jane makes $10,000, the government mails her a check for $4,000. Over a certain range, Jane keeps that money. But as she starts earning more than approximately $18,000, Jane begins to lose the $4,000, at a roughly 20% rate. Add that to payroll taxes (7.65%), the regular income tax (15%, at that range), and Jane is in a rate bracket over 40%, and we are just getting started — other federal, state and local programs and taxes pile on to the same effect.

But this is an absurd sleight of hand. Not getting benefits that you’re not entitled to isn’t a tax! It just isn’t. That doesn’t mean we shouldn’t think about whether we’re creating perverse incentives by phasing out the benefits at too low a point—or, conversely, whether having the benefits run through the tax code is a good idea at all—but it’s just silly to treat lost subsidies as a tax. We don’t, after all, factor in the fact that Mitt Romney doesn’t get food stamps in figuring his tax rate.

McCaffrey counters:

You might be thinking that losing a benefit is not a tax. That is an understandable sentiment, but Jane will not be comforted by it.

Jane’s comfort level has fuck all to do with whether losing a benefit is a tax.

Looking just at the EITC, as Jane’s earnings go over $18,000, she loses some of the dollars she is earning to “regular” taxes, and the $4,000 she was getting in assistance is disappearing. It’s real, green, money that she is losing.

Right! But that doesn’t make it a tax. If I give a homeless man a dollar today, I’m neither taxing him nor cutting his salary if I don’t give him another one tomorrow. Similarly, our society has decided to offer various aid programs to the poor, with defined thresholds for poverty. And we’ve even had the foresight not to make them all-or-nothing, phasing them out so as not to make not working a better option. But it makes no sense to have an anti-poverty program for those who aren’t poor. Indeed, by McCaffrey’s logic, I’m being taxed because I’m not yet drawing Social Security retirement benefits. And those who didn’t serve in the military are being taxed because they don’t get the GI Bill. Certainly, I’m being taxed because my GI Bill benefits stopped once I finished school. Except that, you know, I’m not.

Leaving aside the idiocy of McCaffrey’s word games, his public policy concern is nonetheless reasonable.

Some may conclude that it is fair to take back the money given to the poor as soon as they are no longer really poor. But this creates the high marginal tax rates just noted. And this is a major public policy problem, for at least two reasons.

One, these high marginal tax rates create “poverty traps” that keep the poor poor, and make escape to the middle class difficult. Similarly, the middle class these days are having a hard time doing the savings that might elevate them from their class into the upper class. Our tax laws essentially create a caste system, with barriers between income class levels.

Two, the poverty trap is also a severe marriage penalty, making it virtually economically impossible for lower income classes to marry. If Jane, making $18,000 a year, marries Dick, also making $18,000, suddenly Dick and Jane become a household, a single taxpayer (and benefits recipient) as far as the government is concerned. Their income has moved from $18,000 to $36,000 — exactly a range of steep marginal tax rates.

There’s no doubt our tax code creates some perverse incentives and otherwise has perverse effects. As I’ve noted previously, my tax rate has gone up by virtue of my wife dying. Despite having the same two children and the loss of roughly half our household income, I owe the government a larger percentage of my reduced earnings by virtue of being a head of household rather than married filing jointly. There’s no rational policy basis that I can think of for penalizing widowers with children.

But McCaffrey never tells us what he proposes to do about the particular problem he highlights. Should we simply give everybody, regardless of need, all of the subsidies that we afford anyone? Because, otherwise, there’s always going to be a phase-out point that hurts those crossing that barrier and creates incentives against so doing. That’s an awfully expensive solution and one that doesn’t strike me as particularly helpful to the working poor.

“There’s no rational policy basis that I can think of for penalizing widowers with children.”

———————

Oh i agree..

Now that we have computers, why cant this be done gradually rather than have big drop-offs? If you think it good public policy, that you really need to encourage people to work, you should be able to phase it out slowly enough that there is no net loss of income. I think people work for a number of reasons and you dont really need to do that.

Steve

In Europe many nations utilize both a VAT and income taxes to pay for their social goods and services – a blend of flat and progressive taxation. Here in America, Republicans are proposing to shift the tax burden (aka “redistribution”) from higher income citizens and businesses to lower income citizens – a move to regressive taxation only.

