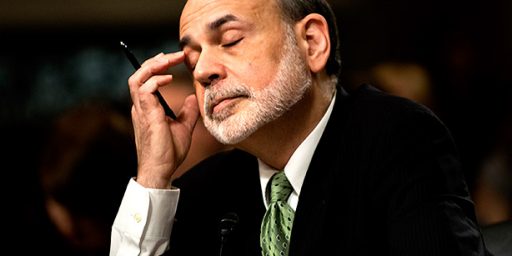

Ben Bernanke Named as Greenspan’s Replacement

President Bush has named Ben Bernanke, the current chairman of the White House Council of Economic Advisors, to succeed Alan Greenspan as the head of the Federal Reserve.

While Mr Bernanke has differed slightly with Mr Greenspan in favouring more formal inflation targeting, the choice will maintain continuity after the departure of a chairman credited with deftly managing interest rate policy and leading the US to nearly two decades of robust, non-inflationary growth.

I’m not so sure about that. Bernanke is seen as being more moderate than Greenspan and that could be a bad thing. The appeal of Greenspan is that he was seen as an inflation hawk to the point that he’d bring about a recession to control inflation. A more moderate chairmen might be seen as being more willing to use monetary policy to affect the business cycle vs. simply wanting to reign in inflation.

Bernanke’s academic credentials are about as good as one can find. Bernanke recieved his PhD in economics from MIT (one of the top institutions as far as economics is concerned) and is a professor at Princeton University (another top institution for economics). His curriculum vita is quite impressive with publications in top journals.

Following his nomination, Mr Bernanke said: “Our understanding of the best practice in monetary policy evolved during Alan Greenspan’s tenure at the Fed, and it will continue to evolve in the future.”

“However, if I am confirmed to this position my first priority will be to maintain continuity with the policies and policy strategies established during the Greenspan years,” he said.

Bernanke is trying to signal that things will remain the same after Greenspan leaves and (assuming he is confirmed) Bernanke takes over. The idea here is to keep markets and investors from becoming nervous.

The problem is that in the past the Fed and monetary policy have been used as a means to counter the business cycle. Via the Phillips Curve and the inflation-unemployment trade off. Inflation would be increased via monetary policy which would lower unemployment. The problem was that this ignored a basic tenet of microeconomic theory that people do not suffer from money illusion. If all prices and income increase by the same amount people do not change their behavior. Hence after using monetary policy to affect inflation the impact on inflation became less and less until it disappeared completely and one could get high unemployment and high inflation.

One of the ways to get out of this problem is to have a central banker (the Fed chairman) who has a reputation as being an inflation hawk. Volcker and then Greenspan managed to build this reputation and the impact of it can be seen in the article,

Mr Greenspan has been a highly successful Fed chairman, cementing the anti-inflation credibility of the Volcker-Fed. Both growth and consumer price inflation have averaged about 3 per cent per year during his 18 years in charge.–emphasis added

To preserve this credibility is probably what lead Senator John McCain to quip that if Greenspan were to die (while still serving as Fed chairman) he’d “prop him up and put dark glasses on him.”

Update: Brad DeLong notes that Bernanke is a “demand sider and Phillips curver”. While true to some extent even Brad is a wee bit misleading. Not very many people accept the initial version of the Phillips curve. Now the accepted version is the expectations augmmented Phillips Curve. Here, the slope of the Phillips curve depends on the expectations people have about inflation. If the expectations are that inflation is going to remain stable, then there could be some short term gains to be had by increasing in inflation rate as people’s expectations would lead them to see wage increases as a reason to supply more labor. Of course, the more inflation is used to try and lower unemployment the faster people’s expectations will adjust and soon there will be litte or no gain.

Mark Thoma over at An Economists View notes that Bernanke has a reputation for not being overly partisan. He points to an article from the New York Times

Mr. Bernanke built a sterling reputation while at Princeton, and has won widespread praise for his cogent analyses while at the Fed. But he has studiously avoided partisan political issues, at least in public. He has said little about issues at the top of Mr. Bush’s agenda, like Social Security and tax cuts, and his economic writing betrays few hints of political ideology. “If you read anything he’s written, you can’t figure out which political party he’s associated with,” said Mark L. Gertler, a professor of economics at New York University who has written more than a dozen papers with Mr. Bernanke. Mr. Gertler, who said he did not know his close friend’s political affiliation until relatively recently, added: “He’s not ideological. I could imagine Ben working with economists in the Clinton administration.” Alan S. Blinder, a longtime colleague at Princeton who has advised numerous Democratic presidential candidates, also said he had worked alongside Mr. Bernanke for years without having any sense of his political views. “We wrote articles together and sat at the same lunch table thousands of times before I knew he was a Republican,” Mr. Blinder recalled. “We never talked politics.” Mr. Bernanke enjoys enormous credibility among economists in academia as well as on Wall Street – an advantage for him that may also pay off for Mr. Bush.

Mark also notes that Bernanke is closer to the “rules” side in the “rules vs. discretion” debate than Greenspan was. For most of you that last will seem rather cryptic. In economics there is a debate over using things like monetary rules vs. discretionary policy. This issue first came up in the Time Inconsistency paper by Finn Kydland and Edward Prescott (which was one of the papers when Kydland and Prescott were awarded the Nobel in economics). The idea is that discretion leads to sub-optimal outcomes and rules might result in some what better outcomes.

Tyler Cowen also has a post on Bernanke and rates his for the job. The overall grade looks to be an A- with an Incomplete for “having that magic Greenspan touch”. Tyler also has a post on Bernanke’s contributions to economics as well.

Max Sawicky sees it as the best possible choice, but given Max’s views of the other candidates (Feldstein and Hubbard) that isn’t saying much.

Update II: As usual James beat me to the punch on this one and has lots of big media links that are worth checking out. And as James notes, this is not a Harriet Miers/crony appointment. Bernanke is extremely well qualified, well liked in the profession, and is not a complete unknown from Bush’s inner circle.

Anyone have any of those WHIP INFLATION NOW buttons that Greenspan handed out during the Ford administration?

Oh and Drew Curtis at Fark had the line of the day: