$15 Minimum Wage Would Do More Harm Than Good

The Congressional Budget Office assesses several reform proposals.

A new Congressional Budget Office report titled “The Effects on Employment and Family Income of Increasing the Federal Minimum Wage” comes to some rather stark conclusions.

The executive summary:

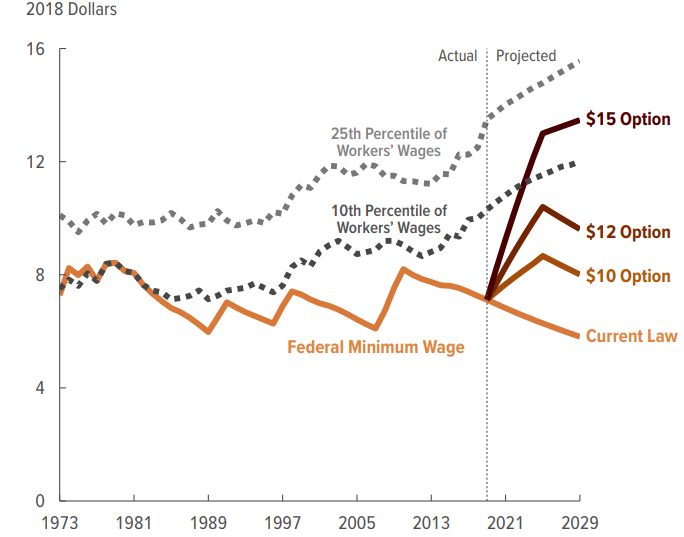

The federal minimum wage is $7.25 per hour for most workers. The Congressional Budget Office examined how increasing the federal minimum wage to $10, $12, or $15 per hour by 2025 would affect employment and family income.

• In an average week in 2025, the $15 option would boost the wages of 17 million workers who would otherwise earn less than $15 per hour. Another 10 million workers otherwise earning slightly more than $15 per hour might see their wages rise as well. But 1.3 million other workers would become jobless, according to CBO’s median estimate. There is a two-thirds chance that the change in employment would be between about zero and a decrease of 3.7 million workers. The number of people with annual income below the poverty threshold in 2025 would fall by 1.3 million.

• The $12 option would have smaller effects. In an average week in 2025, it would increase wages for 5 million workers who would otherwise earn less than $12 per hour. Another 6 million workers otherwise earning slightly more than $12 per hour might see their wages rise as well. But the option would cause 0.3 million other workers to be jobless. There is a two-thirds chance that the change in employment would be between about zero and a decrease of 0.8 million workers. The number of people with annual income below the poverty threshold in 2025 would fall by 0.4 million.

• The $10 option would have still smaller effects. It would raise wages for 1.5 million workers who would otherwise earn less than $10 per hour. Another 2 million workers who would otherwise earn slightly more than $10 per hour might see their wages rise as well. The option would have little effect on employment in an average week in 2025. There is a two-thirds chance that the change in employment would be between about zero and a decrease of 0.1 million workers. This option would have negligible effects on the number of people in poverty.

The two main sources of uncertainty about the changes in employment are uncertainty about wage growth under current law and uncertainty about the responsiveness of employment to a wage increase.

In graphic form, it looks like this:

Dave Schuler argues that the report “demolishes the case for a $15/hour minimum wage” and that Democrats and others those looking to help the less fortunate should “try something else.”

Persisting in campaigning for a $15/hour minimum wage at this point would suggest that your actual objectives in a $15/hour minimum wage are something other than helping the people you’re claiming you want to help. Objectives that have been suggested are to render non-unionized minimum wage workers non-competitive with unionized ones which seems pretty convoluted to me or giving unions with minimum wage multiple contracts an automatic raise.

According to the Bureau of Labor Statistics, the percent of hourly workers who receive the minimum wage or less is 2.3% of hourly workers, about 1% of total workers. They tend to be young, in the South, and work in the restaurant and food service sector. It would be interesting to see the effect of increasing the minimum wage on rents since the states that have increased their minimum wages also have higher rates of homelessness.

I presume advocates of the $15 wage are well-meaning but I agree with Dave’s assessment.

At the aggregate level, the trade-offs forecast by the CBO would be stark. Yes, millions would see at least some increase in their pay. But the 1.3 million who would at least nominally be lifted out of poverty with a $15 dollar minimum wage would be entirely offset by those losing their jobs.