We can look to many Republican-controlled states, such as Kansas or Louisiana, where there are proposals to eliminate or drastically reduce income taxes and replace them with sales taxes which clearly increase taxes on lower and middle class tax payers.

Conservative America is now all in on the specious notion that their adherents are the producers and Liberal adherents are the non-producers, hence these state proposals and the Romney/Ryan proposal to shift the tax burden onto lower and middle class taxpayers.

America has now has a clear choice – go all in on “why bother with a nation, every man for himself” or “we are nation and there is much we can collectively do to benefit all Americans.” Dumb or Smart, which path will we take?

some politicians need their voting bloc to need them, ’nuff said? poverty is a huge industry in this country- look at all the gov’t. programs and the virtual army they employ. they have little incentive to ever end poverty- just like there’s no incentive for the dea to end the drug war, they’ll be out of business.

even so there will always be poor people, it’s something nobody can ever control in any society that’s “free”. tough pill to swallow but the more you help, the more you hurt.

This is just the classic conservative observation of the “poverty trap,” repackaged to make it more palatable to the left. It’s a good effort, but I don’t think it’ll work.

@al-Ameda: Income taxes punish work and productivity; sales taxes punish consumption. Why am I not surprised which one you favor?

We’ve been trying to improve the transitional policies for years and years. We want positive incentives for work and self-sufficiency. We are trying to create them. I guess until those policies are perfect someone can complain, but it is kind of late to run around with hair on fire. This is an understood problem which people (including, as noted, Clinton with welfare to work) have tried to solve.

(I see some hair on fire already, up-thread)

BTW, I think this is actually related:

Very true, but at this point predation by the poor is quite well in check.

Soooo I’m getting that it’s o.k. to use the words tax and taxes as a euphemism for “disincentive” when it comes to corporations, job creators, and GOP voters but we must stick to the strict literal definition of the word with it comes to po’ folks. Did I get that right?

@bill: …says the guy who’s never been poor. Go live in a ghetto or uber rural community and then come back and post that drivel–see if your experience matches what you’ve been told.

Thinking a little more, I’m afraid this ties to guns and home defense. Reactionaries don’t want to end poverty. They don’t want a strong police force to prevent crime. They just want their own guns to fight off the murderous poor on their own doorstep.

@Jenos Idanian: And consumer demand blunts those (minor) tax disincentives because more work still equals more money. Why keep leaving half of the equation out?

Leave it to a member of the liberal academe (USC in recent decades has begun even to challenge UCLA and Berzerkeley for sheer foggy headedness) to come up with a bait and switch straw man so misleading, so hackneyed, so absurd, it actually boggles the mind. Not paying a welfare recipient welfare is a “tax?” Riiiiight.

That all said, what this McCaffery fellow has done here, without realizing it, and certainly without being able to grasp the irony, is to point out how self-defeating it is even to have an income tax. Taxing income never has and never will make any sense, because by taxing income you’re also taxing savings, along with venture capital and other capital investments, which are the very things a government should be encouraging not discouraging.

What we should do is scrap the entire income tax code, repeal the 16th Amendment and then fund the federal government with a national sales tax that exempts basic and absolute necessities. Fat chance, however. Any such idea is verboten. And Democrats would fight tooth and nail against it until hell froze over.

Lastly, as a separate but related topic, if McCaffery and his ilk really want to see examples of regressive taxation they should look no further than gasoline taxes. Hell, fuel excise taxes are the most regressive things under the sun. The poor urban dweller driving a clunker, struggling to make ends meet, eating out of garbage cans, pays the same exact tax as the wealthy USC professor, driving a Lexus SUV, on his way to his summer home in Monterrey. That’s regressive taxation.

@Pharoah Narim: Uh, no. That discussion is actually about taxes. Raising taxes on the rich is actually about, you know, raising their taxes.

How about we mention the huge tax on entering the pool to be considered for really good working/middle class job? The education system–I guess if poor folks weren’t so lazy they could score more hours at the Piggly Wiggly to offset what pell grants don’t cover. Or they can go in hock to their eyelids and pay 1/3 of any entry-level salary they get IF they are lucky to actually to get a job that a college level education is needed–then its closer to 1/2. Why hold it against people for doing what’s in THEIR best interest? Isn’t that the onservative/libertarian mantra? I haven’t seen anyone criticizing corn farmers for growing MORE corn just to get the subsidy.

We can side step all this nitpicking, fingerpointing and crumb snatching if we realize that you can’t cheat social physics. People need to work. Capitalism works best when it is INefficient meaning you have lots of overlap in industry areas. In other words, its better to have 5 hardware businesses in a town rather than 1 Home Depot. All this push towards market “efficiency” was nothing but a ruse to hoist a hodgepoge of monopolies upon us.

We basically have a economy built for around 200 million people and we built jails and public housing for the rest. People with 100 lb brain stems say jobs aren’t going to come back–post industrial–yadda yadda yadda. That doesn’t change the fact that 1/3 of workers are surplus labor and the 2nd third of worker are trapped in service jobs for the top 3rd. The top 3rd can either pay the welfare (cheaper) or build more jails and pay for more security. Our economy will never change until that dynamic changes. 2/3rd+ of working Americans ought to be in jobs that directly create GNP.

@James Joyner:

Well then we too should focus specifically on taxes on the rich. I’ll start by saying the rich are OK. They’ll be OK under the new tax regime. They’d be OK with another 2 or 3 percent off the top. That’s because they are rich.

I know it’s “class warfare” in some circles to notice that people who drive Lamborghini can spare a little, and that some working couple with a 15 year old min-van can spare less.

The “fairness” of the reactionary is that Lambo guy and minivan guy should pay the same tax.

@James Joyner: Granted. They resist such taxes because it, in their view, is a disincentive to engage in further economic activity. We can view the behavior of the hypothetical example you used in the same way. Slightly different cause–but same effect. BTW, there are still lots of places where 4K is serious cash–like several months living expenses. I think the youngsters today call it “hood rich”. So I understand the decision to stay put and keep the 4K in hand unless some leap ahead opportunity (which used to come though college or vo tech) came knocking. Thank goodness those discouraging gov’t bootstrap programs took me to places in the private sector where 4K is about what I spent on vacations for the year.

@john personna: I don’t think anyone argues they should pay the same amount in taxes. Some argue they should pay the same rate, figuring that the rich would still pay proportionately more, but even then most support some progressivity in the form of standardized deductions and whatnot. But I’ve argued that we need progressive rates, anyway, for precisely the reason you point to: we need more revenue and you can’t get blood from a turnip.

In terms of “class warfare,” my argument is pretty narrow. I think it’s reasonable to argue that those who’ve gotten the most benefits from society should contribute more to support its infrastructure. I don’t think it’s constructive to argue that they owe us more money because they’ve somehow gotten over and taken more than their fair share.

I’m sure that The Club for Growth will be all over this real soon. We all know how much thatthey hate “unfairness” in the tax code.

Perhaps if all the poor people would get together and fund a PAC, they would get their concerns heard more often….

@al-Ameda:

How does creating financial incentives for poor women to have children and not get married benefit all Americans? How does rewarding short term thinking and punishing long term thinking benefit all Americans?

Think about how progressives want everyone to have the same healthcare, the same transportation, and the same education for their children no matter how hard they work or how much they plan for the future. How does that benefit all?

Every government program should be review to determine if it rewards deferment of short term pleasure and long term thinking. Encouraging such thinking would actually benefit everyone.

@James Joyner: I completely agree with you here. I think we also need to update our view of what money is to suit the times. From an obvious perspective it isn’t even tangible anymore–most of the “dollars” in existence are overwhelmingly electronic. In function however, money is no longer a store of value–I propose it is merely a license to make transactions in the economy. Viewed that way—you can easily see that too much money in too few hands in effect chokes off activity from the economy. Plutocrats have more licenses that they can ever use while skid row Bobs of the world can’t even make a basic economic transaction. There is a lot of forgone demand in the later group and the groups above them than there is in the former group (who forgoes zero demand). Beyond a certain threshold, increased “success” actually starves the economy as fewer people can participate in lesser degrees (and less often). Progressive taxation is a means to balance out this equation. I’m not saying its the best–but neither is “more is better” (at least, not beyond the point of diminishing returns)

@Superdisturber: How does it benefit all Americans to have children eating out of dumpsters. Unless we’re going all in on the slumdog meme.

