Federal Reserve Announces Another Round Of Stimulus Creating Money Out Of Thin Air

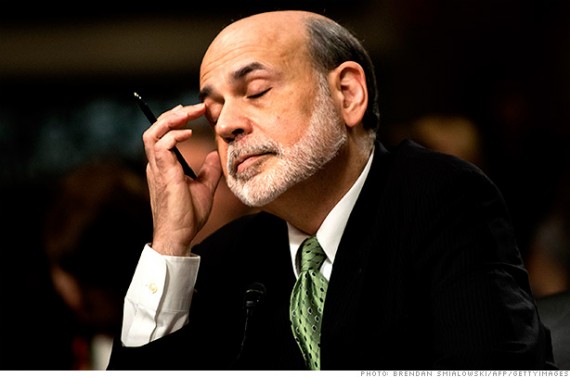

Ben Bernanke thinks doing more of the same is just what the economy needs.

Faced with an economy that has been weakening since April and economic forecasts that put GDP growth below 2% for the rest of the year and well in to 2013, the Federal Reserve today announced its third round of “quantitative easing” in an effort to stimulate a seemingly inert economy:

WASHINGTON — The Federal Reserve opened a new chapter on Thursday in its efforts to stimulate the economy, announcing simply that it plans to buy mortgage bonds, and potentially other assets, until unemployment declines substantially.

The Fed said that it would expand its holdings of mortgage-backed securities and potentially take other steps to encourage borrowing and financial risk-taking. But perhaps more significant was the basic change in its approach: For the first time, the Fed pledged to act until the economy improved, rather than creating another program with a fixed endpoint.

In announcing the new policy, the Fed sought to make clear that its decision reflected not only an increased concern about the health of the economy, but an increased determination to respond – in effect, an acknowledgment that its approach until now had been flawed.

The Fed also acknowledged its limits. “Monetary policy, particularly in the current circumstances, cannot cure all economic ills,” the Fed chairman, Ben S. Bernanke, said at a news conference.

The Fed’s policy-making committee said in a statement that its efforts would continue for “a considerable time after the economic recovery strengthens.” Specifically, it said it would act until the outlook for the labor market improved “substantially,” although it did not offer a numerical target.

In a separate statement, the Fed said its senior officials now expected the economy to expand from 1.7 to 2 percent this year, down from their June projection of growth of 1.9 to 2.4 percent. The officials continued to predict that the unemployment rate would not fall below 8 percent.

“The weak job market should concern every American,” Mr. Bernanke said at the news conference. “The modest pace of growth continues to be inadequate to generate much improvement in the current rate of unemployment.”

Fed officials predicted that growth would be somewhat faster in coming years, and that unemployment would decline somewhat more quickly, presumably reflecting the impact of the measures the Fed announced Thursday.

(…)

In its measures, the Fed said it would add $23 billion of mortgage bonds to its portfolio by the end of September, a pace of $40 billion in purchases each month. It will then announce a new target at the end of this month, and every subsequent month, until the outlook for the labor market improves “substantially,” as long as inflation remains in check. The statement did not further explain either standard.

The Fed’s statement made clear, however, that it would continue to stimulate the economy even as the recovery strengthened, suggesting that it was now willing to tolerate somewhat higher inflation in the future to encourage growth in the present.

“A highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens,” the Fed’s policy-making committee said in its statement, issued at the end of its regular two-day meeting in Washington.

Asked what improvement in unemployment would satisfy the Fed, Mr. Bernanke said: “We are looking for ongoing, sustained improvement in the labor market. It is not a specific number we have in mind, but what we have seen the last six months, that isn’t it.”

The committee’s statement said that the Fed now expected to hold short-term interest rates near zero at least through the middle of 2015, and that it would take other measures as necessary – including purchasing other kinds of assets. The projections of senior Fed officials showed, however, that almost all of them expect to start raising short-term rates before the end of 2015.

This is, of course, the third time that the Federal Reserve has tried to use quantitative easing to resuscitate a sluggish U.S. economy. The first round occurred in the wake of the fall 2008 financial crisis and involved the Federal Reserve buying up Treasury Notes and Mortgage Back securities to the point where, by the early Spring of 2009, it had nearly $2 trillion dollars in assets on its books. The second round came in the fall of 2010 and involved the purchase of some $600 million in Treasury securities. While in both cases there is evidence that the measure helped stabilize the financial sector, especially the 2008-2009 asset purchases, there’s not nearly as much evidence to support the assertion that this is a practice that helps to stimulate economic growth in either the short or the long term. In fact, the only real effect from late 2010’s QE2 appears to have been an increase in stock prices which, based on the record of the economy over the past 18 months, seems to have had only a minimal impact on growth outside of Wall Street. So, there’s at least some reason to hold back on the optimism here unless, of course, you’re fortunes are tied to the S&P 500, in which case this is likely to turn out to be a pretty darn good deal for you.