I’m dubious of a single median wage across the United States to begin with. $15/hour for 40 hours a week times 52 weeks a year is $31,200. That’s 72% of the median household income in our poorest states but only 39% in our richest. Which is to say, it’s probably too high for West Virginia and Arkansas and almost certainly too low for Maryland and DC.

We need to figure out how to shore up the middle class, for economic, social, and political reasons. It’s not obvious, though, that targeting hourly workers is the way to go.

Dave elsewhere advocates doing more to keep manufacturing jobs in the United States and keeping out competition from immigrants—especially unskilled ones but also H1B visa recipients on the higher end. I have decidedly mixed feelings on both fronts.

I’m also skeptical, for a variety of reasons, about massive wealth transfers via the tax code that the progressive wing of the Democratic Party advocates. But continually cutting the rate paid by top earners, particularly those in the financial sector, pushed for so many decades by the Republican Party has contributed to the problem rather than “trickling down.”

Wait…what???

Re-arranging the data so it reads better…

1.3m is ~7.5% of 17m.

Seriously…in a country where 95% of the people have seen flat wages for 35 years, while 5% have seen an astronomical rise in wages, is now all of the sudden concerned about the bottom 7-8%?

C’mon kids. That doesn’t pass the giggle test.

Let’s take a look at the areas that have already passed a $15 minimum wage and see how they have fared. I doubt 7-8% of the population lost their jobs. If that had happened the Trumplicans would be crowing about it from the rooftops.

I’m not an economist, but this makes far more sense to me…

https://www.marketwatch.com/story/15-minimum-wage-reduces-poverty-doesnt-cut-jobs-berkeley-study-says-2019-07-08

I really have to wonder if Republicans have finally taken control of the CBO.

@Daryl and his brother Darryl: According to the most recent BLS stats I can find (March 2018):

We’re therefore talking a small number of Americans who earn minimum wage to begin with. (Those who earn less, presumably, are tip-based workers exempted.)

So, we’ll see modest increases in pay for those at or slightly above the minimum wage—but only pull 1.3 million out of poverty. And it’ll cost that many people their jobs. It seems like a bad trade-off.

@Daryl and his brother Darryl: The same link verifies and expands upon Dave Schuler’s demographic summary:

Essentially, most people earning minimum wage live in states where that’s not a terrible income. Conversely, high-income states can’t attract workers at that wage so pay more.

Kevin Drum posted about this same report earlier today.

He says about the same thing as far as how many people see their wages go up:

However, he had a quite different takeaway as to the number of jobs lost:

I don’t think of either you or Kevin Drum as people who just make stuff up, so I’m very curious about this discrepancy, which is substantive. He gives a number that’s roughly half of what you give.

Here’s one thesis. Drum includes the qualifier “among adults”. So maybe CBO thinks half the people thrown out of work are teenagers? Is that where this difference comes from?

20 million win, and about a million lose. But maybe they find other jobs? I think it’s probably a net gain.

Drum also mentions:

Even after all the job losses, there’s a net gain in wages to workers. Which is a boost to GDP and economic growth. I wonder why a party that has been ruthless about its pursuit of economic growth shies away from this one?

Never mind. This is who owns the GOP. Of course they are against it.

I will remark that I’ve seen lots of studies of places like Seattle and SF, where they have instituted $15/hour minimum wage already, and it has had very little impact in terms of eliminating jobs.

But I’m open to the proposition that things might not work that way in, say, Stevensville, MT (I have a relative who lives there). And eliminating jobs there accelerates the decline of these communities.

Except that Stevensville isn’t declining. My relative that lives there just moved there because it’s cheaper, it’s fairly close to a good airport, and is a great place to run her nationally-based consulting business from. She is not a minimum-wage worker, but she’ll need a few to provide the usual services in Stevensville.

I have another relative that lives in Custer, SD. This is another place that might experience a severe impact from minimum wage. But Custer has a very strong tourist business, and seasonal employment. Bumping the minimum wage will be passed on to all those tourists, who will no doubt still come there to see Mt. Rushmore, the Black Hills, the Badlands, Deadwood, Devil’s Tower, and the annual motorcycle meetup in Sturgis. So, not exactly not thriving, either.

What is happening is that things are changing in these locations. The way things used to work doesn’t work any more. And there’s protest and pushback about that, and that’s all well and good. I’m not at all sure though, that this means these communities will be ravaged by a lower minimum wage. Maybe there are other places it would be bad for?

I’m looking for ways to push a little money from the wealthy regions to the not-so-wealthy region that just won’t end up in the hands of middlemen. Most national businesses are organized in such a way that they extract money from small communities, rather than inject it. I’m looking for ways to reverse the flow. I’m not sure raising the minimum wage does, but I wouldn’t mind seeing Walmart having to pay greeters more money.

@Daryl and his brother Darryl:

These areas tend to be the more expensive areas anyway, so the jump isn’t as high.

Note that I am not saying (in this comment) that a $15 minimum wage is too high, too low, or too anything, merely that the data that you want to look at isn’t representative of the country as a whole.

@Daryl and his brother Darryl:

Also, we have really low unemployment, so that 1.7M will likely be able to find new jobs.

I don’t think the minimum wage should be the same everywhere (I would vary it county by county), but I also think that people making the minimum wage should, as a rule of thumb, be paid enough to not qualify for government benefits, and should have stability with regards to hours and scheduling (to accommodate child care, a second job, etc.)

I’d favor a federal minimum wage of $10+, where the plus is a factor based on food, housing, energy, medical and transportation costs in the county. And work scheduled less than two weeks in advance is time and a half.

(If we want to subsidize labor for businesses in depressed communities or something, I’m ok with doing that, but that should be an explicit decision rather than a slow failure to raise the minimum wage — and if your business depends on workers who qualify for various subsidies like Medicaid, perhaps your business doesn’t really need to exist).

Something else in the CBO report that argues against raising the minimum wage. While incomes would rise by about $44 billion, prices would rise about $39 billion. But those price rises will not be hitting the rich. They’ll be hitting people who shop at places that pay minimum wage — your Walmarts, your fast food joints and so on. So this gives the poor a raise with one hand while taking away their buying with the other.

And those lost jobs are a big deal. One of the worst things that can happen to someone is prolonged unemployment. It shortens their lifespan, dents their long-term earning, hurts their health, makes them more prone to substance abuse, mental health issues and suicide. You’d be better off raising the wage a little but having a better social safety net (which is what we’ve done with expanding Medicaid and food stamp eligibility so that many minimum wage workers qualify).

Also, that Berkeley study is from a group I wouldn’t trust as far as I could throw them. The leader is long-time Marxist who is accused of coordinating his research with labor groups and politicians. Most famously, when the University of Washington group — hand-picked by the city to measure the effect of the minimum wage hike — was about to report that it had a negative impact on employment, Reich was contacted by the city to drum his own report coming to the opposite conclusion. More importantly, numerous economic groups have disputed their analyses and found them wanting.

I’m glad people are willing to literally bet the lives of the thousands of people who will lose their jobs on the idea that Reich has done his math right. But I’m not willing to conduct a giant economic experiment with this huge of a downside based on research that is, at best, contested.

The problem of minimum wage laws is that not everyone is supposed to make a living from his or her job. There are entry-level workers, people that work in some positions on non-profits, married people that just want flexible hours, etc. You can use minimum wage laws to increase wages, but there is a limit of how much you can increase without forcing business to cut employees(And that would not be necessarily bad).

You can’t have people lunching and dining every day on restaurants if people that work there are being paid properly. In Europe, restaurants work with less employees and people are less likely to have lunch there. Not a bad scenario for me, but you can’t have “cooking at home is oppressive for women” and restaurants workers need a living wage.

You have to chose. And you’d need to change a lot of things in the daily lives of Americans and in the economy.

A pity Republicans don’t believe that…indeed, I’ll bet one of the big reasons so many are pushing for raising the minimum wage is that many people who work for that rate or a little above that rate have to apply for government benefits, which Republicans are trying to take away…why should anyone work for a wage so low that he/she can’t even support himself from that wage…

@Andre Kenji de Sousa:

I nominate you for the not-enough-to-live-on wages. The rest of us would like to live.

@Hal_10000:

What percentage of that $39B price increase will be paid by the folks earning minimum wage? Ballpark… maybe half? Likely less, since a lot of those price increases will be things like grocery stores, which get used by nearly everyone.

So, it’s not putting money into the working poor’s pocket and then taking immediately from it, it would be broadly redistributive. Which you might also object to. But, the working poor would be significantly better off.

This is a real issue, and it’s why everywhere that has raised the minimum wage has done it in steps — it makes it a lot easier for people to get new jobs as it doesn’t freeze up the entire labor market.

So, you want to create a de facto universal basic income, distributed only to the working poor, with a whole lot of strings attached? Can’t have people buying too good of food on food stamps, you know… also, we better drug test them.

Do you know what the working poor need more than food stamps? Money. It’s like food stamps, but it can be used to fix the car.

We subsidize unskilled labor a lot already — between Medicaid and food stamps and the earned income tax credit, we make it possible for businesses to pay less than a living wage — and I would really question why we are being so indirect about it and why someone would want to increase that subsidy.

The safety net is good for people who have fallen, who are struggling to find work, etc., but should it really be bolstered as a way of life?

There’s dignity to work, and that dignity is measured in dollars and cents.

A March 2019, Econtalk podcast was with a researcher specifically tracking the minimum wage increase in the Seattle area

The impact falls most heavily on those who are not yet in the labor market. The higher minimum wage makes investment in training a bad strategy. Restaurants are moving to strategies that reduce the need for unskilled labor

Making it harder to get employment in the first place to gain experience is a very negative impact on the poor.

If wonks all over predicted Seattle’s min wage would do the same (but has not and did not) – Why should I now believe the same from Mr. Joyner? In seriousness, I don’t disagree that $15 may be on the high end, but it is probably not that far off. Adjusted for inflation, the minimum wage back in late 60’s – early 70’s is equivalent to $10 ish today….we are underpaying at the federal min wage level and yet every time it comes up – the sky will fall, job losses everywhere blah, blah, blah. This country is so afraid to do what is right for people in lower paying jobs, but no problem running a massive deficit to provide better off with more money….all odd to me

@An Interested Party: In some areas, $15 is not nearly enough. In some areas it might be too much. Think back to the lemonade stand: charge too much and you lose customers. Charge too little and you lose money. Supply and demand.

One of the first jobs I had was at an arena. I got $1.75 per event. But gas was twenty-four cents a gallon and a McDonald’s hamburger was fifteen cents.

Back then Eastern Airlines was paying college students and other part-time workers $7 an hour to clean their airliners’ interiors. This was at a time when the minimum wage was around $2 an hour. But Eastern paid their people very well with top benefits. When the airline industry was deregulated, Eastern went under. There is a lesson there.

@Gustopher:

The issue is not me nor you. The issue are entrance level jobs – not having these entrance level jobs is worse than having them paying a lower wage.

@JKB:

Do you have actually data on this, normalized against another similar sized city without the $15 minimum wage?

I’ve lived in Seattle for about 15 years, and that trend has been chugging along (coffee shops, and high end fast food), but I haven’t seen any increase in the increase. You’re describing the lunch spots that have popped up around Amazon.

We also have self-checkout lanes, and have for the entire time I have been here.

(My usual grocery has removed the manned express lanes, and I have stopped using the store except for cat litter, and have found a different grocery for everything else)

Oh please…as if you and people like you actually care about the poor…if you really did, you wouldn’t support Trump and his Republican enablers…

@JKB: Also, I would again point out that Seattle is a high cost city where the $15 minimum didn’t change things that much by percentage.

Coffee and a snack regularly runs close to $8, and the era of the $10 lunch is long past. Lunch is $15. If you cannot pay a worker roughly lunch/hr, your restaurant will fail.

Bumfvck, KS is a lot cheaper. Seattle is not a valid reference point. It doesn’t prove your point, and the fact that it doesn’t prove your point means nothing.

Isn’t this a bit like discussing whether zoos should have unicorns? A federal $15, $12 or even $10 minimum wage is not going to happen, at least not in my lifetime since I’m 62.

@Gustopher:

I cited an interview with a U of Wash researcher commissioned by the city of Seattle to study the impact of the minimum wage increase. He lives in the city and is aware of the cost of living. The trend to counter-service restaurants was related to him by the head of a Seattle restaurant owners association.

@JKB:

That is someone who is literally paid to lobby for cheap labor for restaurants. Not a credible source without a whole lot of independently corroborated data.

The shift to counter service as opposed to full service restaurants is happening nationwide, including areas, like here in NC, where many if not most restaurant workers make $7.25/hr. Saying that the Seattle minimum wage increase led to this phenomenon there is disingenuous.

Businesses that employ low-wage workers already employ as few as they possibly can without losing customers. That’s why there are never enough cashiers in any given Walmart, for instance. I think the assertion that jobs will be lost as a result of a minimum wage increase is a scare tactic, and is an assertion not borne out by history.

@Jay L Gischer:

I literally cut-and-pasted the report’s executive summary (from the PDF of the actual report, not the Internet summary) here and skimmed through the rest. The numbers I’m using are the median numbers.

Kevin wrote, “Unusually for the CBO, it was a little hard to dig out all the relevant numbers, which means I had to read the whole thing fairly carefully.” So he’s doing his own analysis of their numbers. I literally can’t find the number 700,000 in the report but maybe he’s interpolating or rounding. I’m sure he’s doing honest analysis but, again, I’m just using the report’s topline takeaways.

Skimming, I see that they project in 2025 that 94% of teens in the workforce will be low-wage (earning less than $19/hour) but that they will constitute only 10% of the workforce. So I don’t think that accounts for the discrepancy between 1.5 mil and 700k.

EDIT: No, your conjecture turns out to be right. From page 12 of the report:

The whole thing reads like this. That is, there’s a lot of statistical analysis but it’s written for someone without any economics training, patiently breaking down how trade-offs work.

@Bruce Henry: counter service: I am seeing more self service centers at fast food restaurants and some of the sit down places are going to ordering devices at the table. The restaurants are short on help now as job opportunities are everywhere. A few years ago people were lined up every week at the fast food places applying for jobs.

@Hal_10000: “You’d be better off raising the wage a little but having a better social safety net (which is what we’ve done with expanding Medicaid and food stamp eligibility so that many minimum wage workers qualify).”

Ah, the old Republican two-step!

Step one: We can’t possibly raise the minimum wage because that would hurt the blessed Job Creators and they will slash their workforce. Much better to allow them to pay as close to zero as possible, and then have robust social services to help those not making enough to live.

Step two: Why would we want to give taxpayer money to lazy moochers who can’t be bothered to find a job that pays them enough to live? That’s socialism. If people want to live decently they should move or learn a trade or find a job that pays better than minimum!

And remember — we must never never never never never suggest that business owners have any kind of moral responsibility to their employees. The workers are only parasites who are trying to steal the God-given profits of the sainted Job Creators.

1) The headline is factually incorrect. Clearly a minimum wage increase that helped 95% and hurt 5% is the very definition of ‘more good than harm.’

2) Lower working class Americans are competing with immigrants and robots to see who can survive on less. Schuler’s idea is to reduce the number of immigrants in that competition, which will leave Americans competing with a slightly smaller number of immigrants and robots to see who can survive on less. That’s not a solution, that’s kicking the can down the road. . . just a few feet. We will still be up against the fact that robots are evolving much faster than homo sapiens, adding skills hourly, getting better and better while their human competition gobbles opioids and mumbles ‘MAGA’ into their pillows.

3) Of course a single national wage is nonsense, who the hell would stay in Marin county earning $15 when they could live so much better on $15 in Oklahoma? If you assume they can stomach Oklahoma. Weight it by county, it ain’t that complicated, we have, well, basically robots who can sort it all out.

4) Remember when we were all deciding on a system that enriched a tiny percent of the population while leaving everyone else stuck in neutral? And we thought maybe. . . No, you don’t remember that conversation because we never had it. Amazing just how little discussion went into the plan that involved giving everything to a couple dozen people. Yeah, that just. . . happened, right? But every effort to ameliorate the situation is poo-poohed by the experts whose limp indifference to the lives of real people allows this catastrophically unjust system to leave millions with no choice but serfdom or revolution.

5) Money has got to be relocated from the pockets of the 1% (of which cohort I am still a member thanks to my wife) and especially the .01%, into the pockets of the people living in pup tents under the freeway not half a mile from where I now sit on my pampered ass looking down over my pool, and the lake, and the Hollywood sign. But every suggestion – every single one – gets shot down with regretful head-shaking. Gosh, we’d really like to, but. . . but. . . but. . . Keep that up, and people will figure out how to build guillotines.

@Bruce Henry:

Then why no go even bigger to $20, $30 or $50/hour?

Typical Republican/conservative non sequitur used whenever this subject is discussed…

@An Interested Party:

I think it’s a perfectly reasonable response to the claim that mimimum wage job losses are a only a scare tactic.

@michael reynolds:

It depends on how much it helped the 95% and hurt the 5%, no? Modest gains for those now earning $14.50 an hour that are offset by 1.5 million who go from $12.50 an hour to nada is problematic.

Agreed. We’ve long done it for Federal Government workers, including those in the armed services. We have locality bands and adjust pay accordingly. We could just use those calculations.

I’m not sure a minimum wage increase does much of that. We need to figure out how to shore up those at the bottom. But raising the cost of low-skill labor just further incentivizes their replacement with robots or off-shoring as much as possible. And I don’t know that we need to increase the pay of middle-class teens looking for some pocket money. There has to be a better way to target adults, particularly heads of households, that doesn’t disincentivize hiring them to begin with.