@James Joyner:

Well, two things up front. One pedantic. The idea that at the same rate the rich pay proportionately more is mathematically false. They pay proportionally the same as everyone else.

Second, and this is really, really, important, conservatives fail the critical math problem, that with a flat rate the taxes of the great bulk of middle class people must rise. Why? You just gave a net tax cut to the wealthier, and the money has to come from somewhere. It isn’t just magic.

Realistic estimates for a flat tax are all much higher than current effective middle class tax rates, for that reason.

On your class warfare thing … you seem to be letting someone else’s emotion block your reason then. You might accept a progressive tax, but you won’t support it foursquare, because those other people talk about it wrong.

@superdestroyer:

They are arguing over at Marginal Revolution today that all of US economic problems result from a too-low birth rate.

@superdestroyer: “Think about how progressives want everyone to have the same healthcare, the same transportation, and the same education for their children no matter how hard they work or how much they plan for the future. How does that benefit all?”

Umm, by giving them access to health care, transportation and education?

@Jenos Idanian #13:

Exactly how are you punished by public highways, air traffic safety, clean air and clean water, food and drug safety, public transportation systems, public airports, Medicare and Social Security, to name a few things that seem to bother you?

@wr:

For what it’s worth, he characterized progressives with the vanishingly-far left idea of equal outcomes. The same “transportation” for everyone, no matter how hard they work. The guy has no grip.

@superdestroyer:

How does opposing planned parenthood and opposing birth control square with conservatives’ desires to keep poor women from having unwanted burdensome children?

@al-Ameda:

The conservative fascination with consumption taxes is another example of a math problem. Consumption taxes that pay the bills would be very, very, high.

If you are bad at math, the conservatives can tell you things that on the surface are very comforting. If you start to think about the math, it all breaks down pretty quickly.

I mean think about it, if you cannot actually name spending cuts which (a) have broad support and (b) make a trillion dollar difference, then you can’t just invent a tax plan that magics it all away. You have to pay taxes to cover what you spend.

You don’t sound like someone who has ever seen real, honest to goodness third world poverty.

@ James

The party you belong to seems to have utterly rejected this view. Is that a problem for you?

Jenos Idanian #13 says:

This is just the classic conservative observation of the “poverty trap,” repackaged to make it more palatable to the left. It’s a good effort, but I don’t think it’ll work.@al-Ameda: Income taxes punish work and productivity; sales taxes punish consumption. Why am I not surprised which one you favor?Please, please, pay attention to me.

FTFY

@James Joyner:

“Some argue they should pay the same rate, figuring that the rich would still pay proportionately more, but even then most support some progressivity in the form of standardized deductions and whatnot.”

And some, like Jenos above, say the rich should pay a lesser rate, and possibly less as an absolute number, than the poor, as a means of avoiding punishing work. It’s the philosophy which underlies your party’s actions and permeates their rhetoric, James.

I understand that revocation of programs a tax increase does not make. But is your argument that the poor don’t pay high taxes since they have a net negative income tax. If so they are harmed the most by the regressive policies that underlie state and local taxes, as well as sales tax. Just because the government decides to throw them 4 grand a year not just to subsidize them, but to subsidize the businesses they work for that do not pay a living wage, doesn’t mean their effective tax rate is low.

@Dave: The poor pay no income tax; indeed, they pay a negative income tax, receiving more in refund than they paid into the system. They get hosed in terms of sales taxes.

@James Joyner:

“They get hosed in terms of sales taxes.”

Yes, they do. And yet Republicans have made no secret about wanting to use less income taxes and more sales taxes (as illustrated by Jenos above).

I guess it’s only class warfare when the poor fight back.

@john personna:

I’m increasingly certain Americans do not want to pay for the level of government we desire. We want to fund a government that spends 25% of GDP with taxation at 15% of GDP. Liberals want big, expensive social programs. Conservatives want a big, expensive military and social programs that are negligibly smaller and cheaper than the liberals want. Liberals want to raise taxes only on the rich. Conservatives only want tax cuts (that will apparently create unicorns that poop $20 bills or something).

