Taxpayer Risk: $9.7 Trillion

When all of the various programs to address the financial crisis are added up the total that taxpayers on the hook for could approach $9.7 trillion.

“We’ve seen money go out the back door of this government unlike any time in the history of our country,” Senator Byron Dorgan, a North Dakota Democrat, said on the Senate floor Feb. 3. “Nobody knows what went out of the Federal Reserve Board, to whom and for what purpose. How much from the FDIC? How much from TARP? When? Why?”

This is what you get when you rush through things. The oversite on this whole thing has been dubious at best.

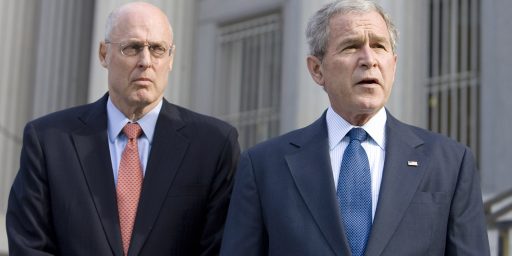

When Congress approved the TARP on Oct. 3, Fed Chairman Ben S. Bernanke and then Treasury Secretary Henry Paulson acknowledged the need for transparency and oversight. The Federal Reserve so far is refusing to disclose loan recipients or reveal the collateral they are taking in return. Collateral is an asset pledged by a borrower in the event a loan payment isn’t made.

In short, “Trust us, we’re from the government and we are here to help you.”

DRUDGE RULES!

To achieve that $9.7 T number you have to assume that every financial institution in the country goes bankrupt. You are talking about the failure of every single financial institution that has every cent that is secured in any manner by the FDIC, the Treasury and the Fed.

I can only guess that you are being flatly disingenuous for the sake of reciting a very, very large number.

I think that it makes sense to distinguish between the Federal Reserve’s part in this and the federal government’s. The Federal Reserve isn’t strictly a federal agency and, well, it just creates the money it uses.

The federal government can create money, too, by printing it but mostly it borrows. Putting the two into a heap is misleading.

I disagree Dave in that knowing exactly what your exposure is, both real and potential is better than ignorance.

No Scott. It counts the $1 trillion in stimulus packages so far, $3 trillion in Fed & FDIC lending, and promises to lend upto $5.7 trillion more if needed. See my comment to Dave as well.

I was never keen on the whole bail out idea, and this only makes me think my initial reaction was right.

I really don’t like the idea that money is going somewhere and nobody is being required to show where and to what purpose.

“oversight” … but other than that I’ll comment when I can give it more time.

The fact that any of the publishers on this website would DARE to publish about fiscal rectitude is LUDICROUS.

Hey, man, where’s my profitable Iraq war?

Wars are like the assholes in this society, there is no profit to be gained from war; and there is also no profit to be gained from being an ass hole.