Perusing the financial writers and pundits, one finds a mix of opinions today’s Fed decision.

Matthew Yglesias is quite optimistic:

This isn’t my dream of super-clear forward guidance, but it’s a huge step in the direction of Krugman/Woodford style precommitment. The key thing is that they’re no longer saying that accommodative monetary policy is conditional on the recovery being weak. Instead, interest rates will stay low for a while even after the economy recovers. In other words,build that apartment building right now.

I reserve the right to flip-flop, but my initial assessment is that this is a huge positive step.

As is Ezra Klein:

The Federal Reserve’s announcement Thursday is a big deal.

It’s a big deal because of what they’re doing. They’re buying $85 billion in assets every month through the end of the year, and then they’re potentially going to keep doing it in 2013. They’re promising to keep interest rates low through the recovery, and then keep them low after the recovery strengthens.

But it’s a bigger deal because of what they’re saying. Thursday, the Federal Reserve said, finally, that they’re not content with 8 percent unemployment and a sluggish recovery, and they’re willing to actually do something about it. If you’re an investor or a business owner trying to decide what the market is going to look like next year, you just got a lot more optimistic.

But Paul LaMonica argues that the Fed’s move isn’t likely to have much of an impact on the economy because the real work has to be done in Congress:

What’s needed to get the economy back on track is not more liquidity. It’s fiscal action by Congress. Getting the federal debt load under control, while simultaneously making sure that budgets for the government’s most vital programs, be that defense, education or social safety nets for the poor, are not eviscerated. Reforming an antiquated tax code. Regulating industries that need more oversight, while not going overboard with too many onerous rules.

Bernanke can’t change any of that. But with politicians too busy trying to get re-elected than actually governing, the Fed has no choice but to act more aggressively. There are legitimate fears that the lame duck (or is it just lame?) Congress will fail to reach an agreement before the end of the year to avoid the so-called fiscal cliff of automatic spending cuts and higher taxes.

In other words, the Fed may feel compelled to act merely to prevent a significant economic slowdown that could occur in the early part of 2013.

“QE3, QE4 or QE5 may not do much to boost the economy. The bigger issues are concerns about the election, regulation and the fiscal cliff,” said Wilmer Stith, manager of the Wilmington Broad Market Bond Fund (ARKIX) in Baltimore. “But there hasn’t been this much political uncertainty since the Great Depression and this is the worst possible time to have it. If we fall off the fiscal cliff, we’d likely enter another recession.”

And Walter Russell Mead that there’s actually more bad news than good in today’s announcement:

First, the fact that we need the help. That means that four years after the panic of 2008 the U.S. economy is not yet securely on track for a self-sustaining recovery (and Europe is in much worse shape). When the doctor says you need another operation, it means the first operation didn’t work. The Obama stimulus didn’t work; you can argue about who is responsible, but the basic argument is over why we failed, and there is no getting away from it.

Second, monetary stimulus on this scale really is a little bit like a powerful, mind-altering drug. You get a high going up, but coming down hurts—and over time it takes more of the drug to get the same result. The economy’s response to both fiscal and monetary stimulus looks a bit flabby these days—it seems to take a bigger jolt to get the same response.

Third, while there’s not a lot of inflation out there now (unless you look at energy, food, health care, education and gold—and who needs any of that stuff?), the risk that down the road some nasty turn of the screw could set off 1970s-style inflation is real. And with every round of stimulus those risks grow—unquantifiably, but they grow.

Inflation, of course, is the major concern any time a central bank increases the money supply — and, make no mistake, quantitative easing does increase the money supply — but so far, at least according to the official statistics there haven’t been many clear signs of inflation out there except the sectors that Mead mentions above. Likely, that’s due largely to the fact that the economy has been so weak relatively speaking that there hasn’t been a sufficient spark to set inflation off and running. Additionally, much of the monetary expansion still exists mostly on the books of the Federal Reserve which, by the end of this year, will hold more than $3 trillion in assets it has acquired since the 2008 financial crisis. At some point, those assets are going to come off of the Feds books, and cash will flood into the economy. Add to that the more than $1 trillion that banks are holding on to rather than lending at the moment and the cash being held on the books of major corporations, and you’ve got the potential for a fairly large expansion of the money supply, followed by its inevitable effect price inflation, just in time for when the economy really recovers, assuming it ever does.

