ThinkProgress Flogs Drunken Horse

Whether due to innumeracy or intentional deceitfulness, ThinkProgress has the JobsOhio bill totally wrong.

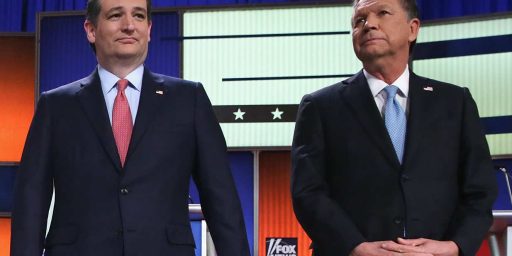

ThinkProgress really doesn’t like Gov. John Kasich’s JobsOhio bill:

ThinkProgress really doesn’t like Gov. John Kasich’s JobsOhio bill:

[Kasich] been actively pushing his state’s assets into the hands of private corporations, with his main job creation plan being the formation of JobsOhio, a private entity that will be tasked with coaxing business into the Buckeye state…

Part of Kasich’s plan for financing his new, privatized development agency (of which he will be chairman) includes leasing the state’s liquor stores to JobsOhio, which will then use the money to run its operations.

[A] deeper look at the numbers indicates that Ohio is getting the short end of the stick on this deal. As Ohio Budget Watch found, Kasich’s plan involves the state selling about $7 billion in expected revenue from state liquor stores to JobsOhio for just $1.5 billion… Thus, Kasich is selling his state’s liquor stores at fire-sale prices, even as it faces billions in deficits.

The import being that Gov. Kasich is selling out Ohio to enrich himself. But there are two glaring problems with TP‘s analysis. First, when they say “of which he will be chairman,” they somehow neglect to mention that the chairmanship is an ex officio position: The board of directors consist[s] of the Governor and eight directors (see also, Sec. 187.01(D) of the actual bill). That this was likely the case occurred to me immediately, yet TP appears not to have even considered it. And that’s despite the fact that, over a month before TP‘s piece was written, the bill passed the Ohio Senate “31-2 with wide Democratic support,” a fact which ought to have given them pause.

Second, they elide over the time value of money aspect of the deal. Assuming a 5% interest rate over 30 years, the present value of $6.8 billion is… $1.57 billion (feel free to do the calculation yourself to check my work [UPDATE: more precise calculations below]). The prime rate has been 3.25% for the last year and the yield on a 30-year Treasury note has fluctuated between 3.51% and 4.84% over the last year. As such, projecting a 5% rate for an investment inherently riskier than US Treasury bonds is fairly conservative.* Obviously, a projected 30-year profit of $70 million dollars is hardly selling out the state “at fire-sale prices” for “pennies on the dollar.”

So, either ThinkProgress is intentionally trying to mislead its readers or they are hopelessly innumerate. Given how painfully obvious both of these errors are to anyone even passingly familiar with the relevant issues, one is inclined to conclude that it’s the former.

—

* But, note that higher inflation is expected in the near- to middle-term. If the discount rate interest turns out to be even slightly higher, say 5.5%, the present value of $6.8 billion falls (to $1.36 billion in the event the projection is a mere 50 basis points low).

If inflation rises, the revenue from the liquor stores will also rise, so the $6.8B revenue guess Would have to be adjusted for inflation.

Further, with Republicans threatening to default on some treasury obligations already, as well as threatening to vote avaunt raising the debt limit, a monopoly selling liquor may be less risky than treasury notes.

And finally, this privatization scheme screws over future budgets by replacing a revenue stream with a lump sum to be spent now.

It’s a bad deal.

Because, of course, the projected future tax revenue hasn’t included any projections about future liquor revenue receipts.

Well, that’s certainly one way of looking at it. Let’s hope the world’s finance ministers don’t share your… strange notions of risk, though, or our interest payments on our debt will shoot through the roof.

That’s not right. It’s not even wrong. The lump sum will be paid, but JobsOhio is set up as a non-profit providing capital to businesses (increasing the state’s tax revenues) throughout the entire term of the deal.

That sounds to me like you just don’t like it because it involves nassty, filthy “privatization.” The fact that the state has no business monopolizing frakking liquor sales doesn’t even enter into it.

The simple fact is, TP is so totally wrong about both facts discussed, it’s hard to escape the conclusion that it’s a result of conscious mendacity.

It would be better to just sell off the stores rather than lease them. There is no reason for government to be involved in the retail end of selling stuff. As to long term risk, selling booze probably is safer than treasuries if our past has any bearing on the future.

Steve

Corrupt Ohio wingnuts selling off the State of Ohio’s profit producing businesses to their cronies is a good deal for Ohio, how exactly?

Because Freedom! Don’t you understand anything about Libertarian philosphy?

Not sure it’s a Libertarian thing.

The corrupt Russian politicians sold off their country’s profitable businesses to their cronies, too.

Thinkprogress is one of the sloppiest blogs out there. Whenever they’re right, it’s an accident.

4 Points.

1 getting $1.5 billion for an asset worth $1.57 Billion (your estimate) is a $70 Million loss, not a $70 Million profit.

2. The 6.8 Billion is a total over 30 years, not a lump sum to be recieved in 30 years.

3. Annual Revenue stream from 1.5 Billion with 5% interest rate is less that 120 Million, which is replacing an annual revenue stream of 230 Million.

4 The whole deal is being financed with bonds anyway. The State could borrow the 1.5 Billion itself, make the payments from the revenue stream, and still have half the revenue left.

Either you didn’t read the article or someone (not TP) has a problem with numbers.

Indeed. The profit here is assigned to the investors who were supposedly getting this deal at fire-sale prices.