A lot of conservatives complain that America will “turn into Europe,” but what they don’t seem to realize is they WANT America to be more like Europe–they just don’t want to PAY for it. Oh, they’ll shriek to the heavens if someone proposes Europe-style gun legislation, but don’t mess with their Europe-style social insurance or Medicare.

A lot of liberals are pretty open in their desire to make America more like Europe, but they don’t want to pay what Europeans pay, either, because it would take a VAT, and it doesn’t get more regressive tax-wise than a VAT. They even put a VAT on food over there.

Personally, I think a VAT is inevitable, mostly because if Europe could get it done with income taxes alone they would have, and they have had to institute VATs. Given that Americans want their government to pay for pretty much all the stuff European governments pay for, plus a gargantuan, expensive, world-spanning military, I don’t see how we avoid one ourselves.

@Mikey:

I think we could do it reversing all Bush tax cuts and with some spending cuts. There are even smart spending cuts, like an end to farm and energy subsidies. Of course, many a slip between “could do it” and “will.”

(I don’t think the Democrats are really against taxes so much as gun-shy. The Republicans pilloried them as “tax and spend liberals,” even as they invented “don’t tax and spend a anyway.”)

@Moosebreath: I’m generally in favor of moving away from taxing income to taxing consumption. But that would have to be structured in a way that didn’t screw over the least among us. Maybe exempting groceries, medicine, and the like entirely.

@James Joyner:

As I say, I don’t think that math holds up. Feel free to show me how you can collect something like $2 trillion from consumption.

(The studies I’ve seen say you absolutely have to tax food and medical costs, as well as rent, in order to bring in enough spending base for a consumption based tax.)

From the National Bereau of Economic Research (link)

Now honestly James, had you internalized a 30% sales tax, or were you allowing yourself to coast on the math, just assuming it would be more comfortable?

@john personna:

Nobody’s going to go for dumping all the Bush tax cuts. For one thing, that would cut the child tax credit in half–now go out and explain to a middle-class family with three kids why their tax refund is $1500 less. Not to mention millions of people at the lower end who haven’t owed tax for 10 years but suddenly would.

Politically, we’ll probably only ever be able to raise income taxes on the upper end. Even the cut-taxes-at-all-costs Republicans agreed to that, so the precedent is set. But as Europe discovered, there’s an upper limit to income tax progressivity and so they’ve had to institute varying levels of VAT.

We have the advantage of holding the world’s reserve currency, and our economy is among most productive per worker in the world, so I don’t believe we’ll be “turning into Greece” as some conservatives say. But at some point we will have to start paying for what we’re spending just to keep the cost of servicing the debt from wiping out the rest of the budget.

@Mikey:

Well, see math, above. There’s nothing wrong with a simple progressive income tax as your principle means to tax workers. The pre-Bush tax levels were not too far off given spending levels. If you can’t return to those for political/emotional reasons then you can overlay some left-field thing like VAT.

Not because it’s the only way, or the simplest way, but only because it’s redirection (“rabbit!”).

But of course you’ll need to burden those middle class families about the same with an added VAT as you would with income tax, because you need to raise about the same amount of money.

@Mikey:

Exactly.

@john personna: A family can reduce the amount of VAT they pay by deferring consumption. Of course that doesn’t apply if the VAT is on food, but there’s no requirement for a VAT on food either. We could make it look however we want.

But this is all a bit tangential to my original point, which is Americans want a whole lot more government than they’re willing to pay for, and more than many are willing to even admit.

@Pharoah Narim: i’ve never been rich, never ashamed to work and take care of my family.

@anjin-san: been there, glad i don’t live there. but we aren’t talking about “there”, we’re talking about “here”.

@Mikey:

I would certainly reduce consumption with a new consumption tax, and I am neither young nor poor. But that’s really the second problem, that it would reduce spending across the board, something we do not really want.

The first problem is that if people cut spending you just need to increase the rate again.

As I keep saying, we need to raise the same money. There is no way to “magic” it with a tax that no one pays.

@john personna:

Well, there will be once I breed that money-pooping unicorn. Just you wait.

Seriously, though…one thing I noticed when reading around the ‘net about this stuff is how much flatter and less progressive other countries’ federal tax systems are. They have fewer brackets and the high rates kick in at lower incomes than here. And that’s not even accounting for stuff like a 19% VAT.

So you lack the insight to see that the help we give to the poor in this country – help that you claim “hurts” – prevents much of the abject misery we see in poor third world populations?

You might not want to advertise that…

@al-Ameda: Exactly how are you punished by public highways, air traffic safety, clean air and clean water, food and drug safety, public transportation systems, public airports, Medicare and Social Security, to name a few things that seem to bother you?

Taxation is a necessary evil. What we’re discussing here is what form of taxation. And please, make the argument that the things you cited actually cost enough to run us $16 trillion into the hole.

VATs are simply a way for the government to get large amounts of money at minimal effort and with as little visibility to the voters. I’m a big believer in making it very, very clear to people just what they are paying in taxes. For example, signs on gas pumps detailing just how much of every gallon bought goes to the state and federal governments. No more withholding — people better learn to save up and pay off their taxes.

Let’s have our government work on basic notions of fiscal honesty and transparency with our money.

@Moosebreath: Idiot. There are ways to help protect the poor from being “hosed” by a move towards a sales tax. Choosing to exempt specific items is a good one — food, for one. Clothing and staples below certain prices.

It just has to be done carefully. Remember when the Democrats were so thrilled to impose that “millionaires’ tax” on yachts? It was supposed to soak the rich and bring in the dough. Instead, the rich started buying and keeping their yachts offshore, and the main consequence was to almost wipe out the domestic luxury boat business — putting a lot of very well-paid, highly-skilled craftsmen out of work. On a lesser scale, John Kerry avoided Massachusetts taxes on his yacht by registering it out of state. I think he saved most of a million dollars on that one — until someone noticed that his “Rhode Island” boat was spending an awful lot of time in Massachusetts waters.

Very classy, James. And it is good to know that the writers for OTB are not restricted by the draconian restrictions placed on the commentariat. Well done throughout! Be proud today!

@al-Ameda:

It does not and is one of the reasons that Republicans are irrelevant. However, how do progressives plan on increasing the quality of the social safety net in the U.S. as the same time that they adopting policies that encourage poor people to have childern and policies that encourage people to not think about the long term.

How do progressives plan to encourage long term thinking and deferment so that the U.S. will not have to spend so much on a social safety net when it adopts policies that discourage hard work and long term thinking.

@john personna:

The alternative to a trillion dollars in spending cuts is a trillion dollars in new taxes. How many Democrats really support the doubling of income taxes to balance the budget.

In reality, the Democrats have pushed a message that 95% of the people in the U.S. can get everything they want from the government and only 5% will have to pay more taxes. Democrats support higher income taxes because most Democrats believe that those taxes will be paid by others.

However, if consumption taxes go up, the people who can defer gratification and can plan ahead will avoid paying some taxes whereas people who have a short term horizon will pay more in taxes.

@James Joyner:

Progressives like the negative income tax because it makes poor people automatic Democratic Party voters. When people are not paying for the government that they demand, they will demand more of it and will not care about the effect of higher taxes on others.

i’d encourage everyone to read starting at page 35:

http://constitution.org/tax/us-ic/cmt/ruml_obsolete.pdf

Dr. Benjamin Carson brushed by this on the Hannity Show. There is a buzz about Carson’s speech at the National Prayer Breakfast. Speaking of his mother, he said she worked several jobs at the same time to stay off welfare because she’s never seen anyone get off welfare once they took it.

Some like to claim laziness and there is some of that. But the fact is, that once you hit the income level to get benefits, you fall off a cliff and it is hard to work you way back off welfare incrementally. One either has to achieve great success that moves you up and away from the cliff edge. Or one has to be willing to give up the warm hearth of the dependency and endure the loss in income until true independence is achieved by earned success. Of course, the tax system impedes the achievement of independence by increasing the share of your earned income it takes as you progress away from the welfare precipice.