The other thing to keep in mind is the fact that, as I’ve noted, the primary impact of QE1 and 2 seems to have been to boost stock prices. Indeed, Tyler Durden points to an interesting exchange during today’s press conference by Ben Bernanke:

QUESTION: My question is — I want to go back to the transmission mechanism, because speaking to people on the sidelines of the Jackson Hole conference, that seemed to be the concern about the remarks that you made, is that they could clearly see the effect on rates and they could see the effect on the stock market, but they couldn’t see how that had helped the economy.

So I think there’s a fear that over time this has been a policy that’s helping Wall Street, but not doing that much for Main Street. So could you describe in some detail, how does it really different — differ from trickle-down economics, where you just pump money into the banks and hope that they lend?

BERNANKE: Well, we are — this is a Main Street policy, because what we’re about here is trying to get jobs going. We’re trying to create more employment. We’re trying to meet our maximum employment mandate, so that’s the objective. Our tools involve — I mean, the tools we have involve affecting financial asset prices, and that’s — those are the tools of monetary policy.

There are a number of different channels — mortgage rates, I mentioned other interest rates, corporate bond rates, but also the prices of various assets, like, for example, the prices of homes. To the extent that home prices begin to rise, consumers will feel wealthier, they’ll feel more — more disposed to spend. If house prices are rising, people may be more willing to buy homes because they think that they’ll, you know, make a better return on that purchase. So house prices is one vehicle.

Stock prices — many people own stocks directly or indirectly. The issue here is whether or not improving asset prices generally will make people more willing to spend.

One of the main concerns that firms have is there’s not enough demand. There are not enough people coming and demanding their products. And if people feel that their financial situation is better because their 401(k) looks better or for whatever reason — their house is worth more — they’re more willing to go out and spend, and that’s going to provide the demand that firms need in order to be willing to hire and to invest.

So basically, what Bernanke is saying here is that the Fed has decided (with only one dissenting vote) that the best way to stimulate the economy is to create another stock market bubble. Pardon me, but haven’t we been here before? Didn’t we see the same thing happen in the 1990s with the Dot-Com Boom, only to see the market crash when reality set in, sending the economy into a recession. Didn’t we see it again in the 2000s when the Fed kept interest rates low to please the stock market, which was partly the cause of the housing market bubble that sent us into the deepest recession and weakest recovery since the end of World War II? And those are only the two most recent examples of artificially created asset bubbles, history is replete with many others both here in the United States and around the world (i.e., the Japanese real estate and stock market bubbles of the late 80s and early 90s from which that nation still hasn’t recovered). Do human beings not learn from history? (Who am I kidding? Of course we don’t)

In an ideal world, the Federal Reserve should have only one policy concern, maintaining the stability of the value of the dollar and prices in the economy as a whole. Indeed, that was essentially its sole mission when it was first created and for many decades thereafter. In 1978, however, Congress passed the Humphrey-Hawkins Full Employment Act which, among other things, required the Fed to also include as it’s goal maintaining so-called “full employment” and promoting economic growth. By doing this, Congress in many ways established essentially contradictory missions for the Fed because the policies that promote full employment often work against price and monetary stability, and vice versa. It is only, perhaps, because the Fed has been led for most of the period since then by Chairman who were very much inflationary hawks that we haven’t seen the full impact of those contradictions. Nonetheless, one can see some elements of that in Fed policy since 2008, which has been as much concerned with trying to create economic growth as it has been on the Fed’s original mission. The fact that those efforts have not worked very well would seem to indicate that the Federal Reserve Board isn’t really the appropriate entity for pursuing goals like economic growth. Indeed, Bernanke himself seems to recognize that when he says that it’s really up to Congress to fix our fiscal problems and get the economy moving again.

For the most part over the past 4 years, Fed policy has been very good for Wall Street, but not so good for Main Street. Given that track record, it seems unlikely that what the Fed announced to day is going to have any significant on the economy. But, hey, they’ll love it down at Goldman Sachs so that’s good, right?

Ben pushed the Dow up another 206 poiints today. Ah yes, the Obama appointees at the Fed are helping me out again. People who have lots of money invested (like myself) make money, while most everyone else’s dollars are devalued and their purchasing power decreased. Ask anyone who is active in the real estate markets and they will tell you that interest rates are not a sales barrier; buyers just can’t get credit due to new regulations (under the Dodd/Frank regime). To continue this game, re-elect Barack Obama. I’ll do better and ordinary working folk (and their unemployed brethren) will stay stuck in the mud.

Be sure to read that as an indictment of Congress.

@Let’s Be Free:

buyers just can’t get credit due to new regulations (under the Dodd/Frank regime).

Citation needed.

@Let’s Be Free:

Stricter lending standards for home ownership is not necessarily a bad thing, I would have thought 2008 would have made that obvious.

@john personna:

I don’t disagree. But then Bernanke has been saying things like that for years now and nobody on Capitol Hill listens to him

@Let’s Be Free:

Buyers can’t get credit, true, but that has nothing to do with Dodd-Frank, really. Rather it’s a combination of factors, including:

1. Lots of people lost jobs and/or income and so got into financial trouble;

2. Banks don’t want to lend, because they’ve become incredibly risk-averse;

3. Potential buyers are often underwater on their existing mortgages and so can’t flip out of their old homes;

4. Banks have instituted higher minimum down payments.

I dont think this will help. The fed is buying MBS with the new money which is suppose to lower mortgage interest rates. But high interest rates is not the reason home sales are sluggish. Some where between 1/3 to 1/2 of all mortgages are under water. If your mortgage is underwater, you can not sell your home. If you can not sell your current home, you can not buy a new home. Until home prices rise, the market is locked up.

This is a balance sheet problem. People have too much debt. Total debt, all private and public, is something like 350% of GDP, which is an improvement over 2009 when it peaked at 385% but it is still higher than any time in US history except that last few years. Historically, total debt to GDP has run around 160%.

Peoples net worth has declined with the housing crash, stocks in real terms have done nothing for the last 10+ years, real wages have been stagnate for the upper incomes, declined for working people. Unless wages rise we can not take on any more debt. Even if wages increase, I expect people to pay off the excess debt before they start taking on more debt.

I just dont see how cheaper interest rates help this. Would debt defaults / forgiveness help? yes. Inflation? yes. Higher wages? yes. Lower interest rates? no.

I don’t think this translation is necessary or helpful, Doug. Bernanke says that monetary policy stimulates demand by stoking asset prices. His toolbox contains only monetary policy tools. The best way to stimulate the economy would be a nice fat $10,000 check to every American but fiscal policy measures like that are off-limits for the foreseeable future.

maybe it’s time we realized that “home-ownership” in itself is not a sign of “success”, being able to pay for it is- but only to an extent. still, pumping funny- money into an already lifeless economy isn’t working too well- maybe we need to see what it’s really going to do? not in election season maybe but this house of cards bs just ain’t working anymore.

@rudderpedals: Yes, that would work too. Its a demand problem but we have not faced a demand constrained economy since the 30’s and all the people who know how to deal with one are gone. What we have is a generation of elites and a bunch of older voters whose only experience with a secular economic slow down was with the supply constrained economy of the 70’s. They keep trying supply side solutions to a demand side problem and wonder why it is not working.

At some point we are going to have to recognize that the “old” economy is not coming back and start reinventing the “new” one. The debt based economy was based on strong economic growth which in turn was dependent on “cheap” oil. The cheap oil is gone,

It may not turn things around, but it will help in the short term. We need Republican support and all those so called job creators that are sitting on their thumbs until they get things their way. If they really want to prove Democrats wrong give them support and see if their plan is bad, instead of obstructing and saying it does not work. What are they afraid of? It working and our country gets back on its feet again and they will look bad. If that is so How petty is that?

Hell, what’s another half a trillion dollars a year between friends, eh? NBD. This is free money. It grows on trees. Literally. Bernanke will pay for these $40 billion/month bond buys with money harvested from the money trees in the money meadows in Moneytown. If there’s anything left over he’ll throw money confetti parades on Money Lane. Inflation is a myth. Simply does not exist. Weimar Republic? Nah. “It’s different this time.” The 1970’s? Nah. Good times, in fact. Do a little dance. Make a little love. Get down tonight.

Seriously, Bernanke has gone ahead and not only jumped the shark tank he’s departed the planet. He’s left the solar system. This new QE program is so utterly preposterous it nearly defies words. Where do you even start?

How are interest rates having a binding effect on the economy? They’re already at record lows. Do we actually believe that if car loans go from 0% to, uh, 0% that all of a sudden we’ll be partying like 1999? Absurd. That if 30 year mortgages drop below 3.55%, or wherever the hell they’re at, that all of a sudden people will start gobbling up homes and the likes of Lennar and KB will start building them by the many thousands? Give me a f’n break. It’s tough to buy a home when you’ve just been foreclosed out of your last home and, you know, you don’t have a freakin’ job. Geez. Besides, even if somehow this program did manage to spur the housing market in sales and purchases there’s so much excess inventory it still wouldn’t really help GDP growth nor employment in a material sense. There are entire subdivisions, hell, entire neighborhoods, out there with empty homes. Lowering mortgage rates a few bps won’t change that.

When exactly will this program end? When “unemployment declines substantially?” Uh, earth to Bernanke, unemployment might not decline substantially for years if not decades and, hello, if things actually did turn around macro wise then unemployment might increase substantially, because people in that event will be returning in droves to the workforce. Then what?

This is an unfathomably reckless policy by a collection of bureaucrats who very bluntly have lost their minds. It won’t end well. Pretty soon we’ll be saddled with very high inflation, ergo much higher interest rates, ergo potentially catastrophic levels of unemployment and underemployment.

If Romney wins this election the first thing he should do is jawbone Bernanke & Krewe into stepping down. Otherwise the country is toast.

@Doug Mataconis: We have a nasty cycle here. The increased political polarization* means, among other things, that Politicians won’t listen to anyone that doesn’t agree with them.

That’s the way to create trouble, not stop it.

I know the country has trouble when most of the people in the our comments section are agreeing — and Congress still doesn’t have a clue.

* a quick Google search for scholarly articles on the the subject yields a ton of information on this subject … which, alas, I don’t have time to read at the moment.

“…it seems unlikely that what the Fed announced to day is going to have any significant on the economy. But, hey, they’ll love it down at Goldman Sachs so that’s good, right?”

Doug, you do realize that this is a Democrat president, right?

That book I read back in 1996 about how the economy was a chaotic system and you really couldn’t do anything after crashes to get it back to the old equilibrium is looking more and more accurate by the day….

On the other hand, if it’s all going to end in revolution anyway, why not open the spigot and start up job production plans? At least we’ll be getting people back to work.

(I think we’re going to have to do a combination of strong unions to force more $$$ out of the CEOs and down into the workers’ paychecks, insistence on better energy efficiency, a lot of investment in infrastructure and R&D, and start setting tariffs up again so we don’t have dumping. We have to start thinking about job protection of the average worker as being very important. And stop rescuing the banks. Too Big To Fail–>Too Big To Exist. Break up the banks and make banking boring again.)

@Doug Mataconis

This is inaccurate. QE increases bank reserves, not the money supply. The money supply in terms of banking expands with demand for loans and contracts when the loans are paid back.

No, it’s because swapping financial assets cannot be inflationary. Only the composition is changing, not the quantity.

Correct. Fortunately the Fed can try to inflate as long as it wants, it will never happen without household demand for debt. Bernanke can’t force people to take out loans. The effect of the program will be minimal, either in terms of inflation or GDP growth.

@Tsar Nicholas:

JKB, when people are willing (no, demanding, that you take their money for free….)

Tell me…. what capitalist would not take advantage of this situation? ”

“Here, I give you money, I don’t want a profit on it, I don’t even want my money (not even adjusted for inflation) back… Just give me something back.”

Tell me you would turn that deal down.

Let me give you a lead, “USA…. USA…. USA…”

You can say it, really, you can.

A few years ago, credit rules were very loose and mortgages were easy to get, maybe too easy. It should have been tighter. Now it is tight, people can’t get mortgages, nothing is moving: now credit should be made easier. The banking system got it backwards. Here is an idea for Mr. Bernanke: get the banks to immediately lower everyone’s mortage interest rate to 3%. See what that does for the economy.

As far as inflation, I can’t see how that would help anyone. If anybody doubts that we have inflation, here are just a few food price comparisons:

soft drink: 2 years ago 50 cents, same size is now $1.25. Popcorn: was 99 cents a box(3pack), now $2.69. Doritos and chips: was $1.88, now $3.24, candy bars: were $4.99 for ten pack, now $7.54. These are just basic food items. Fresh fruits and vegetables are out the roof. And of course, the outrageous price for a gallon of gas – gouging!

@Clanton: The inflation in food and fuel is what economists call demand-pull. It means the supply of those commodities is failing to keep up with global demand and so prices rise. The Fed can’t do anything about that.