@James Joyner:

That’s really the crux of it for me. A too-high minimum wage would also incentivize the use of independent contracting and off-the-books immigrant labor while seriously diminishing work opportunities for youth.

@James Joyner:

There is no such thing as dis-incentivizing hiring by wages, hiring is already disincentivized by the desire for profit. No one is carrying 10 employees they could manage without. Company X needs 50 people, so company X employs 50 people. If those 50 people earn more the cost is picked up regressively by the hoi polloi, or it comes out of profit. This in turn incentivizes efficiency as companies try very hard to compete without having to raise prices.

Put it this way: the number of unnecessary employees currently being paid by Wal-Mart is zero or close to it. If they have to pay more they’ll either cut profits or pass the costs along to consumers and risk losing ground to more efficient retailers. They can’t fire people they don’t employ, and if they currently employ people they can fire, then they aren’t the Wal-Mart we’ve heard so much about.

As to relative harm, in a country at full employment, which is more destabilizing, 10,000,000 people trapped in perpetual serfdom, or 500,000 unemployed people collecting UE checks? Unemployment is a problem when the safety net is inadequate, which is why a Frenchman without a job is not in as dire a situation as an American. Trapping millions in a state of slow-rolling decline, ignored by their government, ruled by billionaires, that’s instability.

@Andy:

Change labor laws to limit so-called contract workers, institute employer verification. Easy peasy. Easier than trying to raise a child on $7 an hour.

@michael reynolds:

Well, sure. But, presumably, there are workers earning $10/hour that contribute $11/hour to Walmart’s bottom line. If Walmart is required to pay them $15/hour, they either go away or Walmart has to raise prices enough to cover the $4/hour in losses.

That’s the problem I don’t know how to fix. A lot of these jobs are the kinds of things teenagers used to do for pocket money. Now, people are trying to raise a family on them because so many jobs in the manufactuing sector have gone away. I don’t know that we can square that circle by simply mandating higher-than-it’s-worth pay.

@James Joyner: Thanks for doing the digging!

But it is borne out by Say’s Law. Who needs history when you can take the word of an aristocrat French pseudo-economist from the 18th Century?

@James Joyner:

In fact, it isn’t my favored strategy, either. My favored strategy is UBI. UBI will also have a big impact on the de facto minimum wage because it provides an alternative to working, and alters BATNA for the worker.

But UBI as national policy is a long way off, and I’m feeling like a bump in minimum wage might make a decent interim measure.

@James Joyner:

Or they sacrifice profit. Duh. Their gross profit last year was ~130,000,000,000 dollars. They have 2,000,000 employees. I’m never to be trusted with math, but that looks like about 65,000 profit per employee. So I really think the Waltons could take a very small haircut and treat their employees like human beings.

@Andy:

So does Rush Limbaugh. He’s been doing your schtick for 25 or 3o years now. You should thank him for giving you such a durable talking point.

Furthermore, Wal-Mart employees are being paid by taxpayers in the form of social safety net costs, and given 130 billion in profits, you’d think that’d rankle all those small government types. But nope. The Waltons profit by passing their costs onto taxpayers. And the small government types say what about that? Nada, aside from suggesting we take away the food stamps.

We’d love to help the unfortunate, but gosh it’s so complicated, whereas letting a few families buy up the entire country, well, that’s easy.

@michael reynolds:

They’re paying full-time workers nearly $15/hour already:

They still have too many part-time workers who don’t receive benefits, although the percentages have declined significantly.

@James Joyner:

OK, so evidently rising wages have not hurt Wal-Mart. Right? Wal-Mart is paying more, earning huge profits, and we have very low inflation. Which rather invalidates the premise that raising the minimum wage would fuel inflation.

There are some very easy fixes, starting with a serious and enforced employer ID program which would help cut the competition from undocumented workers. Easy for the employer, requires nothing but off-the-shelf technology, and despite all the whining, no harder than figuring out how to accept Visa and Amex. Why don’t we do this? Because Republicans like undocumented workers to simultaneously increase their profits while providing them with convenient scapegoats to gin up racist votes from the very people who’d benefit.

Then, labor laws limiting the use of so-called contractors and requiring OT in certain circumstances, also opposed by Republicans because, um… an honest ideological aversion to big government? Or might it be greed? Guess which one I believe?

@michael reynolds: “Of course a single national wage is nonsense, who the hell would stay in Marin county earning $15 when they could live so much better on $15 in Oklahoma?”

