Bush’s Secret Plan to Kill Social Security

Brad DeLong thinks the combination of progressivity and privatization offered by President Bush to fix Social Security is really a secret plan to kill it off.

Pozen Pill – How Bush’s version of “progressive indexing” would kill Social Security (Slate)

This sounds like a not unreasonable way to keep Social Security healthy through most of the century. And progressive price indexing, by itself, is neither left-wing nor right-wing. Insulating the working poor from benefit cuts and tapping income-tax revenues to fund Social Security is “liberal.” For Social Security to become a flat-benefit guardian against destitution, rather than a substantial base line layer of retirement income for everyone, is arguably “conservative.” But when you combine Pozen’s progressive indexing with Bush’s separate proposal for private accounts, it becomes something different: a way of phasing out Social Security altogether. Here’s how:

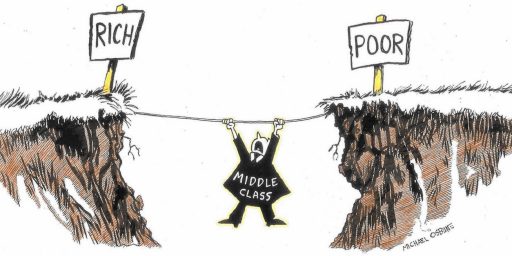

Pozen’s proposal caps the maximum Social Security retirement benefit at roughly $22,500 dollars a year (adjusted for inflation). Bush’s private-accounts plan—which would allow people to contribute 4 percent of their wages—makes retirees repay the taxes they diverted into private accounts out of their standard Social Security benefit. Medicare premiums are already deducted from your Social Security check. Deduct the claw-back for the private-accounts diversion as well, and by late in this century the odds are that—at least for the upper middle class—the standard Social Security check would be zero. Social Security would no longer be a universal program: It would be a program in which the half of America that is richer and more powerful and more likely to vote sees large chunks of its money going in and nothing coming out.

Even without private accounts, aggressive means-testing a la Pozen risks undermining Social Security over time. Insulating the poor from cuts is a left-wing goal. But it will create a large class of Americans who get much, much less out of Social Security than they put in and for whom Social Security as a whole is demonstrably a very bad deal. Early Social Security guru Wilbur Cohen may well have been correct in his belief that “in the United States, a program that deals only with the poor will end up being a poor program. … ” Loading a large chunk of the burden of fixing Social Security onto America’s upper middle class may be the first step in the creation of a mid-21st-century political majority for the phasing-out of the program as a whole.

I agree with DeLong that changing the public’s incorrect perception that Social Security isn’t already a welfare program might have bad consequences, as I’ve argued previously. Until I saw his explanation, though, the rather obvious solution to this problem eluded me. Why not simply do away with the FICA tax altogether?

Let’s just once and for all dispense with the fiction that there is a “Social Security Trust Fund.” Since we’re paying for current benefits with current receipts, why not just eliminate the separate Social Security payroll tax and raise the income tax dollar for dollar? Do that and it’s all just tax money rather than a set-aside to which one is entitled to get paid back with interest.

For a lot of folks, Social Security is already a program where they get much less from it than they put in. And not all of those folks are rich–in fact, many of them (as has been argued previously) are hard-working poor who are more likely to die before they draw substantial benefits.

Social Security has never been anything other than welfare–it’s just been pitched dishonestly (and successfully so) by its proponents. It was cleverly packaged to provide benefits even to those with no need for it in order to provide an incentive for its continued existence.