Paul LaMonica, and the debt hawks, are utterly, totally wrong. As Jib correctly points out, this is a demand-driven recession – consumers are broke. Those that aren’t broke are either living paycheck-to-paycheck or so afraid of an unexpected big expense that they’re just not able to spend on non-essentials the way they did in the late 90s and early 00s. Reducing the national debt will not affect that problem in the slightest measurable amount.

@Doug Mataconis:

That’s because Ben hasn’t actually _done_ jack squat about the problem, despite being the guy with the keys to the economy. Maybe with this, things can actually start moving upwards again, instead of simply not getting worse.

@Tsar Nicholas:

As always, Tsar, you have no idea what you’re talking about. Go take a Macro 101 class, so you can at least use the terms correctly in these arguments. Bernanke’s idea (and I’m still not sure it’s the best way forward, but it’s better than the big bowl of nothing soup we’ve had lately) is to reduce the financial pressure/risk on homeowners & prospective home buyers. If they don’t feel like something as simple as replacing a flat tire is going to send them into bankruptcy and homelessness, they might just be willing spend a little more disposable income. If consumers spend more, companies will build more. Then they’ll need to hire more. Eventually (one hopes), this will translate into more people being in the labor force again at (again, one hopes) higher wages. I say it over and over again, but it still applies: You can’t sell things to people who have no money.

@Clanton: Inflation by itself isn’t bad; it is a driver for interest rates, because people won’t invest in things that pay less than inflation. Unfortunately, as more and more money gets concentrated into fewer and fewer people, the interest rate has less impact on the average consumer than the inflation rate – if I still had a 401k, I’d be a lot less concerned about inflation, because I’d at least be getting some benefit from it.

@Jib: Agreed. Major efforts on the supply side aren’t likely to work better than pushing on a string or putting 10 pounds of sand in a 5 pound bucket. At this point wouldn’t additional supply side efforts just push interest rates down some more as the beneficiaries avoid investment in the real world, preferring safety for their new dollars?

Doug wrote: “you’ve got the potential for a fairly large expansion of the money supply, followed by its inevitable effect price inflation . . . ”

Do you have any evidence that inflation is inevitable?

@Spartacus:

We certainly have not seen “wage and price” inflation. In fact, Ben would probably like to see some wage inflation.

(Price inflation has been spotty, inconsistent and hard to decipher among oil spikes, ethanol subsidies, and droughts.)

Yep, looks like you got the memo, Doug. MItt Romney’s statement:

“The Federal Reserve’s announcement of a third round of quantitative easing is further confirmation that President Obama’s policies have not worked. After four years of stagnant growth, falling incomes, rising costs, and persistently high unemployment, the American economy doesn’t need more artificial and ineffective measures. We should be creating wealth, not printing dollars.”

Finally, the FED has decided to follow through on the Federal Reserve mandate to promote full employment! Thank God! I was wondering when he would pay attention to that part of this mandate.

Now is this enough? Nope. There needs to be another round of fiscal stimulus . We need to vote out a bunch of Republicans first, but the very fact that the Fed is moving decisively to expand gives the Democrats cover to push for Stimulus II.

@Spartacus:

Doug just needs to not make economic predictions.

The confidence fairies have been predicting hyperinflation since the day after the crisis broke in 2008, and there has been nothing.

@Ben Wolf: I am not sure that is the case. I think we have inflation in food and energy because people have to consume food and energy.

Here is what I think is happening. Central banks try to ignite inflation (to relieve the debt burden) by increasing money supply. Inflation takes off in commodities. Suppliers raise prices in finished goods.

HOWEVER, since wages have not risen, people do NOT have more money to spend. They spend more on stuff that they have to consume but less on everything else. So we get inflation in required spending but deflation in discretionary items. For discretionary items that prices can not be dropped because existing margins are very low, the demand drops with the price increases. costs creating idle capacity and leading to more layoffs.

I think you can see this in the inflation stats. Prices have gone up on staples but down on discretionary items. It balances out as 0% inflation because there is no extra money in consumers hands since wages have not gone up. If wages dont go up, consumers do not have more money to spend and GDP will not grow.

The old answers, tax cuts, less regulation, lower interest rates, they are not going to help because what they do is stimulate supply. We have plenty of supply, we have too much supply. What we need is demand. And that requires pay raises (and more people working).

By itself, you’re right. But coupled with a round of fiscal stimulus to prime the pump…

Stimulating demand is going to require some counter intuitive thinking that frankly a lot of people are incapable of. For example, the economy would be better off is companies made less money PROVIDED that the reason they make less money is because they are paying workers more.