Obviously. Hence all the time I spent talking about the present value of that revenue.

Almost half the lump sum payment will go to paying off $700 million in bonds which the state will no longer owe or pay interest on. And, as noted above, JobOhio will provide capital to Ohio businesses, increasing tax revenue from more usual sources.

See previous.

Don’t be so hard on yourself. Math is hard.

“And, as noted above, JobOhio will provide capital to Ohio businesses, increasing tax revenue from more usual sources.”

Businesses are sitting on record amounts of cash. I dont know Ohio all that well. Is there really a need right now?

“. Annual Revenue stream from 1.5 Billion with 5% interest rate is less that 120 Million, which is replacing an annual revenue stream of 230 Million.

Almost half the lump sum payment will go to paying off $700 million in bonds which the state will no longer owe or pay interest on.”

If Dave’s numbers are correct, then this is a crappy deal for taxpayers. They could pay off those other bonds in 6 years or so with the other half of the revenue stream and have 24 years of money, assuming these arent older bonds at very high rates. I assume this is being done to avoid a short term tax increase or having to cut spending. Taxpayers need someone to look after their long term interests.

Steve

Getting out of the liquor monopoly (and replacing it with a tax on liquor) would be a good thing. But that’s not what Ohio has done. They’ve sold a monopoly to a private entity, one with the ultimate lobbyist as its Chairman. Secondly, talking about the time value of money is all well and good, but at the very best this seems like a one to one swap. So it most certainly is a case that it is privatization for the its own sake. But not real privatization – did the state even look into what it could have gotten by selling off the liquor licenses and eliminating the monopoly. I don’t care how many state politicians were convinced to vote for this, it smells like a crony-capitalism deal. How much you want to bet that within the next decade there will be massive complaints about liquor prices as the monopolists improve that $230M revenue stream, followed by a big public outcry to eliminate the monopoly, and then the “investors” will reap the benefits of selling off the liquor licenses?

2. The 6.8 Billion is a total over 30 years, not a lump sum to be recieved in 30 years.

Obviously. Hence all the time I spent talking about the present value of that revenue.

Then you clearly don’t know how to do the calculation because 1.57 billion is the present value of 6.8 billion to be paid in 30 years, not a revenue stream of 230 million a year for thirty years.

At 5% interest that revenue stream has a present value of about 3.5 Billion. In other words, you could borrow 3.5 Billion at 5% interest and the annual payments (for 30 years)would be about about 225 million.

In other words, what this program does is basically commit over $100 million per year for the next 30 years for a private company to “encourage” business development in Ohio.

The calculation is simplified, but you’re still way off base.

For instance, assuming (as you implicitly do) a steady revenue stream of $230M and projecting each years’ collections individually (5% interest), the total comes to $4,931,055,391.78 (2041’s $230M, for instance, is worth only $53.2M now). The state will get back some $100M/year in capital investment (about $2.14B), so the actual figure would be around $2.79B (not counting new tax receipts from expanded business and employment). Take out the 700M in bonds that will be paid off now (not including interest that won’t have to be paid; I’m assuming that was subtracted out of the $6.8B 30-year total to get your yearly revenue figure, along with other expenses related to running the alcohol monoploy like state payroll, benefits, compliance, record keeping, &c.), and you’re at $2.09B.

So, breaking it down yearly instead of simplifying it, the gross (before JobsOhio’s own debt service, payroll, and other expenses) is, of course, higher (an extra $14.63M/year over the back-of-the-envelope calculation I did above; I trust I don’t need to break down the present value of that 30-year revenue stream), but we’re still nowhere near “fire-sale prices,” especially considering the State gets the benefit of the money now rather than having it dribble in over 30 years. And it gets out of the liquor trade, which it has no business being in.

This argument is starting to look a lot like the “tax the rich and we won’t have any more budget problems” debate. The real money involved is nowhere near what some imagine. Only this time, most of Ohio’s Democratic legislators decided this was a good deal and voted for it, while you’re sticking with TP‘s spin even though it’s patently false.

Wow. Just Wow.

For a person who uses big words like innumerate you really don’t understand math at all.

It’s really simple.

As you said, the discounted present value of 6.8 billion 30 years from now is 1.57 billion, so we agree on how to calculate that.

This is not a “simplification” of the present value of 228 million a year for thirty years ( which I explicitly rather than implicitly assume). It is an answer to the wrong question.

The present value of a constant revenue stream of 228 million for the next 30 years is roughly 3.5 billion. (You seem to have come up with 4.9 billion but I’ll stick with my calculation).

Getting 1.5 Billion in exchange for 228 million for the next 30 years is like paying 15% interest on the 1.5 billion.

1.5 billion at 5% should cost about 100 million per year.

So the state is giving up a revenue stream of 228 million annually and getting the equivalent of 100 million in revenue.

Nothing the state does with the 1.5 billion affects this basic equation, because it gets subtracted out of both sides. (The 700 Million for the bond payoff comes out of the 1.5 Billion)

This argument has no similarity to questions of taxing the rich. I’m just asking you to get the math right.

Hidden in your response might be your admission that I’m right. “The state will get back $100 million per year in capital investment”. This only makes sense if you mean that JobsOhio will make $100 million a year in investments in Ohio business. That sounds a lot like my statement that this is the equivalent of giving over $100 million a year to a private entity to encourage business development in Ohio. If you want to argue that that is a wise policy for Ohio, thats fine. Just admit that is what you are doing.

The only proper use for tax money is to give it to rich friends of Republican politicians. Once you understand that, everything they do — and everything Dodd cheers for — becomes a lot easier to understand.