It’s a minimum wage, not a living wage. No, you can’t live on it in Marin, so if employers want to find workers there they’ll need to pay more than minimum. But this is a statement that this is the very least that an employer can get away with paying an employee — unless, of course, they’re in one of those states that allow tipped employees to be paid what I got for babysitting when I was 16…

@Andy: “Then why no go even bigger to $20, $30 or $50/hour?”

Hey, why not go even smaller? Why not make the minimum $3, $2, $1. Hell, why not demand workers pay the employers for every hour they work.

Hmm, it’s just as stupid this way. I guess we’ve discovered a new transitive law of trolling.

@michael reynolds:

The economy is booming and Walmart has quasi-monopoly power in many communities. It’s way easier for Walmart to absorb modest hikes to wages and benefits than a smaller operation.

@wr:

$15/hour is rather on the high end in the poorer states and not enough in the richer states. I don’t know what the right baseline is but think it should come with a locality rider. The Federal minimum wage is simply meaningless in much of the country right now because it’s hard to hire anyone for $7.25. (To the extent a minimum wage is a good idea, it should also be indexed to inflation so that there doesn’t have to be constant fighting in Congress over it.)

@James Joyner: “If Walmart is required to pay them $15/hour, they either go away or Walmart has to raise prices enough to cover the $4/hour in losses.”

Or, you know, give a billion or two less to the members of the richest family on the planet.

Funny how it never enters these conversations that large corporations could simply divert some money either from the owners or the top executives to help the rest of their payroll. No billionaire should ever have to pay a single penny, either in taxes or in expenses for the company they’re living off.

@James Joyner: ” I don’t know that we can square that circle by simply mandating higher-than-it’s-worth pay.”

Higher than it’s worth to whom? Apparently to those who decided that the only role of a corporation is to make the maximum return to shareholders and top executives.

Oh, and you keep mentioning minimum-wage jobs as somehow belonging mostly to teenagers. Well, back when that was actually true 50 or so years ago, the minimum wage (adjusted for inflation) was actually 40 to 50% higher. So we used to pay teens more than we now pay heads of households for the same work.

@James Joyner: “They still have too many part-time workers who don’t receive benefits, although the percentages have declined significantly.”

You say this as if it’s somehow an accident of history rather than a deliberate choice.

@michael reynolds:

If everyone was employed by WalMart, you might have a point. But everyone isn’t. The vast majority of employers don’t have the pockets or economies of scale to what big companies like Walmart can do. And that’s why a lot of the local $15/hour proposals around the country specifically exempt small employers – because they know that raising their labor costs is going to hurt those small firms big time.

And the irony is you’d just be making the Walmarts and other big companies stronger because by artificially raising labor costs, those efficiencies you talk about will end up driving the new/small/growing firms under, leaving only the big players left and in an even more powerful position than they were previously.

I haven’t listened to the EconTalk podcast, but if we want to quote Vigdor, let’s establish that he’s had multiple positions:

https://www.nytimes.com/2018/10/22/business/economy/seattle-minimum-wage-study.html

@wr: it’s deliberate, Walmart has screwed its employees since the beginning. Sam Walton had to be sued because he refused to pay his employees minimum wage.

Walmart was finally shamed into paying its full-time employees a little more, and as a result they decreased the percentage of their workforce that’s full-time. Half the employees at your local Walmart are part-time.

@Gustopher: this is huge:

It’s very hard to get ahead in life if you can’t predict your schedule.

@Andre Kenji de Sousa: That article says nothing at all about cooking at home being oppressive to women. Instead, it says,

@Monala:

In countries where there are paid vacations and reasonable minimum wages no one writes articles about the problem of cooking at home or whatever. Because if you are not cooking at home, you are not going to restaurants that pay crappy wages you are eating packaged food with poor nutrition.

You can’t have both. And I think that it would be healthier if wages in the services industry were higher and if people eat less at restaurants. My worry is with entry-level workers or apprentice-level work at things like startups.

But you can’t have both.

@Andre Kenji de Sousa: That’s not what you claimed. You cited the article with a statement, “Cooking at home is oppressive to women,” that appears no where in the article and is not even implied. The article says that cooking at home is a good thing; that there are a lot of barriers (time, access, money, etc.) that prevent people from cooking at home; and therefore if we think this should change, we need to address those barriers.