We see this same mechanism working no only among the poor but in the children of the upper middle class who refuse to leave home. They are unwilling to tolerate the loss of the comforts of their dependency unless they achieve some lucky break into a job that immediately pays them a high income. And it is the result of the same trend, the removal of any rules or responsibilities attached to the continued support by mom and dad or the State.

But the loss of benefits is not a tax like the increase in the portion of earned income taken by the government is, but it is a cost burden imposed upon those seeking to break free of the welfare trap.

@Jenos Idanian #13:

Absolutely, there are ways to make sales taxes progressive. However, Republicans never propose taxes which include them. There are two reasons for this:

1. by exempting sales of necessities, the sales tax rate increases considerably. As john personna cited above, exempting food, medical care and housing nearly halves the amount subject to the tax, or nearly doubles the rate needed to create the same income. Unless your idea of a national sales tax is in the 30% range, you’re not getting there with a sales tax.

2. they have shown time and again that their idea of tax fairness is to transfer the tax burden downwards onto the “lucky duckies” (aka “the takers”, aka “the 47%”, etc.) who don’t pay income tax now. Or as James Carville put it, afflicting the afflicted and comforting the comfortable. Or as Warren Buffett put it, class warfare on behalf of his class.

BTW, for someone who complains regularly and loudly about personal attacks showing one has no ideas of one’s own, starting a post “Idiot” is not the way to convince people you actually oppose such things.

@anjin-san: helping is for charities, the gov’t needs to get out of that business as it costs us way too much. i have no problem saying that in private/public. the gov’t has enabled way too many people to the point that they have no shame/pride when holding their hands out. they feel “entitled” to stuff they didn’t work for. sure, there is a small % of people who will never succeed at anything- we’re encouraging more. i’ve been around the block, i know people at all ends of the spectrum and make my points from reality.

Sure. And when charity falls short, which it certainly will, we will all just have to learn to step over the bodies in the streets. Rich people can build 10 foot walls around their homes with razor wire on top, just like they do in bananna republics. Murder and kidnapping rates will soar, as desperate people decide they just don’t give a shit any more.

Got to love the conservative vision for America.

http://www.npr.org/blogs/itsallpolitics/2012/09/19/161409916/welfare-wasnt-always-a-dirty-word-in-the-romney-family

A video of Mitt Romney’s mother Lenore, talking about how here husband, (the Gov. of Michigan at the time) once received public assistance.

Say what? This is what I understand about this recent flap with Mickelson: he sees his tax bill and gets sticker shock and says something about thinking about, maybe moving somewhere else, and then some people have a cow and then he came out with some apology or something. Mickelson makes a lot of money for his skills at moving a small ball around. Far more in a recent year than I would get working at my current pay rate over several lifetimes. That being said, Mickelson is simply saying the same thing that millions of us say quite often: at tax time, when we get the total for three bags of groceries, the bill for a two hour furnace repair (why did I not go into that instead of 6 years of college ? And they even get to drive a company truck.), and the cost of taking the family to a theme park (counting food probably about the same as going to see Phil play golf). People take action: they change where they shop, get a higher paying job, move toanothet location. I have moved twice because of high property taxes. My choice. No one jumped on me about it. People do it all the time. Look at Florida. People don’t move there just for sunshine (try spending some time down there in the summer).

As far as Mickelson’s salary: he chose this career and worked to develop the high skills needed to win and compete at a professional level. No one gave him this. I could have picked up a golf club years ago and tried it. There is absolutely no law or regulation that prevents me or anyone else. If someone feels the PGA (or NBA, MLB, NHL, NFL PBA, WWE), is paying their athletes too much, complain to them about it, or the tv networks, or the merchandisers, or the fans, who give a week’s pay to go see them play, or the team owners. It is our choice what we do.

This Mickelson seems like a good person to me, never hear anything negative about him and he is a credit to his profession. Those who criticise him are being petty; a cheap shot.

If Phil is losing 60% of his income to taxes then he needs to hire a new tax advisor …. or he can just move to another no-State-income-tax paradise like Florida, Alaska or south Dakota.

@Tyrell:

Al Ameda said it well, but if poor Phil is paying 60% on his gross he’s an idiot who hired an idiot as his CPA.

That Gulfstream V he uses nearly weekly is depreciated constantly. The fuel and crew costs are straight write offs. The 10% of earnings his caddy takes off the top are as well.

