AP Twitter Feed Hacked, Dow Plummets

Why does the stock market care if there is an explosion at the White House?

The Associated Press Twitter feed reported “Two Explosions in the White House and Barack Obama is injured.” The account was hacked; the report was false. The stock market nonetheless tanked until the report was debunked.

NYT (“Hacked A.P. Twitter Feed Sends Erroneous Message About Explosions at White House“):

The Twitter account of The Associated Press was hacked on Tuesday and erroneously sent out a tweet saying there had been explosions at the White House, injuring President Obama.

Within a few minutes, Twitter suspended the account, and Julie Pace, the chief White House correspondent for The A.P., announced at a White House briefing that the account had been hacked.

Jay Carney, Mr. Obama’s press secretary, confirmed that the president was unharmed.

Editors at The A.P. soon followed with a statement saying that “The (at)AP twitter account has been hacked. The tweet about an attack at the White House is false. We will advise more as soon as possible.”

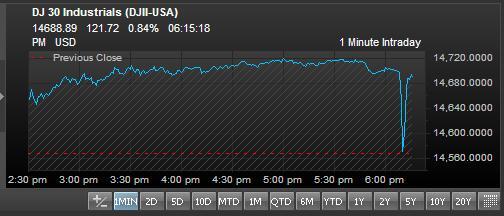

The Dow Jones industrial average plummeted more than 150 points when the news broke on Twitter — an indicator of traders’ presence on the social media platform — before immediately recouping the losses after it became clear that there had been no incident at the White House.

Aside from why AP doesn’t practice better security or why investors would react based on a single, unconfirmed report from one source, the question that strikes me is: Why should President Obama’s getting injured impact the value of 500 major companies?

Don’t get me wrong: the president of the United States is an important fellow. And, certainly, I’m pleased that the democratically elected leader of my country’s executive branch of government is safe.

But if, heaven forbid, an explosion incapacitated or even killed the president, we’d swear in Joe Biden, lower the flags to half staff, and continue to march. The country would mourn its fallen leader. If the attacker turned out to be a foreign terrorist, we might even launch major military action in response. But, at the end of the day, the value of Microsoft, ExxonMobile, and JPMorganChase shouldn’t be affected.

Wow, I’ve read a few novels based on this scenario. The SEC better look for who placed puts on the stock market.

In which case the Dow would not have tanked but instead doubled as war is good for business. (just ask Halliburton)

Hmmmm…. I wonder how the Stock market would have reacted if he had been reported dead? According to Drew, Obama is the only one holding back the economy. If he just got out of the way…

Actually it shows the markets being not too stupid. It as only a 1% hit, and it only lasted 10 minutes.

It could have been an emergent behavior of high speed trading systems, but even then it didn’t get out of hand. 1% is well within normal daily volatility. That was probably not enough to trigger any stock market “circuit breakers.”

James, if you really don’t know, the day-to-day value of traded stocks is largely illusion. Perceptions drive the market. If Company A announces a great new gizmo, the stock will rise, merely in anticipation of increased sales. Only the thinking changed, not the actual value.

Likewise for an attack on the White House.

But these stories are scary- a while ago, some news blog accidently posted a failed airline merger from three years previous as a new story, and the value of the stock was reduced 50 percent most of the day, until it was all cleared up.

Please don’t remind me that Biden is next in line. I mean, he seems well-meaning and all, but …

All right, who bought all the derivatives….? I bet somebody managed to take a hell of a lot of money off the table during that drop.

Sometimes I wish I didn’t feel I was living in a Tom Clancy novel.

They realized that Joe Biden might be in charge now and panicked?

Investors didn’t panic. Market gamblers panicked. And that is pretty much all the Wall Street types who make their money churning rather than investing in companies expected to grow. Plus they’ll blame this on some auto programmed word search linked into the trading software.

We shouldn’t mix up the two.

Clearly ‘the market’ freaked at the thought…..

They key is to remember that the stock market doesn’t tell you what the company is worth – it tells you what the last price a buyer and seller agreed on. That gives a lot of insight into what it’s worth, but it isn’t the same thing. It moves all the time because of the daily flow of A wants to sell and B wants to buy and how much does the price move as a result. None of that actually changes the value of a company either, but the stock price moves.

@john personna: Yes, ‘plummet’ or ‘crash’ seems to be a rather strong word here.