Your point that we can’t both improve the factors that would enable more people to cook at home, and increase wages for restaurant workers simultaneously (since who would be eating out and contributing to those higher wages?), may be valid. And it’s also true that other countries don’t treat workers as badly as the US does, and therefore the obstacles to cooking at home are less likely to exist.

But you didn’t make those points originally. Instead, you threw out an inflammatory comment linked to an article as if it were a quote from it, when the article said nothing of the kind. In the context of this post, it implies that the same liberals/leftists who are advocating for a higher minimum wage also oppose the idea of cooking at home and consider it part of female oppression. (While there are plenty of people who object to the unfair division of labor at home, including food preparation – i.e., the female “second shift” – I haven’t heard anyone oppose cooking at home per se). You usually don’t resort to such tactics.

@Hal_10000: And being a Marxist is….what? Wrong? Is that what you’re suggesting?

@michael reynolds:

But only to the extent that people believe that people who are working should be able to house and feed themselves and their families because of it. And who believes THAT anymore?

@James Joyner: Just to keep us all on the same page, $14.26 per hour totals $29,660.80/year–provided that the work week is 40 hours (I haven’t worked retail in a long time, but some people tell me that in retail, the work week is 34 hours now, IDK). Your comment makes it sound like 14.26 is already too much.

Doesn’t sound like it to me. Last year, I paid taxes on $35,000, and I’m retired and work part-time as a substitute teacher (about 90 days/part days this past school year).

@wr: I couldn’t find it, but IIRC, the 1938 minimum wage of 25 cents/hour was established because that represented 101% of subsistence income for a family of 4. If that is the case, then yes, the minimum wage should be a living wage.

Given that a significant number of minimum wage earners do not require 100% of subsistence for a family, an argument could be made for a lower standard than the $19+/hour the minimum would be had it been indexed since 1968 (according to my friend Wikipedia), but I’m not amenable to making that argument for a society that has been as disingenuous as this one has been and apparently still is on the subject.

One other point related to my previous comment to James: $29,660.80 is only barely above the poverty line for a family of 4. But yeah, I know–what are “those people” expecting?

@Andy: Then why no go even bigger to $20, $30 or $50/hour?

Why not let everyone own a machine gun or a cannon or a nuclear bomb for self defense? Republicans say tax cuts pay for themselves so why not reduce it to 1%?

What would happen if we did raise the minimum wage to $5o? Say we increase it 10% per year till we reach that point. What’s an average meal at McDonald’s now, $6.50? Would it go up to $45? How about gas? Doesn’t seem like there’s a lot of labor cost in that but I really don’t know for sure. Would the economy collapse forever or would we all adjust?

Not really, as your response is nothing but a bullshit tactic…

Give poor people more money and they spend it. How is that bad for any business? Give corporations a tax break on repatriated dollars, how do they spend it? Stock buybacks and dividends. Which is better for the economy, more spending by many or greater wealth for few?

@An Interested Party:

And the replies like this are…what, exactly?

The point is – why $15?

What is the empirical argument that accepting the set of tradeoff’s that come with a $15/hour minimum is the ideal choice as compared to other options?

And if, as some people assert, the downsides of a $15/hour are either very small or just dishonest scare tactics, then why not make it higher?

@Andy:

Minimum wage increases do not explain the rise of the Amazons and Wal-Marts. They succeed in every wage environment, from low-wage states to California.

I don’t share in the obligatory reverence for small business. You know why small employers so often fail? It’s not the minimum wage, it’s that they’re generally speaking, incompetent. It’s how capitalism works, rather like showbiz – everyone wants to be a star, but 99% of the aspirants fail. And they fail because they don’t have it, don’t have the idea, or the energy or the discipline.

I just moved to LA, so new everything – grocery stores, pet stores, doctors, dentists, handyman, ad infinitum. I have a dry cleaner I could hit with a pistol shot from my back yard, but I avoided them on the basis of reviews which showed them to be rude and incompetent. Would they have been less rude or incompetent had they been able to afford one more employee? I rather doubt it. They’ll either change their ways fast, or go bankrupt, but it will have nothing to do with the cost of the help. Indeed, if I wanted rudeness I’d expect to find it from some underpaid employee who may well be living in a pup tent.

@michael reynolds:

I’m not saying they explain their rise – I’m saying that a high minimum wage will hurt them less than smaller competitors to say nothing of mom-and-pop businesses.

Well, if you want competition, I think it’s wise not to punish small businesses more than big businesses. Every big business started small and businesses that grow are where most new jobs come from. I don’t see any reason why the biggest players need more advantages than those they already have, which are already too much IMO.