Take Apple as an example. Their margins are very high so they could make ipads and iphones in the US and sell them at the current prices and still make money but less money than today. So instead of a wildly successful and highly profitable biz with $50 billion in the bank, they would be a wildly successful and very profitable biz with $20 billion in the bank. But the overall US economy would be better off with a less profitable Apple that built stuff in the US since that extra $30 billion would be paid in wages and circulating in the economy instead of making 0% interest in a bank.

Now if companies make less, their stocks go down. So if we follow the Apple example and apply it to the economy as a whole, companies would make less, the stock market would be worth less and the economy would be stronger and unemployment lower.

waiting for heads to explode in 3…2…1

@Jib:

DingDingDing! You, my friend, understand more about business and economics than the entire ECB…

“I just dont see how cheaper interest rates help the economy….” is rubbish.

Well, lets see, if I buy a house at a 3.75% loan, the mortgage is about $460 on $100k loan.

At 6%, that same loan is gonna go for $600.

Thats a HUGE difference. And 6% was a dream rate till about 6 years ago.

This inflation threat is nonsense. Look at Japan, they’ve printed more $$$ than we have the last 20 years and their inflation rate is zero and has been for decades.

In the old days, inflation was thought to be either wage/push or demand/pull.

We have zero wage push due to china and off-shoring depressing wages.

We have zero demand pull, since demand is the problem

We will not create another bubble as doug fears since we can RAISE interest rates to stifle this expansion.

But first. we have to have an expansion we can stifle.

Housing is starting to go up again.

@Jib:

Well, yes. Production of oil globally has remained relatively flat for the last seven years despite increasing demand, particularly in Asia. Food production has also not kept pace. Fundamental to macro-economics is that prices rise when demand pushes beyond productive capacity.

The Fed has tried to stimulate and inflate via the money supply, but the Fed doesn’t have control of it. It can only influence the price of loans in the hope of luring people into taking on debt again. The Fed’s charter forbids it from adding financial assets to the private sector; it can only swap them and alter their composition. It can only change the total quantity by paying out yields on bonds, which its ZIRP has pushed down to under 2%.

@Ben Wolf: I get that with oil but I am not convinced on food. Candy bars are not keeping up with demand?

But then again, with corn by-products being put into everything including fuel through ethanol I could see corn not keeping up with demand especially with the drought.

However, grain is sold on a futures dominated market and if the fed dumps lots of money into banks that trade on those markets, they can drive up the price and it has nothing to do with the demand of grain but the supply of money coming into the market.

I must just be a real outlier.

1) Higher taxes force me to work harder and be more productive.

2) I’m not buying more stuff — not because I can’t afford to, but because there’s no stuff I want to buy.

3) I’m not buying a house, not because I either can’t afford it, or because interest rates are too high, or even because the market isn’t going up, but rather because I haven’t decided to stay here forever and it’s all a pain in the ass.

Apparently I am an economic class of 1, because none of the usual arguments ever seem to mean anything to me, personally. Unless there are other people out there who can also choose how much work to take on depending on where they want to peg their lifestyle, are gadget-saturated and have kind of seen the light on the advantages of renting, it seems I am alone.

Tax rates, interest rates, regulations, all of it has no impact at all on whether I go buy something tomorrow. The last relatively expensive thing I bought was the computer I’m typing this on. The economic impetus was: I spilled coffee on my old computer.

I’m also not hiring anyone. I actually need a personal assistant, and I could afford to pay one, but what a pain in the ass. The interviewing, the hiring, the training, the inevitable disappointment, the slow realization that she’s only going to do half what I hope she will and that she’s almost as much trouble as she’s worth.

At least one job is going begging because who needs the hassle. Maybe Ben Bernanke can help me with that.

Doug loves to whine about the weak economy because it helps his team…but heaven forbid anyone should actually do anything about it…because that’s just as bad.

If you want to build something…build it now. Hire an Architect and Contractors and Laborers…Hire people damn it….Bernanke just gave you the biggest green light you will ever get. Incomes are going to raise…but interest rates are going to stay low through 2014 and well into 2015. Well after the economy will recover…even if left to it’s own devices.

Bernanke should have done this months ago. Actually he should have been sued for malpractice for not doing it before. Better late than never I suppose.

@legion:

No, inflation is pretty bad, and inflation and recessions are not entirely separated.