Maybe Phil’s big problem is that he earns way too much by just wearing a certain cap or shirt while playing his game.

The bottom line is Phil can either STFU and hire better people but seriously, he has good people and is most likely paying a more Romney like 14% against the gross.

I hesitate to call him a liar, but let’s face it, he’s a liar.

@al-Ameda:

Most professional golfer actually live in Florida or Texas for tax purposes and the ability to practice year round. However, pro athletes have to pay taxes in the state where they play the games. Even if Phil Mickelson lived in Florida, he has to pay California states on winning in California. Phil is actually voicing concern about the taxes on his endorsements, investments, and private companies. He would be better off living in Florida or Texas because of the higher taxes on non-tournament winnings. However, his wife does not want to move. So the question is how much in additional taxes is he willing to pay to keep his wife happy?

@bill:

Charities do good, locally. They are not everywhere though, and make no effort to be. There is no 1-800 number that links anyone in need to a charity ready and willing to help them.

And so, people who prefer charities to government must understand that they are cutting some people off.

The cruelest conservatives are like that, though they don’t like to admit it straight up. Government programs are bad, from their perspective, because they DO help everyone.. They’d rather not help everyone. Screw ’em, right?

@john personna: not really, since we all consider ourselves to be “the gov’t.” we will take advantage of whatever the gov’t. “gives” us as it’s already ours in theory. the sheer amount of fraud and complete lack of shame when using gov’t handouts is just wrong. give a man a fish vs. teach him to fish. it has nothing to do with being conservative either, most Americans get angry when they see their tax dollars abused by losers with 0.0 shame. but when you dive in and are rewarded, why would you ever stop?

If you don’t like the linguistic implications of saying that the poor face a very high marginal tax rate, then why not just say that under current policies, the difference between after-tax income and pre-tax income for the very poor shows a very low marginal increase at certain levels. That is, increasing pre-tax earned income by $1 results in, at times, an after-tax income increase of only $0.10.

The fact is, a lot of credits and deductions function as negative taxes. Your whinging about whether they’re technically taxes or not does not change the fact that the way these benefits are structured to expire means that poor people in a certain income range face a very high disincentive to earn another dollar (this, of course, from the playbook of the right and Arthur Laffer and so on).

@Figs: The post makes all of that abundantly clear. I don’t disagree with the professor’s argument; I take issue with his subterfuge of calling the phasing out of aid as a tax.

But it’s just a semantic argument at that point. You know what he’s saying, he’s fully acknowledging that he’s talking about benefits and taxes, and he’s using a semantic shortcut because in that sense, the phasing out of benefits acts in the same way that taxation would. I don’t get the outrage.

@Figs: It’s not just a semantic argument. Words mean things. Arguing that phasing out benefits is tantamount to a tax–much less actually a tax–has rather bizarre implications, which I spell out at some length in the post.

Moreover, while he gets at a real problem–perverse incentives caused by the intermixing of our welfare and taxation systems–he doesn’t actually propose solutions. Does he want to simply give everybody welfare with no means testing? Does he want to make phase-outs slower? What?

I understand all of the points you’re making, and I think as far as the semantic thing, you’re right. But I just don’t understand why there’s such a resistance to this easier wording for what’s clearly a very real phenomenon. I mean, you understand what he means. When he says “marginal tax rate,” he really means the difference between before tax and after tax income, with all taxes, credits and deductions taken into account. I think it’s an acceptable shorthand, just for the sake of brevity, once all of the precepts are laid out, as they appear to have been. I don’t read it as the author trying to snooker anybody. He’s just talking about the way that tax rates and benefit phaseouts combine to take a surprising percentage of a marginal dollar earned at certain income levels.

As far as solutions, I don’t know. I had assumed that wasn’t really the point of the paper, right? I mean, it’s possible to structure those phaseouts so that they’re more gradual, or to call them roughly what they actually ought to be: negative tax brackets. I agree with you that it’s a real problem, and I don’t really know what would be the best solution, maybe apart from a wholesale reconsideration of the tax code, or rates being determined by a function rather than by a complicated interaction of brackets, credits, deductions, etc.