Because it bears repeating:

@legion:

Check out the Employment Act of 1946. The Humphrey-Hawkins ‘Full Employment’ Act moniker is an Orwellian ruse to disguise the fact that the 1978 legislation effectively crippled the employment focus of the 1946 act. Also more control was given to Congress over the Fed at that time.

Politicians are doing a spectacular job managing the economy so far, (for a rapidly shrinking sector of the populace.) But greed is never good enough, is it? So let’s just keep pretending that Humphrey-Hawkins didn’t gut the 1946 act.

Actually that’s why most non-moral-based economics agree that some redistribution is economically beneficial. The lower you shift the money in the income tiers, the higher the consumption gets which (as long as there is sufficient capital supply) improves both the economy at large and general welfare.

You’re not only not alone, you’re part of ECONOMIC THEORY. TA-DAA.

@Jib: Corn, wheat, soya, cocoa beans and other crops which are used as ingredients in almost everything aren’t keeping up. Most candy bars for example use high fructose corn syrup as a sweetener.

@michael reynolds: There is something to what you are saying. I remember way back in the 60s where there was speculation (mostly in sci-fi books) about the impact of producing so much stuff so efficiently on society. There was speculation that we could reduce working hours, devote more to leisure and self-actualization (and unfortunately, drugs, drinking, and other hedonisms). I’m wondering whether we are getting there. Although times are tough, it is not a lack of stuff. If push comes to shove, I could live on my household inventory for years (i.e existing furniture, cars, appliances), I wouldn’t need to eat out so often. Cable, gym memberships could go. All without materially reducing my life. Thinking out loud here, I’m thinking maybe we are in some kind of economic trap where a reorder of our basic society paradigms are needed. Everybody work less. Some redistribution mechanism designed (without the negative moralizing). What is going on now is not working and I don’t think any side has an answer.

@Doug Mataconis: Mitch McConnell listens, but he says that’s not his top priority – he has a president to defeat, after all. Then lower top marginal tax rates.

Ben Wolfe actually has it right. What is he doing on an Austrian economics blog??

@The Q:

Have you ever stopped for a second to consider this from the perspective of a saver, or a retiree dependent on savings?

@Andre Kenji:

Inflation is bad if you’re a lender. If you’re a debtor, inflation is great, because it erodes the value of your debt owed.

Think about it: A owes B $100. But inflation sets in, and soon that $100 isn’t as worth as much as it was, so it’s become easier for A to repay. So if you owe a lot on your mortgage, school loans, credit cards, etc., you want inflation.

Doug needs to stop reading conservative economists, who did not foresee the 2008 collapse and has gotten everything wrong since, and start reading people who have gotten everything ring, like Krugman.

The bolded part is exactly what the FED (finally!) decided to do, and the Administration and the Fed are moving to relieve mortgage debt. I’m betting that we will see a second round of stimulus, since the Austerian case for fiscal restraint is being abandoned all over the world. Austerity was supposed to bring an inflation-free recovery: instead its brought renewed recession, and both Asia and Europe are moving toward renewed fiscal stimulus.

@Ebenezer_Arvigenius:

Thank God. I’m relieved to hear it.

Yeah, bottom line: the whole trickle-down notion is nonsense. Give me more money now and I’ll risk it in stocks. Give me more money 30 years ago when I was poor and I’d have immediately spent every last dollar.

@Scott:

As a sci-fi guy myself I’ve thought along similar lines. Among the reasons I don’t feel quite compelled to hire an assistant is this thing I’m typing on. I no longer spent two hours at Kinko’s printing off a manuscript, I email it. I don’t answer snail mail on a typewriter, I talk to fans on Twitter and Facebook. And so on. Not to mention the astounding ease with which I can do fact-checking and research now. There’s no way in hell I could do without a PA without technology. So that job has been “outsourced” to the internet.

@Jib: I wonder how much of the increase in essential costs is due to the increase in the price of oil?

There’s also the ghastly weather having had an effect, although from all that I’ve read the real price jumps will be next year.

@Drew: Yes. QE will end up being contractionary rather than stimulatory because so much interest income is being taken from the private sector. Quoting Warren Mosler today:

http://moslereconomics.com/

@Drew: well, i can’t remember the last time banks were paying anything that remotely resembled interest. they get virtually free money from the fed, why bother? and now we got downgraded again……because of this “stimulus”.

Bernake knows very well eight nothing more than a temporary up. If it even does that. The reason he’s doing this now is because he’s trying to save his job, knowing full well if Romney gets elected, he, Bernake, will be replaced by somebody who can actually do the job.

@Eric Florack: No one can get this job done.